All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com site has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

100k Chase Sapphire Preferred® Card Offer: FAQs

As of May 15, 2025 — This offer has now expired.

The 100,000 point welcome offer on the Chase Sapphire Preferred® Card is a huge one. We’ve only seen a 100,000 point offer on this card once and that was back in 2021!

An offer this big means our team gets a lot of questions — here are the answers to the most frequently asked ones.

How do I apply for the Chase Sapphire Preferred® Card?

If you don’t have a referral link in your household, I appreciate it so much when you use my affiliate links! These don’t cost you anything, but they pay us a cash commission. This commission supports my business, which allows our team to keep all of our resources free.

If you have a friend or family member who already has the card, they can send you a referral link to sign up. More on how to generate a referral link is below.

Am I eligible?

Officially the terms state these people are not eligible “(i) current cardmembers of any Sapphire credit card, or (ii) previous cardmembers of any Sapphire credit card who received a new cardmember bonus within the last 48 months.”

In order to be eligible you need to:

- Be under 5/24

- Not be a current Sapphire cardmember (of any Sapphire card — there are 3!)

- Not have received a welcome offer in the past 48 months (4 years) from any Sapphire card

How can I find out when I earned a bonus last time?

There are a few ways to figure this out if you don’t have a record in your notes.

You can call Chase and ask them. They should be able to tell you over the phone. It helps if you know the account number on the card. It’s easiest to ask “Can you tell me when I earned the bonus on this card?”

If you know approximately when you opened the card, you can also look back at your old statements to see when the bonus was credited to your account. You’ll see a transaction called “new member bonus” with the bonus points credited there.

If you know for sure when you opened the card but not when you earned the bonus, you could calculate the 48 months starting three months after the card was opened. Since the time you have to earn a bonus is typically three months, this is a good way to estimate when you would have earned the bonus.

How can I find out if I’m under 5/24?

If you’re not familiar with the term, 5/24 refers to the number of credit cards you’ve opened in the last 24 months. Chase typically will not approve you for a new card if you’ve opened five or more credit cards in the past 24 months.

The most accurate way to find out if you’re under 5/24 is to check your credit report and count all of the cards that appear as new cards in the last 24 months. You’re looking for any cards that appear on your credit report, from any bank.

Business cards typically don’t count towards your 5/24 status, but some do. If a business card appears on your personal credit report, then it is likely that Chase will count it in that 5/24 number.

Can I get this if I have the Chase Sapphire Reserve®?

The short answer is no. You can only get this welcome offer if you don’t have any other Sapphire card.

The longer answer is sort of. If it’s been more than 48 months since you last received a bonus on a Sapphire Reserve card, you could downgrade the Reserve card and then apply for the Sapphire Preferred. If you’re working in two-player mode, you could also refer a spouse or partner to get the Sapphire Preferred.

Can I get this if I have the no annual fee Sapphire?

No. You can only have one Sapphire card open at a time, and this includes the no annual fee Sapphire card (now discontinued).

If you want to get the Sapphire Preferred, what you can do is product change the no annual fee Sapphire card to one of the Chase Freedom cards, or close the card.

I’m an authorized user on my partner’s card, can I get this card?

Yes. Being an authorized user does not prevent you from getting your own card. You don’t need to be removed as an authorized user before applying for the card.

Your partner can even refer you to earn those referral points, and you can sign up for the card in your name!

Downgrading FAQs

How long should I wait after downgrading?

Two weeks is a good rule of thumb. You can try in about 4-5 days, but two weeks is recommended to make sure the system has time to clear the records of your previous card.

What happens to my points when I downgrade?

They stay with the downgraded card.

If you have another card open that earns Ultimate Rewards points (like any of the Ink cards), you could move your points over to that card before or after downgrading. But you don’t need to.

Once you open a new Sapphire card, you can connect that account to your downgraded card and move the points to the new card if you’d like to.

Which card should I downgrade to?

It’s up to you. The customer service agent should give you the options. Generally we suggest you ask for the “Visa Freedom with Ultimate Rewards.” This card may be referred to as the “Classic Freedom” by some customer service reps.

This card is discontinued but mimics the earning structure of the Chase Freedom Flex® Credit Card where you can earn 5x on rotating categories each quarter (up to $1,500). But the “Freedom with Ultimate Rewards” has a few advantages.

