All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from our partners. American Express is a Katiestraveltricks.com advertiser. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Southwest Card Guide

Signing up for a Southwest credit card is one of the easiest ways to earn a lot of Southwest points quickly so you can take even more flights. Southwest credit cards are also a huge help when it comes to earning a Southwest Companion Pass, and they give you a first free checked bag for everyone in your reservation!

This post is a roundup of all the Southwest cards so you can easily compare and contrast the options. We’ll show you a breakdown of all the benefits and annual fees to help you pick the card that’s right for you.

Looking for more information on the Southwest Companion Pass? We have a whole module dedicated to it in our free course. Find it here.

Updates October 2025: We’ve added screenshots at the bottom of the article to help you know how to check if you’ve used your card benefits.

Updates August 2025:

Not sure if you’re eligible for a Southwest card? We’ve added eligibility checkers here.

Updates July 2025:

As of July 24, 2025 — fees have raised on all Southwest cards. Benefits have been lost as well, starting in 2026.

Starting July 29 for flights on or after January 27, 2026 — Southwest card holders will have benefits releated to picking assigned seats. Benefits vary per card and are explained below.

Updates May 2025:

All Southwest credit cardholders will get their first checked bag free for each member in their party who is booked on the same reservation (up to 8 people).

Key Updates for Fall 2025

As of July 24, 2025, all of the Southwest credit cards have higher annual fees for new customers. Existing customers will have the same annual fee through the end of 2025. Any card renewals in 2026 will have the higher annual fee.

The following benefits are being dropped from these cards starting in 2026:

Be sure to use these benefits before they expire on December 31, 2025. Scroll to the bottom of the article for screenshots on how to check if you’ve used these benefits. These benefits reset when your annual fee is charged.

- Upgraded Boarding and Early Bird Check In credits. This makes sense since Southwest’s boarding process is changing. Though it still leaves a gap of nearly a month (from January 1-26) where cardholders have neither these previous benefits nor the assigned seating benefits. See more on redeeming Upgraded Boarding or Early Bird Check-In.

- The $75 statement credit for purchases at Southwest.com for the Southwest Rapid Rewards® Priority Credit Card ($229 annual fee, Terms Apply). This is straight up a significant devaluation for this card. Easiest way to redeem is to buy a $75 gift card at Southwest.com

- The $500/year fee credit for points transfers on the business cards. This benefit also had a way that households could earn an extra 2,000 points to help qualify for the Companion Pass. You can use this to help consolidate your points into one account. You can also just move points between accounts to get some Rapid Rewards points — since points transfer fees give you 3x or 4x earning, depending on the business card.

- The 365 Wi-Fi credits on the Southwest® Rapid Rewards® Performance Business Credit Card ($299 annual fee, Terms Apply). This is ending because Southwest has said it is adding free WiFi on all flights.

The following benefits are being added:

- Assigned seating perks.

- First free checked bag for cardholder + up to 8 people on the reservation. Chase is trying to pass this off as a new benefit, but overall this is still a loss for Southwest customers who previously had two bags flying free before Southwest’s policy changes.

- Lower annual fee cards are getting a 10% or 15% coupon on their account anniversary. This can’t be used on Basic Fares.

- Cards are getting some new bonus spend categories (varies by card), but it’s only 2x. Still might help with some Companion Pass points earning.

- It’s slightly easier to earn A-List through spending on the highest annual fee cards, but the A-List benefits aren’t that much better than what those higher fee cards give you

Strategy Tips: Existing Cardholders

Existing cardholders should not immediately go and cancel their cards.

You will not have to pay the higher annual fees right away. If you have a card renewal before January 1, 2026, you’re lucky. That’s because your card will renew one more time at the annual fee you currently have. Which means you get an additional year at a lower annual fee.

Overall, these are my tips:

- Keep your card through December 31, 2025.

- Use as many benefits in 2025 as you can.

- When your annual fee renews in 2026 — call and ask for a retention offer and explain that you’re very dissatisfied with these new fees and loss of benefits. The agents might be able to offer you extra points or a partial fee credit to keep the card.

- Watch and observe. We just don’t know enough about how the assigned seating benefits will work in practice. Will being able to pick assigned seats 48 hours in advance be plenty of time to get seats together as a family? Will it be necessary to pick seats at booking? It’s too hard to judge which benefits are necessary and we can’t even start to know until January. We won’t have a complete sense until it’s been a couple months at least.

- In 2026, you might decide to keep the card, downgrade your card, upgrade your card — 0r cancel altogether. There are a lot of factors for each person to weigh. We try to make that easier with our benefit calculators in our Southwest Card Guide.

Also note that cancelling cards will now complicate seating. If you book a flight while you hold a Priority card pick your seats — and then cancel the card, your seats will be released.

Strategy Tips: Companion Pass

We’ve updated all our Companion Pass guides and resources to give you the best and most accurate information for your strategy as offers change. You can find them here.

Which Southwest Card Is Best?

Previously I thought the Priority card was clearly the best Southwest card and a great overall value. Somehow Chase has managed to gut this card while raising the annual fee. And it didn’t even get some of the new benefits that the lower fee cards get.

Now I think the Southwest Rapid Rewards® Plus Credit Card and the Southwest Rapid Rewards® Premier Credit Card offer about the same value as each other — with the Premier having a slight edge.

The Plus will give you the lowest out of pocket costs at $99 (terms apply). And on cardmember anniversary you’ll get 3000 anniversary points each year (that’s worth about $45 in flights) and a 10% coupon (not valid on Basic flights). And at least you’ll get to pick Standard seats 48 hours in advance, which puts you ahead of anyone who booked a Basic fare.

The Premier card costs you $149 each year (terms apply). But on your cardmember anniversary you’ll get 6000 anniversary points — that’s worth about $90 in flights. You’ll also get a 15% off coupon on your anniversary (not valid on Basic fares). And then you’ll get the additional option of picking Preferred or Standard seats 48 ours in advance. Effectively when you value the anniversary points, I think the Premier card costs $5 more — and I think that $5 is worth it for having more seats to pick from.

The Priority card is now $229 (terms apply) and is now only worth it if you really value being able to pick your seats right at the time of booking and want to hope for Extra Legroom seats 48 hours in advance. Oddly the Priority card doesn’t include any anniversary coupon like the lower annual fee cards do.

Key Differences Between Cards

All cards include the same baggage benefits — one free bag for the cardholders and up to 8 people on the same reservation.

But each card has notable differences. Information on what is included is in the details section for each card below.

The most notable differences on the Southwest cards are

- Annual fee

- Whether they offer credits for Upgraded Boarding or Early Bird Check In (through Jan 2026)

- The number of anniversary points you earn

- Whether they earn a promo code on account anniversary

- Welcome offers

- What type of seat you can select for free, and when you can reserve a seat (for flights January 27, 2026 and onward)

Annual Fees

Annual fees range from $99 to $299 on Southwest cards. Annual fees were raised on all the cards in July 2025.

Seating Perks (Assigned Seats, Upgraded Boarding, Early Bird Check In)

These benefits are in a transition period.

Some of these cards come with Upgraded Boarding and others with Early Bird Check In. These benefits will be valid through the end of 2025.

Upgraded Boarding can only be used 24 hours or less before your flight departs. If the A1-A15 slots are still available at that time, you can upgrade to those boarding positions and get on the plane as one of the first passengers. This is only valid for one segment of your flight but has the potential to give you a very good boarding position for that flight. So if I was going Chicago to LAX with a stop in Denver — my upgraded boarding would only get me A1-15 on one of those flights. Read our full guide here.

Early Bird Check In is different. It automatically checks you in for your flight 36 hours in advance. This will generally give you an earlier boarding position. Read our full guide here.

