The Complete Guide to the Chase Ritz Carlton® Card

The Chase Ritz Carlton® card flies under the radar of a lot of credit card enthusiasts because it is not open for new sign ups. But this card is still available as an upgrade option and a one of the best options for airport lounge access. The Priority Pass lounge access it offers is unmatched by any other card — all card holders (even authorized users) get Priority Pass access. You get unlimited Priority Pass guests. And it is free to add authorized users! If you frequent JFK, BOS, or LGA this card also gets you unlimited access to the new Chase Sapphire lounges. Unfortunately as of July 1, 2024, this card will no longer provide access to Priority Pass Restaurants but will retain other Priority Pass experiences like Be Relax Spa.

Chase Ritz-Carlton® Card: Quick Hits

- Earning: 6x on Marriott, 3x on dining/car rentals/airfare, 2x on all other purchases.

- Welcome Offer: None. Available via upgrade only.

- Annual Fee: $450.

- Top Perks:

- Unlimited Priority Pass Select membership (including experiences, does not include restaurants after July 1, 2024).

- Global Entry/TSA Precheck credit ($100 every 4 years).

- Free authorized users who also get Priority Pass access.

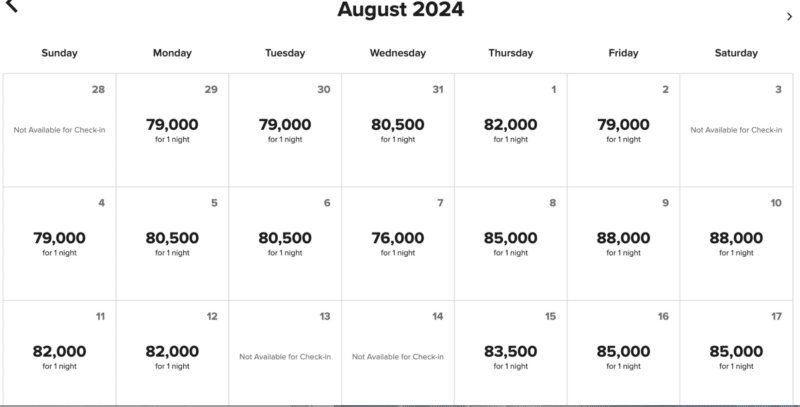

- Annual Free Night Certificate (up to 85,000 points).

- Automatic Marriott Gold Status

- $300 Annual Travel Credit.

Good for: Frequent travelers who want airport lounge access especially if you frequent an airport with a Priority Pass experience like Be Relax Spa, Gameway, or a Chase Sapphire Lounge. Can be especially valuable for families due to Priority Pass access for unlimited guests.

Drawbacks: No welcome bonus, requires existing Marriott card and $10,000 credit line for upgrade.

Overall: A hidden gem among travel cards with excellent benefits for its annual fee, especially for families.

How to Get the Chase Ritz-Carlton® Card

The Chase Ritz Carlton credit card is a bit more tricky to get into your wallet. You currently cannot apply outright for this card. So how exactly do you get this card?

You need to apply for a different Chase Marriott personal credit card like the Chase Marriott Boundless® first. After holding this card for one year, you’re eligible to upgrade to the Ritz Carlton card. Simply call the number on the back of your credit card or send a secure message to Chase and ask for an upgrade.

There are a few caveats to getting the Ritz Carlton card:

- To open a Chase Marriott card in the first place, you’ll be subject to Chase’s 5/24 rule. If you’re not sure what that is, you can read all about it here! Be aware that to apply (and receive) a welcome offer any Marriott card, you cannot have received the welcome offer on any Marriott card in the previous 24 months.

- When upgrading to the Ritz Carlton card you’ll be required to have at least a $10,000 credit line on the card. If your current Marriott card doesn’t have that high of a limit, you can always request to move some credit to that card from an existing personal card with Chase.

Earning Rates

- 6x points on Marriott purchases

- 3x points on dining, car rentals and airfare

- 2x on all other purchases worldwide

While this card doesn’t have the best earning rates on the market, it is on par with what you’d expect from other co branded Marriott credit cards. And let’s be honest, the star of this card is the benefits that come with it – not the earning rates.

Note that this card also comes with 0% Foreign Transaction Fees – making it a viable card to carry with you abroad.

Benefits of the Chase Ritz-Carlton® Card

Well, for starters, it packs a punch when it comes to travel perks! From luxury lounge access and automatic hotel elite status to valuable travel credits and comprehensive travel protections, the Chase Ritz-Carlton® Card offers a compelling package for frequent travelers. Let’s take a closer look at some of the specific benefits that come with this card.

Lounge Access

This card has the best Priority Pass lounge access options out there! The Ritz Carlton card gives you access to unlimited Priority Pass lounges for you and all guests traveling with you.

With this card, you’ve been also eligible for access to Priority Pass Restaurants – something most other cards (like American Express cards and Capital One Venture X Rewards Credit Card have done away with) With the Priority Pass restaurant credit, you’ll be credited $28 for your meal. This benefit officially is offered for the cardholder + 1 guest at most restaurants. You can find a list of restaurants here. This list changes but some airports like Seattle are a particularly good use of this. Unfortunately after July 1, 2024, this benefits has been eliminated.