First it is a Visa — the Freedom Flex is a Mastercard. One of the quarterly categories is often warehouse stores so being a Visa means you can use it at Costco stores that quarter for 5x total points.

Also this means you still could get the Freedom Flex later on and earn a welcome offer.

When does the Chase Sapphire Preferred® Card 100k offer end?

The bank has not announced an end date for this offer, so we don’t know yet.

It’s also not uncommon for special offers like this to end early. If you want to make sure you get the 100k offer, you might want to apply sooner rather than later!

The good news is, we usually get some notice when an offer is ending. We’ll be sure to keep you updated as we know more.

How can I refer someone?

Go to Chase.com/referafriend to generate a referral link. You’ll just need your last name, zip code, and the last 4 digits of your card number. Share the link with your friend/family member so they can sign up for the card.

You can also find the referral generator in the Chase app. Go to your card account in the app and scroll down until you see “refer a friend”.

You get 10,000 referral points for each person who applies and is approved for the card through your referral link, up to 100,000 total referral points per year.

What is the Minimum Spend (and Timeframe)?

You need to spend $5,000 on purchases in the first three months from account opening to earn the 100,000 bonus points.

When Will I Receive the Bonus Points?

The bonus points will officially post to your account 6-8 weeks after you meet the minimum spending requirement, although it can sometimes be faster. We find that they typically post whenever your statement closes after you’ve completed your spending.

