All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com site has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Recent Chase Business Card Denials: Strategy Tips

Starting in October, we began to notice a lot more people were getting rejected for Chase business cards, suggesting the need for an updated Chase business card approval strategy.

These were for people under 5/24, with a good relationship with Chase and high credit scores.

I read an analysis that used a small sample size to try to figure out what was happening. We were especially seeing a lot of people getting denied for Southwest business cards and that was throwing some Companion Pass plans for a loop.

But some friends and I wanted to have better data so we worked together to collect data points on approvals and denials. We got over 600 data points! Thanks to my friend Beth from VFamilyTravels for spearheading this effort. You can find it all here.

And the data showed some very strong trends. Here’s what we found and how it can inform your strategy going forward.

Special thanks to Vince LaVergne who analyzed this data for us all so we could understand it!

Biggest factor: How many business cards you have with Chase

Anyone who has been in the points world for a while has heard of the 5/24 rule. It drives a lot of strategy when it comes to opening cards.

Business cards (even business cards from Chase) have never counted towards the 5/24 limit but these denials were happening to people who were under 5/24.

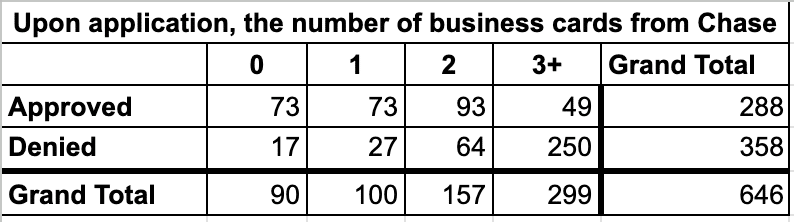

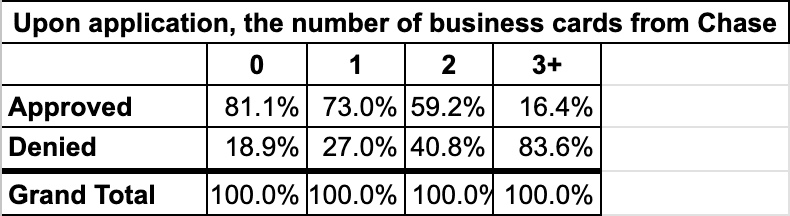

What we found is that the biggest factor for getting approved is how many business credit cards you have open with Chase already.

You can see the percentage of approvals goes steadily down as the number of business cards from Chase increases.

For people with 3 or more business cards from Chase, there was only a 16.4% approval rate. This is less than a third of the approval rate for people with 2 business cards from Chase.

Secondary Factor: Having an LLC helps if you have 3+ cards

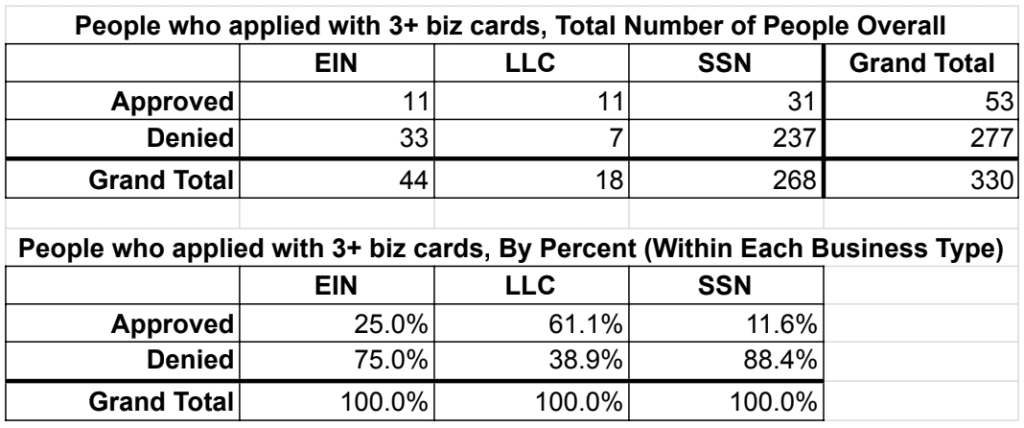

The next factor we dug into with the data points was of those 16.4% of people with 3+ cards who actually were able to get approved — was there any aspect that made them more likely to be approved?

While it’s not close to a guarantee, applying for a business card with an LLC seems to help approval rates. Now the LLC applications had the fewest number so we’re looking at a very small data set.

People applying with the Social Security numbers as sole proprietors were by far the biggest group and while 11.6% did get approved, the vast majority were denied (88.4%).

Factors that do not appear to make a difference

So far the data set shows that all of these factors aren’t really good predictors of whether someone will be approved and won’t likely need to be part of a Chase business card approval strategy.

- Number of personal cards from Chase

- If it had been 90 days since applying for a card from Chase

- If it had been 24 months since receiving a bonus on the card the person was applying for

- Lowering credit limits on other cards from this bank prior to application

- Having a personal checking account from Chase

- Having a business checking account from Chase

Some of these factors were previously believed to help for auto approval.

Factors we have no data on (that may make a difference)

I’d like to continue collecting data points on approvals and denials in order to keep giving the best strategic advice to other points enthusiasts. I plan to release a survey in March where we will continue to collect these data points. But I’m waiting to develop it in case there are other factors that should be tested.

