All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com site has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

How to Pay Bills Fee-Free With PayPal Bill Pay

Update as of May 2024: Many of the options for PayPal bill pay have been removed. Sadly, this is likely very limited in use now.

PayPal Bill Pay gives many people the option to pay utilities, property taxes, and student loan bills with a credit card with no fee! This is especially valuable if you are trying to hit a minimum spend, or just put more expenses on your card to earn more points towards free travel.

What is PayPal Bill Pay?

Typically, PayPal charges 2.9% of the charged amount plus a fixed $0.30 fee to process credit card transfers. However, there is an exception to this fee.

PayPal Bill Pay is a bill pay service offered through the PayPal platform that allows credit card payments to many billers (including utility companies, property tax entities, HOAs, etc) without an associated fee.

Why use PayPal BillPay?

Many biller’s charge a fee for credit card payments. For example, if we pay our utilities directly, our gas company charges a flat $1.50 fee for credit card payments, our water company charges a flat $3.95 for credit card payment, and our property tax district charges 2.19% for credit card payments.

Paying fees may be worth it if you are trying to earn a sign up bonus. But for a large payment, like your property taxes, or something you want to charge monthly and earn points for, like utility bills, it’s nice to have a fee-free option.

In some cases, but not all, PayPal Bill Pay gives customers a fee-free option for making these types of payments. Note that using PayPal Bill Pay is NOT the same thing as checking out through a website and using the PayPal option. In order to use PayPal Bill Pay, you must go directly through the PayPal website or app.

What companies allow PayPal Bill Pay payments?

There are thousands of companies on Bill Pay that make credit card payments more accessible. These include, but are not limited to, utility companies, phone companies, insurance companies, property tax entities, and HOAs.

PayPal Bill Pay also facilitates mortgage, loan, and credit card payments. However, you will not be able to pay off debt with a credit card.

How to pay bills using PayPal Bill Pay

In order to use PayPal Bill Pay you MUST find your biller in PayPal’s system. If you don’t find your biller, you will not be able to use Bill Pay to pay your bill.

Here’s a step-by-step of how to find out if your biller is in Bill Pay and, if so, how to pay that bill fee-free!

