All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com site has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Earn More Points by Re-Earning Card Bonuses

People starting out in this hobby often wonder how more experienced travel points nerds can keep opening cards year after year without running out of cards to open and bonuses to earn.

One reason: there are a lot of card options that can keep someone responsibly earning points for years!

But one of the best ways to keep earning bonuses is to earn bonuses on cards more than once. Some banks (primarily Chase and Citi) will allow you to re-earn a bonus provided certain conditions have been met.

In order to find out whether you can earn a card bonus again, you will need to check the terms and conditions of the specific card you are applying for. Some banks make the eligibility terms easy to find and some make you dig around a bit.

It’s important to stay organized and keep track of your cards using an app like Travel Freely so that you can quickly figure out whether you have met the terms for re-earning bonuses. Otherwise, you may forget whether you had a card before, when you earned your last bonus on a card, or when you closed it.

Here’s how to find the eligibility criteria for American Express, Barclays, Capital One, Chase, and Citi cards.

If you are ever in doubt whether you qualify for the bonus again, send a secure message to the bank to confirm before applying.

American Express

American Express is restrictive about cardmember bonuses and publicly available offers typically include terms that say the bonus is only available once in a lifetime. In practice, a “lifetime” from their perspective seems to be 7 years.

The good news is that you don’t have to wonder and they will always let you know if you apply for a card and you are not eligible to receive the cardmember bonus, for whatever reason. If this is the case, American Express will give you the dreaded pop up letting you know “you are not eligible to receive the welcome offer” and giving you the option to submit or cancel the application.

How to find the offer details

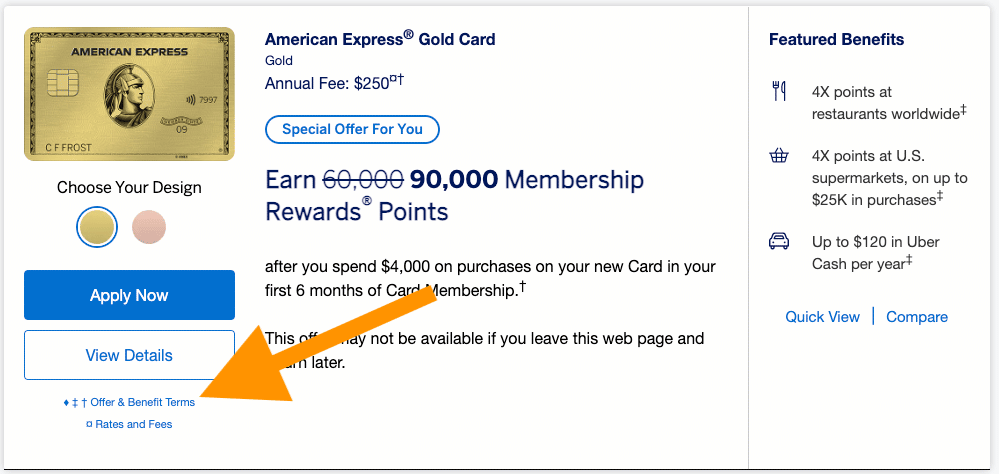

The highest American Express sign up bonuses are typically generated through referral links. We always encourage you to find a referral link instead of using an affiliate link for American Express cards for this reason. We include these on our Best Offer Page and throughout our site.

Once you’ve found the card and offer you are interested in, locate the “Offer & Benefit Terms.” If you do not see these terms, you may need to click “Apply Now.” This will take you to another page, which will have the “Offer & Benefit Terms.”

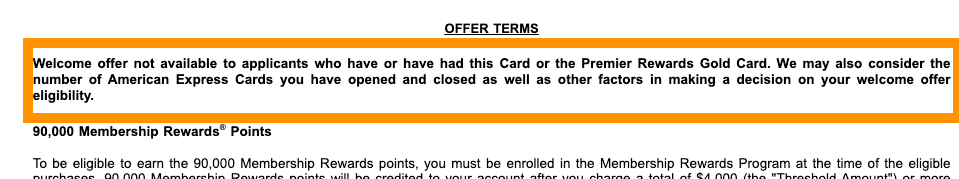

American Express clearly states in the offer terms if the welcome offer is not available to applicants who have already had the card. For example, when you read the terms for the Gold card, the terms state:

“Welcome offer not available to applicants who have or have had this Card or the Premier Rewards Gold Card.”

