Top 9 Ways to Use 80,000 Ultimate Rewards Points

Chase Ultimate Rewards® is one of my favorite programs in miles and points — and one I usually recommend to newcomers! The points are flexible, which gives them lots of potential power. For some people, that leads to analysis paralysis, though. Here are some top ways to redeem those points.

Keep in mind: these options to transfer points are only available if you have a card with an annual fee like a Chase Sapphire Preferred® Card. If you have a card from Chase with no annual fee (like a Chase Freedom Flex℠ or Chase Ink Business Cash® Credit Card), you officially earn Chase Ultimate Rewards® that can only be redeemed for cash back. But! You can move those points over to a Chase Sapphire Preferred® Card or Chase Ink Business Preferred® Credit Card and then be able to transfer them.

Read more in my Guide to Chase Ultimate Rewards®.

Redeem for $800 cash back

While this is considered one of the lower value redemptions, you are still getting $800 cash back! If you have no travel planned, this can be of great value to you. If you earned 80,000 points by spending $4000 for a sign up bonus, that’s like getting 20% cash back.

Redeem through Chase’s travel portal for $1000 in travel

If you want the most options, you can use Chase’s travel portal to book a wide variety of flights, rental cars, and hotels. This site operates like Expedia. The value of your points is fixed depending on the price of the plane ticket or hotel room.

Your 80,000 points gets you $1,000 of travel.

We love to find cheap flights via Google Flights or other cheap flight alerts and then use our Chase Ultimate Rewards® to book. For international flights, your taxes and fees can even be covered by your points to make your flight truly free.

We have also booked hotels through the Chase travel portal and I like the option to be able to use points for smaller, independent hotels.

I especially like this option for families because you are not subject to award seat availability for flights, you can just follow cheap deals. If you don’t have enough points for all the flights or hotels, you can pay partially with points and partially with cash. Your ticket will still have all the travel protections of the Sapphire!

Book up to 16 nights at Hyatt Category 1 hotels

Points can become more powerful and valuable when you transfer them to Chase’s transfer partners. Of those, Hyatt is our favorite. When you are logged in to your Chase account, you can transfer points to your loyalty accounts at a variety of airlines and hotels.

On a road trip to California and back, we stayed at 10 different Hyatt Place properties and came to love them! They typically sleep 6 (2 queen beds + sofa bed) and have a great free breakfast.

Category 1 Hyatts cost just 5,000 Hyatt points per night with standard pricing. Sometimes they are as low as 3,500 off-peak. Since Hyatt is a transfer partner with Chase, you can transfer points 1:1 and use them directly at Hyatt. Find a list of all Category 1 Hyatts here.

Even if you go up to higher categories, you will still find great value at Hyatt properties.

Or browse Hyatt’s map of all properties which you can filter by Category below.

Book 2-5 nights at an all-inclusive property

Transferring our Chase Ultimate Rewards® to Hyatt and then booking an all-inclusive property is one of my favorite uses of points.

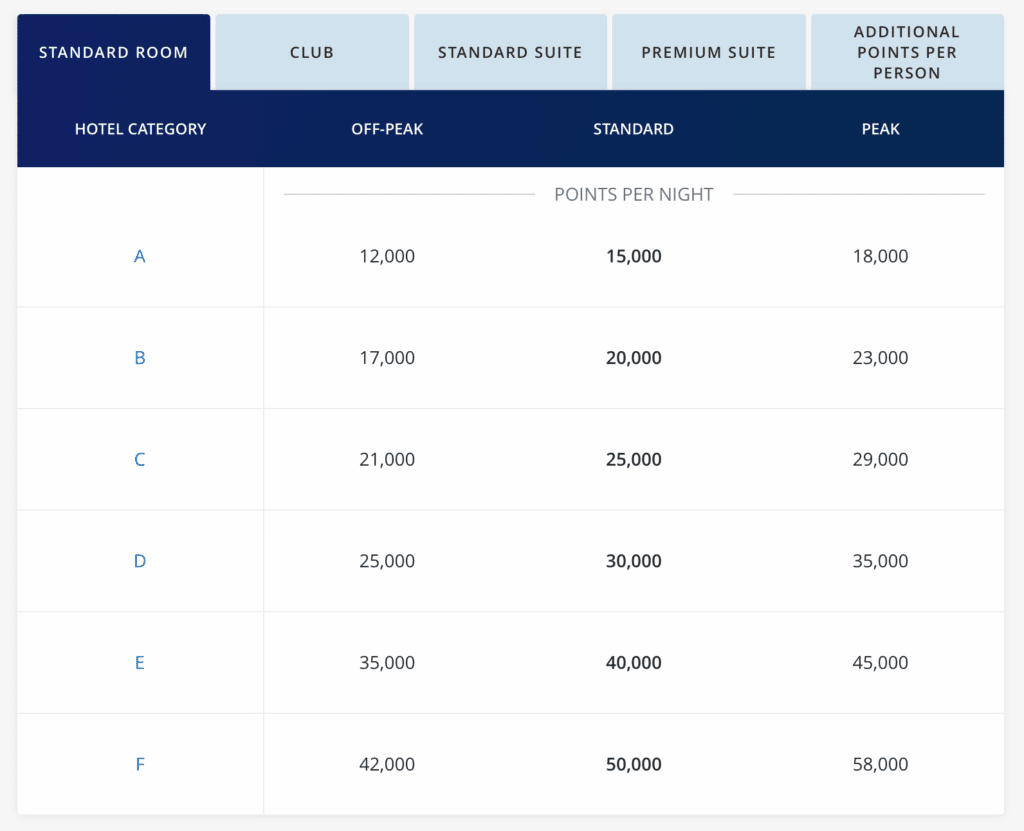

Hyatt has the most all-inclusives of any brand! You can see the full award chart here to see what this would cost. Rates vary by property and season. Search categories here to see pricing. Or browse my all-inclusive map.

