All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from our partners. American Express is a Katiestraveltricks.com advertiser. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Hyatt Card Guide

When you book a hotel stay with Hyatt, you can save a lot of money by paying with points instead of dollars. Hyatt offers low-point redemptions for many of their hotels, with prices starting at just 3,500 points per night. Hyatt doesn’t charge resort fees on points bookings so when you book with points, your stay is completely free.

One of the quickest ways to earn a lot of points with Hyatt is to sign up for a new credit card that is providing a welcome offer. Wondering which card to get? This guide breaks down all of the credit cards that earn Hyatt points to help you decide which one is right for you.v

Overall, you may be surprised to learn that the best way to earn a lot of Hyatt points is not necessarily with a co-branded Hyatt credit card but with an entirely different card! For now, let’s start by looking at the Hyatt credit cards.

Hyatt Credit Cards

Hyatt has two co-branded credit cards for earning World of Hyatt points. One is a personal card and the other is a business card. You can hold both cards at the same time. Both cards are issued by Chase.

The World of Hyatt Credit Card

Annual Fee: $95

Key Benefits:

- Annual free night certificate after each anniversary year (valid at a category 1-4 hotel)

- Earn a second free night certificate if you spend $15,000 in a calendar year

- up to 9x points on Hyatt purchases

- Complimentary Discoverist status with Hyatt

If you’re a fan of Hyatt hotels, this card is a good way to earn more points. You automatically get 4 points for every dollar spent with Hyatt, plus an additional 5 points per dollar if you’re a member of the Hyatt loyalty program. That comes to a total of 9 points per dollar spent at Hyatt.

You get 2 points per dollar spent on dining, airline tickets purchased directly from the airline, gym memberships, local transit, and commuting. The card earns 1 point per dollar for all other purchases.

The card earns one free hotel night every year after your card member anniversary. Because of the annual fee, the night is not really “free” but you can think of it as a prepaid, discounted hotel night.

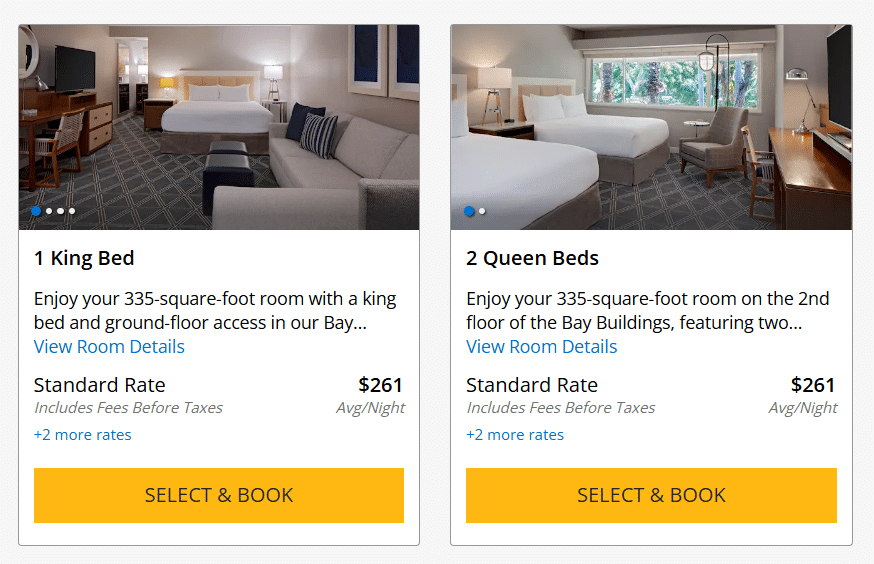

For example, you could use your free night certificate to stay at the ocean-front Hyatt Regency Mission Bay Spa and Marina in San Diego instead of paying $261.

You can earn a second free night certificate by spending $15,000 on the card within a calendar year. You also get complimentary Discoverist status and 5 qualifying night credits each year to help you get to a higher status even faster. You get an additional 2 tier-qualifying nights for every $5,000 spent on the card.

affiliate link

Annual Fee:

World of Hyatt Business Credit Card

Annual Fee: $199

Key Benefits:

- up to 9x points on Hyatt purchases

- Complimentary Discoverist status with Hyatt for yourself and up to 5 employees

- Up to $100 in Hyatt credits each anniversary year

- Earn 10% back on point redemptions after spending $50,000 on the card in a calendar year

Like with the personal card, you get 4 points for every dollar spent with Hyatt, plus an additional 5 points per dollar if you’re a member of the Hyatt loyalty program. That gives you up to a total of 9 points per dollar spent at Hyatt.