Starting July 29, 2025 for flights booked for travel January 27, 2026 or later — these cards all have different assigned seating benefits.

Some offer the opportunity to pick assigned seats at booking for yourself and up to 8 other people flying with you. Others let you pick assigned seats just 48 hours before departure.

Anniversary Points

Each card also earns points on your cardmember anniversary. Southwest points vary in value but generally offer about 1.2-1.5 cents per point. That means 3000 anniversary points will get you a flight that costs $36-$45.

On the higher fee cards, you’ll earn more anniversary points. If you earn 7500 anniversary points, that will get you about $90-$112 of Southwest flights.

Welcome Offers

The offers are typically exactly the same on each of the three personal cards. So when it comes to making a decision, it’s just about comparing the annual fee and the benefits.

The business cards have offers that are different from each other. So when opening a business card, you’ll need to weigh the total offer, alongside the annual fee and benefits.

Personal Credit Cards

Southwest offers three different personal credit cards. They vary in the perks and benefits they offer.

Standard benefits for all of the cards include:

- First free checked bag for up to eight people traveling on the same reservation (starting for flights booked on or after May 28, 2025)

- Delayed baggage insurance

- Lost luggage reimbursement

- Auto rental collision damage waiver

- Purchase protection

- Extended warranty protection

- Travel accident insurance

- Earn extra points per dollar on Southwest purchases

Welcome offers for the personal cards are generally the same for all three cards at any given time but the offer itself can vary a lot throughout the year. It’s common to see elevated offers towards the end of the year. Higher point welcome offers usually come with higher minimum spends. In winter, there is often an offer that includes the ability to earn a companion pass with just one card.

If you’re hoping to earn a Companion Pass, be sure to check out our Southwest Companion Pass timelines.

Plus Card ($99 annual fee)

Southwest Rapid Rewards® Plus Credit Card

Annual Fee: $99 Terms Apply.

Key Benefits:

- 2 early bird check-ins per year through 2025

- 3,000 points per year on your card member anniversary

- Select a standard seat within 48 hours of departure on any fare (for flights on/after Jan 27)

- 25% back on in-flight purchases

- 2x points on Southwest purchases

- 2X at Gas stations and Grocery stores on the first $5,000 in combined purchases per year

- 10% promo code each year on card member anniversary

- No foreign transaction fee

Our Take: This card offers the lowest annual fee of any Southwest credit card and overall still

non affiliate link

welcome offer:

Earn Companion Pass® through 2/28/27 plus 20,000 points

Earn Companion Pass® through 2/28/27 plus 20,000 points after you spend $3,000 in the first 3 months from account opening.

Personal Referral: All information about this card has been collected independently by Katie’s Travel Tricks.

Note that this link takes you to all the SW cards, you’ll need to select the exact one you want!

alternate offer – non-affiliate:

Earn 65,000 bonus points

Earn 65,000 bonus points after you spend $1,000 in the first 3 months from account opening.

In-Airport Offer: All information about this offer has been collected independently by Katie’s Travel Tricks.

Annual Fee:

Southwest® Plus Card: What's It Worth to You?

Enter your personal estimated annual value for each benefit to see a customized calculation of the card's worth.

Your Total Annual Value:

Annual Fee: $99

Your Net Value / Cost:

Premier Card ($149 annual fee)

Southwest Rapid Rewards® Premier Credit Card

non affiliate link

welcome offer:

Earn Companion Pass® through 2/28/27 plus 30,000 points

after you spend $4,000 in the first 3 months.

Personal Referral: All information about this card has been collected independently by Katie’s Travel Tricks.

Note that this link takes you to all the SW cards, you’ll need to select the exact one you want!

Annual Fee:

$149

Terms Apply.

Southwest® Premier Card: What's It Worth to You?

Enter your personal estimated annual value for each benefit to see a customized calculation of the card's worth.

Your Total Annual Value:

Annual Fee: $149

Your Net Value / Cost:

Priority Card ($229 annual fee)

Southwest Rapid Rewards® Priority Credit Card

Annual Fee: $229 – Terms Apply.

Key Benefits:

- $75 annual travel credit for Southwest purchases

- 4 upgraded boardings per year

- 7,500 points per year on your card member anniversary

- Select a standard or preferred seat at booking, on any fare. Upgrade to extra legroom within 48 hours of departure on any fare (for flights on/after Jan 27)

- 25% back on in-flight purchases

- 4x points Southwest Airlines® purchases

Our Take:

non affiliate link

welcome offer:

Earn Companion Pass® through 2/28/27 plus 40,000 points

Earn Companion Pass® through 2/28/27 plus 40,000 points after you spend $5,000 in the first 3 months.

All information about this card has been collected independently by Katie’s Travel Tricks.

Note that this link takes you to all the SW cards, you’ll need to select the exact one you want!

Annual Fee:

Southwest® Priority Card: What's It Worth to You?

Enter your personal estimated annual value for each benefit to see a customized calculation of the card's worth.

Your Total Annual Value:

Annual Fee: $229

Your Net Value / Cost:

Business Credit Cards

Business credit cards are a useful part of an overall credit card strategy. You don’t need to have a large business or an LLC to get a business credit card.

Small businesses and side hustles also count as a business! Things like selling items on Facebook marketplace, tutoring, babysitting, consulting, and selling on Etsy all qualify you for a business credit card.

To learn more about business cards and how to apply, check out our post on business credit cards.

Southwest offers two different business credit cards. The offers on these are more consistent throughout the year than on the personal card offers but they do still vary at times.

(Ended) Perk Exclusive to Business Cards: Transfer Points for Free

Update: This perk has been discontinued as of December 31, 2025.

Both business cards have offered a niche perk, which is that you can get reimbursed for the fees you incur when you transfer points to another Southwest Rapid Rewards member. You can get reimbursed for up to $500 per year. Most people won’t need to transfer Southwest points because you can use your Southwest points to book a flight for anyone. But! If you transfer 50,000 points, and it costs $500 — you’ll also earn 2,000 points in the process. That’s because this is a purchase on Southwest.com, where you earn 3-4 points per dollar.

This is a small amount of points, but can be helpful if you’re trying to top off your earnings for a Companion Pass.

Premier Business ($149 annual fee)

Southwest® Rapid Rewards® Premier Business Credit Card

Southwest® Premier Business: What's It Worth to You?

Enter your personal estimated annual value for each benefit to see a customized calculation of the card's worth.

Your Total Annual Value:

Annual Fee: $149

Your Net Value / Cost:

Performance Business ($299 annual fee)

Southwest® Rapid Rewards® Performance Business Credit Card

Annual Fee: $299 – Terms Apply.

Key Benefits:

- 4 upgraded boardings per year

- Free in-flight wifi

- 9,000 points per year on your card member anniversary

- Select a standard or preferred seat at booking, on any fare. Upgrade to extra legroom within 48 hours of departure on any fare (July 29 for flights on/after Jan 27)

- Global Entry or TSA Pre√ credit

- 4x points on Southwest purchases

- $500 Fee credit for points transfers

Our Take:

This card has no foreign transaction fees.

Southwest® Performance Business: What's It Worth to You?

Enter your personal estimated annual value for each benefit to see a customized calculation of the card's worth.

