All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from our partners. American Express is a Katiestraveltricks.com advertiser. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

The Easiest Way to Earn 10x More Travel Points This Year

The Easiest Way to Earn 10x More Travel Points This Year

Today, we’re diving into the easiest way to earn ten times the amount of travel points in a single year – a simple mindset shift that most people are missing.

The Common Mistake: Sticking with the Same Credit Cards

Most people I talk to who aren’t deeply involved in the points game typically have one or two credit cards—maybe one from their bank or credit union and another from their favorite airline. They diligently put all their spending on these cards, thinking it’s the most responsible way to accumulate points.

While that feels responsible, sticking with the same cards year after year is a very slow way to earn enough points for full vacations.

The Solution: Multiple Credit Card Welcome Offers

The single biggest difference you can make in your points-earning potential is this: instead of putting all your spending on the same one or two cards, open multiple credit cards per year to earn multiple welcome offers. This is the absolute easiest way to supercharge your points.

What About My Credit Score?

I know what you’re thinking: “Multiple credit cards? What about my credit score?” I get it! I take credit scores very seriously. My family has been using this strategy for over a decade, and our scores are still in the excellent range. We’ve even gotten multiple mortgages and a car loan while actively opening new cards.

Once you understand how FICO scores are calculated, it all makes sense. But for now, trust me, it can be done responsibly.

It’s true that the idea of opening multiple credit cards can make people nervous about their credit scores. However, with responsible management, opening multiple cards for travel rewards doesn’t have to negatively impact your credit. Here’s why:

Understanding the Factors that Affect Credit Scores

FICO scores, the most commonly used credit scoring model, consider several factors:

- Payment History (35%): This is the most important factor. Making on-time payments–every time– is crucial.

- Amounts Owed (30%): This is also known as credit utilization. It’s the percentage of your available credit that you’re using. Keeping your utilization low (below 30%) is key. Below 10% is even better.

- Length of Credit History (15%): The longer your credit accounts have been open, the better.

- New Credit (10%): Opening new accounts can temporarily lower your score, but the effect is usually small and short-lived.

- Credit Mix (10%): Having a mix of different types of credit (credit cards, loans, etc.) can be beneficial.

How Opening Multiple Cards Affects These Factors

- Payment History: As long as you continue to make on-time payments on all your cards, your payment history will remain positive. This is the most important factor, so prioritize it.

- Amounts Owed (Credit Utilization): Opening new credit cards actually increases your overall available credit. If you maintain the same spending habits, your credit utilization will decrease, which can improve your credit score.

- Length of Credit History: Opening new cards does slightly decrease the average age of your accounts. However, this impact is relatively small, especially if you have older accounts that remain open.

- New Credit: Each credit card application results in a “hard inquiry” on your credit report, which can temporarily lower your score by a few points. However, the effect is usually minimal and temporary. Spacing out your applications (every 3-6 months) can minimize this impact.

- Credit Mix: Adding more credit cards to your profile maintains a healthy credit mix.

Key Strategies for Maintaining a Good Credit Score While Opening Multiple Cards

- Pay your bills on time and in full, every month. This is the most crucial factor.

- Keep your credit utilization low (below 30%). This means not maxing out your credit cards.

- Space out your credit card applications. Don’t apply for multiple cards at the same time. I usually recommend one new card every three months.

- Keep older accounts open. Don’t close old credit cards, even if you don’t use them regularly, as they contribute to your length of credit history.

By following these strategies, you can minimize any potential negative impact on your credit score while maximizing your travel rewards.

