All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com site has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Southwest Companion Pass with One Business Card {Detailed Timeline}

With the current elevated offers on the Southwest Business cards, it is possible to earn the a Southwest Companion Pass with just signing up for one card.

You could earn it for just over a year (through December 31, 2025) if you can spend $15,000 by about December 1.

You could also (in theory) earn it for almost 2 years (from January 2025 to December 31, 2026) but we don’t necessarily recommend that strategy to the average person as the timeline is very tight which means it has a higher chance of failure.

Both of these strategies have their pros and cons which we will explain.

What is a Southwest Companion Pass?

Let’s start with the basics: if a person earns 135,000 Southwest Rapid Rewards points in a calendar year, besides all those points you just got, you will also earn a Southwest Companion Pass.

Once you earn the Companion Pass: for the rest of that calendar year and the next calendar year, you can name a person who will then fly with you anytime you fly and only pay about $5 in fees each way. (International Flights will have higher taxes).

You can also change your companion 3 times per year.

Since earning our first companion pass in 2015, we have exclusively traveled on Southwest for domestic flights. For much of that time, my husband and I EACH held a companion pass. That means both of our kids were flying domestically for $5 each!

How do I earn a Southwest Companion Pass?

You’ll need to earn 135,000 Rapid Rewards in a calendar year.

But thankfully, it’s much easier to do this than you might think.

That’s because the points you earn from Southwest credit cards go towards qualifying you for a Companion Pass. That includes the welcome offers on these cards.

In our overview, we outline the traditional way of getting a Southwest Companion Pass with 2 card bonuses.

The biggest aspect to be aware of is that you must earn 135,000 points in a calendar year. That means between January 1 and December 31 of the same year. On January 1, your Companion Pass tracker will reset. You’ll still have any points you’ve earned and can use those to book flights! But your Companion Pass tracker will start over at 0.

What are the current offers?

Both of the Southwest business credit cards are offering higher than usual offers right now. You may look at them and only see the offer for 120,000 points and wonder how that can earn you a Companion Pass — don’t you need 135,000?

You do, but here’s how this works.

Both cards require a total of $15,000 in spending to get the full 120,000 point bonus.

You’ll earn a minimum of 1 point per dollar that you spend on these cards. So while spending $15,000, you’ll earn 15,000 points.

Holding one of these cards will also add a bonus of 10,000 points to your Companion Pass tracker. You don’t get to spend and use these points, they just give you a boost on your tracker each year.

So after completing all the spending, you will have 120,000 + 15,000 + 10,000 = 145,000 points on your tracker and a Companion Pass!

Easy: Earn a Companion Pass through December 31, 2025

If you are easily able to spend $15,000 before December 1, either one of these credit card offers will allow you to earn a Companion Pass if you sign up for one.

Both of the cards offer a tiered bonus, so you’ll earn part of the points after spending $3,000-$5,000 and then you’ll earn the remainder after you spend a total of $15,000.

Pros of this method:

- Only one card application necessary

- Fairly straightforward. The only “catch” is that you’ll need to make sure your points all post in 2024 before your tracker resets in January 2025.

- You can have your Companion Pass sooner than if you try to optimize the timeline for a longer Companion Pass. If you have late fall or Christmas holiday travel, you’ll be able to use your Companion Pass already!

Cons of this method:

- Your Companion Pass will be good for less time than if you earn it with 2 cards and our optimal timeline

- You need to spend $15,000 before December 1 to earn this

Hard: Earn a Companion Pass through December 31, 2026

If you want to try to open only one card and also maximize the amount of time with the Companion Pass, there is another option. But proceed with caution as this relies on attention to detail.

To get a Companion Pass through December 2026 with this offer you will need 135,000 points to be earned all in 2025.

But you’ll also be constrained by the offer end date as well as the 90 days you have to earn your first tier of spending.

At this point, Southwest.com lists this offer as ending on 9/16/2024

Step 1: Apply for a Southwest Business card on September 15, 2024

You’ll want to apply for one of these Southwest cards as late as possible — so that you have as long as possible to meet your first tier spending requirement.

Step 2: Wait to Complete Your Spending

With Chase, any earned points will post to your Southwest account within 1-2 days of your statement closing.

It’s not when you pay your bill, it’s not when you meet your spending — it is when your statement closes.

You cannot complete your first tier of spending until after your December statement closes. But if your December statement closes on December 20th, for example, this would be past the 90 days where you have to complete your spending to get the first part of your bonus.

You will need to call Chase to ask to change your statement close date.