The $100 credit is easy to use if you stay at Hyatt hotels at least twice a year. The benefit comes as a $50 credit towards a Hyatt purchase twice a year.

This card doesn’t come with a free night certificate so unless you spend a lot, the annual fee might not be worth keeping this card long term. The 10% back on point redemptions is a nice perk, but you have to spend $50,000 on the card in order to get it.

This is a good card for business owners with big expenses who want to earn Globalist status.

Hyatt Card Eligibility

The 5/24 Rule

Chase has something that the points and miles world likes to call the “5/24 rule”. What this means is that if you have opened 5 cards in the last 24 months (from any issuer), Chase likely won’t approve you for any of their credit cards, including the Hyatt cards.

Most business cards don’t count towards that 5 (though there are some exceptions). Being added as an authorized user to a personal card does count.

The 24 Months Rule

Personal Card: You can earn a welcome offer on a Hyatt personal card once every 24 months. If it’s been less than 24 months since you earned a welcome offer on a Hyatt personal card, you won’t be eligible to earn a new bonus. Even if you don’t currently have the card open.

The 24 months is calculated from when you earned the bonus, not when you signed up for the card. If you’re not sure when you last earned a bonus on a Hyatt personal card, you can call Chase and ask. They’ll be able to tell you over the phone.

Business Card: The same rule applies to the business card. To be eligible for a welcome offer on the World of Hyatt Business card, you must not have earned a bonus for the same card within the past 24 months.

Holding Multiple Hyatt Cards at Once

You can hold both the personal card and the business card at the same time. But you can’t hold multiples of the same card.

For example, you can’t hold two Hyatt business cards at the same time, even if it’s for a different business.

Comparing the Hyatt Credit Cards

| World of Hyatt Credit Card | World of Hyatt Business Credit Card | |

|---|---|---|

| Annual Fee | $95 | $199 |

| Up to 9x points per dollar at Hyatt | X | X |

| Automatic status | Discoverist | Discoverist |

| Annual free night certificate | X | |

| Up to $100 Hyatt credit each anniversary year | X | |

| Earn a second free night certificate after spending $15,000 on the card in a calendar year | X | |

| Earn 10% back on point redemptions for the remainder of the calendar year after spending $50,000 on the card in a calendar year | X |

Other Cards to Earn Hyatt Points

You can earn a lot of Hyatt points with a World of Hyatt credit card, but you can also earn them by transferring points from a card that earns transferrable points.

Currently, the only cards that transfers points to Hyatt are issued by Chase and Bilt. If you hold a credit card that earns Chase Ultimate Rewards points, you can transfer those points to Hyatt at a 1:1 ratio.

That opens up a lot of opportunities to earn even more Hyatt points!

Note: In order to transfer your points to Hyatt, you must hold a card with the ability to transfer points to travel partners. The Chase Sapphire Reserve®, Chase Sapphire Preferred® Card, and Chase Ink Business Preferred® Credit Card all give you the ability to transfer your points to travel partners like Hyatt.

If you hold one of those cards, you can combine the points from your other Ultimate Rewards earning cards in order to transfer them to Hyatt. You can also combine points with someone in the same household.

Chase Sapphire Reserve®

Annual Fee:

Chase Sapphire Preferred® Card

Ink Family of Cards

Annual Fee:

Is World of Hyatt right for you?

Here at Katie’s Travel Tricks, World of Hyatt is our number one hotel loyalty program for a lot of reasons! The predictable award chart, solid benefits, and the ability to transfer Chase Ultimate Rewards points make it a great option.

By understanding the nuances of Hyatt’s loyalty program and utilizing the right credit cards, you can maximize your rewards and enjoy unforgettable travel experiences. For more about Hyatt, we have another blog to help you learn how to use your points for Hyatt.

Table of Contents

- Hyatt Credit Cards

- The World of Hyatt Credit Card

- ELEVATED OFFER!

- World of Hyatt Business Credit Card

- Hyatt Card Eligibility

- Comparing the Hyatt Credit Cards

- Other Cards to Earn Hyatt Points

- Chase Sapphire Reserve®

- ELEVATED OFFER!

- Chase Sapphire Preferred® Card

- Ink Family of Cards

- ELEVATED OFFER!

- Is World of Hyatt right for you?

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.