Southwest Companion Pass Trick: 2024 Complete Guide

Learn the easy way to get a Southwest Companion Pass! One of my favorite travel deals is the Southwest Airlines Companion pass. Learn about the Southwest Companion Pass trick here. This guide aims to tell you everything you need to know to earn two-for-one travel for your family!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Southwest Companion Pass 2024 Basics

Let’s start with the basics: if a person earns 135,000 Southwest Rapid Rewards points in a calendar year, besides all those points you just got, you will also earn a Southwest Companion Pass.

Once you earn the Companion Pass: for the rest of that calendar year and the next calendar year, you can name a person who will then fly with you anytime you fly and only pay about $5 in fees each way. (International Flights will have higher taxes).

Note: Starting January 1, 2023 — Southwest credit card holders will also automatically earn 10,000 Companion Pass “Qualifying Points” so the requirement essentially if you hold a Southwest credit card is to earn 125,000 points. These are not points that you can redeem for flights, these just basically jumpstart your Companion Pass Tracker with 10,000 points.

You can also change your companion 3 times per year.

Since earning our first companion pass in 2015, we have exclusively traveled on Southwest for domestic flights. For much of that time, my husband and I EACH held a companion pass. That means both of our kids were flying domestically for $5 each!

There are a few tricks to earning it and maximizing your Companion Pass, as well as some restrictions. I’m going to try to lay them all out here, so you can enjoy two-for-one travel, too.

If you’ve never flown Southwest, check out my intro guide to flying Southwest. We love the customer service we get on Southwest, as well as the free checked bags and freedom to change our flights up until 10 minutes before take off.

Trick #1: Timing

Timing is important when it comes to the companion pass.

You have to earn 135,000 points in a calendar year (January 1 – December 31) in order to earn your Companion Pass.

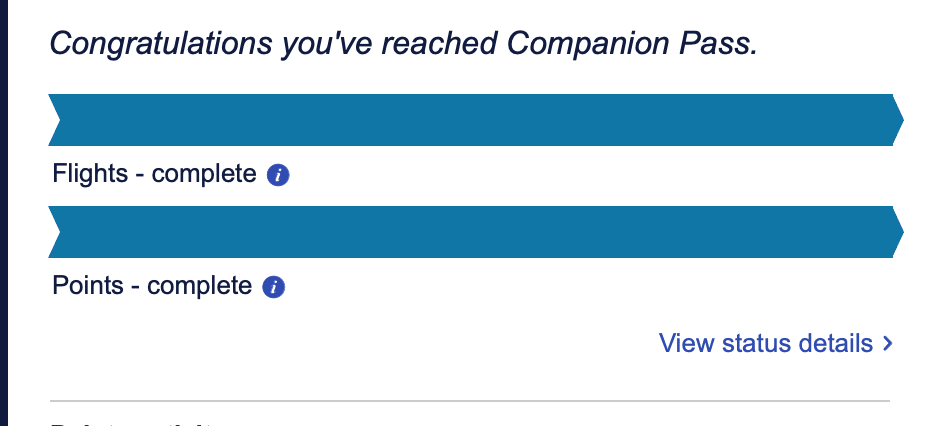

When you log in to Southwest’s website, you’ll see your Companion Pass Tracker on your Account page. This resets on January 1 each year.

You’re not redeeming points for a Companion Pass, it is just an extra perk that Southwest gives to reward you for your loyalty — their way of saying “Thanks for earning those points, here’s a bonus!”

Remember, if you have a Southwest credit card — by January 31 you will have 10,000 qualifying points automatically added to your tracker.

Best time to earn

As soon as you’ve earned your required points, you will get the companion pass for the rest of that calendar year plus the NEXT calendar year.

Earning it early in the year will give you the most time with your Companion Pass.

If you earn the companion pass on January 31, 2023, you will have it until December 2024– the rest of 2023 and the whole next year (2024) — 23 months.