Your Total Annual Value:

Annual Fee: $299

Your Net Value / Cost:

Table Comparing Southwest Personal Cards

Southwest Rapid Rewards® Plus Credit Card |

Southwest Rapid Rewards® Premier Credit Card |

Southwest Rapid Rewards® Priority Credit Card |

|

|---|---|---|---|

| Annual Fee | $99 | $149 | $229 |

| Upgraded Boarding (through 2025) | 0 | 0 | 4 |

| Early Bird Check-in (through 2025) | 2 | 2 | 0 |

| First Checked Bag Free | Yes | Yes | Yes |

| Seat Selection | Standard seat 48 hours before departure | Standard or preferred seat 48 hours before departure | Standard or preferred seat at booking. Upgrade to extra legroom 48 hours before departure, if available |

| Anniversary Points | 3,000 | 6,000 | 7,500 |

| Southwest Travel Credit | $0 | $0 | $75 (ends Dec 2025) |

| Multiplier on Southwest Purchases | 2x | 3x | 4x |

Table Comparing Southwest Business Cards

Southwest® Rapid Rewards® Premier Business Credit Card |

Southwest® Rapid Rewards® Performance Business Credit Card |

|

|---|---|---|

| Annual Fee | $149 | $299 |

| Upgraded Boarding (ends Dec 2025) | 0 | 4 |

| Early Bird Check in (ends Dec 2025) | 2 | 0 |

| First Checked Bag Free | Yes | Yes |

| Seat Selection | Standard or preferred seat 48 hours before departure | Standard or preferred seat at booking. Upgrade to extra legroom 48 hours before departure, if available |

| Anniversary Points | 6,000 | 9,000 |

| Global Entry/TSA Pre√ Credit | No | Yes |

| Multiplier on Southwest Purchases | 3x | 4x |

| Free Wifi on flights | No | Yes, ends Dec 2025 |

Southwest Card Eligibility

There are a few eligibility rules to be aware of, which we will go into below.

Use these flowcharts to help determine if you are eligible for a card.

Southwest Personal Card Eligibility Checker

Is your credit score 700 or above?

Are you under 5/24?

(Have you opened fewer than 5 cards in the last 24 months?)

Do you have a Chase checking account?

Have you earned the bonus on ANY Southwest personal card in the past 24 months?

Do you currently have any Southwest personal card?

Can you closely track your spending and be sure NOT to meet your bonus before December 31?

Does your partner already have a SW card?

Apply In Person

Your best chance for approval is if you apply in a physical branch.

Raise Your Score

Work on raising your credit score before applying for this card. You might be eligible for other offers in the meantime!

View Best Offers »Wait for 5/24

You need to wait until you are under 5/24 to apply. In the meantime, check out offers from other banks!

View Best Offers »Consider Business Cards

You're not eligible for a SW personal card right now, but you might qualify for a business card!

View Business Offers »Limit Reached

You can only hold one SW personal card at a time. Check out other top travel cards instead!

View Best Offers »Wait until December 1st

Wait until Dec 1st to apply so you can still earn a Companion Pass. Bookmark our offers page for later!

View Best Offers »Follow Timeline

Please follow the timeline carefully to maximize your rewards.

You are Eligible!

Please use Katie's Travel Tricks' affiliate link to support her site & free resources!

View Best Offers »Southwest Business Card Eligibility Checker

Is your credit score 700 or above?

Note: Data points show you'll have a better chance to be approved if you also have 2 or fewer business cards from this bank.

Are you under 5/24?

(Have you opened fewer than 5 cards in the last 24 months?)

Do you have a Chase checking account?

Have you earned the bonus on ANY Southwest business card in the past 24 months?

Do you want to apply for a card you still hold?

Can you closely track your spending and be sure NOT to meet your bonus before December 31?

Does your partner already have a SW card?

Switch Card Types

You can apply for the other SW business card. If you have Premier, you can apply for Performance (and vice versa).

Apply In Person

Your best chance for approval is if you apply in a physical branch.

Wait for 5/24

You need to wait until you are under 5/24 to apply. In the meantime, check out offers from other banks!

View Best Offers »Limit Reached

You are only eligible to hold one of each SW business card type. You can't open another of the same one you have.

View Other Offers »Wait until December 1st

Wait until Dec 1st to apply. You won't have to be so detailed oriented and can still earn a Companion Pass.

View Best Offers »Use Partner Referral

They should refer you to the card! Follow the timelines carefully.

You are Eligible!

Use Katie's Travel Tricks' affiliate link to support her site & free resources!

View Best Offers »The 5/24 Rule

Chase has something that the points and miles world likes to call the “5/24 rule”. What this means is that if you have opened 5 cards in the last 24 months (from any issuer), Chase likely won’t approve you for any of their credit cards, including the Southwest cards.

Most business cards don’t count towards that 5 (though there are some exceptions). Being added as an authorized user to a personal card does count.

Holding Multiple Southwest Cards

You are only allowed to have one Southwest personal card account open at a time.

You can hold a business card and a personal card at the same time.

You’re also allowed to hold both of the business cards at the same time. You cannot hold multiples of the same Southwest business card, even for a different business.

The 24 Months Rule

Personal Cards: You can earn a bonus on a Southwest personal card once every 24 months. If it’s been less than 24 months since you earned a bonus on any Southwest personal card, you won’t be eligible to earn a bonus on another Southwest personal card. Even if it’s a different card than you held previously.

The 24 months is calculated from when you earned the bonus, not when you signed up for the card. If you’re not sure when you last earned a bonus on a Southwest personal card, you can call Chase and ask. They’ll be able to tell you over the phone.

Business cards: You’re eligible to receive a sign up bonus on a business card as long as you haven’t earned the bonus for that particular card in the last 24 months. It’s okay if you’ve earned a bonus on a different Southwest business card within that 24 month window.

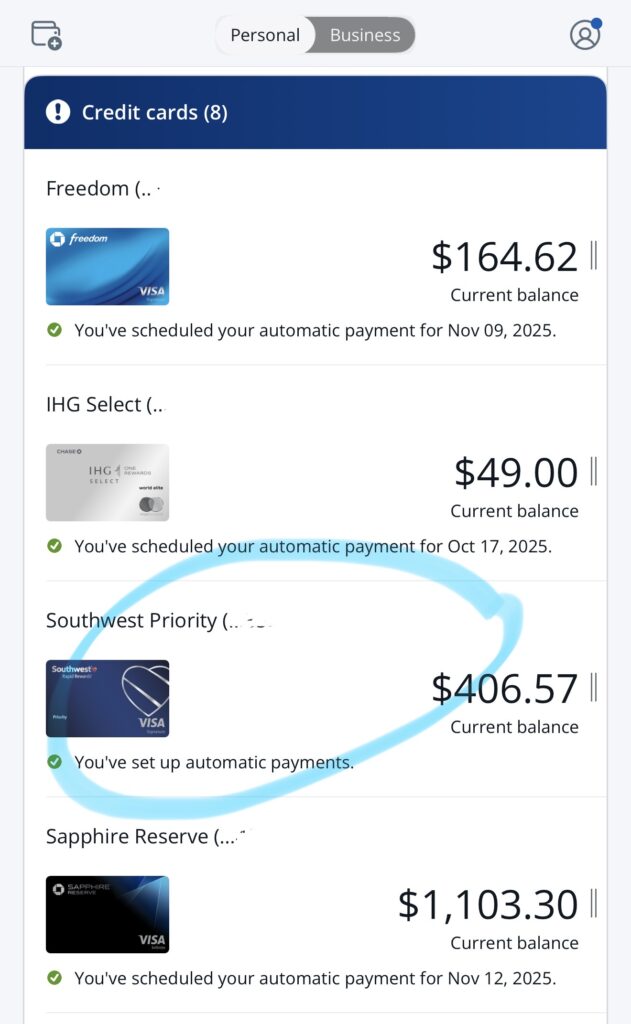

How to Check If You’ve Used Your Benefits

Chase doesn’t make it easy to find out if you’ve used your benefits and the process varies by benefit. To find any of this information, you’ll first need to log into the Chase app or go to their website and find your Southwest card.

Find your Southwest card when you’re logged into the Chase app or website.

