Chase Sapphire Preferred®: Complete Guide to Benefits & Points

The Chase Sapphire Preferred® Card is a favorite card to recommend to people just starting out with miles and points.

The points are easy to redeem and have a lot of options for redemptions.

credit card

welcome offer:

60,000 points

Go> Earn 60,000 Ultimate Rewards® points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

Annual Fee:

$95

Do I qualify for this card?

Before applying to the Chase Sapphire Preferred® Card, there are a few official and unofficial rules to be aware of.

Chase’s 5/24 Rule

Chase has an unpublished rule that is known in the miles and points world as the “5/24 rule.” Essentially, you will only get approved for Chase’s cards if you have opened fewer than 5 credit cards (from any issuer) in the past 24 months.

The easiest way to check if you are under 5/24 is to open a free account with creditkarma.com or annualfreecreditreport.com. Go through your credit report and count how many new credit card accounts show up in the past 24 months. Auto loans and mortgages do not count. People are often asking if a credit card counts for this and the very basic rule is if it is on your credit report, it counts. So look at your credit report to check! Business cards generally don’t report to credit bureaus so you typically will not see those on your credit report. That also means Chase does not count them against you.

Keep in mind that if you are an authorized user on someone else’s account, this DOES show up on your credit report and WILL count against you in Chase’s 5/24 count. Read my full article to understand more.

Sapphire Family 48 Month Rule

The fine print of the offer currently states “The product is not available to either (i) current cardmembers of any Sapphire credit card, or (ii) previous cardmembers of any Sapphire credit card who received a new cardmember bonus within the last 48 months. “

Translation: if you currently hold a Chase Sapphire Preferred® Card or Chase Sapphire Reserve® card, you cannot earn a new card bonus.

If you have a Chase Sapphire Preferred® Card or Chase Sapphire Reserve® Card and earned your bonus more than 48 months ago you can call Chase to downgrade the card to one of the Freedom products (either Chase Freedom Unlimited® or Chase Freedom Flex℠®) and then you would be eligible for a new sign up bonus.

How do I know when I got my last bonus?

You are eligible for a Sapphire card 48 months after you last earned the bonus. But what if you don’t remember when that was? You can send a Secure Message to Chase’s customer service when you’re logged into your account. Simply send a quick message that says “I can’t remember when I got my sign up bonus for my Sapphire card, can you help me find the date?”

If you know when you opened the card, you can use that date plus another 3-4 months.

You can also look through old statements to find out when you got your bonus.

Minimum Suggested Credit Score

There is no hard and fast rule on a minimum credit score to apply. In searching online, most sites recommend having a score in the “good range”. You can read through data points here on Credit Karma as to different scores people got approved at. With Chase, having a prior relationship with the bank can sometimes help if your credit score is on the lower end.

What’s a good sign up offer?

Standard Offer

For many years, the standard sign up offer for the Chase Sapphire Preferred® Card was for 50,000 bonus points. More recently, the standard offer has become 60,000 points after you spend $4,000.

Offer History

In Fall 2020, the offer was raised to 80,000 points after spending $4,000, which was the highest public offer (at this point) ever on this card. Some people do receive a targeted mailing offer for 80,000 points after spending $4,000 on a new card.

On March 22, 2021, this offer returned! Then in June 2021, the offer went up to 100,000 points. We have not seen a 100,000 point offer since 2021. In 2022, we saw the 80,000 point offer return on March 19, 2023 and went back to 60,000 points on May 25, 2023.

How Can I Apply?

Interested in applying? Please use my affiliate link! It helps support my site and doesn’t cost you anything!

Travel Benefits

There are a lot! For a card with a $95 fee, this one is full of great travel insurance, purchase protection, and more.

If you travel even once a year, you want at least one card in your wallet that includes travel insurance, primary rental car insurance, and no foreign transaction fees. The Chase Sapphire Preferred® Card checks all those boxes and more!

$50 Annual Hotel Benefit

The Chase Sapphire Preferred® Card has a $50 Annual Credit on hotel stays purchased through Chase’s Travel website. New cardmembers earn the credit immediately and existing cardmembers will renew their credit each year on their next account anniversary.

Primary Car Rental Insurance (Auto Rental Collision Damage Waiver)

Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is primary which means that if you need to file a claim, it will not affect your personal car insurance rates. This coverage provides reimbursement up to the actual cash value of the vehicle for theft and collision damage for most rental cars in the U.S. and abroad. A notable exception is Teslas, which this card does not cover.