If you earn the companion pass in December 2022, you will only have it until December 31, 2023 which is about 12 months.

For maximum value, you want to try to earn it as early in the year as possible. Keep reading to find out the strategies I use to earn it as early in the year as possible.

Trick #2: Earn a Companion Pass by opening new credit cards

The most straightforward way to earn a companion pass way is by opening 1 or 2 new Southwest credit cards from Chase, which is the exclusive issuer of Southwest cards. There are 3 Southwest branded personal cards to choose from and 2 Southwest branded business cards. Each dollar spent on a Southwest credit card earns you at least 1 Southwest Rapid Rewards point but it is the sign up bonus that is most helpful in earning a companion pass.

Sign up bonuses vary, and often during the year, you will be able to earn the Companion Pass just by earning two sign up bonuses. Other times, the sign up bonuses will get you most of the way there and then you will need to top off your earning with a few more points.

Sign up bonuses on the personal cards start at 40,000 points after spending $1000 in 3 months, but often go up to 60,000+ points after spending $2,000 to $3,000 a few times a year. Some bonuses will have different tiers — like earn 50,000 points after you spend $3,000 in 3 months, and earn 50,000 more after you spend $12,000 total in 12 months. Occasionally Southwest offers a limited time Companion Pass as part of the sign up offer on a credit card. The offer on the Southwest Performance Business card is pretty standard at 80,000 points (after spending $5,000 in 3 months). Annual fees range from $69 to $199 depending on the perks of the cards.

To be eligible for the credit card bonuses you need to have good or excellent credit. You also need to qualify under Chase’s unofficial “5/24 rule” which means you need to have opened fewer than 5 credit cards (from any issuer) in the past 24 months. Head back to my getting started with credit cards page if you’re just starting out with opening credit cards for free travel.

Note: you are only allowed to earn a bonus on 1 personal Southwest card per 24 months, so if you want to earn the Companion Pass solely through credit card bonuses, the easiest way is a combination of 1 business Southwest card and one personal Southwest card.

Here are all your card options. If you’re interested in applying for one of these cards, please use my affiliate links as it helps support my site and doesn’t cost you anything!

Personal Cards

I think the Southwest Rapid Rewards® Priority Credit Card offers the best value by far, even though it has the highest annual fee. The annual fee effectively drops to $74 after the $75 annual statement credit. The statement credit is extremely easy to redeem, you can even buy $75 of Southwest Giftcards on their website each year and the credit comes off on my statement automatically. You could also use it for taxes and fees or in-flight food and beverages.

The Priority card also offers 4 upgraded boardings (instead of the 2 early bird check ins) and more points on your card anniversary.

Keep in mind that you are only eligible for a new personal card if you haven’t received a bonus on a personal card in the past 24 months. Essentially 24 months after you receive your bonus you are eligible to apply for another card and get another bonus (as long as you have cancelled your previous card).

credit card

welcome offer:

50,000 points

Learn more > Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Annual Fee:

$149

Business Cards

Southwest business cards tend to have very consistent offers and we don’t see the same variation as we do on the personal cards.

If you have any side hustle that generates income, you probably qualify! This includes things like selling old toys on Facebook marketplace, walking dogs, babysitting, tutoring, and more.

For those types of “small businesses” you will apply as a sole proprietor and use your Social Security number where it asks for an EIN.

Current Bonus:

80,000 points

Earn 80,000 bonus points after spending $5,000 on purchases in the first 3 months from account opening.

Annual Fee:

$199

credit card

Current Bonus:

60,000 bonus points

Earn 60,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

Annual Fee:

$99

Trick #3: Time your Credit Card Applications

As discussed above, the best time to earn the companion pass is in January. So how do you accomplish that with credit cards? Part of the Southwest Companion pass trick is to get your timing right.