Most American Express cards include this “once in a lifetime” language that excludes previous cardholders from earning a welcome offer again. Despite this language, American Express seems to have set a lifetime at seven years as data points show this is when they start re-approving cards.

If you find an application that does not include this language – typically a targeted offer – then it’s your lucky day and you are eligible to earn the welcome bonus regardless of whether you’ve had the card or not. Katie has been able to do this with the Delta Gold Business card, for instance, with a targeted offer that came in the mail.

Barclays

How to find the offer details

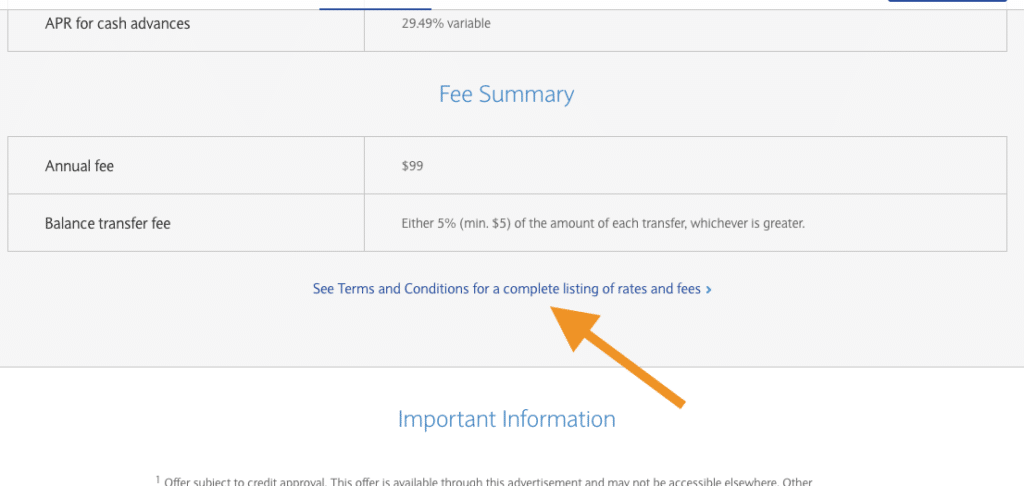

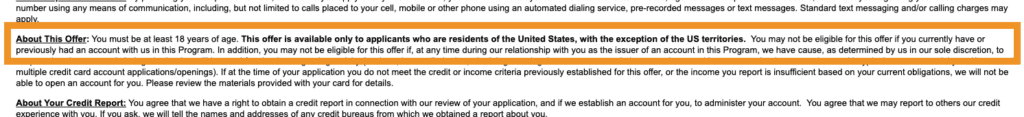

After you find the Barclays card you are interested in, scroll down until you find the “Terms and Conditions”. You can also do a page search for “terms” to find it more quickly.

Once you have opened the “Terms and Conditions” page, do a search of “bonus” or “offer”. You will find a paragraph that addresses bonus eligibility.

Most Barclays cards include ambiguous language like “intended” and “may no longer”. For example, for the AAdvantage Aviator Red Mastercard, the language says:

“these bonuses and incentives are intended for applicants who are not and have not previously been American Airlines AAdvantage Aviator Red Mastercard cardmembers. You understand and agree that you may no longer be eligible for any bonuses and/or incentives in connection with a new American Airlines AAdvantage Aviator Red Mastercard account after this Card Account is opened.”

In practice, if Barclay approves you again, many data points indicate you will receive another bonus.

Capital One

How to find the offer details

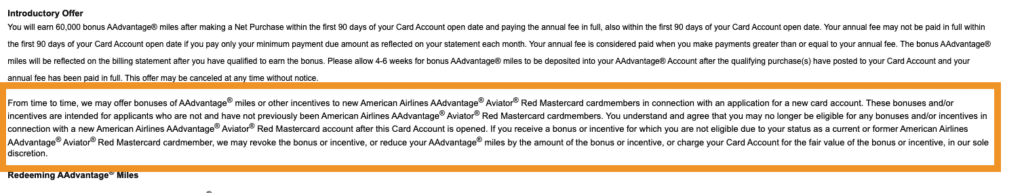

After finding the Capital One card you are interested in, click the “Apply Now” button.

