All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com site has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

How to Open Business Credit Cards (even if you don’t have a business)

Business cards offer substantial points bonuses for new cards. Don’t skip these cards because you don’t think of yourself as a business owner. You might be, from the perspective of a bank. Applying for a business credit card is easier than you might think — see the step by step instructions here.

This article is updated frequently to include new information.

How to qualify for a business card

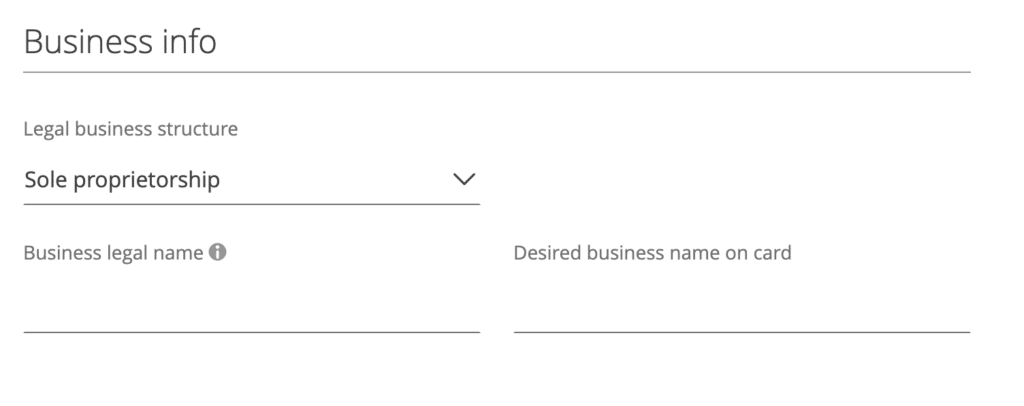

If you earn money through any sort of side hustle, you probably can qualify for a business card. That’s because you can be considered a “sole proprietor” with a small business from the perspective of the bank.

We own and rent out a condominium and apply for business cards for our rental property business. When we travel, we sometimes rent out our house via Airbnb, so we have other business cards for that business. I’ve talked to friends who sell (even sparingly) on eBay or Facebook Marketplace or craigslist and apply for cards for their resale businesses. One even applied by listing $100 annual income from her garage sale business and got approved. If you freelance or tutor or consult or babysit or drive for Uber you probably qualify, too.