You need to time your card applications carefully. Business card applications from Chase can take a few weeks to process, so I recommend starting the application process as early as October 15. You can try applying for both a business card and a personal card on the same day and it might get approved. Or you can apply for 1 first, wait 30 days and apply for the other.

The next step is critical: timing when you will receive your bonus points.

After you complete your minimum spending requirements, Chase typically gives you your bonus points on the day that month’s statement closes.

Let’s say you apply for the card in early October and complete your $1000 spending pretty easily in November. When your statement closes on December 15 (for example), you will earn your 50,000 bonus points. But wait! That’s NOT what you want to do. You are trying to get those bonus points to post in January at the earliest.

You absolutely don’t want to complete your minimum spending before January 1.

Got it? Don’t complete your minimum spending before January 1!

Technically you should be able to complete it as soon as your December statement closes. The date will vary for each person. You can call to confirm your statement closing date and often you can change the date you want it to close.

If you want to do some end of year charitable giving on your card (one of our favorite ways to complete minimum spending requirements) you could do that on December 31 and you should be fine, most transactions don’t post on your credit card for a few days anyway.

But if you want to be absolutely sure, just wait till January 1 to spend big. You could apply for your cards as early as October 3. You need to complete your spending within 3 months so watch your dates very carefully. You can also wait until December or January to apply for the cards if you don’t have any travel planned early in the year. Historically, usually in the late fall and winter, Chase raises the sign up bonuses on all the Southwest credit cards, so personally, I like to wait until I see an offer of 60,000 points before I jump on it.

You can also sign up for my free downloadable guide which has an optimal timeline here.

The 10,000 “qualifying” points from having a credit card will appear on your Companion Pass Tracker by January 31.

Sample card combos to earn the Companion Pass

These calculations were calculated with the 50,000 point bonus on the personal cards that was available on January 1, 2024.

Remember: effective January 2023, if you hold a Southwest Rapid Rewards Credit Card on the “first business day of the calendar year” you will get a boost of 10,000 Companion Pass Qualifying points. These will be deposited by January 31st. You only get one boost, even if you have two different cards. This “boost” is not giving you points you can redeem but just points that will get added to your Companion Pass tracker.

Personal Cards Only:

Opening any Southwest personal card will give you 51,000 points after completing your spending. I prefer the Priority card over the lower annual fee Plus card due to all the benefits it adds. If you open only a personal card, you will still need to find other ways to earn the 74,000 other points to earn the Companion Pass. This can be through a combination of additional spending, referring friends and family to the card, or using shopping portals. It is hard to do, I’d recommend waiting for another higher offer.

| Card Opened | Southwest Priority Card |

| Total Annual Fees paid | $149 |

| Total points earned after minimum spending | 51,000 points 50,000 from bonus + 1,000 from spending |

| Additional points needed to reach 135,000 and earn Companion Pass | 84,000 points (you’ll get 10k added to your tracker by holding a card) |

| Additional premium benefits | 4 upgraded boardings per year + $75 back on Southwest purchases, which includes taxes and fees from booking flights |

One Personal + One Business Card:

Southwest Priority Card + Southwest Premier Business Card

This combo will give you the lowest total spending across two cards to reach your bonuses. You could also substitute the $69 annual fee Plus card if you wanted lower annual fees.

| Cards Opened | Southwest Priority Card Southwest Premier Business Card |

| Total Annual Fees paid | $248 |

| Total points earned after minimum spending | 114,000 points 110,000 from both bonuses combined + 4,000 from spending |

| Total spending needed to earn bonus points | $6000 |

| Additional points needed to reach 135k and earn a Companion Pass | 11,000 |

| Additional premium benefits | 4 upgraded boardings per year $75 back on Southwest purchases, which includes taxes and fees from booking flights 2 Early Bird Check Ins per year |

Southwest Priority Card + Southwest Performance Business card

This card combo gives you the highest level of benefits from Southwest cards. It requires a higher level of spending to achieve both bonuses but will offer more points, too.