Prices listed are for double occupancy. You can choose to pay points for extra people or cash. When we go, we have often chosen to add kids by paying cash at check-in, usually $125ish a night per kid.

We have been to the Hyatt Ziva Cancun four times as well as the Dreams Palm Beach {now closed} in Punta Cana and Ziva Cap Cana.

We love that since all food and drinks are included, we just relax and enjoy it! The nightly shows and daily activities are great, too.

Fly 3 people round trip to Ireland

Aer Lingus is another transfer partner for Chase Ultimate Rewards® and you can transfer points at a 1:1 ratio (sometimes even with a bonus!)

The best deal for Aer Lingus flights is to fly on a non-stop flight from Chicago or farther east to Ireland. Flights are priced per segment and by distance. Off-peak dates cover 2/3 of the year. It will cost 13,000 points each way in economy.

For non-stop flights on Aer Lingus booked via British Airways, Aer Lingus, or Iberia (prices shown off-peak/peak), here is the pricing:

13K / 20K for flights 3,000-4,000 miles flown

16,250 / 25K for flights 4,001 to 5,500 miles flown

Taxes on the flights vary but are usually $100-$200 per ticket.

Read more about flying to Europe with points

Fly 2 people round trip from West Coast to Hawaii

British Airlines is another transfer partner of Chase Ultimate Rewards®. It is also an airline partner with Alaska and American Airlines. Just like Aer Lingus, award flights are priced by distance and per segment, which makes this a great value only for non-stop flights.

Non-stop flights from the West Coast to Hawaii (on American or Alaska) will price as 32,000 round trip in Economy + $5.60 each way in taxes. Great value for families if you can find 4 award seats available together on a flight. You can read more about how to book this here.

Fly to Europe on AirFrance or KLM with a discount for kids

Flying Blue is the name of the loyalty program that AirFrance and KLM (based in the Netherlands) share. While FlyingBlue doesn’t have an award chart, it does have monthly promos that offer some cheap tickets to Europe! It’s common to see tickets in economy pricing at 13,000-15,000 points each way in economy. Even better, kids get a 25% discount on award pricing!

The downside to FlyingBlue is higher fees than other airlines. You’ll typically pay $200 on a round trip ticket in fees.

One of the easiest ways to find availability with FlyingBlue is to use SeatSpy.

Read more here on this sweet spot.

Book 3 round trip tickets within the US on United

United’s pricing for award flights is now dynamic so depending on the route and dates it will change. But traditionally flights cost 25,000 points round trip within the lower 48 states — so this is still a good starting gauge.

United is a transfer partner with Chase Ultimate Rewards® and you can transfer your points at a 1:1 ratio. This could be an especially good value if you fly in and out of smaller airports where tickets are typically more expensive.

Transfer to Southwest to book flights

Our favorite domestic airline is Southwest! It is another great transfer option with Chase Ultimate Rewards®. When you transfer your points 1:1, those 100,000 points will give you about $1,400 in Southwest airfare. Booking flights with Southwest on points instead of with cash is easier because of the way refunds and changes are processed. Points get redeposited in your account instantly and can be used to book a ticket for anyone.

If you are planning to earn a Southwest Companion Pass, any points you transfer from Chase Ultimate Rewards® to Southwest will not count towards the Companion Pass, but you can still use them when booking any flight.

Earn More Chase Ultimate Rewards®

credit card

welcome offer:

60,000 points

Go> Earn 60,000 Ultimate Rewards® points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

Annual Fee:

$95

credit card

welcome offer

up to $750

Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend a total of $6,000 on purchases in the first six months after account opening.

Annual Fee:

$0

credit card

welcome offer:

$750

Earn $750 (can be worth 75,000 points) after you spend $6,000 in 3 months

Annual Fee:

$0

Table of Contents

- Redeem for $800 cash back

- Redeem through Chase’s travel portal for $1000 in travel

- Book up to 16 nights at Hyatt Category 1 hotels

- Book 2-5 nights at an all-inclusive property

- Fly 3 people round trip to Ireland

- Fly 2 people round trip from West Coast to Hawaii

- Fly to Europe on AirFrance or KLM with a discount for kids

- Book 3 round trip tickets within the US on United

- Transfer to Southwest to book flights

Table of Contents

- Redeem for $800 cash back

- Redeem through Chase’s travel portal for $1000 in travel

- Book up to 16 nights at Hyatt Category 1 hotels

- Book 2-5 nights at an all-inclusive property

- Fly 3 people round trip to Ireland

- Fly 2 people round trip from West Coast to Hawaii

- Fly to Europe on AirFrance or KLM with a discount for kids

- Book 3 round trip tickets within the US on United

- Transfer to Southwest to book flights

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

![Best Marriott Family Hotels and Resorts to Book on Points [Map]](https://katiestraveltricks.com/wp-content/uploads/2022/06/is-my-credit-score-low-after-getting-a-credit-card-9-500x383.png)

[…] Top 9 Ways to Use 100,000 Ultimate Rewards Points for Families […]