Trip Cancellation / Trip Interruption Insurance

This insurance helps out if a trip is cancelled or “cut short by sickness, severe weather and other covered situations.” It allows you to be reimbursed up to $10,000 per person and $20,000 per trip for non-refundable travel expenses, including passenger fares, tours, and hotels. This comes into effect even if you’ve just paid for taxes and fees with your card.

Baggage Delay Insurance

This coverage will reimburses you for essential purchases like toiletries and clothing if your baggage is delayed over 6 hours. That means if you baggage fails to arrive within 6 hours of your arrival, you can get up to $100 a day for 5 days. This is one of very few cards to carry this insurance!

Trip Delay Reimbursement

If your flight is delayed more than 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.

Lost Luggage Reimbursement

If you or an immediate family member check or carry on luggage that is damaged or lost by the carrier, you’re covered up to $3,000 per passenger.

More Protection Benefits

These benefits are often overlooked but can be so valuable! We have filed multiple claims for purchases under these protections — for a stolen cell phone, for a washing machine, and even for our inflatable hot tub. The key is that you must make the purchase for this item with this credit card and still have the card open when you make the claim.

Extended Warranty

Extends a manufacturer’s warranty by an additional year, on eligible warranties of three years or less.

Purchase Protection

This benefit covers your new purchases for 120 days against damage or theft up to $500 per claim and $50,000 per account.

Instacart, Door Dash, & Lyft Perks

Instacart Benefits: $15 per quarter

Activate here by July 31, 2024. You’ll start with 6 months of complimentary Instacart+ which gives you free deliveries on orders of $35 or more. The membership auto-renews — so I suggest cancelling right away! You’ll also get $15 in statement credits each quarter through July 2024 — so $60 a year! After your Instacart+ runs out, you can still get pick up orders.

Door Dash: Free DashPash for 1 year

You’ll get unlimited deliveries with a $0 delivery fee and reduced service fees on eligible orders over $12 for a minimum of one year with DashPass, DoorDash’s subscription service. Activate by 12/31/24.

Lyft – 5x Points

Earn a total of 5x points on Lyft rides through March 31, 2025. That’s 3x points in addition to the 2x points you already earn on travel.

Earn more points

After you earn a welcome offer on a Chase Sapphire Preferred® Card, you can continue to earn more points in lots of other ways.

Bonus Earning Categories

Starting August 16, 2021 Chase added a bunch of new bonus categories! If you use your Chase Sapphire Preferred® Card in these categories of spending, you will earn more points.

- 5x total points on all travel purchased through Chase Ultimate Rewards®

- 3x points on dining, including eligible delivery services, takeout and dining out (previously 2x)

- 3x points on select streaming services

- 3x points on online grocery purchases (excluding Target, Walmart and wholesale clubs)

You earn 1x points on all other purchases.

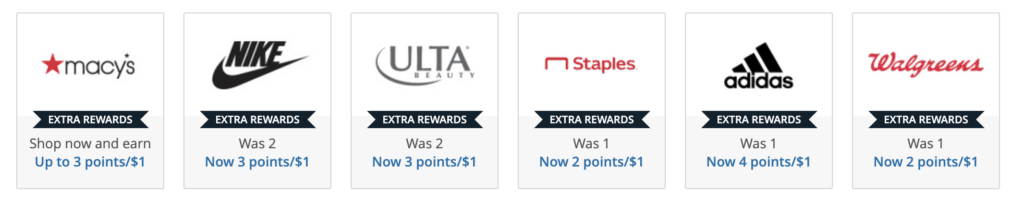

Shop Through Chase®

By clicking through from Shop Through Chase® you can earn extra points at a wide variety of stores. The earning rates change frequently (almost daily in some cases) but here are some samples.

Anniversary Points

10% Anniversary Point Bonus. Each account anniversary, cardmembers will earn bonus points equal to 10% of total purchases made the previous year. That means, $25,000 in spend will earn an additional 2,500 bonus points. This is going to be a very small earning amount for most people.

Combining Points From Other Cards

If you have other cards that earn Chase Ultimate Rewards®, you can combine them onto one card. This is particularly useful if you have one of the Chase Freedom cards or Chase Ink Business Cash® Credit Card or Chase Ink Business Unlimited® Credit Card. All of those no annual fee cards earn Chase Ultimate Rewards® points can only be used for cash back–BUT you are allowed to move them over to an account like a Chase Sapphire Preferred® Card and then those points get all the value of the Chase Ultimate Rewards® points that the Sapphire has.

credit card

welcome offer:

$200 Bonus Cash Back

Learn How to Apply – Earn $200 bonus cash back after you spend $500 on purchases in your first 3 months from account opening.

Annual Fee:

$0

credit card

welcome offer

up to $750

Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend a total of $6,000 on purchases in the first six months after account opening.