| Cards Opened | Southwest Priority Card Southwest Rapid Rewards® Performance Business Credit Card |

| Total Annual Fees paid | $348 |

| Total points earned after minimum spending | 136,000 points 130,000 from both bonuses combined + 6,000 from spending |

| Total spending needed to earn bonus points | $8000 |

| Additional points needed to earn Companion Pass | None! You’ve earned it! |

| Additional premium benefits | 8 upgraded boardings per year $75 back on Southwest purchases, which includes taxes and fees from booking flights Free Wifi on flights TSA Precheck/Global Entry credit |

Business Cards Only:

While you can only open one personal card, the rules for business cards are different. You can open both business cards in the same year if you choose to.

Southwest Premier Business card + Southwest Performance Business card

| Cards Opened | Southwest Premier Business Card Southwest Rapid Rewards® Performance Business Credit Card |

| Total Annual Fees paid | $298 |

| Total points earned after minimum spending | 148,000 points -140,000 from bonus -8,000 from spending |

| Total spending needed to earn bonus points | $8000 |

| Additional points needed to earn Companion Pass | None! You’ve earned it! |

| Additional premium benefits | 4 upgraded boardings per year 2 free Early Bird Check-Ins per year Free Wifi on flights TSA Precheck/Global Entry credit |

Trick 4: Earn 2 passes with just 3 card sign ups

This trick is perfect for families. Watch my YouTube video to learn more.

Trick 5: Other Ways to Earn Rapid Rewards Points

New credit card sign up bonuses are the fastest way to give yourself a huge points boost on your quest to earn a Companion Pass. But it isn’t the only way! Here are a few more options. These are also the best options for card offers that get you most of the way there but maybe not all the way.

Refer a friend (or spouse) to any Southwest Credit card if you already have one

- Referral bonuses are usually 20,000 points per referral. If you have any Southwest credit card, you can generate a personalized link that will allow you to refer a friend to any of the Southwest cards.

- Sometimes Chase will release a lower offer through the referral page.

- If you refer a friend to a Southwest credit card in December after your December statement is closed, this referral will post to your account in January and will count for your next year’s companion pass earning. This is a great way to get a boost on your earning.

Rapid Rewards Shopping Portal

- Earn points by clicking through the links from a wide variety of online shopping options

- Note: bonuses sometimes allow you to earn as much as 3500 bonus points after spending certain amounts — but technically these bonus points won’t count towards the Companion Pass. Just the base points on your portal purchases. In practice, though, sometimes these bonus points often count towards your companion pass.

Book Hotels Through Southwest Hotels

- Earn points per dollar you spend on Southwesthotels.com – and bonus points of up to 10,000 per night!

- Southwest partners with Booking.com for this and guarantees the best rates

Rapid Rewards Dining Program

- Register any credit or debit card to earn points when you dine at participating restaurants.

- Technically only the base points you earn count towards the companion pass, not any bonus promotions — but in practice the bonus promotions seem to count as well.

Earn points for flights you take and pay cash for on Southwest

- Depending on which card you have, you will earn 2x-4x points on any Southwest flight you’ve purchased, in additional to the points you get for your actual flight.

Earn bonus points though Southwest partners (base points only, not bonus points)

- Hotel stays booked through Rocketmiles can earn up to 10,000 Rapid Rewards points per night

- Car rentals booked through the Southwest partner site can earn points per booking

- Check the Southwest site for all the current deals!

Quarterly bonus points from Chase

- Every quarter, Chase targets some cardholders for bonus spend opportunities. Sometimes it is as simple as earn 5x on all spend. Or it might be spend $1,000 and earn 3000 points.

- Check your cards here: https://www.chase.com/mybonus to see if they qualify every quarter!

Which Points Don’t Count Towards Earning a Companion Pass?

