All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com site has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

American Express Membership Rewards Guide

Today we’re looking at the best ways to earn and redeem American Express Membership Rewards® points.

American Express makes it easy to earn a lot of points, even after you earn that initial welcome bonus. They have generous earning rates on certain spending categories, plus many other ways to earn points on top of your regular monthly spend.

When it comes to redeeming points, American Express has a lot of nice options as well! They have many popular transfer partners like Air Canada and Virgin Atlantic, as well as several transfer partners unique to American Express, like ANA and Hawaiian Airlines.

September 2025 update:

Starting September 16, 2025, the transfer ratio from American Express to Emirates has changed. The new rate is 5:4. That means if you transfer 5,000 Amex points to Emirates, you will receive 4,000 Emirates miles.

Earning Membership Rewards® Points

The easiest way to earn a lot of points quickly is to sign up for a credit card offering a welcome bonus. This gives you the most bang for your buck as you’ll earn that welcome bonus on top of the points you earn for every dollar spent.

You can also earn points through regular spending, referring friends and family, Amex offers, and other promotions.

For people who like to earn the most points they can on their regular everyday spend, American Express has some really high earning rates in certain categories.

For example, the Gold card earns 4x points at restaurants worldwide (on up to $50,000 in purchases per calendar year, then 1x) and 4x at U.S. Supermarkets (on up to $25,000 per calendar year in purchases, then 1x). For a family that spends a lot on groceries, this is an easy way to rack up a significant amount of points.

Cards that Earn Membership Rewards® Points

American Express offers several cards that earn Membership Rewards points. You can get both personal and business cards.

Personal Cards

- American Express Platinum Card®

- American Express® Gold Card

- American Express® Green Card

Business Cards

- The Business Platinum Card® from American Express

- American Express® Business Gold Card

- Business Green Rewards Card from American Express

- The Blue Business® Plus Credit Card from American Express

Card Application Quirks and Tips

Order to apply

American Express has some rules on who is eligible for a welcome offer and when. For many of their card families, if you already have a higher tier card (like the Platinum), you wouldn’t be eligible to earn a bonus on a lower tier card in the same family (like the Gold).

For this reason, it’s best to apply in this order for Membership Rewards® earning cards:

Green first, followed by Gold, then Platinum.

That way, you’ll have an opportunity to earn a welcome bonus on each of the cards.

Lifetime language

For most American Express cards, the terms and conditions state that the welcome offer is only good once per person, per lifetime. In other words, you can only get a welcome offer once for that particular card.

In practice, though, it seems like “lifetime” is more like 7 years. Many people find that they are eligible to earn a bonus on the same card again after 7 years, but there’s no guarantee this will always be the case.

Certain offers won’t include this lifetime language.

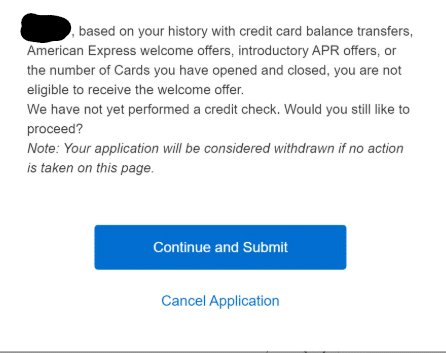

Pop Up Jail

Sometimes, when you apply for an Amex card, you’ll get a pop up window that says you’re not eligible for the bonus.

This is known as “pop up jail”. It can happen for any number of reasons. It could be that it’s been less than 7 years since you’ve applied for that card, you’ve applied for a lot of new cards recently, you haven’t been putting enough spend on your current Amex cards, or something else.

There’s no hard and fast rule for how to get out of Amex pop up jail, but if you see it, some people think it can help to put more of your regular spend on the Amex card(s) you already have open.

Sometimes people find that if you apply for a targeted offer or an offer in your Amex account that you’re more likely to get through the application without a pop up.

For some co-branded cards it may help to call and apply directly. I know of at least one data point of someone who called Hilton and applied for the Hilton business card and was able to bypass the pop-up that way.

Welcome Offers

The highest welcome offers for American Express cards are typically targeted. That means not everyone will qualify for the best offers out there.