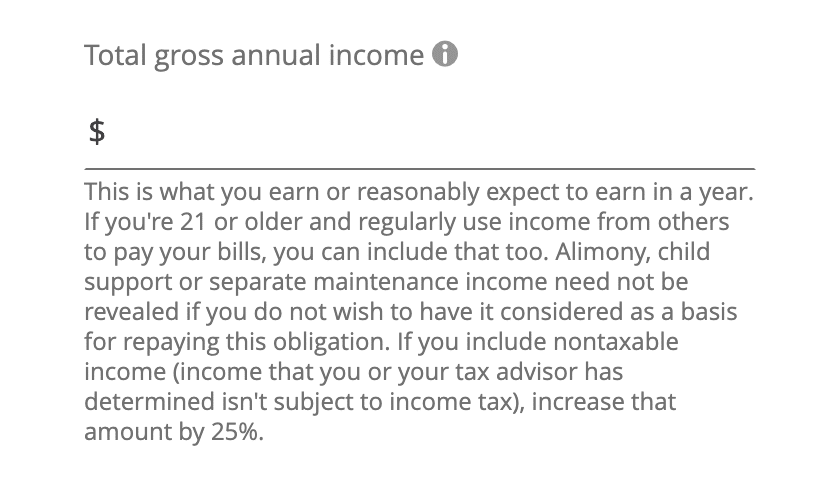

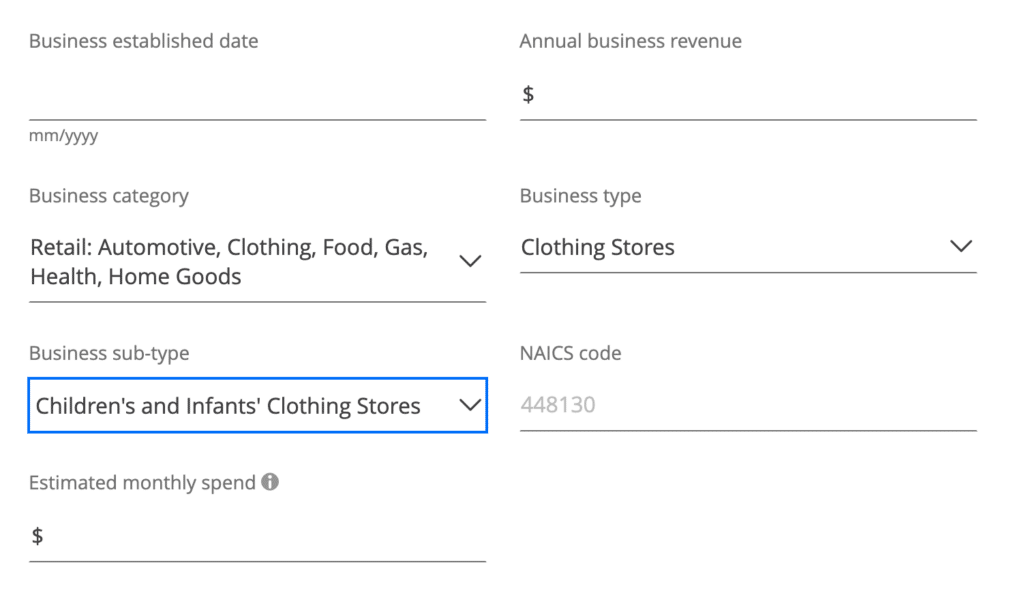

The most important thing is to be honest on your application about your business revenue. If you make $200 a year selling your kids’ old clothes on Facebook Marketplace, just put $200 when it asks for revenue on the application. You can also watch my YouTube video for more details on this.

What are the tax implications?

Generally speaking, there are no tax implications for opening a business card.

The IRS isn’t notified that you have opened a business credit card or told how much or what you charge to the card.

If you already have a side hustle that earns more than $600 per year, you may already receive a 1099 form for that anyway, but this won’t have any direct relationship with any business credit cards you’ve opened.

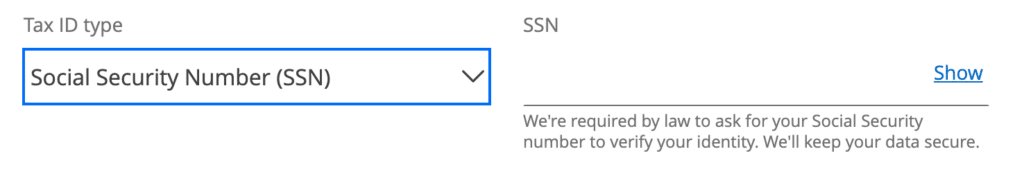

You can apply as a sole proprietor and use your Social Security Number as a Tax ID. Or you can apply for a free EIN from the IRS.

Why business cards should be a key part of your overall points strategy

Why do I bother even mentioning business cards? There are two big reasons: access to more great offers and reducing the number of cards on your personal credit report.

Increased offers

Having a small business will open the door to a lot more offers for you. Honestly, I think the offers are so great that if I didn’t already have a few side hustles, I would be motivated to start one just to access the deals.

The ability to open business cards more than doubles your card options and earning potential because it adds so many more card offers you can apply for.

Opening business cards doubles your card options

Helps your credit score

Next, generally speaking, business cards don’t affect your personal credit report. This helps keep your credit score higher if you want to apply for cards and cancel them after one year.

There is an important caveat for business cards from Capital One which are generally reported to your personal credit report with the exception of a few including the Capital One Venture X Business credit card.

Because business cards generally don’t show up on your personal credit report, they also make it easier to get approved for more cards from more banks.