It is important to note that not all Rapid Rewards points you earn will count towards the 125,000 you need to earn a companion pass. Here are the points that technically DON’T count:

- Points transferred from Chase Ultimate Rewards® accounts (like the Chase Sapphire Preferred® Card)

- Points converted from hotel or car loyalty programs

- Purchased points

- Points from e-Rewards?, Valued Opinions, and Diners Club?

- Tier bonus points

- Flight bonus points

- Partner bonus points (with the exception of the Rapid Rewards Credit Cards from Chase).

In practice, some people find that partner bonus points DO actually count towards the Companion Pass, so your results may vary.

Check out the full terms here.

Trick #6: Complete your minimum spend with low monthly expenses

One of the key parts of using credit cards to earn miles and points is not spending more money to reach these bonuses, but just to leverage your everyday spending. We have monthly expenses that are around $1,000 a month so we often need to use other strategies to help us reach minimum spends. This is also helpful with bonuses that require a larger amount of spending (like $10,000+) if we want to complete it more quickly. Read our full article here.

- Move all your spending to your new card. We use Google Pay to set up both of us to use the new card for stores that accept contactless payment.

- Buy store gift cards. You can’t do this perpetually, but if you are a few hundred dollars short on a minimum spend, it can help to buy a gift card to a store where you know you will use it. I sometimes buy as much as $1,000 in Costco gift cards, knowing I will spend it eventually. This only works if you have the cash flow to essentially pre-pay your biggest expenses.

- Buy Visa gift cards when your grocery store or Staples has a promo (otherwise the activation fees might not be really worth it). I then register these gift cards with a PIN number online and use them for bills that I can only pay with a debit card, like my health insurance (many online processors will consider them a debit card — always test with a smaller amount first!)

- Pay your car or home insurance (or time a new card sign-up to when you have an insurance bill coming). Many companies will even allow you to pre-pay.

- Pay your property taxes. This varies depending on location. In our county, I am charged a small fee to do this but I often find it worth it anyway if I’m working on a new card bonus.

- Fund micro loans through Kiva. You will get paid back eventually and do good in the process!

- Save up your charitable giving and use your credit cards to give.

- Use Plastiq to pay bills where credit isn’t usually accepted. Again, there is a fee but sometimes the fee is worth it for us, like if we pay a $50 fee but then get $700 of travel! If you want to pay your mortgage, you can only use a Mastercard, so this doesn’t work for the Southwest cards.

- Open a new bank account and fund it with a credit card – Doctor of Credit has a great resource on this. I recently opened a money market account with Great Southern Bank and was able to fund $4900 with a Chase credit card. It coded as a “Financial Purchase” and I received points for the purchase. I will keep the account open for 30 days and then close it.

- Prepay monthly expenses like Netflix, gym memberships or tuition.

- Pay a car down payment. When we bought a car we were allowed to put $2500 of the down payment on a credit card. Varies by dealer.

- Load your Amazon account with Amazon gift cards.

- Add a trusted family member or friend as an authorized user and let them reimburse you for their purchases.

- Pick up the tab if out to dinner with friends and have them pay you back via Venmo or another electronic cash app.

- Get reimbursed for business expenses. Clear this with your company first.

- Pay your rent with a service like RadPad or Place. Usually about a three percent fee.

- Pay your federal income or state income taxes (fees of 1.67%+ will apply.

- Pay tuition.

Companion Pass FAQs

When Does My Companion Pass Start?

After you’ve earned your 135,000 points in a calendar year, you should get access to your Companion Pass within a few days.

If you’ve completed your spending on a credit card, your points will generally post within a day of when your statement closes. This date varies from person to person.

How will I know I’ve earned the Southwest Airlines Companion Pass?

When you log into your Southwest Account, you can see your progress right on the dashboard.

When you have earned the Companion Pass, you will receive an email from Southwest congratulating you on earning it.