The new survey will include

- Business revenue

- Business: years in operation

- Household income

- Any other factors that seem relevant that are suggested to test

Strategic Takeaways

The biggest takeaway here is that as of now, you should limit the number of Chase business credit cards you are keeping open.

You should always keep any given card open for a minimum of 12 months. But if it has been a year, you may want to cancel that card.

Read more about canceling cards in our ultimate guide to canceling cards here.

If you can get down to two business cards from this bank, it’s going to more than triple your chances of being approved. We saw this theory work out with a lot of people this winter who were denied for Southwest business cards.

After denials, we advised people to cancel business cards so they ended up with two or less, wait 30 days and applied again. We saw almost all were approved at that point.

Now again, 16% of people who had three or more business cards were still approved for another. And of these, the biggest correlation for approval was applying for an LLC.

So if you have an LLC, you might be able to get approved even if you already have 3 or more business cards from this bank.

Chase Ink Strategy

Before you close a Chase Ink card, make sure you’ve held it for at least 12 months. You’ll also want to move any Ultimate Rewards points you have over to another card in your household. If you’re holding a Chase Sapphire Preferred® Card, this is an easy place to move your points.

If your points balance is showing 0 and you’ve had the card for 12 months, you can go ahead and cancel the card.

Business Card Referral Notes

If you’re planning to keep earning a Companion Pass, it’s advantageous to keep at least one Southwest card open in your household so that the next time you start up the process, you can refer someone else in your household.

With the Southwest cards, I’d recommend keeping a personal Southwest card open to do this. This is the best for your credit score anyway.

The same is true of Ink cards — you’ll always earn more points if you refer your partner to the card! So you’ll want at least one person to keep at least one of the Ink cards open so you can continue to earn those referral points.

What about my credit score?

Closing a business card generally has no effect on your credit score.

When you open a business card, there is a small effect on your score — because the bank will check your personal credit. That means you’ll have an extra credit inquiry or “hard pull.” on your credit reports.

But most banks don’t add business credit cards to your personal credit reports. That means that the length of the time you have the card doesn’t reflect in your credit score. So cancelling after a year doesn’t have any effect on your credit score over keeping the card for a long time.

What about my relationship with the bank?

Though we don’t have any data that shows this, I still think it could be good practice to keep one business card long term to establish a history of business cards with the bank. The same is true for personal credit cards.

Chase business card approval strategy: continued data collection

We’d like to keep collecting data from January on. I will wait to create the survey until a few weeks into March so that we can make sure we’re asking the best questions. Add any questions you’d like to see on the survey below in the comments!

Table of Contents

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

I’d love to see average monthly spend on existing cards. I think it would also be helpful to see if the person tried to recon.

both great thoughts, thanks! Will add to the next survey!

I’m curious if you see anything to suggest that Ink cards are treated differently than co branded business cards?

Nope, they all seem to be the same.

Also curious if the data shows any correlation with the 3+ cards being for the same or different business under a single SS#

I was told by Chase that I cannot transfer business points to a personal card, I have sapphire reserve.

You can if you are the primary cardholder on the business account. You just have to connect those accounts.

I often transfer points earned from business cards to my reserve card to get the 1.5% bump.

Quite often one or two calls to other chase reps will get you a different answer, especially if they are international Chase employees to begin with.

Hopes this helps.

that’s a good question for us to ask!

Does it make any difference to Chase how many business cards you have with other banks?

Nope, unless it is a business card that reports to personal credit reports, they can’t even see it.

Thanks for this update Katie. Strangely enough, my wife always gets denied when applying for business cards (she’s on her second one) and after talking to them they would approve. I on the other hand always get approved and now I’m on business card number 3 (all are from the unnamed bank BTW). So question, does this change your 3 year plan? We were all scattered when we first started collecting points before we learned about you so we’re now trying to get on a track particularly since we want to do the two person SW strategy. Anyway, thank you for all you do!

I will need to double check but I believe last time I looked, the Three Year Plan mostly still holds. I will work on making any necessary updates soon!

On reddit I found a discussion of inks getting added to credit reports in the last few days (transunion was most common), I haven’t checked myself but big if true

Thankfully it was an error and is being corrected.

Katie – Apparently, Chase has a policy that hasn’t been enforced with Ink cards in the past. It basically says that you are not eligible for a bonus until 24 months have passed. I applied for and achieved bonuses on all 3 Ink cards last summer and my plan was to cancel them after a year and then reapply a month after that. Could you do some research about that from people who have recently applied after one year?

Just to clarify — the 24 month language used to be in the application and wasn’t enforced. But is no longer in the application or terms. So this is not currently something that could disqualify you from a bonus. Now of course they can deny you! But unless this 24 month language appears on the application or offer terms again, you will qualify for the bonus if you get approved.

I’ve opened Inks and closed them before 12 months is up before. Is there data to suggest I should keep them open for the full year as mentioned in the article? Can you expand on that?

I’m not sure I have a specific Chase data point, but Amex will tell you up front that they will claw back points if you cancel before a full year (even on upgrade offers). It’s just considered best practices to avoid claw backs, shutdowns, and to have a better relationship with the bank.

I am curuious if Business Revenue amount plays a role. Could you add this question to the survey please.

Yes, I’ve wondered that as well!