Annual Fee:

$0

Refer a Friend

If you already have a Sapphire card, another great benefit is that you can refer a friend — or a spouse to the card!

The typical referral bonus is 15,000 points.

Combining Points Across Your Household

Even more powerful is the ability to combine points across your household! This means if only one person per household holds a Preferred or Reserve card, you can transfer all other Chase Ultimate Rewards® points to that card and use all the redemption benefits!

This is also why I generally recommend both spouses get a Sapphire card and then combine points. Then one could downgrade to a no annual fee Freedom card.

The first time you combine points across your household, you’ll need to call the number on the back of you card to link your accounts. The accounts essentially get another one way “link.” So in our case, I can transfer points from any one of my Chase Ultimate Rewards® earning cards to my husband’s Sapphire card (which is how we set up our link).

How do I redeem Chase Ultimate Rewards®points?

For more on some of my favorite options to redeem these points, check out my post on sweet spots for families here.

Highest Value Potential: Transfer to Partners

Transferring your Chase Ultimate Rewards® to airline and hotel partners is one of the easiest ways to get more value for your points. My personal favorite transfer partner is Hyatt!

Points must be transferred in increments of 1,000 points. You can transfer to your own loyalty accounts or to the loyalty accounts of any authorized users on your card.

Chase Ultimate Rewards®has 10 airline transfer partners.

- Aer Lingus

- Air Canada Aeroplan

- British Airways

- Emirates

- Flying Blue (Air France/KLM)

- Iberia

- JetBlue

- Singapore Airlines

- Southwest

- United Airlines

- Virgin Atlantic

Chase Ultimate Rewards®has three hotel transfer partners:

- Hyatt

- IHG

- Marriott

All transfers are final–so make sure you really want to transfer. Once you transfer your points to a partner, you cannot turn those points back into Chase Ultimate Rewards®points.

Learning about award sweet spots is where you can really begin to maximize the value of your points. Read more about some sweet spots here.

Redeem for travel at 1.25x in the Chase portal

Though it is not strictly the best value, my family has redeemed a lot of our points through the Chase portal. This is because it allows us to book rental cars, independent hotels, and even rental homes with our points. Sometimes the cash rate of a hotel or flight is cheap enough that it makes more sense (and cents!) to book through the Chase portal.

It is easiest to think about it as 10,000 points will get you $125 of travel.

Redeem for cash back

The cash back rate is 1 cent per point. So 10,000 points will get you $100 cash back.

Pay Yourself Back

With Pay Yourself Back, your points are worth 25% more through December 31, 2023 when you redeem them for statement credits against existing purchases in select categories — currently charities.

There are other Pay Yourself Back categories but none of these make sense to pursue because the redemption rate is identical to cash back rates — so you may as well just get cash back.

Comparing Preferred vs. Reserve

Though the names are similar, the cards have some similar benefits, and are considered the same “Card Family,” there are some notable differences. The most obvious is the annual fee. Preferred = $95, Reserve = $550

To help offset the much larger annual fee, the Reserve includes:

- $300 annual travel credit

- Priority Pass Membership (Free airport lounge access for yourself and 2 guests)

- Complimentary Lyft Pink membership (+10x on Lyft) through March 31, 2025

- 3x on Travel and Dining

- 10x total points on Chase Dining purchases through Chase Ultimate Rewards®

- 10x total points on hotel stays and car rentals purchased through Chase Ultimate Rewards®

- Points are worth 1.5x instead of 1.25x in the portal

When we were booking a lot of flights and hotels through the Chase Travel portal, it was worth it to us to pay the higher annual fee of the Reserve. The break even point is about 60,000 Chase Ultimate Rewards®. If you’re planning to redeem 60,000 or more points through Chase’s travel portal in a year, having the Reserve would give you a better value.

If you are interested in the benefits of the Reserve but might not use them for a year, I recommend getting the Preferred first and then upgrading later to the Reserve because the sign up bonus is higher!

credit card

Current Bonus:

60,000 points

Earn 60,000 Ultimate Rewards® points after you spend $4,000 on purchases in the first 3 months from account opening.

Annual Fee:

$550

What if I don’t want to be locked in to paying a $95 fee?

After you’ve held the card for one year, you need to decide how to proceed. You should generally never cancel a card before holding it for a whole year. Banks frown on this and it won’t help get you in their good graces. Some banks will even claw back bonus points or won’t approve you for additional cards in the future.

Personally, I consider this card a “keeper” and keep it long term.

Upgrade to Chase Sapphire Reserve®

After holding the card for a year, you can also upgrade to the Chase Sapphire Reserve® card. This can make sense if you want to take advantage of some of the higher level benefits on the Chase Sapphire Reserve®.