How to use Southwest Companion Pass: Designating your Companion

The email you receive from Southwest will invite you to designate your companion. When you log into your account, you should also be prompted to designate a person.

Keep in mind, you can change your companion 3 times in a calendar year, so you do have some flexibility. But after the 3rd change, your companion will be locked onto that person.

After designating your companion, you will also receive a physical card in the mail that says “Companion Pass” with your companion’s name. We have always just stuck this in a drawer and never looked at it again. We’ve never needed it.

How to Book with Southwest Companion Pass

If you already have a flight booked, you can now add your companion to it. You can always do this over the phone if you want to. Or generally it can be done online. Log into your account and find your booking. You should see a link to “Add Companion” to your reservation. The reservation screen is very similar to booking a regular ticket.

You always have to book your flight and then add your companion separately. You can use your Rapid Rewards points to book more than one ticket. So if you are a family of 4 with one companion pass, you can book 3 tickets together from one Rapid Rewards account and then add the companion. You and your companion will also always have separate reservation numbers so it is an extra step on check-in. You will need to check in separately.

We love that Southwest doesn’t charge change fees and will just deposit your miles back into your account as long as you cancel at least 10 minutes before your flight leaves!

Occasionally we have run into problems with adding a companion to our reservation. Sometimes with International itineraries you need to call in to add a companion. You will also pay additional taxes when flying internationally. Sometimes because we have 2 companion passes, we need to call in to add the 2nd companion because the screens error out and tell us we already have added a companion to the reservation. Sometimes if we want to change a reservation and have already added our companion to the reservation, we need to call in to do so. Southwest customer service is always helpful and friendly so really, don’t be afraid to call and ask for help!

What other questions do you have about the Companion Pass? Do you need help with the Southwest Companion Pass Trick? I’d love to help you get some two-for-one tickets!

Table of Contents

Table of Contents

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Hi. I just canceled my personal card 11/16/23 that I have had for 5 years. How long should I wait to apply for a new personal card?

Usually I recommend about 14 days to make sure it clears out of Chase’s system

Hi, Katie. I have a Southwest personal card that I have had for several years. Can i apply for the Priority card and get the bonus points even though I already have a personal card?

You would need to cancel your SW personal card first before applying for a new bonus

Hi Katie! We’re a couple trying to start earning Companion Passed on alternating 2yr cycles. Thanks for your advice.

On March 9, 2024, P1 received the SW personal card 30k bonus and companion pass til 2/28/25…

What do you think is the best approach to start getting on a 2yr cycle?

Should P1 try to get business cards to extend the companion pass? Or should P2 apply for cards in late 2024 to get a pass through 2026?

When should P1 cancel his card?

Are you hoping to just hold one at a time? Or would you ultimately like to hold 2 at a time (like if you have 2 kids)

And, one more question – if i cannot what do you think about my wife opening a Priority card to get the Companion pass for 2025?

Yes, this is a good plan, especially because you can refer her to her own card and you will get a 20k referral bonus

I just realized I have 125K points and it’s the end of November. I am signed up for 3x points on purchases and 25% extra points on purchases. do earn the 10K points…

1. will the 3xs points be included?

2. Will any purchase I do with my card before 12/31 go towards the 2023 points I have accumulated?

Help? any other ideas?

Only purchases for a statement that CLOSES in December will count towards this year. 3x points would count IF they post in December

What happens after you have already opened up several cards and earned the bonuses? Do you just close the accounts, then reopen them in a few years? Is there another way to continue to earn the companion pass without opening/closing credit cards and earning the sign-up bonuses?

It is easiest to earn a chunk of points by closing the credit cards and re-opening. There are other ways to earn points without the credit cards but it is harder to get to 135,000.

I applied for SW business card because I sell quite a bit n classifieds without. Tax id. SW replied I must have a tax I’d. Any suggestions?

If they are asking for verification, you just need to tell them as a sole proprietor you don’t have a EIN but you use your Social Security number. This is common. Your SSN can become your Tax ID if you are a sole proprietor.