How to check if you’ve used the $75 Southwest credit or $500 fee credit

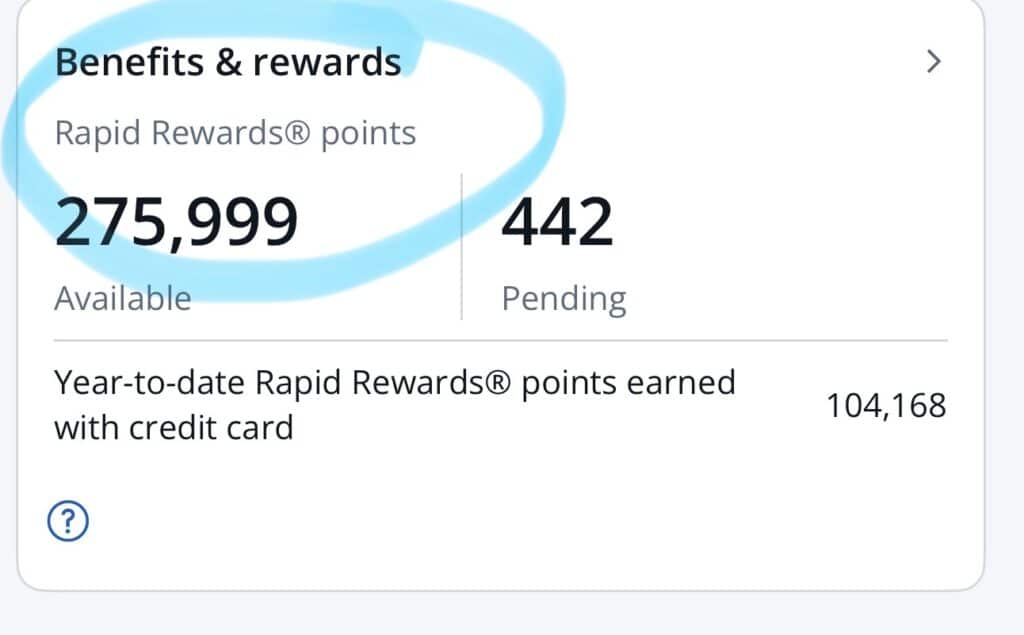

The process for checking your Priority card’s $75 Southwest credit or the $500 fee credit for points transfers on the business card is the same. After you’ve selected the card you want to check, you’ll then scroll down and click on “Benefits and rewards.”

Click on Benefits & rewards to find info on your $75 or $500 credits

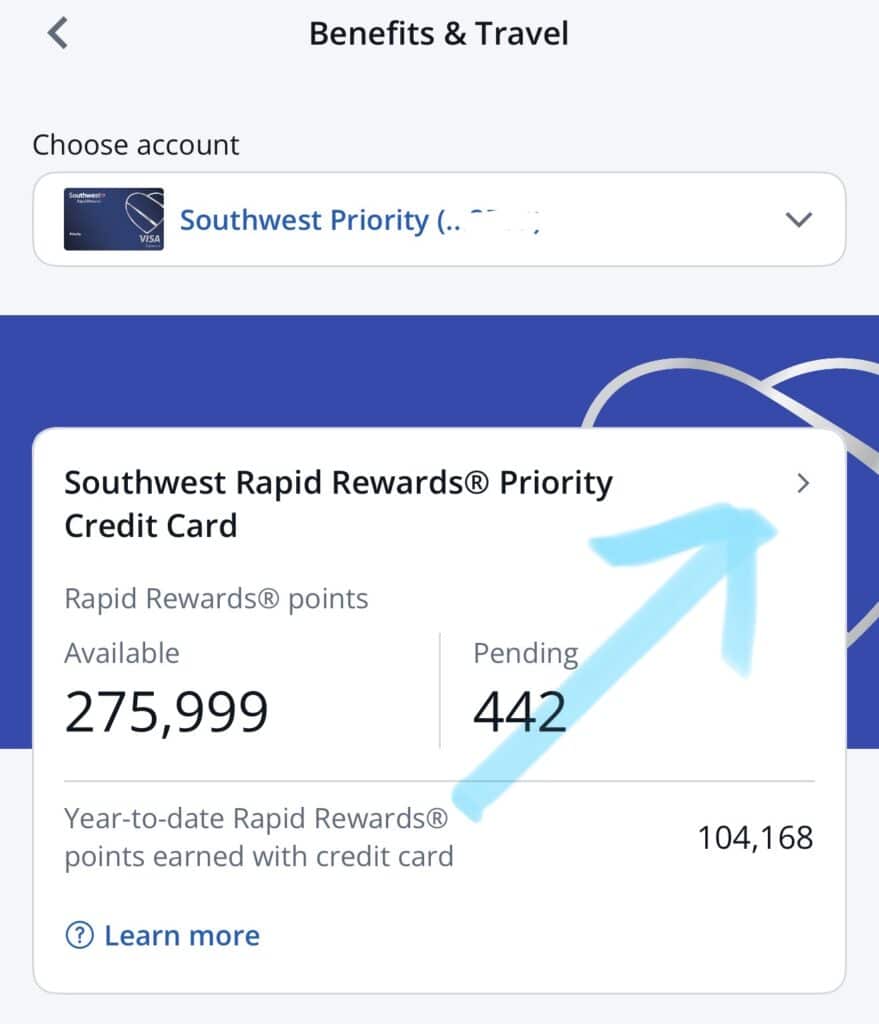

You’ll need to click again on the arrow next to your card name. It looks very similar to the place you clicked previously.

Then click on the > arrow next to your card name

From here you will scroll down to a section that says “Track your benefits.” Here you can find the how much you’ve used of your benefit as well as when it will reset.

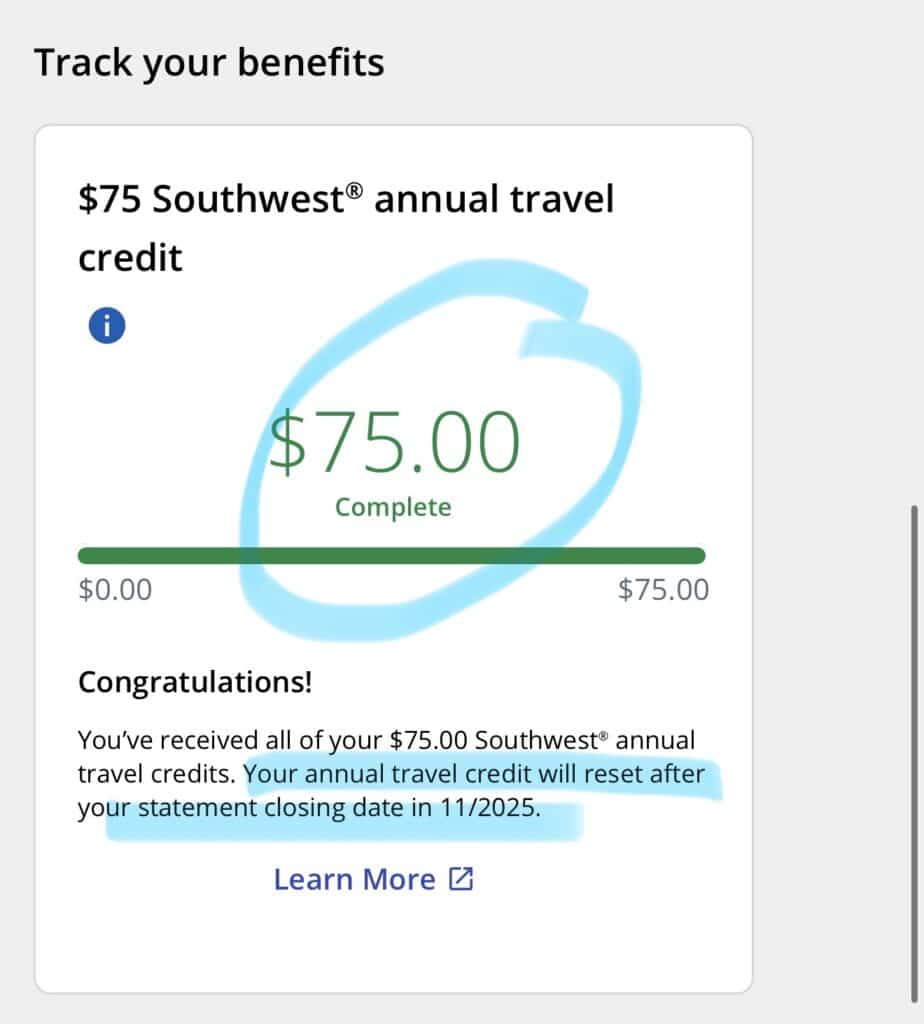

I’ve used $75 and my credit resets after my statement closes in 11/2025.