Keeps you under 5/24 longer

If you’re working on slowly applying for cards from Chase, you can mix in business cards from Chase and other banks without affecting your 5/24 score.

My favorite business card offers

If you apply for a card, I appreciate when you use my affiliate links! It costs you $0 to use but helps support the site and allows me to keep creating resources.

Chase Ink Cards

The Chase Ink Business Cash® Credit Card and Chase Ink Business Unlimited® Credit Card will list their bonus as cash back. But there’s an important loophole here for you to learn! These cards technically earn Chase Ultimate Rewards® points that can “only be redeemed for cash back.” If you also have a Chase Sapphire card, you also earn Chase Ultimate Rewards® points. The UR connected to your Sapphire card are more powerful because they can be transferred to partners like Hyatt and United which can unlock some sweet value.

If you have both a Chase Sapphire Preferred® Card and Chase Ink Business Unlimited® Credit Card or Chase Ink Business Cash® Credit Card — Chase will let you move the Chase Ultimate Rewards® from the “cash back” card over to the Sapphire — and they gain the ability to transfer to partners! The same principle works with the Chase Freedom cards which are no annual fee personal cards.

welcome offer:

Alternate offer: you may be able to earn additional points through Rakuten

Annual Fee:

Lower spend options: Cards from Barclays

Barclays often has great business card offers that require a relatively low spend to earn a bonus. Barclays is most likely to approve you if you have opened 6 cards or fewer in the past 24 months. They also sometimes flag an application and will require you to go through a rigamarole like sending in paper copies of your driver’s license to get the account approved.

Applying for a Business Credit Card: Tips

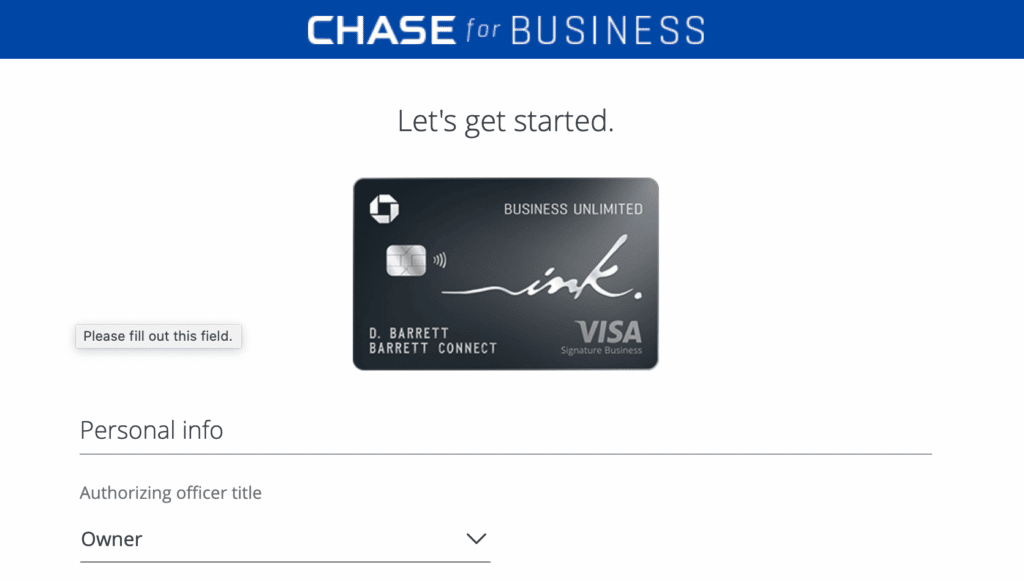

Screenshots of Chase Business Credit Card Application

You will likely be a sole proprietor

How long does it take to get approved?

Sometimes you will get instant approval. After you submit your application, your approval may be confirmed.

Other times, the bank may need more time to review your application. After this review, they may auto-approve you, or they may request additional documents. Because of this, it can take up to 30 days for the bank to make a decision.

What happens if I put personal expenses on a business card?