Offers are typically higher through referrals than through other links. We keep a list of reader referrals to make sure we’re always sharing the best offers available.

It’s common to see different offers depending on what browser or device you’re using. If you know there’s a higher offer out there that you’re not seeing, try switching browsers, using incognito mode, or looking for the offer on a different device (like a laptop instead of your cell phone).

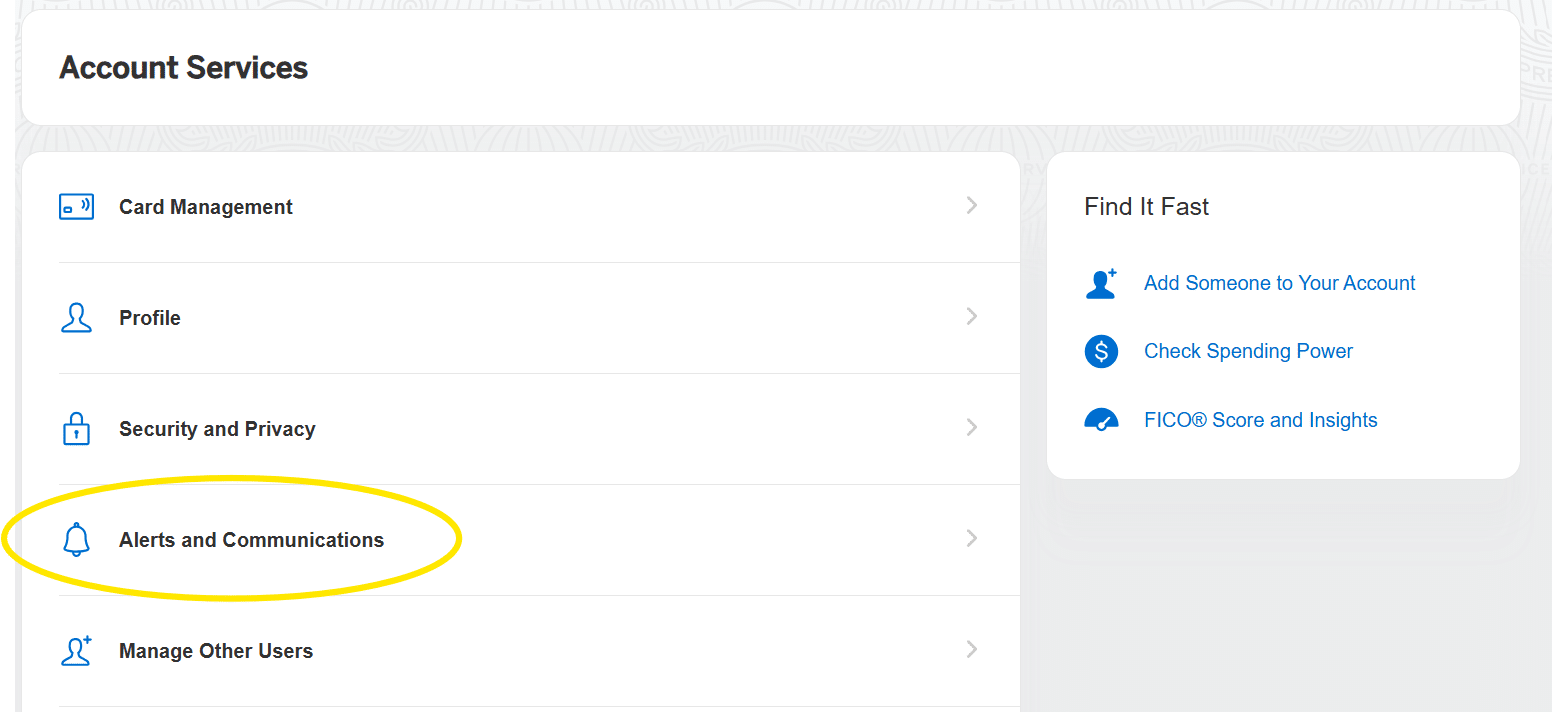

Opt In to Marketing Offers

Opting in to marketing offers is another way to see targeted offers and special deals. In your Amex account, go to account services and click on “Alerts and Communications”. From there, you can opt in to marketing emails.