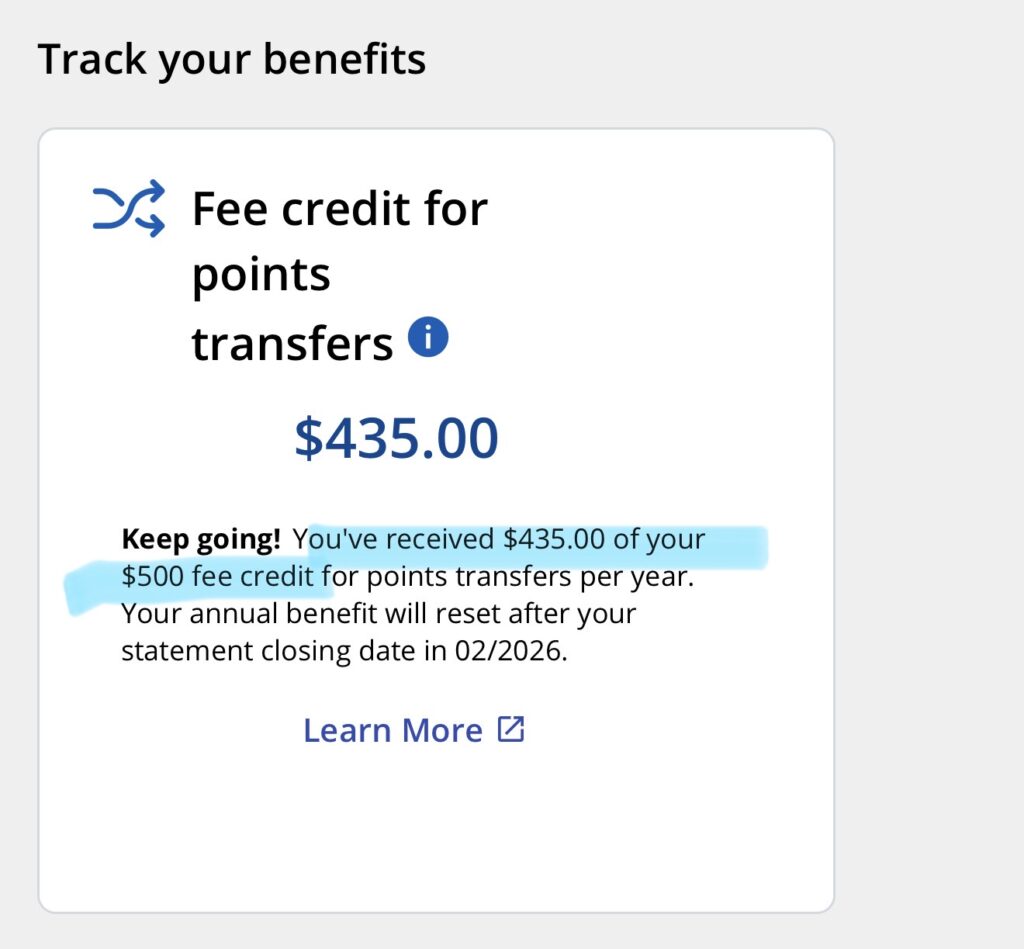

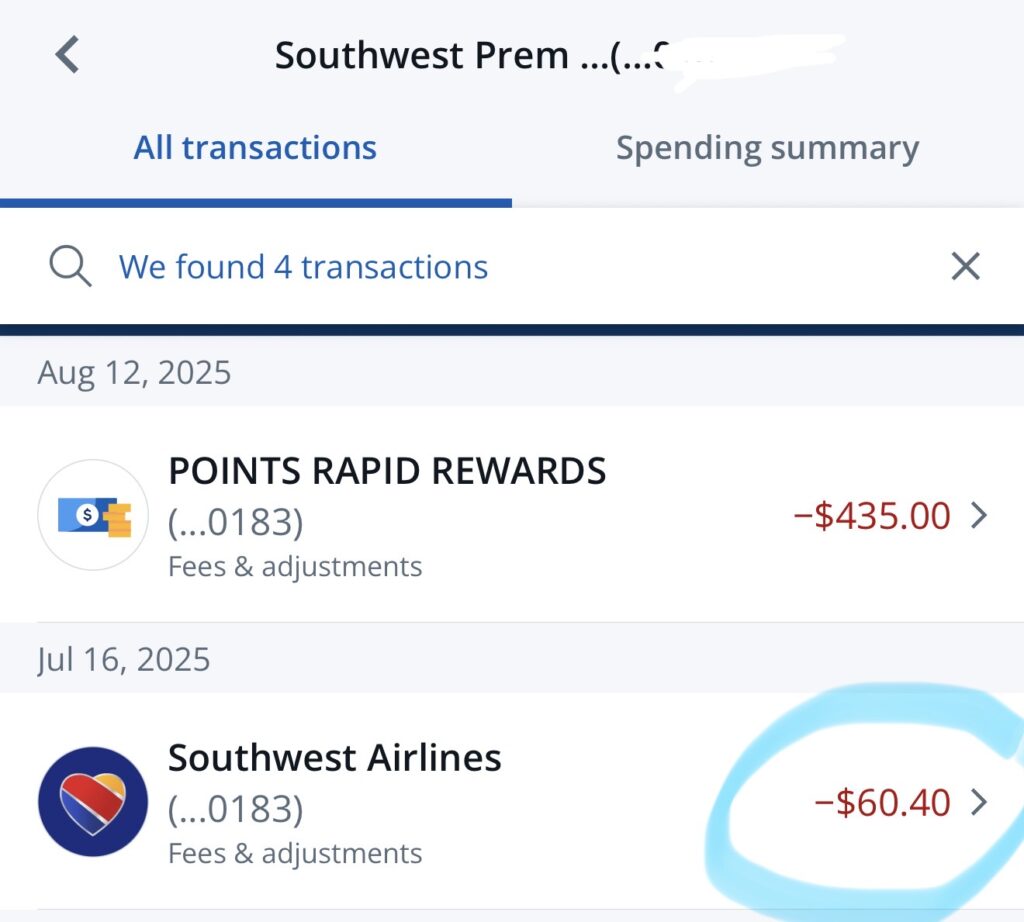

I followed the same process for my Premier business card and can see that my Fee credit for points transfer is almost used up, I have used $435 of $500. It states that my annual benefit will reset in 2/2026 but this is actually incorrect since this benefit is being discontinued 12/31/2025.

I have used $435/$500 of the fee credit for points transfers

How to check if you’ve used your Upgraded Boarding and Early Bird Check In credits

Through December 31, 2025, every Southwest card has either 2 Early Bird Check In credits or 4 Upgraded Boarding credits per cardmember year. But Chase doesn’t make it easy for you to find if you’ve used them ever since discontinuing the digital tracker they used to offer. Here’s how to confirm if you’ve used your credits and when they reset.