You will be taken to an application page that has “Important Disclosures”. You could scroll through all of it or just do a search of the word “bonus” to pull up the eligibility rules.

Capital One bonuses typically include “one-time” language, although this seems to conflict with the part of the terms that says “may not be eligible.”

That may is a bit ambiguous and leaves room for Capital One to award bonuses again.

There are reports of people earning Capital One bonuses multiple times, but if you are thinking of reapplying in hopes of re-earning a bonus, I’d suggest contacting Capital One to confirm you are eligible.

Capital One Venture and Venture X eligibility rules

The Capital One Venture Rewards Credit Card and Capital One Venture X Rewards Credit Card are some of our favorite flexible rewards cards. Capital One states that the Venture and Venture X bonuses are “one-time” and you and that “existing or previous accountholders may not be eligible.”

While you may not be officially eligible to earn a Venture or Venture X bonus multiple times, you are eligible to receive both bonuses once. So if you have received a bonus on the Venture card you can also receive a bonus on the Venture X card, and vice versa.

Chase

Chase is pretty transparent about bonus eligibility rules.

While Chase cards all have similar language, you will still want to read the terms and conditions carefully since there are some slight differences with some card families.

Chase credit cards typically allow customers to earn the bonus again under two conditions:

-

- It has been 24 months (or 48 months for Sapphire cards) from when the applicant last received the bonus for that card and

-

- The applicant does not currently hold the card that is being applied for or, in some cases, any card in the card family that is being applied for.

Ensure these criteria are met – double checking dates (this is one reason it’s important to track your cards!) and downgrading or canceling cards where applicable – before reapplying for any Chase cards.

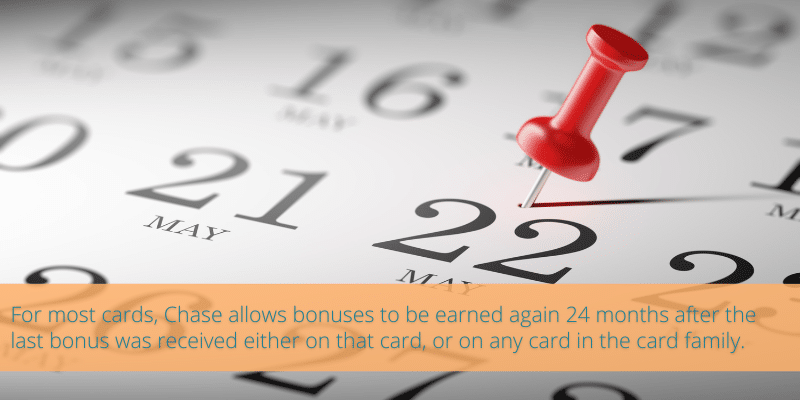

Length of time since last bonus

For most cards, Chase allows bonuses to be earned again 24 months after the last bonus was received either on that card, or on any card in the card family.

Note that with Chase the clock starts the date the bonus was earned and not the date that the card was last opened.

Note that with Chase the clock starts the date the bonus was earned and not the date that the card was last opened.This means that before applying to re-earn a bonus, you will need to downgrade (for example, downgrade your Sapphire card to a Freedom card) or close the card to be eligible for the bonus again. It’s typically recommended to wait 2-4 weeks after downgrading or closing an account before applying. You need time for the active card to fully clear out of Chase’s system before they will approve you again.

Chase eligibility rules table

| Card Family | Re-earning bonus permitted | Eligibility | Other terms |

| Sapphire | Yes | 48 months from last bonus | Not available to current cardholders of any Chase Sapphire card |

| Ink cards | Yes | None currently listed | -Can earn a bonus for each Ink card every 24 months -Can earn bonuses for the same Ink card within 24 months if you have multiple businesses |

| Southwest personal cards | Yes | 24 months from last bonus on any Southwest personal card | Not available to current cardholders of any Southwest personal card |

| IHG personal cards | Yes | 24 months from last bonus on any IHG Rewards personal card | Not available to current cardholders of any IHG Rewards personal card |