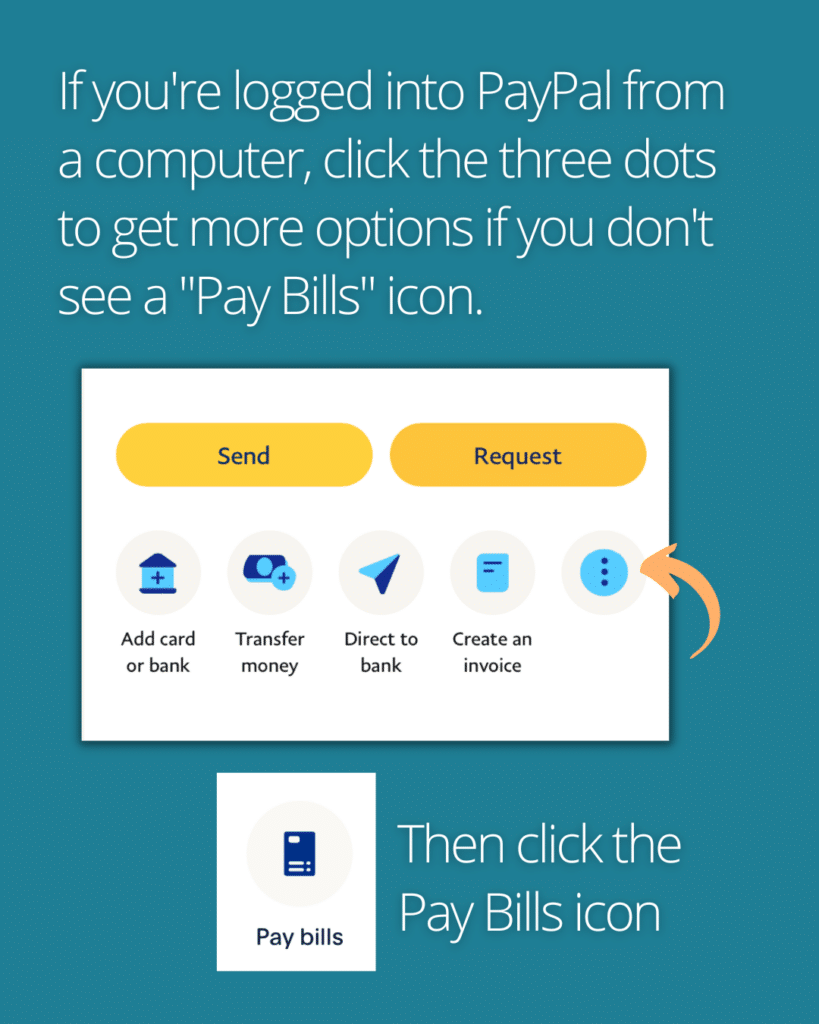

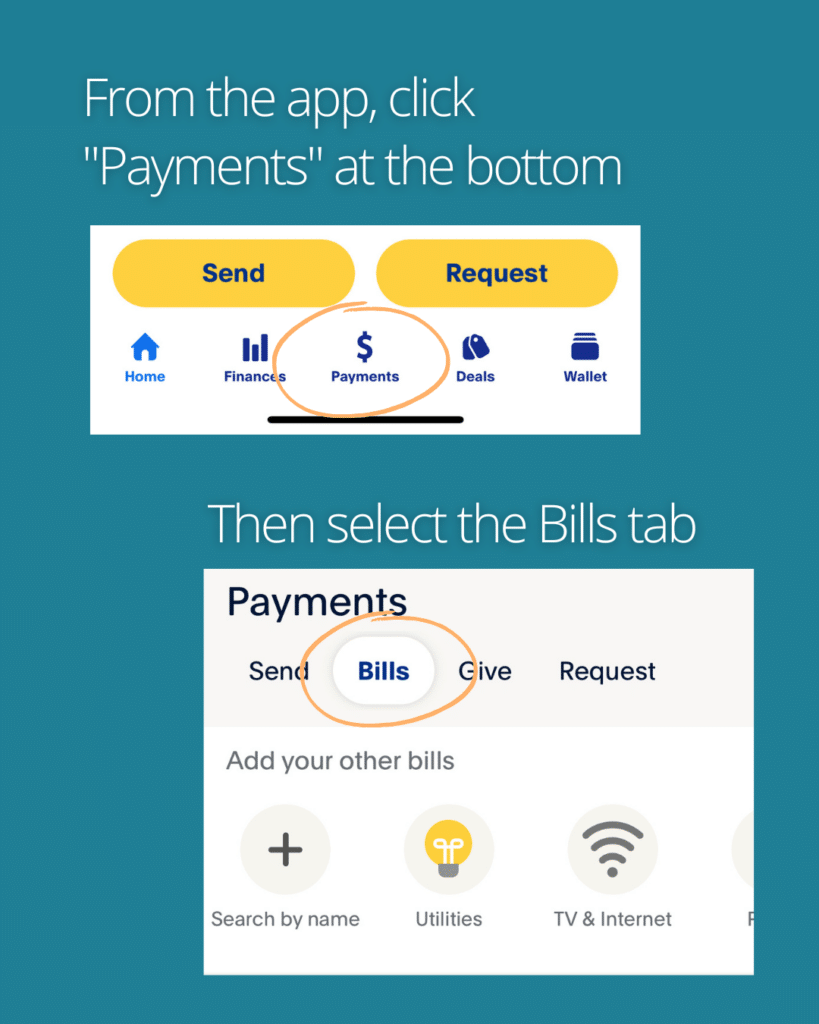

1. Locate the “Pay bills” option

If this is your first time using Bill Pay, it’s a bit buried in both the app and the website. You will probably need to click the three dots to find the “Pay bills” icon. After you’ve used it, it will automatically show up as an option on your dashboard