First you’ll need to log in to the app or website and select your specific Southwest card.

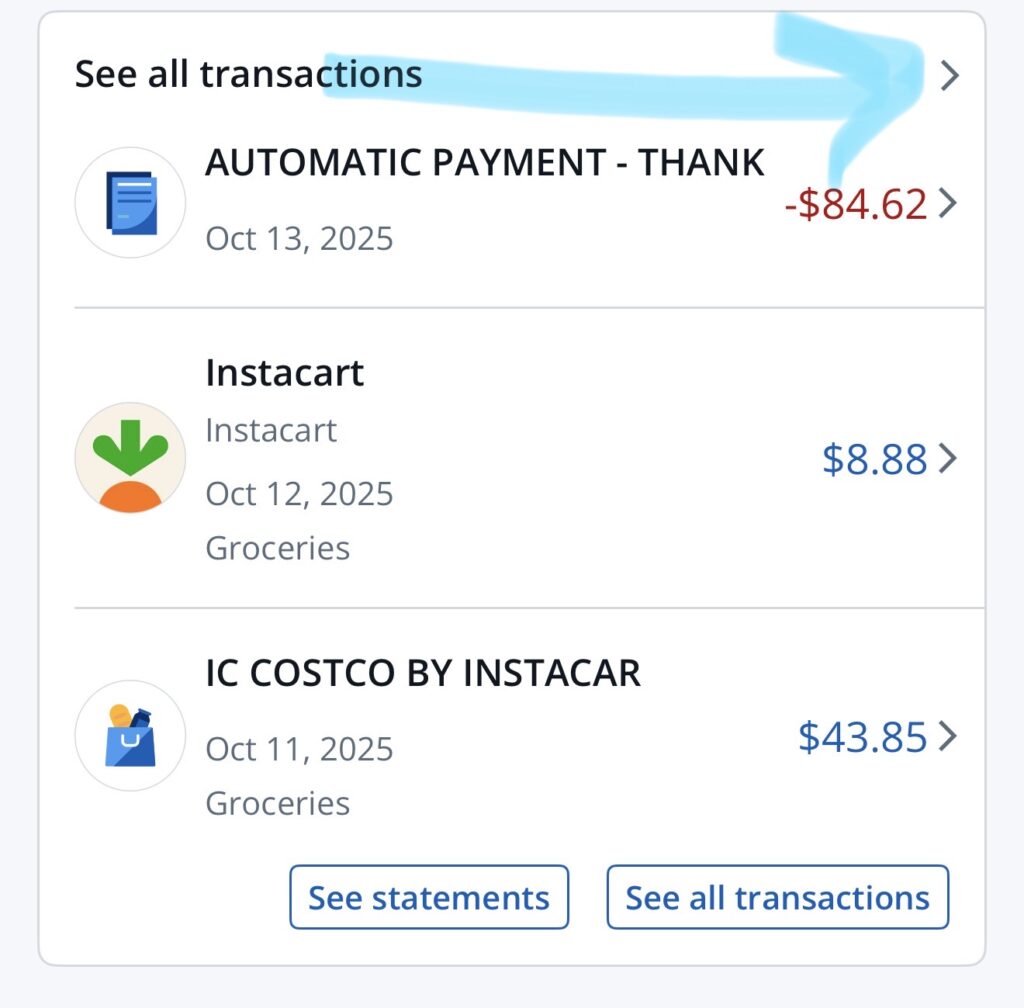

Then you will click to “See all transactions”

Select “See all transactions” when you are looking at your card

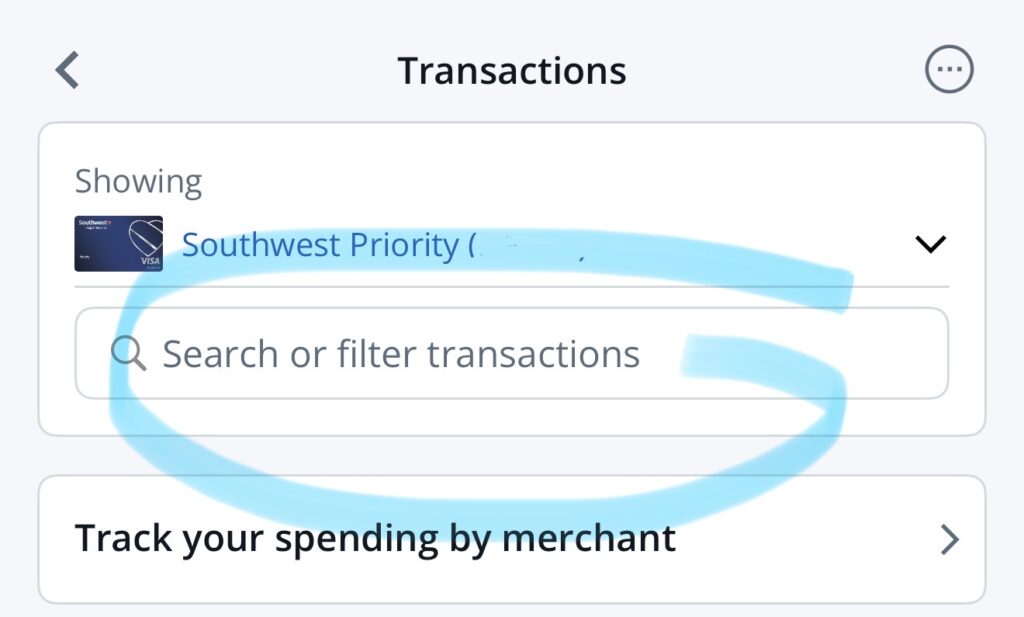

From here, you’ll want to filter your transactions.

Click to filter transactions

Then depending on your app view, it will look one of two ways.

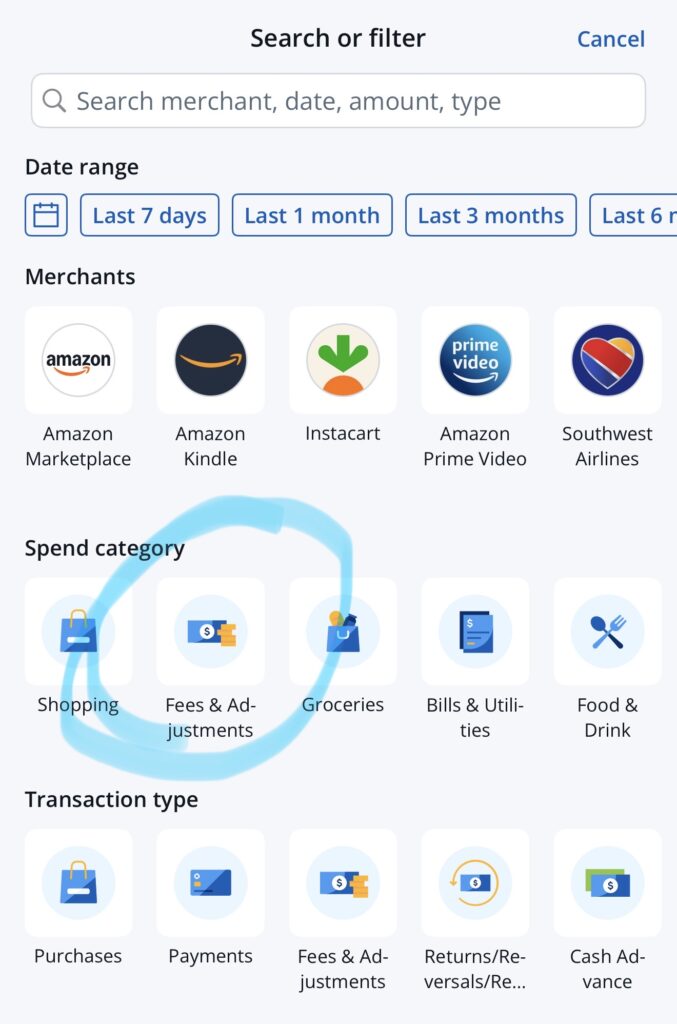

Version 1 – select “Fees and Adjustments”