| Marriott cards | Yes | 24 months from last bonus on any of the following: Marriott Bonvoy® Premier credit card, Marriott Rewards® Premier credit card, Marriott Bonvoy Boundless® credit card, Marriott Rewards® Premier Plus credit card, Marriott Bonvoy Bold® credit card. | Not available to current cardholders of any of the following: Marriott Bonvoy® Premier credit card, Marriott Rewards® Premier credit card, Marriott Bonvoy Boundless® credit card, Marriott Rewards® Premier Plus credit card, Marriott Bonvoy Bold® credit card. |

| The World of Hyatt Credit Card | Yes | 24 months from last bonus | Not available to current cardholders of the World of Hyatt card |

| Southwest business cards | Yes | 24 months from last bonus on business card that is being applied for | Not available to current cardholders of the Southwest business card that is being applied for |

| IHG One Rewards Premier Business Credit Card | Yes | 24 months from last bonus on IHG Rewards Premier Business card | Not available to current cardholders of the IHG Rewards Premier Business card |

| The World of Hyatt Business Credit Card | Yes | 24 months from last bonus | Not available to current cardholders of the World of Hyatt Business card |

How to find the offer details

Find the Chase card you are interested in.

Once you are on the offer page for the card, click “Apply Now”

Find the “Offer Details”.

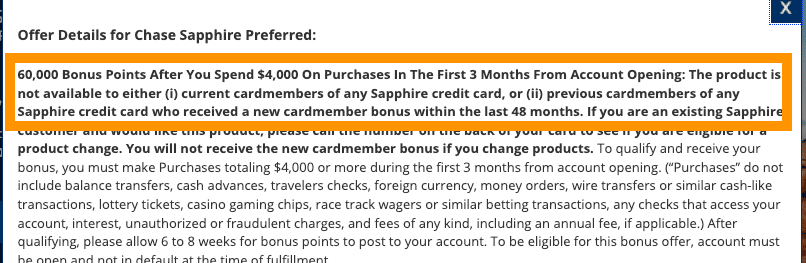

Chase puts the bonus eligibility at the top of the Offer Details, making it simple to find out how often you are eligible to receive a bonus on that card.

Chase Business Ink cards eligibility rules

We love the Chase Business Ink cards. These no-fee cards are easy to apply for – even if you don’t have a formal business – and provide a lot of opportunities to earn a lot of Ultimate Rewards

The process for figuring out eligibility on the Chase Ink cards is a bit different from other Chase cards. After you have clicked “Apply Now” from our affiliate link, you will be taken to Chase’s website.

If you go to “Offer Details” you will find out the bonus information but you will NOT find eligibility terms.

There are two no-fee Ink cards that earn Ultimate Rewards, and one with a $95 annual fee. These terms do not preclude you from earning a bonus on each Business Ink card. Additionally, you can apply for each card both as a business with an EIN and a sole proprietor with a SSN.

There are many reports of people opening the same Ink card with the same business and earning the bonus multiple times within 24 months.

While Chase may not be currently enforcing these terms, Chase could choose to claw back points or shut down accounts for people who violate them if they choose. It is more prudent to apply with different businesses and/or using your Social Security number for one and EIN for another if you choose to apply for multiple within 24 months.

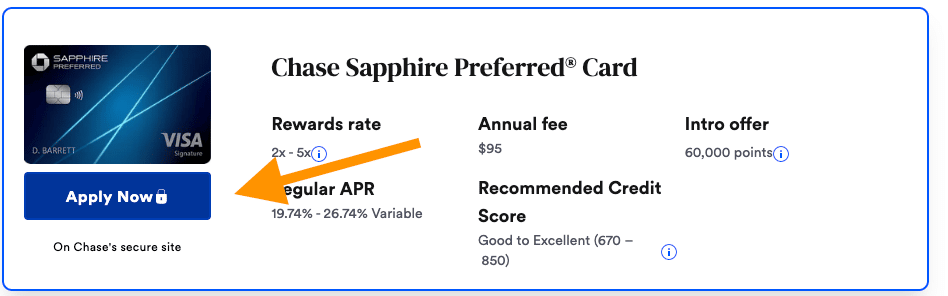

Chase Sapphire eligibility rules

Most people start their travel points journey with a Chase Sapphire Preferred® Card. For good reason! This popular card (along with the premium Sapphire card, the Chase Sapphire Reserve®) comes with great benefits and earns flexible rewards that can easily be transferred to 14 partners, including World of Hyatt, Southwest Airlines, and United Airlines.