2. Add a New Bill to PayPal Bill Pay

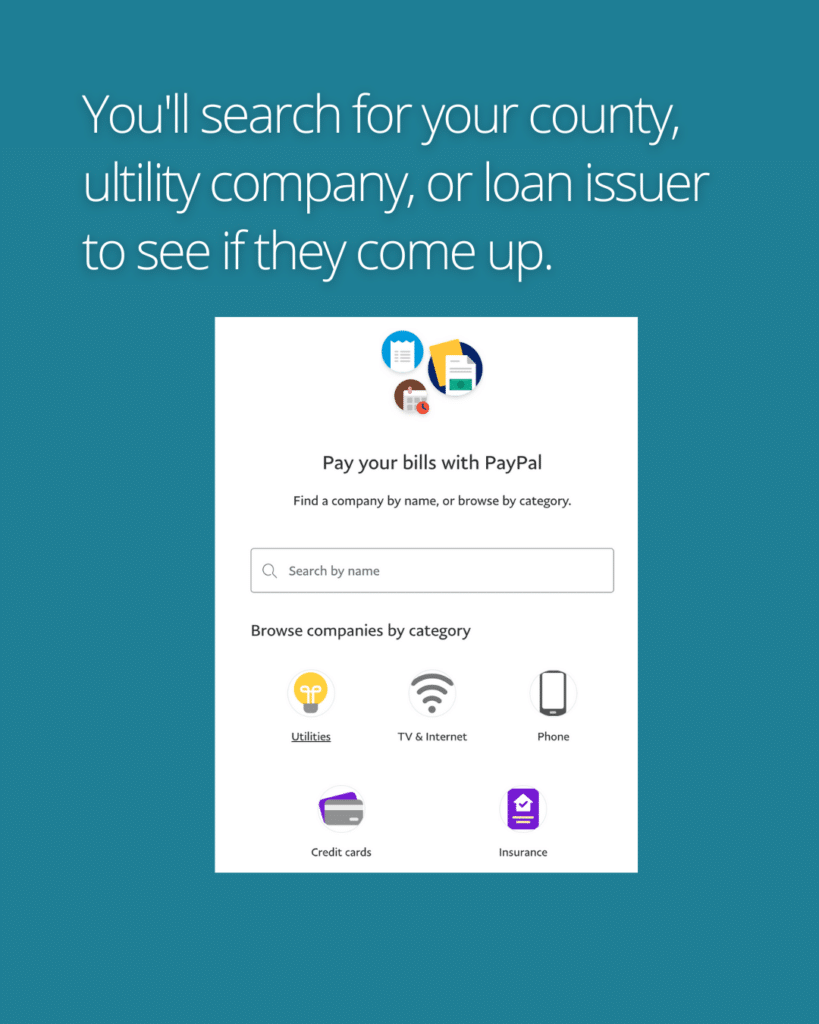

To add a new biller, click the “Add a New Bill” option and search by name or browse by bill category. If you are able to find the company you are looking for – yay! Proceed to the next step(s).

3. Enter and confirm your account number

Most of the time, this will be the account number on your bill. If you are paying property taxes, this may be your parcel number. If you’re not sure what number to use, contact the biller to confirm.

Look up your statement balance

PayPal will not know how much you owe on your bill. You will need to check your statement to ensure that you are paying the amount owed.

5. Enter your payment amount in PayPal Bill Pay

After confirming how much you want to pay, click the “Pay” button. On the next screen, you will enter your payment amount.

6. Enter your payment details and submit payment to PayPal Bill Pay

You will have the option of paying with any of your PayPal linked accounts, or adding a new payment option. Follow the steps to add your credit card and submit your payment.

In some cases, when you get to the payment page, there will not be a credit card option. If this is the case, the biller is not currently accepting credit card payments through PayPal Bill Pay.

7. Monitor your bank and biller accounts

If the payment goes through, you will see it as pending on your credit card statement. It will show up as “PAYPAL *(BILLER NAME)”. It can take several days for the payment to be reflected on your biller statement.

Important Tips for using PayPal Bill Pay

Zero Your PayPal Balance

If you have any PayPal balance, this will be used first before your credit card. Make sure you’ve transferred any balance to your bank account.

Start with a small test amount

The first time you set up a new bill you can make a payment of $1 to ensure that everything goes through correctly. After the test amount shows up in your biller account, you can go through the process again and pay the balance.

Pay Early

It can take several days for your payment to hit your biller, so I would suggest submitting your payment through PayPal at least one week before its due date.

Set Your Cash Advance Limit to $0

Occasionally merchants using bill pay will trigger a credit card cash advance. Cash advance incurs high daily interest rates and don’t qualify to earn points. Set your cash advance to $0 to make sure this doesn’t happen. You can just call or message your bank and say “I want to set my cash advance limit to $0, or as close to $0 as possible.” This way if the merchant did run it as a “cash” transaction, it would just get declined by your bank.