More Ways to Earn Points

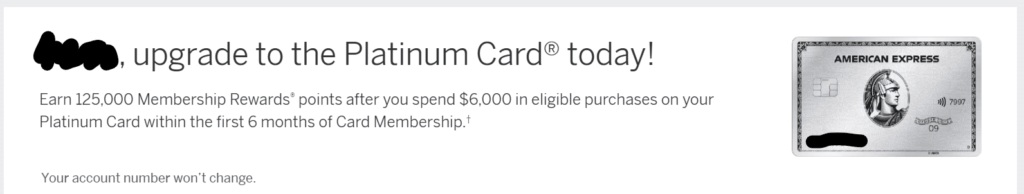

Upgrading Cards

You can sometimes earn bonus points by upgrading a card to a higher tier card. For example, if you have the Gold card, you may be offered a bonus to upgrade to the Platinum card. You might see these types of offers in your online account, in an e-mail, or through the regular mail.

These bonuses are typically targeted and they’re not always available.

If you’re thinking about upgrading your card anyway, it never hurts to ask if there are any offers available!

A Note on Downgrading Cards:

The Green, Gold, and Platinum cards don’t have a free version you can downgrade to. If you want to close those accounts but keep your Membership Rewards® points, one option is to open a Blue Business Plus Card.

This card earns Membership Rewards points®, has no annual fee, and still gives you access to the full list of transfer partners.

Another option is to open an Amex checking account. More on that below.

Retention Offers

If you’ve had an Amex card for at least a year, you may be able to get a retention offer to keep the card open longer. You can call Amex or use the chat feature to ask for a retention offer.

Tell the agent you are thinking about closing your card and you’re wondering if there are any retention offers available. If they give you a good offer, great! You can accept over the phone or chat.

If you don’t like the offer or you’re not sure about it, just tell the agent you’re going to think about it. Retention offers change regularly so if you don’t get an offer (or you get an offer you don’t like), you can always try again another day.

Add an Authorized User

You can often earn bonus points for adding an employee or other authorized user to your account. Usually, this requires putting a certain amount of spend on the card.

Referring Friends and Family

You can earn bonus points when friends or family sign up for an American Express credit card using your referral link. This is a great way to maximize your points when working with a spouse or partner.

Keep in mind that referral offers change regularly and the best offers may not be through your own personal referral link.

The nice thing about Amex referrals is that if you have any American Express card, you can refer to any other American Express card. That means if you have an Amex Gold card for example, you could refer someone to sign up for a Hilton Honors card through American Express and you’ll still get the referral bonus.

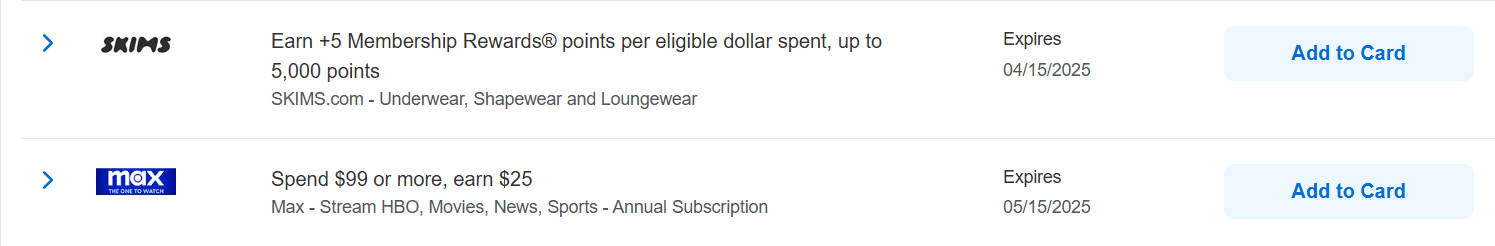

Amex Offers

Amex offers appear for every American Express card you have. Offers are often targeted and may not be the same on each card. Offers are sometimes for cash back and sometimes for Membership Rewards® points.