In my app, it shows this view on my personal card

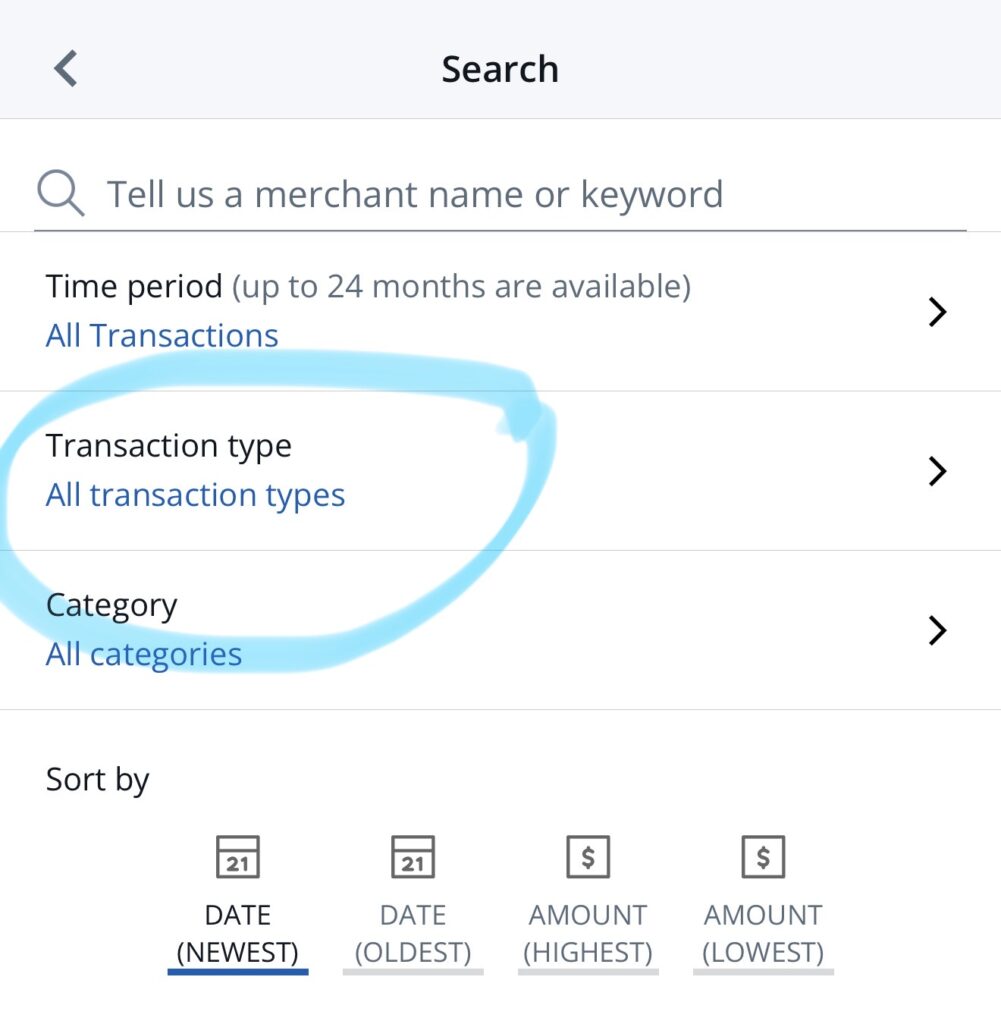

Version 2: Select the arrow next to “All transaction types” and then filter for “Adjustment and Fee”

My business card makes me filter this way, first by selecting the arrow by “All transaction types”

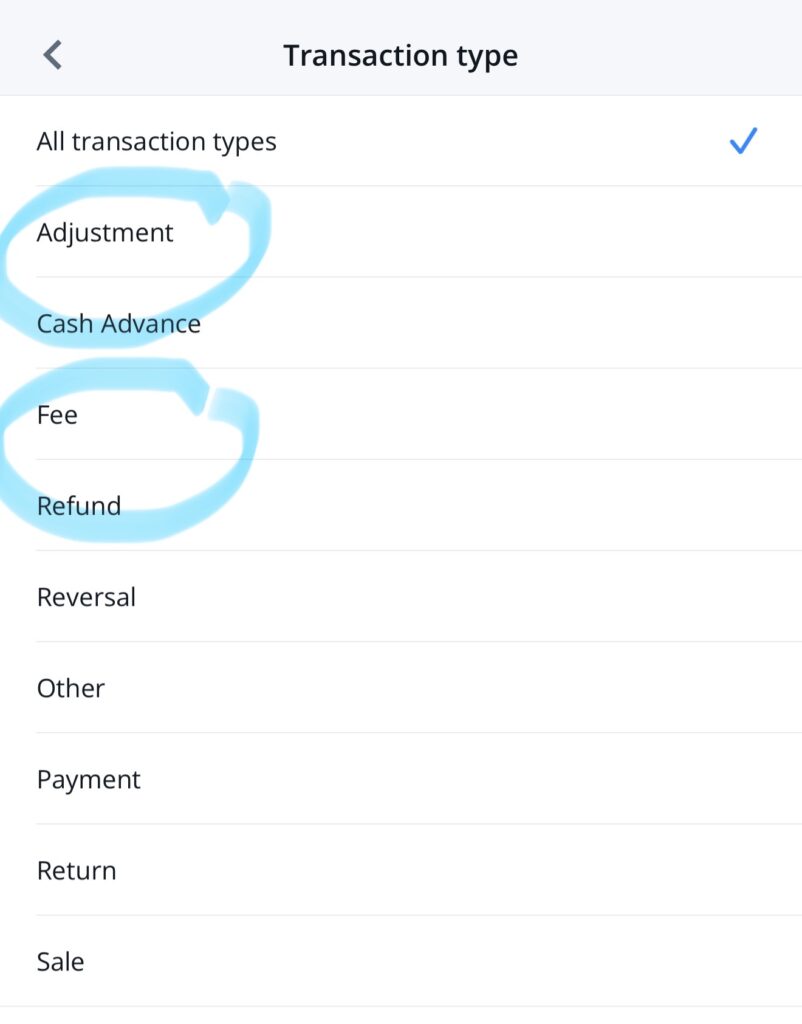

Then it lets me filter for “Adjustment” and “Fee” — you need to do these one at a time.

Once you’ve filtered your transactions, you can more easily find any times you’ve used the fee credits in the past year. It can also help you confirm when you paid your annual fee. That tells you when your credits will reset.

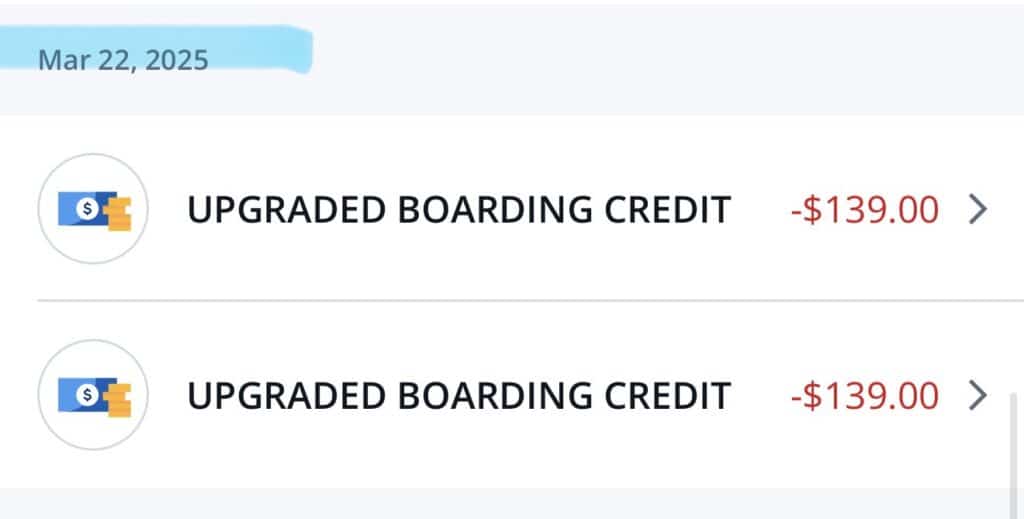

This showed me that I used 2 of my Upgraded Boarding credits in March 2025.