Downgrade to the Chase Freedom Unlimited® or Chase Freedom Flex℠

You can also choose to downgrade your card to a no annual fee card like the Chase Freedom Unlimited® or Chase Freedom Flex℠. These cards will allow you to keep your Chase Ultimate Rewards® points, but you will only be able to redeem them for cash back, you won’t be able to transfer them to travel partners or get the higher 1.25x rate through the travel portal.

After a year of holding your Freedom card, you could upgrade to the Chase Sapphire Preferred® Card again.

The advantage to downgrading to a Freedom card, instead of cancelling, is that the card remains on your credit report, lengthening your credit history, which in turn, improves your credit score.

The Freedom cards have some great benefits, too — like the Freedom Flex℠ offers cell phone insurance if you pay your bill with the card.

And don’t forget — you can combine points across your household, so you could transfer your points from a Freedom card to you spouse’s Sapphire card and still get all the Sapphire benefits.

Cancel

Your last option is to cancel the card. Don’t forget to use or transfer all your points if you decide to do this because you will lose them when you cancel the card.

What other questions do you have about the Chase Sapphire Preferred® Card?

Table of Contents

Table of Contents

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

If my spouse has /is an authorized user on my account will she get the bonus if she applies?

If so you can�t overstress how important it is to not but your spouse on.

They can still get a bonus even if they are an authorized user. The main disadvantage to adding them as an authorized user is that it will show up on their own credit report and Chase counts it as a new card when they count towards eligibility with 5/24. It is actually possible to remove an authorized user and also have it removed from their credit report, just takes a few steps.

Thanks for this great guide! If I refer my spouse and we both end up with the 100,000 points would we be able to redeem them for the same trip? Like if we want to use all of it to pay for the resort would we be able to combine the points in any way in order to redeem it for the same stay?

Yes, you can combine points across your household. You currently have to call Chase to link your accounts but then you can transfer Ultimate Rewards between them and combine points into one account. From there you could book through the Chase portal or transfer to Hyatt or other partners.

Hi, what if you already have a freedom card? My hubs and I both have a sapphire, so makes sense to combine points, then downgrade to a freedom card to avoid annual fees. Or would you just transfer points then close the card? Thanks!

You can still downgrade to a Freedom card even if you already have one. There are 2 versions of the Freedom card anyway. I like keeping the Freedom Flex because it allows you to keep earning points at a rate of 5 points per dollar in rotating categories each quarter. If you aren’t sure how you want to use your points, I’d recommend keeping one Sapphire open and downgrading the other to whatever Freedom you don’t have.

We personally like keeping one Sapphire open long term because I like the car rental insurance it gives and I like to keep my options open with transferring points. But if those don’t appeal to you, you could also just transfer your points out and downgrade to a Freedom.

Can you apply for both chase sapphire and reserve to earn both bonuses?

You cannot. You can get one bonus from EITHER Sapphire product every 48 months. Usually the Preferred has a much higher offer so that will give you more points. You could then upgrade to the Reserve after you’ve had the Preferred one year if you like those benefits.

Thanks for taking the time to explain, this is great information!

My partner has the Chase United card, can he transfer his points from that card to get the welcome bonus of the Chase Sapphire?

With the United card, any points he has earned have already been transferred to his United account. He would still be eligible to get a Chase Sapphire bonus as well. He could then transfer the Sapphire Ultimate Rewards points to United if he wanted (or another transfer partner)

Thanks for this great guide Katie!

Question, hoping you can help with- I have a Sapphire Reserve, Freedom Flex, and just got Ink. It’s been at least four years since I got the Sapphire bonus and I’d like to get it again so trying to figure out the bet plan to get that done. I was going to transfer points on my Freedom to Sapphire and close the Freedom. Then downgrade the Sapphire to Freedom Flex and a month later apply for Sapphire card to get the sign up bonus. My question is around my points – if I do that and get the Sapphire again can I transfer all the points that are now on my Freedom card to my new Sapphire? Are there any limitations to moving points?

You can have more than one Freedom at a time, so you don’t really need to close your Freedom account. You can just downgrade your CSR to another Freedom Flex or a Freedom card. And yes, you’ll be able to transfer back to a Sapphire from a Freedom.

Thanks for all the great info! I don’t understand how to get the extra value (the 80,000 pts being worth $1000? Can you explain like I’m a 5 yr old? 🤓🤪

Sure! So when you book travel with your points through Chase’s travel portal, points are worth 1.25% more. So 80,000 points offsets $1,000 travel booked this way. It’s like booking via Expedia but when you’re logged in to your account.