To use an offer, you must first add it to your card by clicking the blue “Add to Card” button. Then use your card to pay, and you’ll get the bonus points or cash back on your card.

Pay Over Time

Amex occasionally runs offers where you can earn bonus points by signing up for “Pay Over Time“. This is where you pay off large purchases over time (with interest), rather than all at once when your statement is due.

You don’t actually have to use the pay over time feature to get the bonus points, you just have to set it up.

Open an Amex Checking Account

You can earn even more points by opening a personal or business checking account with American Express.

Amex often runs promotions where you can earn a bonus by opening an account and meeting the requirements.

Offers and requirements can vary, but for the Business checking account, you can expect to earn anywhere from 30,00-60,000 Membership Rewards® points just for opening the account and completing the qualifying activities. Qualifying activities can also vary, but typically these include things like setting up direct deposit and keeping a minimum balance for a certain length of time.

The American Express Rewards Checking Account earns Membership Rewards® points on debit card purchases.

Keep Your Points Even if You Close Your Credit Cards

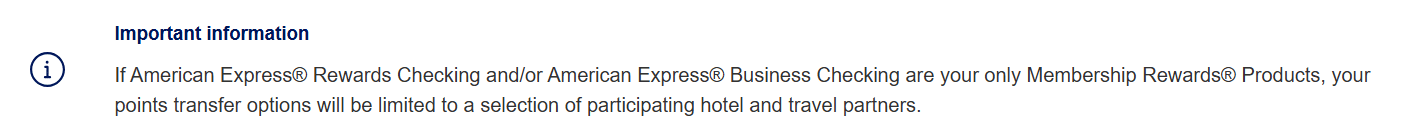

Having an American Express Checking Account open is a good way to keep your points alive if you decide to close your Membership Rewards® earning cards. But keep in mind that you won’t have access to all transfer partners.

Here are the transfer partners you can access with just an Amex checking account:

Air Canada Aeroplan

British Airways Executive Club

Cathay Pacific

Choice Privileges

Delta SkyMiles

Etihad Guest

Hilton Honors

Iberia Plus

Marriott Bonvoy

Qatar Airways Privilege Club

Singapore Airlines | KrisFlyer

Virgin Atlantic Flying Club

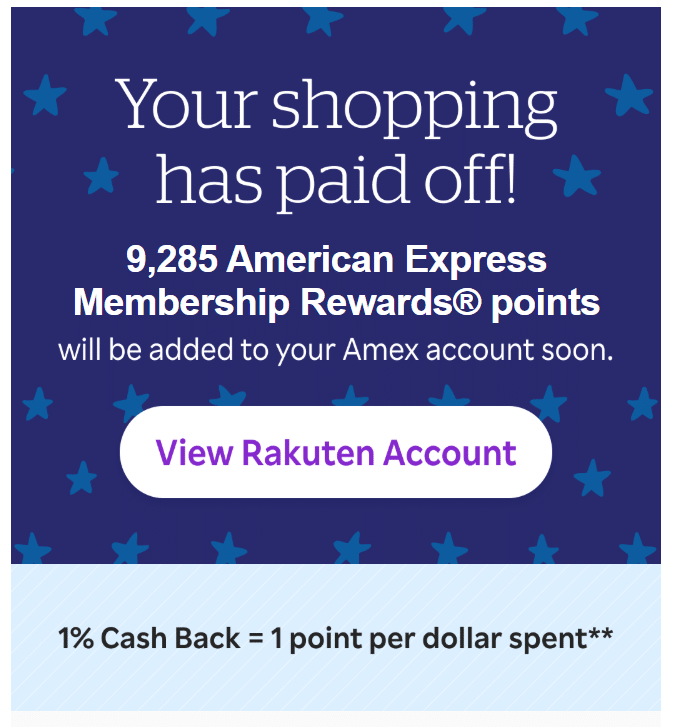

Earn More Points with Rakuten

Rakuten is a shopping portal where you can earn cashback on everyday purchases.

New to Rakuten? Here is our referral link.

To earn cashback, all you have to do is sign up for an account and click through a Rakuten link (via their website, browser extension, or app) before making an eligible purchase at a participating retailer.