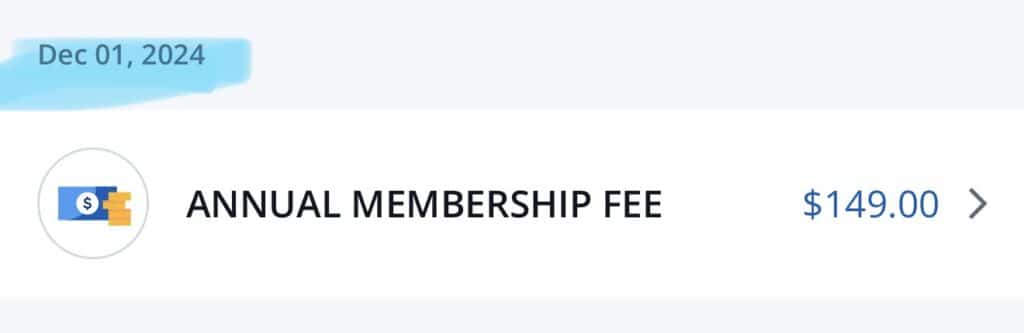

This confirmed when I was charged my membership fee, so I can expect to be charged again on December 1, 2025, and then my credits will reset.

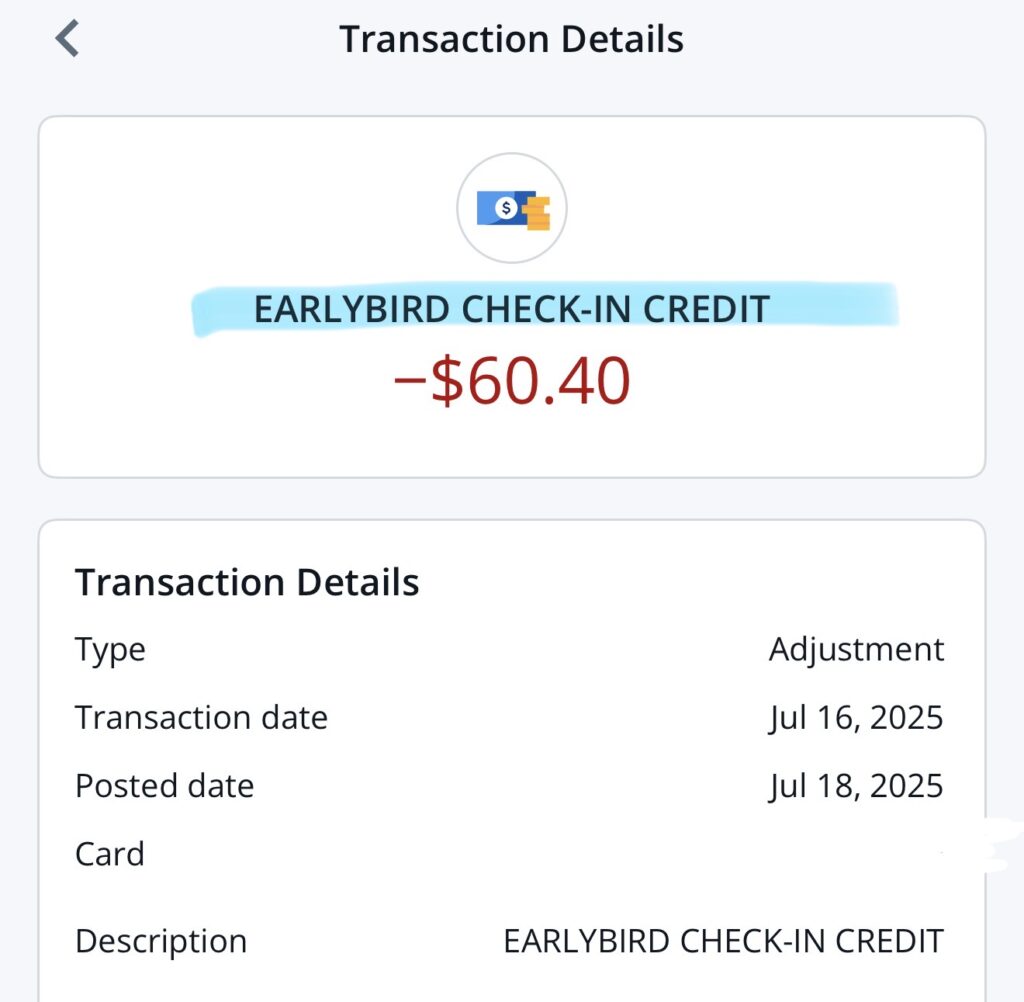

Sometimes it isn’t as clear which benefit has triggered the credit but if you click for more detail, you’ll find it.

This wasn’t clear on first glance why I had a credit

But when I clicked into the transaction detail, I could see that this was for my Early Bird Check-In Credit.

Table of Contents

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

When transferring points between family members (all of whom are Rapid Rewards members) are all transfer fees eligible for redemption(the $500/yr benefit on participating cards) or only those that were transferred out of the cardlholder’s RR account to another (non cardholder) RR member? In other words, if I transferred all of my daughter’s points to my husband (cardholder) would that transfer be eligible to go toward the $500/yr. credit? Or only if this scenario were reversed?

It doesn’t matter who is transferring the points, the $500 fee credit is just for paying the fee for the transfers. You could use your SW business card to pay the transfer fee from one stranger’s account to another and you’d still get credited $500 per year (through Dec 31, 2025).

I also got DoorDash quarterly and Instacart monthly benefits from my Southwest Plus card (thanks to you!).

End of year question! My Performance Business card just renewed (AF hit Dec 6). Does the $500 points transfer credit reset at the cardmember year or is it a calendar year? I used it up in March of 2025. I can’t find the tracker anymore or any info about it being a benefit…but want to use it again if it is.

Terms say anniversary year but you might want to double check via secure message with Chase when that resets for you!

I was not able to find my upgrades or early bird check ins. I followed your instructions, but my app showed different options. I was not able to find what you showed. I have the priority card.

sorry it didn’t’ work for you! It seems like they cut even more functionality ahead of dropping these benefits.

If we get a Priority card, are we able to choose seats & get 1 checked bag free if we select Basic ticket fares? Is there any reason to purchase higher grade fares if we’re using the Priority card?

Yes you get all that with Priority card! No real reason to purchase higher fares when booking with points if you have Priority.

slight amendment — the thing to be aware of is that Basic fare does not allow changes. So if you book Basic with points you should book one-ways because if one half goes down in price this will be easier to cancel/rebook/get a refund for the difference

I have the priority card, and my husband has the performance business card and a companion pass. My annual fee is coming up and it doesn’t make sense for us both to keep such high annual fee cards. We are definitely keeping his. Can I downgrade to a no annual fee card? All the southwest cards have an annual fee, so that would be a different family. We need zero foreign transaction fees as my daughter is using it overseas. Any help would be appreciated!