In order to earn (or re-earn) a bonus for either Chase Sapphire card, you 1) cannot be a current cardholder of either Chase Sapphire card and 2) cannot have received a bonus on a Chase Sapphire card within the last 48 months.

These are currently the only Chase Travel℠ cards with a 48 month stipulation. Other Chase cards have a 24 months rule.

Citi

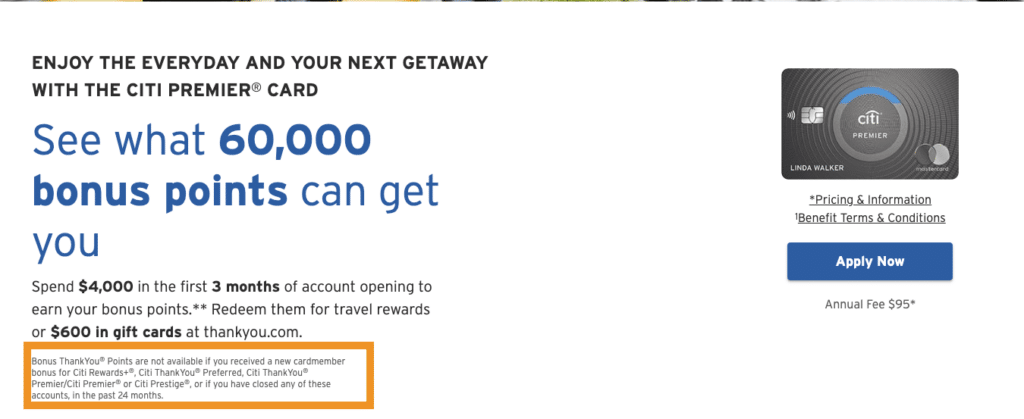

Like Chase, Citi clearly allows new cardmember bonuses to be earned multiple times.

Unlike Chase, current cardholders are not excluded from earning a bonus. Many of the bonus terms, in fact, incentivize cardmembers to keep their Citi cards open since you may not be eligible for the bonus if you have closed an account within the past 24 months. This means your 24 months clock will restart when you close an applicable card.

How to find the offer detail

In order to find the eligibility terms for a card, find the card you’re intersted in on our best offers page and click through to Citi’s page for the card you are interested in.

For many cards, Citi clearly states who is eligible for the new cardmember bonus under the bonus offer.

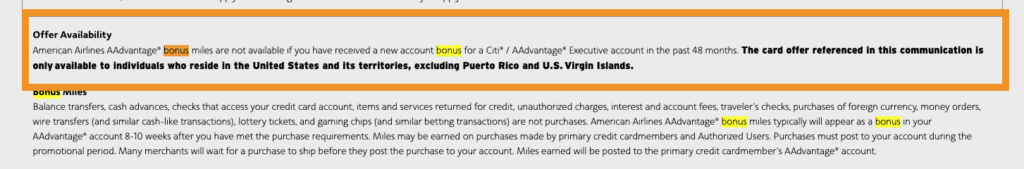

Other Citi cards put the eligibility terms further down. For example, when I click through from the affiliate link to the Citi AAdvantage Executive card, the terms are not there. But a quick search for “bonus” will take me to the offer availability.

Citi Strata Premier® Card eligibility rules

The Citi Strata Premier® Card does allow you to earn a bonus again! However, you’ll need to be careful about what Citi cards you have opened and/or closed in the past 24 months.

The terms and conditions exclude you from earning a new cardmember bonus if you received a bonus on Citi Rewards+®, Citi ThankYou® Preferred, Citi ThankYou® Premier/Citi Premier® or Citi Prestige® cards within the last 24 months or if you have closed any of these accounts in the past 24 months.

Table of Contents

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Hi, if you can’t have closed the citi premier within 24 months of re-applying to earn the bonus again, then the only option would be to downgrade, correct? What would be a good card to downgrade to, in order to be able to re-apply for the citi premier and get the bonus again after 24 months? Thanks!

You can downgrade the Citi Premier to the Citi Rewards+ card. There is some question as whether downgrading a Citi card resets the 24 month clock, so to play it safe you could open the new Citi Premier card 24 months from your last bonus (there is no rule against having more than 1 Citi Premier card), and then close the old one.

https://www.doctorofcredit.com/downgradingproduct-changing-citi-card-affect-24-month-eligibility-hint-no-idea/