In addition to Priority Pass restaurants, you’re also eligible to use your membership at Priority Pass Experiences including Gameway, Be Relax Spas and Minute Suites.

This card also offers the best access to the Chase Sapphire Lounges of any card. You are able to bring in unlimited guests and have unlimited visits. Currently there are Sapphire Lounges at BOS, JFK, LGA, and HKG.

85,000 Annual Free Night Certificate

This certificate is redeemable at thousands of Marriott Properties. You can also top off your certificate with up to 15,000 additional points. This means you can book a hotel valued up to 100,000 points with this certificate!

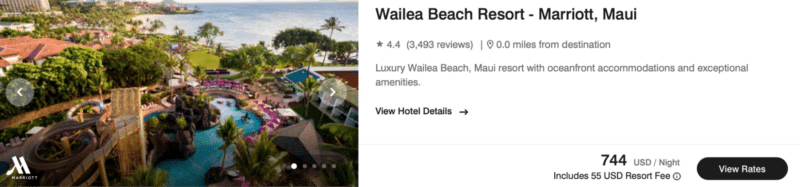

You can use your free night certificate at thousands of hotels across the globe including some aspirational family friendly properties such as Wailea Beach Resort.

If you’d like to stay closer to home, the popular-with-families JW Marriott Marco Island has many nights available during summer travel season.

$300 Annual Travel Credit

Use this credit for baggage fees, seat assignments, upgrades, lounge access and more. Redeem this credit by secure messaging Chase or calling 1-855-896-2222 after making your purchase. You can find examples of what works here.

More Travel Benefits

15 Elite Night Credits: Automatically earn 15 Elite Night Credits each calendar year that you hold the card.

Automatic Marriott Gold Status: Spend your way to Platinum with $75,000 spend on the card each calendar year.

Free Authorized Users: There is no fee for adding authorized users to the Ritz Carlton card. And they enjoy the same level of Priority Pass, including restaurants and experiences. This can be a HUGE savings if you regularly travel with a large family and frequent lounges or restaurants at the airport!

Global Entry/TSA Precheck Credit: A $100 credit is available every four years to use for yourself or anyone else!

Less Frequently Used Travel Benefits

$100 Property Credit at Participating Ritz Carlton Properties: When booking a minimum of a 2 night stay at a participating Ritz Carlton or St Regis hotel on a non-discounted, member rate, with your Ritz Carlton card, you are eligible to receive a $100 property credit during your stay. Credit may not be used on room rates or property goods/services operated by a third party. This credit seems unlikely to be of extreme value to most people. However, it’s worth taking note of if you happen to fulfill the requirements to use it. Call 1-800-542-8680 to book.

Three Ritz Carlton Club Level Certificates: These certificates are awarded each account anniversary and are available to be used on paid stays of up to seven nights maximum. They are subject to availability and are only available on non-discounted member rates. Much like the $100 property credit, the likelihood of most people using this perk is low. However if you find yourself fulfilling the requirements to use it, it is worth it to be aware of this benefit. Call 1-800-542-8680 to book and redeem your certificate.

Additional Benefits and Protection

Lost Luggage Reimbursement: Up to $3,000

Rental Car Coverage: Primary rental car coverage up to $75,000 when you charge the entire rental car to your Ritz Carlton card. Coverage includes theft and collision damage both domestically and abroad.

Trip Cancellation/Interruption Insurance: Reimbursement up to $10,000 per person and $20,000 per trip for nonrefundable, prepaid expenses.

Trip Delay Reimbursement: A common carrier delay of more than 6 hours OR an overnight stay results in reimbursement for non-covered expenses. This includes lodging and meals for each ticket that is paid for using the Ritz Carlton card.

Extended Warranty Protection: A one year extended warranty of the original manufacturer’s warranty of three years or less.

Return Protection: Reimbursement available for items purchased within 90 days that are not eligible for return with the merchant. There is a $500 maximum per claim, up to $1,000 per year.

Purchase Protection: Items less than 120 days old that were purchased using the Ritz Carlton card are covered up to $10,000 and $50,000 per year.

Roadside Assistance: Towing, jumpstart, locksmith, gas delivery are a few of the covered incidents up to 4 times per year with a $50 service fee.

JP Morgan Concierge: Similar to the Amex Platinum concierge, the JP Morgan concierge can book travel, dining and event reservations for you, along with shopping needs.

Note that some of the above mentioned benefits are not unique to just the Ritz Carlton card. However, the array of benefits included on the Ritz Carlton card make it a heavy hitter in the frequent traveler’s wallet.

The Final Verdict

Within the Marriott card family, the closest contender to the Ritz Carlton card is the American Express Bonvoy Brilliant card with an annual fee of a whopping $650.

If you’d like to learn more about the Ritz Carlton card, you can do so directly on their website, here.

This card is a hidden gem among the ultra premium cards. If you can make use of the annual free night certificate, travel credit and lounge access, this card can be a great addition to your wallet. For family travel specifically, this might be one of the best luxury card options on the market.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.