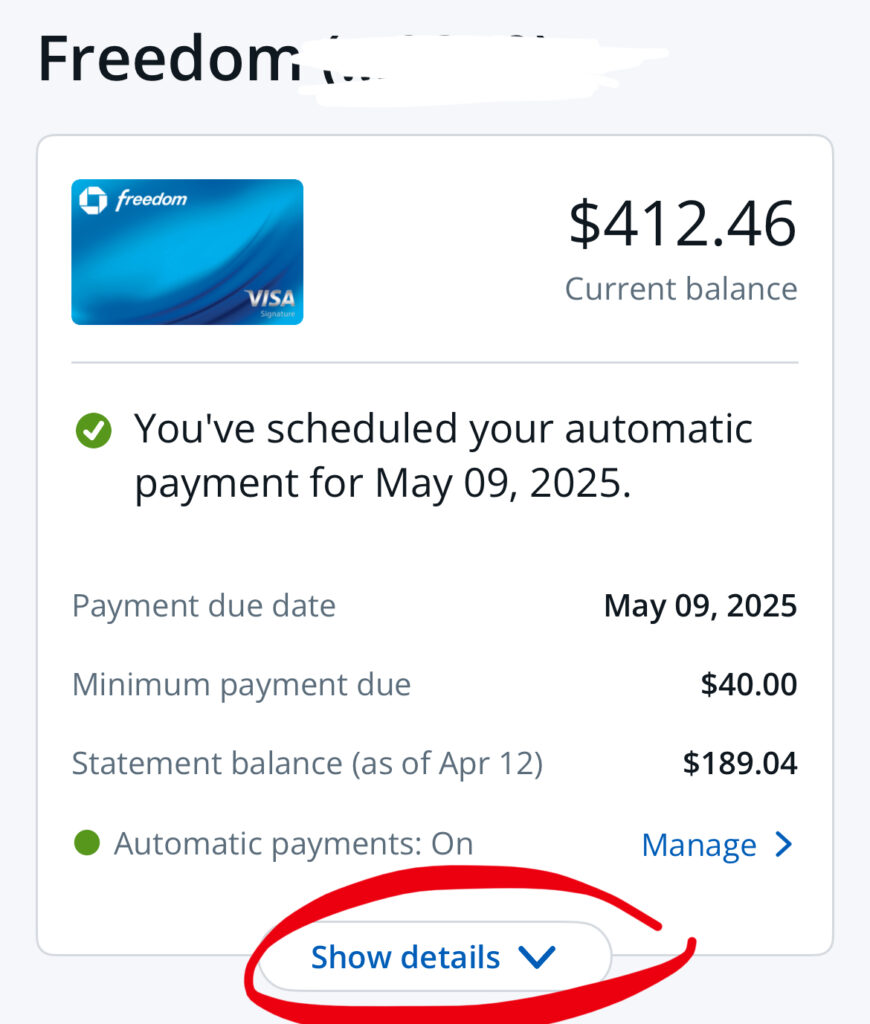

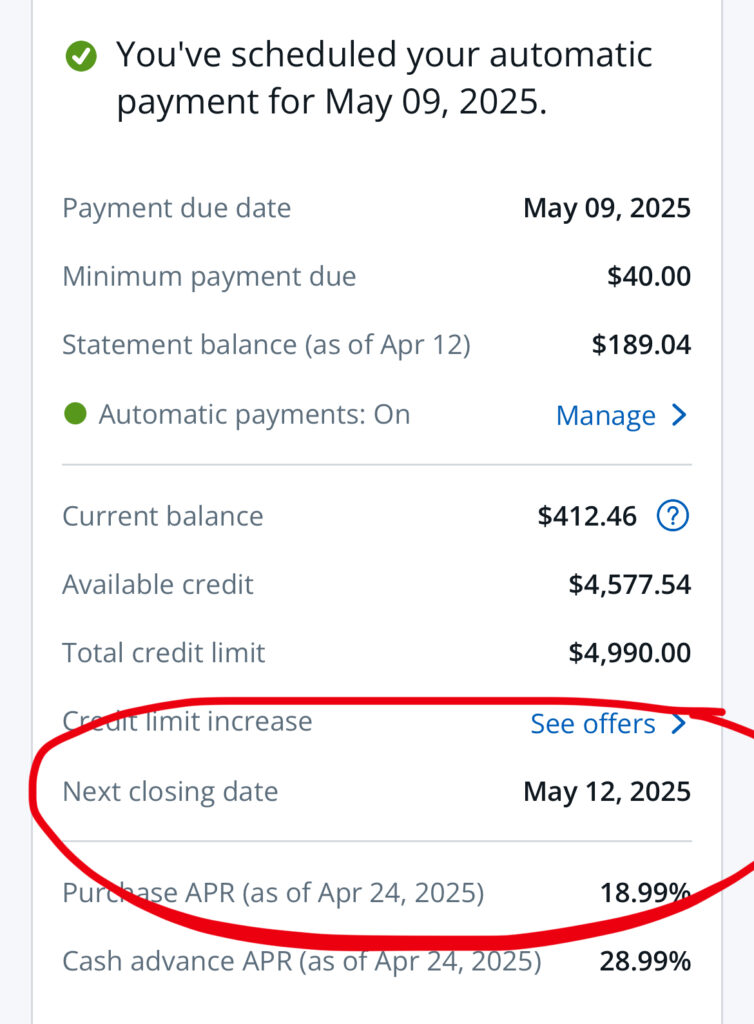

You can find your statement close date in the Chase app or on their website when you are logged in. In the app, find your card and click “Show details”

Then you can find your statement closing date.

Is it really worth the $95 fee?

Absolutely! The welcome offer alone is worth well over $95, but even after the first year, the card offers excellent value. It’s our favorite beginner card, and it’s also a keeper card long term!

The $50 annual hotel credit and the $10 monthly DoorDash benefit easily help to recoup the cost of the annual fee. Benefits like travel insurance, purchase protection, and no foreign transaction fees give you even more value.

For people interested in using points and miles to save money on travel, this is the best overall card to start with. Many of the transfer partners are easy to learn (especially Hyatt and Southwest) so you can start using points for travel right away. Worst case scenario you can cash out your 100,000 points for $1,000 cash back. That’s a pretty great “worst case!”

Having a card that gives you access to transferring points to travel partners opens up a lot of sweet spots for high value redemptions, allowing you to take more trips more often!

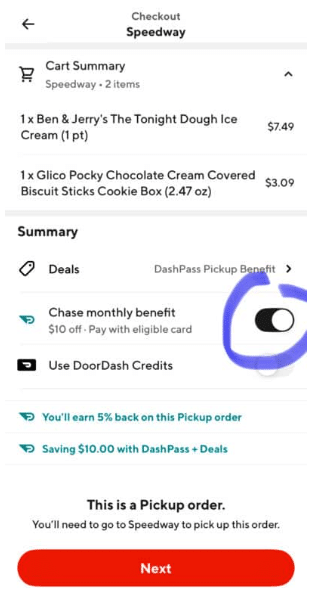

How do I use the $10/month DoorDash benefit?