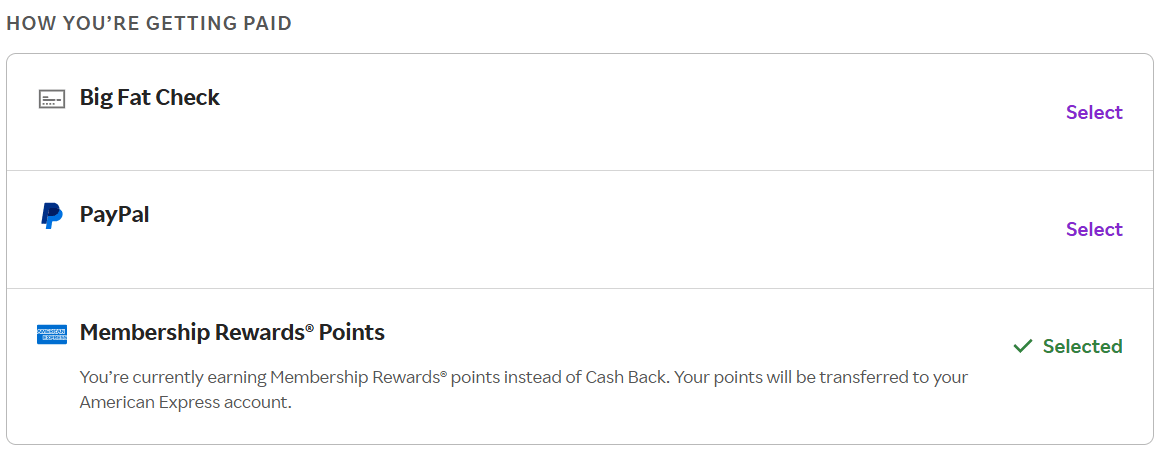

If you have an American Express credit card that earns Membership Rewards® points, you can opt to earn points instead of cash back.

You don’t have to make the purchase on your Amex card to get the points. You can use any form of payment that is accepted by the retailer, including other credit cards, debit cards, and gift cards.

This is a great way to earn more points on top of the points you already earn when paying with a credit card!

Connecting your Amex account to Rakuten

To start earning Membership Rewards® points with Rakuten, all you need to do is connect your American Express account to Rakuten. Sign into your Rakuten account and go to “account settings”. Under “how you’re getting paid,” select Membership Rewards® points. You’ll be prompted to sign into your American Express account. Complete the steps, and you’ll be all set!

Once you’ve selected to earn Membership Rewards points, you’ll see earning rates in terms of points instead of cashback. The amount of points you receive is a direct 1:1 ratio with the cashback Rakuten offers. For example, 1% cashback = 1 point per dollar. 5% cashback = 5 points per dollar, etc.

Points are deposited directly into your American Express account quarterly.

Combining Membership Rewards Points

Points from all of your Membership Rewards® earning cards are pooled into one bucket, so they’re already combined. This is different from other banks like Chase, where all of the points are kept with each individual card where you earn them– unless you choose to combine them.

American Express does not allow you to combine points with friends or family members.

If a friend or family member is an authorized user on one of your Membership Rewards® earning cards, you can transfer points to their airline or hotel loyalty account for free. Each person must be an authorized user for 90 days before you have the ability to transfer points to their partner loyalty account.

Redeeming Membership Rewards® Points

There are several ways to redeem Membership Reward® points. Some offer more value than others, but the thing to remember is that the best use of points is the one that saves you money on the trip you want to take!

American Express Travel

You can use points to pay for travel expenses when booking through American Express Travel. Simply select “use points” or “use points + card” when checking out. This is a simple and straightforward way to use points to save money on your travel expenses.

When redeeming points through American Express Travel, points are worth 1 cent per point for flights and 0.7 cents per point for most other expenses (like hotels, rental cars, and cruises).

10,000 points in American Express Travel could cover a $100 flight or a $70 rental car.

Pay with Points

You can pay with points when checking out with participating brands, such as Amazon, Best Buy, and Grubhub. This is typically not a very good value for your points because the redemption rate is usually poor (0.7 center per point in most cases).