Step 3: Change Your Payment Due Date and Statement Close Date

Statement close date is the date when the bank ends your billing cycle. All cleared credit card charges up to that point will be added to the statement.

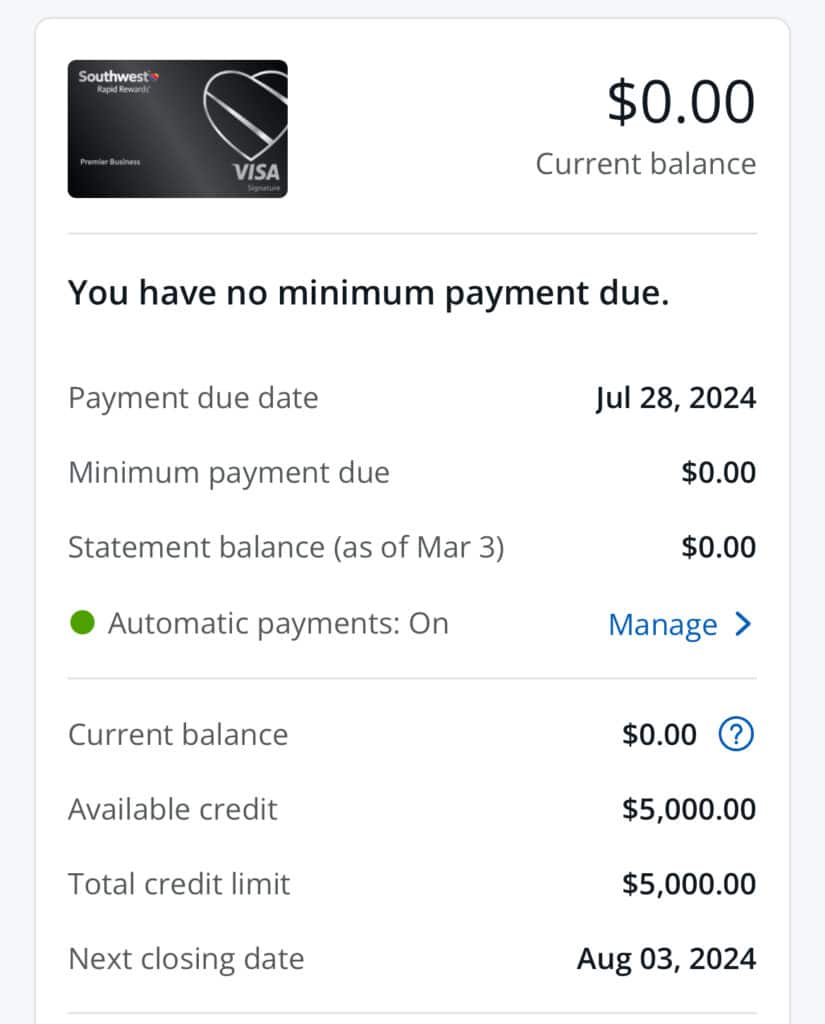

This is easiest to check on the Chase app.

Here it shows my due date is July 28, 2024 and my next closing date is August 3. 2024.

Because your statement close date determines when you will get your points, you need change the date in order to have more control as to when your Southwest points post to your Rapid Rewards account.

You have to do this indirectly by changing your DUE date. Typically, the time period from your statement close to your due date is 27-28 days. Whenever your due date is, your statement will close about 28 days before that. This can vary and I recommend picking your dates with some wiggle room.

I found that choosing a payment due date of the 28th of each month on my business card pushed my statement closing date to the 3rd of each month.

You can request to change this on the app, but when I have done that, it isn’t confirmed right away. I think it is more direct to just call the number on the back of your card and talk to a representative to ask to change your due date. They can also confirm what your statement closing date will be based on that due date.

Step 4: After December statement closes, spend spend spend!

Let’s say you applied on September 15th and your December statement closes on December 3rd. Between December 3rd and December 15th, you need to make sure you are spending all of your first tier of spending. This will be either $3,000 or $5,000 depending on which offer you chose. Keep very careful notes.

Keep in mind that sometimes purchasing items and then returning them will still count towards your minimum spend requirement. Sometimes being within $500 of the spend means Chase awards points early. I’d leave at least $1000 off what is required and spend that between your December statement close date and December 15th (your 90 mark).

Step 5: Continue spending until you reach $15,000 total

Your deadline will be June 15, 2024 but I’d recommend trying to earn much faster if you’re able to!

Pros and Cons

Pros:

- You’ll only need to open one card to earn a Companion Pass for almost 2 years

Cons:

- Requires high attention to detail

- Requires very tight spend timeline in early December

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.