Sign up for a DoorDash account and add your Sapphire card as a payment method. You should see a banner asking if you want to activate DashPass benefits through Chase.

As a Chase Sapphire Preferred cardholder, you get a complimentary membership to DashPass. This offer is currently available through December 31, 2027, or for a minimum of one year. (If you open the card after December 31, 2026, you would still get a full year of the service.)

Once DashPass is activated, you can shop for pickup or delivery. The $10/month benefit is good for any non-restaurant order. Grocery stores, convenience stores, and liquor stores typically qualify.

Add items to your cart and go to checkout. On the final checkout screen, there is a toggle button for the Chase monthly benefit. Click that button to apply your $10 coupon.

We have a full post on how to use the DoorDash benefits with screenshots that walk you through the full process.

What are Chase Sapphire Preferred® points worth?

At a minimum, 100,000 Ultimate Rewards points are worth $1,000 cash back or $1,250 towards travel with Chase Travel℠.

If you transfer points to travel partners, you could get even more value. Here are some examples of what you could do with 100,000 points. We have a full post of ideas here and here, too!

- Fly 8 People roundtrip to London on Virgin Atlantic (12,000 points plus around $350 taxes and fees per person).

- Book 20+ nights at a Hyatt category 1 hotel (standard rates start at 5,000 points per night; off-peak starts at 3,500).

- Book a week at an all-inclusive resort through Hyatt (standard rates start at 15,000 points per night; off-peak starts at 12,000).

- Fly 3 people roundtrip to Hawaii on American Airlines from anywhere in the US (30,000 points and $11.20 taxes and fees per person booked through Finnair).

- Fly 4 people roundtrip to Ireland on Aer Lingus (you would actually need 104,000 points for this one, but you’ll earn at least 105,000 after meeting the minimum spend. The cost is 26,000 points per person, with taxes and fees around $285).

Ready to apply?

When you use our affiliate links to apply, it helps support our team. Thank you!

I really hope this FAQ tackles all your questions about the incredible 100,000-point Chase Sapphire Preferred® welcome offer! It’s truly one of the best deals I’ve seen, and it’s such a fantastic way to kickstart your travel adventures using points and miles. Since high-value offers like this can disappear without much warning, now is an excellent time to consider applying if you’re eligible and it fits your travel strategy.

Table of Contents

- How do I apply for the Chase Sapphire Preferred® Card?

- Am I eligible?

- Downgrading FAQs

- When does the Chase Sapphire Preferred® Card 100k offer end?

- How can I refer someone?

- What is the Minimum Spend (and Timeframe)?

- When Will I Receive the Bonus Points?

- Is it really worth the $95 fee?

- How do I use the $10/month DoorDash benefit?

- What are Chase Sapphire Preferred® points worth?

- Ready to apply?

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

When a retired person whose spouse is employed applies for this card, how should they answer the employment question? The options are “employed,” “unemployed,” and “other.”

My retired husband just applied via your Katie’s Travel link. He clicked “unemployed” and received the message, “We are reviewing your application.” Does “other” mean retired? Or should he have clicked “employed” since most of our income comes from my job?

If “unemployed” was the wrong button, should he call the reconsideration line now or wait until he gets a denial letter? If he receives a denial letter, then he calls and gets approved, will he still get the 100,000 bonus, even if by the time he is approved, the welcome bonus will have decreased?

(In the long run, it would work better if he gets approved several days from now instead of today, because I got the Sapphire Preferred a month ago, and us spending $10,000 in four months will be a little tricky, and some extra days will be nice. “Luckily,” I have expensive dental work within the next two months. When I tried to give him my friend’s referral link, it was only for 60,000 points. Thus, he went through Katie’s Travel 100,000 link.)

Nevermind.

Several hours after my husband applied, he received an email saying he was approved. I didn’t need to worry about him possibly clicking on the wrong employment status.

I’m so sorry I missed this before. I hope you got it figured out. You do the the 100k bonus even if it is reconsidered. Generally, I’d suggest selecting “Other” when retired because you do have income still. You can also email us at katie@katiestraveltricks.com