Delete Linked Bank Accounts

Some people have reported PayPal reverting to stored payment methods. You may want to delete any linked bank accounts or other payment methods to ensure that the payment goes through on the correct card.

Note: No Autopay

You will not be able to set up automatic payments through PayPal Bill Pay.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Great information. So then if the utility company shows up and when you go to pay you can enter your credit card information, does that mean you are all good for the no fee payment through PayPal? I currently was trying to test it with a $1 amount, but it is having an issue currently for me so not sure if it lets you know later or not, but thought I’d ask. Also seeing if since it is paying through PayPal if using a credit card will classify that as PayPal instead of utilities. Lastly, would the only downside to this be that it isn’t autopay so you have to pay attention to it monthly? Thanks

I’m not totally if the utility category will pass through to the credit card or not, you’d probably need to test. But let me know what you find! Yes – main downside is having to pay each month. And I think it should be on the screen pretty early if you have to pay a fee — I have never had a fee come up so again I’m not 100% sure.

Curiously, my county tax collector is listed on my PayPal app as a PayPal biller, but when I called the county to double check they say they don’t accept PayPal. I heard this from 3 different people on 3 different phone calls.

This is true for me as well. I think that Paypal Bill Pay comes to them as a bill pay just as a bank bill pay would so they don’t recognize it as Paypal. You can do a test smaller amount if you have time and confirm they receive it.

Do you need to have a paypal personal account? I have a business one and don’t see the pay bill option anywhere

I found my county on my personal account as well as my business account. But the business account wouldn’t allow this type of payment.

You need to set up a personal account.

I have only tried from my personal account.

Paypal bill pay option is only for personal accounts.

“The block heel on those pumps looks so sturdy and comfortable to walk in.”

I see my county listed and it lets me add the account number, but when I go to pay, I get a message, “something is not working, try again later”. Anyone else having this issue?

Yes. I got a similar message “things don’t appear to be working at the moment” after easily finding and adding the county site to the biller in PayPal and updating the payment to my rewards card.

@Kristin and @Martha – same. I found my county and added the account number but then it said “something isn’t right, try again later” (or something like that)… I guess I’ll try again later. Hopefully it’ll work tomorrow (November 1st) so I can get double the points on Bilt.

After trying to pay San Diego County property taxes with Paypal Bill pay, I got the same error message “Things dont appear to be working at the moment”. I spent hours across multiple calls over a week on the phone with Paypal customer service agents and managers. I tried small payments, multiple different accounts. Nothing worked. Has anyone figured out a way to get around this error message? Otherwise I’m going to have to figure out a different way to hit this 8K in 3 month SUB :*)

I have gotten this error message from several entities listed as payee options under PayPal Bill Payer. As described above, may county real estate taxes (Clark County) are listed as a PayPal payee, but it doesn’t work. Also, Tmobile is listed as payee does not work. So PayPal billpay has been a lot of work for not many points.

Just to leave a data point, I was getting the “things don’t appear to be working” repeatedly earlier this month. I was able to do a workaround (selected to pay with bank account and then changed it to credit card on the confirmation page) but it took 2 weeks to show up on my County Tax account.

I just tried again today and it went through smoothly with no error messages. It hasn’t shown up on my tax account yet but I’m hopeful that they worked out whatever issues were going on.

The payment posted to my County Tax account today, just 2 business days after I submitted through Paypal. It really does look like they fixed whatever issue was causing the errors and delayed payment.

Does the credit card company treat this as a cash advance or as a normal charge? In other words, do you owe interest from the date it hits your credit card, or is it interest-free if you pay it off by your normal monthly due date?

Should be treated as a normal charge. I recommend you set your cash advance limit to $0 or as low as the bank can go just in case.

Is there a limit that I can add for chase credit card? For few days I have been trying to add new chase card for bill pay but I don’t see chase credit as an option. I don’t understand

You’re signed into Paypal and it isnt’ letting you add a credit card?

So frustrating!!! I’ve been trying to pay property taxes for over a week and continue to get message: “things don’t appear to be working right now – try again later” Ugh!

I hope it resolves for you soon!

Appears Paypal has shut down the option to pay property taxes.

I’m seeing the option removed for my county now, too. Did you see an announcement about this or your county is off PayPal Bill Pay too?

Most of the vendors that I used are gone now. Bummer!

Ahhh shoot! My county is gone, too.