Hello there. Thanks for all the great info. I applied for the SW Visa Rapid Rewards card in Feb 2024 when the SUB was a companion pass through Feb 2025 after min spend (which we just completed). My companion pass should hit any day now. Can I add a SW business card to extend that pass….or do I need to wait 24 months, close the personal card, and restart the process from the beginning following your advice above?

I’m looking to add a business card anyway…but the SW one is only beneficial to me if it extended the companion pass.

Thanks for your help!

Yes you can add the business card to extend it!

I’m 130k out of the 135k required for Companion. Are points accumulated for purchases in December or when you’ve paid your bill in December? I’ve already posted payment Dec 4th and won’t again until Jan 4th. Should I pay the bill early?

Paying the bill early won’t help, unfortunately. Your best bet for quick points is probably Rapid Rewards Shopping and hope the points post quickly.

HI Katie………Love the site and appreciate the content very much. I have a question about Companion Pass please. I was awarded it on 7/15/23 (through 2024), so given that when did or does the calculation for the next one start and run through?

If you were to earn 135,000 points in 2024, it would extend your expiration date through Dec 31, 2025. You can find the Companion Pass Tracker when you log into your Southwest account.

If you say they reset to 0 in Jan – how does the posting of the final $10k in Jan get you to $135k? Am I misunderstanding the reset?

If you have timed it right, all your fall credit card bonuses should not post until after January 1.

Do you perhaps have a diagram for a couple earning SW cards to earn a companion pass every year. I’ve listened to your directions but don’t get how a partner’s application would earn a Sw companion pass in alternate years

For every year you would just alternate. So if P1 applies right now for business and personal card, they will earn it through December 2025. Then in late 2025 or early 2026, P2 would apply for personal and business SW cards.

Hi Katie, your website has been a great source of information! We have used your referral links to open several credit cards. My husband and I both have SW companion passes (first time thanks to you :D). Our two children will be our companions. Do my husband (P2) and I (P1) have to purchase airline tickets separately so we can individually add our companion? Or can P1 purchase tickets for both P1 and P2, and then afterward P1 and P2 can add our companion? Thanks in advance!

You can buy the adult tickets together! And then you can each add your kids as companions.

Thanks for this great information. I should have my companion pass in place next week. My wife will probably not have hers until first week of March. Since we have a family of 5 and will have 2 companion passes with 2 separate Rapid Rewards accounts, am I correct that we need to do two separate bookings? One for me, my companion, and one child and the other for my wife and her companion. We have trip planned this summer and I am probably going to book once my companion is in place and just change her companion from paid to companion once the CP is in place.

You can put you and your wife and one child on the same booking. Then you will each have to add your companions separately.

I just earned my Companion Pass. The points have posted after my statement closed and I have even booked a flight for my companion already. Due to a trip being cancelled, I now have to cancel a large purchase at AirBnb that helped me qualify. Can SW take back the companion pass once granted? Am I at risk of having an issue with Chase? I plan to keep using the card for everyday expenses, to show that this was not a scam, but I won’t have any particularly large charges anytime soon.

They won’t take it back, but it is a good idea to “re-spend”that money to show that it was a legit cancellation and not a scam!

Hi Katie , thank you SO much for your insights! I have 75K points in my account as of today. I received an offer for companion pass / credit card when spending $4k in first three months and as I understand it – this companion pass will be usable for 12 months. Do you recommend that route or is there an option to purchase the needed 60k points ($900) and the companion pass is good for 2 years?

HI-

I earned a companion pass for all of 2023 and 2024 thanks to your great instructions! I opened a personal and business account for myself.

I would now like my husband to open a personal and business account in late Oct/early Nov with points posting in January per your recommendation. Do I close my two accounts first? Also, when do I close my accounts so I can redo this whole process for myself in two years?

Thank you!

Jane