First, if you have a small business with a bookkeeper that keeps track of expenses, you’ll need to sort this out with them!

Most banks will require you to attest that you will be using your new business account “only for business purposes and not personal, family or household purposes.”

While it isn’t illegal to put personal expenses on a business credit, banks are required to ask you to use it for business expenses only. That’s due to the CARD Act which extended new protections to consumer credit cards but not business cards.

How to link your Chase business and personal accounts

If you have both business and personal accounts with a bank, you may have to create separate logins for the business cards and personal cards. This can be annoying when you are monitoring your cards and are having to log in and log out of your accounts.

Chase has simplified linking your accounts and now allows you to do this online by following these steps. While you still will have a separate business and personal login, you can easily link your accounts online so you can see everything in one place.

Table of Contents

- How to qualify for a business card

- What are the tax implications?

- Why business cards should be a key part of your overall points strategy

- My favorite business card offers

- Applying for a Business Credit Card: Tips

- How long does it take to get approved?

- What happens if I put personal expenses on a business card?

- How to link your Chase business and personal accounts

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

If you put personal expenses on a business card, you will be liable for the debt. Depending on the card issuer and the type of card, you may be held personally liable for any debt accrued on the card, regardless of whether it is for business or personal use. Additionally, the card issuer may revoke the card and cancel your account if you misuse the card for personal purposes. to use it for personal expenses, you may also be liable for any taxes due from the personal use of the card.

Can I apply for multiple business cards and get multiple Sign-Up Bonuses. I’m thinking 2 cards, 2 different businesses that are both sole proprietor owned? I currently have an Ink Business Unlimited and would like to get another for a different business.

Yes absolutely!

Can I apply for two of the same Ink cards at the same time if I use a different structure for each? — Apply for one card as a sole proprietor using my SS# and then apply for a 2nd card as an LLC using my EIN?

You could but generally Chase will only approve one business card every 30 days.

I thought I read earlier in a different article if you have a big expense coming up open up a card. So if we pay for my daughter’s completion dance up front and she has a YouTube channel, is this counting as a business? Or does it need to be business expenses purchased to get the welcome offer? I’m having trouble wrapping my mind around being an Uber driver, what am I spending 6k on to get the welcome bonus. Thank you. I enjoy your content.

That sounds like a business to me! You’ll see part way down in the article, many people do put personal expenses on a business card!

How do I account for buying our Disneyland tickets on this card? Company trip? Business trip to Disney?

What if they ask for documents to prove the legal name of the business? As a sole proprietor using a social I have nothing to give them so it was denied. Any advice?

You can give you Driver’s License or SS card in that case — those are the documents you have as a sole proprietor to show your identity!

Hey Katie! I’ve been denied for my first two biz card apps this month, and I have no idea why. I called both companies and they had no answers. At 3/24, credit score 828, followed your instructions to a T, actually have legit consulting business as a side hustle…any ideas? They were Alaska Air biz card and American Air biz card.

So even calling and asking to be reconsidered, they both still said no? Alaska Air (Bank of America) can sometimes be harder for approval if you don’t have a checking account with Bank of America. At 3/24, that usually isn’t an issue but that might help for future applications with Bank of America. You can always apply again for those cards in a few months and see if anything changes. Sometimes banks will go through periods of tightening up approvals for very specific reasons. I wouldn’t worry about it too much — and just try some other business cards.

How do I determine which purchases I can put on my business card? Don’t they all need to be business related?

My understanding is that banks only include language saying it “must” be used for business expenses to follow the policy of the CARD Act. In practice, all my business cards have offers on them for many places I can use them for extra points or cash back that have nothing to do with business expenses so that leads me to believe, it isn’t firm.

On your Best Offers page, some of the business cards specify that they don’t count toward the 5/24 rule, but some don’t say anything about it (on “My take” sections). How do we know if the business card we’re applying for counts or not? Or do they all not count?

Generally business cards don’t count. I can try to go back and clarify on all the cards. The ones to look out for are Capital One cards which occasionally count. I always specify on those!