Occasionally, Amazon will have offers where you can get a discount of 15-50% off your purchase when paying with points. If you’re targeted for one of these offers, it could be worth using a few Membership Rewards® points to activate the coupon.

You typically don’t have to pay for the whole purchase with points to get the discount. Using just one point toward the purchase is sometimes enough to trigger the discount. This only works if you’re targeted for an offer.

American Express Transfer Partners

You can often get the most value by transferring Membership Rewards® points to transfer partners and booking through that airline or hotel program.

Here are all of the transfer partners for American Express and their transfer ratios. A 1:1 ratio means that 1,000 Membership Rewards® points transferred = 1,000 points in the partner program.

Airlines

- Aer Lingus AerClub 1:1 ratio

- Aeromexico Rewards 1:1.6 ratio

- Air Canada Aeroplan 1:1 ratio

- Air France-KLM Flying Blue 1:1 ratio

- ANA Mileage Club 1:1 ratio

- Avianca LifeMiles 1:1 ratio

- British Airways Executive Club 1:1 ratio

- Cathay Pacific Asia Miles 1:1 ratio

- Delta Air Lines SkyMiles 1:1 ratio

- Emirates Skywards 5:4 ratio

- Etihad Airways Guest 1:1 ratio

- Iberia Plus 1:1 ratio

- JetBlue TrueBlue 250:200 ratio

- Qantas Frequent Flyer 1:1 ratio

- Qatar Airways Privilege Club 1:1 ratio

- Singapore Airlines KrisFlyer 1:1 ratio

- Virgin Atlantic Flying Club 1:1 ratio

Hotels

- Choice Privileges 1:1 ratio

- Hilton Honors 1:2 ratio

- Marriott Bonvoy 1:1

Transfer Partner Sweet Spots: Airlines

Aer Lingus

Flights to Ireland are as low as 26,000 points and around $285 in taxes and fees for a round trip.

Air Canada Aeroplan

Aeroplan doesn’t impose fuel surcharges for award tickets, so taxes and fees are usually reasonable. A nice perk when booking with Aeroplan is the ability to add a stopover for 5,000 additional miles. This allows you to visit multiple cities with a single award ticket. Note: Cancellation fees can be high.

All Nippon Airways (ANA)

American Express is the only bank that transfers to ANA. Through ANA, you can book roundtrip flights to Europe and Asia for competitive rates. They also have a unique option to book an around the world ticket for one low price. Taxes and fees can be high, so watch out for that. Unlike with most other programs, transfers are not instant. It can take 2-4 days for your points to appear in your ANA account.

Emirates Skywards

Emirates offers reasonable rates to Europe, especially on their fifth-freedom flights from Newark. Non-stop flights from Newark to Milan or Athens are 35,000 miles and around $150 roundtrip.

Singapore Airlines

Singapore Airlines offers competitive rates for flights to Asia. They can also be a good option for booking United Airlines flights within the US and to Hawaii.

Virgin Atlantic

Virgin Atlantic uses dynamic pricing, which means prices vary widely, but you can often find really cheap flights to London. As low as 6,000 miles + $80 in taxes and fees. Flights on the return have significantly higher fees, so it could be worth looking at a different airline program to get back to the US. Virgin also offers a unique way to use your points for cruise redemptions. Transfer bonuses to Virgin are frequent.

Transfer Partner Sweet Spots: Hotels

Choice Privileges

Choice offers reasonable rates for hotels across the United States and Europe. Many of their properties in the US have suites with 1+ bedrooms. They also have many hotels that can sleep 4 in Europe, which is often hard to find!

Hilton Honors

The standard transfer rate to Hilton is 1:2, which makes the points needed effectively half. For example, to book a hotel that costs 50,000 Hilton Honors points per night, you only need to transfer 25,000 Membership Rewards® points per night. Hilton has a large global footprint and they guarantee connecting rooms, which makes this a good option for families. Amex frequently offers transfer bonuses to Hilton as well, making the actual number of points needed even lower.

Table of Contents

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Do you lose your remaining Membership Rewards points if you close your card?

Yes you need to keep at least one card with MR open