The Time Investment vs. The Reward

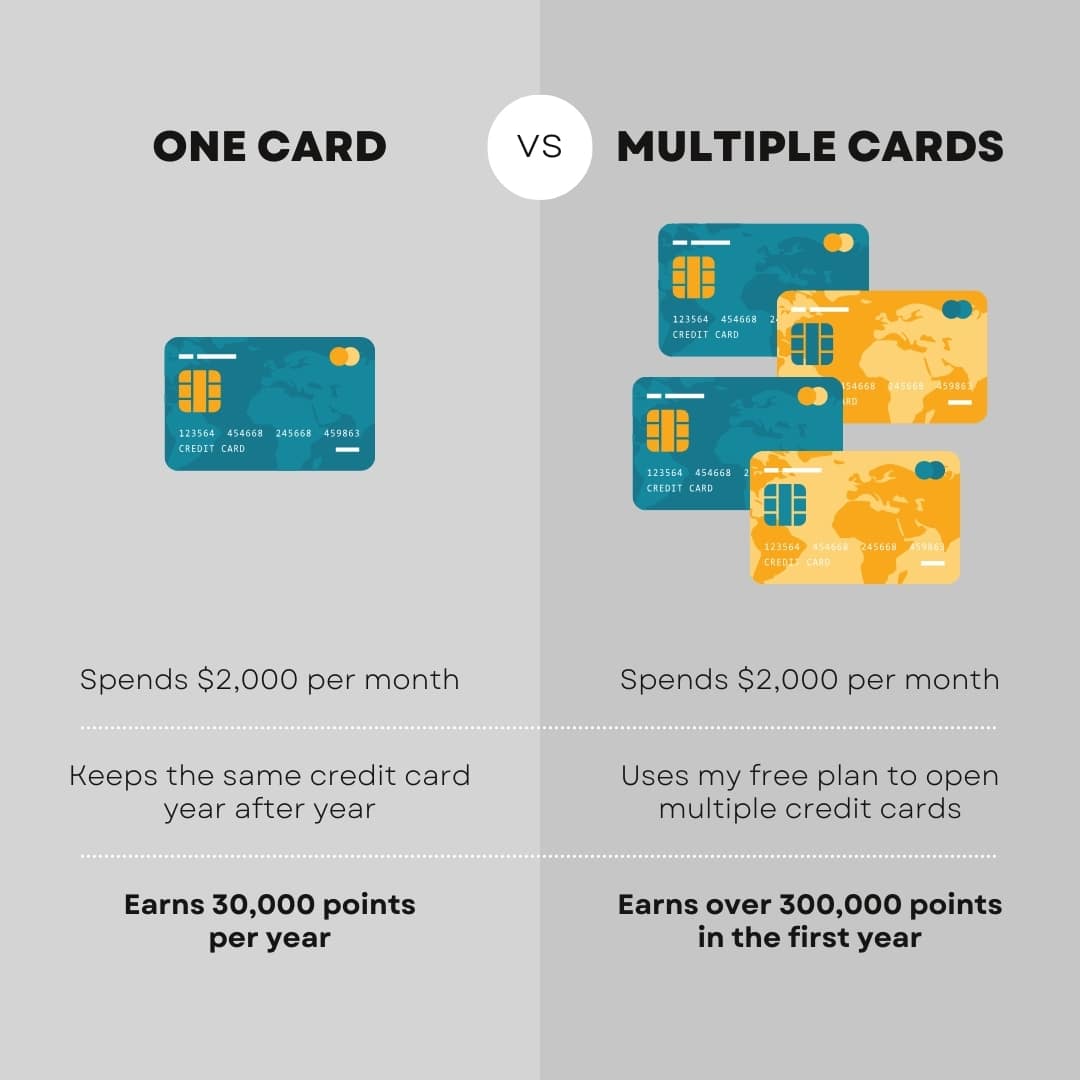

Let’s take a minute to focus on why sticking with the same cards is such a big mistake, and a major reason is the incredible return on your time investment when you leverage welcome bonuses. Let’s look at an example:

- Scenario A (One Card): A family spends $2,000 per month ($24,000 per year) on a Chase Sapphire Preferred card (earning roughly 30,000 points per year).

- Scenario B (Multiple Cards): The same family strategically opens four new credit cards per year, each with a welcome offer (e.g., spending $4,000 in three months to earn a 75,000-point bonus). Following my easy points earning plan, they would earn 310,000 points in the first year.

That’s ten times as many points just by opening additional cards!

Let’s break down the time investment. Opening a credit card, including filling out the application, receiving the card, setting up online access, and autopay, might take about two hours per card (being very generous). Opening four cards would take about eight hours total.

Now, let’s assume those points are redeemed for cashback (the lowest possible value). Scenario A yields $300 cashback, while Scenario B yields $3,100. That’s an extra $2,800 for eight hours of work – an effective earning rate of $350 per hour! And remember, this is the lowest valuation of points. Transferring to airline and hotel partners can yield even greater value.

Should I Focus on Credit Card Earning Categories?

This is a question I get asked a lot, and it’s a valid one. Many credit cards offer bonus rewards in specific spending categories, like dining, travel, groceries, or gas. The idea is that you earn more points or cash back for purchases made in those categories. But let’s take a look at why focusing on credit card spending categories, doesn’t offer the most value.

The Case Against Focusing on Categories (and My Preferred Approach):

- Time and Effort: Tracking bonus categories and switching between cards for different purchases can be time-consuming and require a lot of effort. For many people, the extra few points earned might not be worth the hassle.

- Simplicity and Efficiency: My preferred approach, and what I recommend for most people, is to prioritize earning welcome bonuses by putting all your spending on new cards until you meet the minimum spend. This strategy is much simpler and more efficient.

- The Power of Welcome Bonuses: The sheer number of points you earn from a welcome bonus far outweighs any extra points you might earn from bonus categories on a single card. For example, earning a 75,000-point bonus after spending $4,000 is like earning 18.75 points per dollar spent. This is significantly higher than any bonus category multiplier.

- Avoiding Analysis Paralysis: Focusing too much on categories can lead to analysis paralysis, where you spend so much time trying to optimize your spending that you end up not earning as many points overall.

For most people, especially those just starting out with travel rewards, I recommend focusing on earning welcome bonuses. This is the fastest and easiest way to accumulate a large number of points quickly.

When to Open a New Credit Card

There are two key times to consider opening a new credit card:

Everyday Spending

Our biggest secret to racking up points quickly is strategically using our everyday spending to meet the minimum spend requirements for new credit card welcome offers.

This simple strategy has allowed our family to earn hundreds of thousands of points each year, fueling our travels. Instead of spreading our spending across multiple cards to chase bonus categories, we focus on maximizing the value of those initial welcome bonuses by putting all our regular expenses on the new card until we hit that spending threshold. This means things like:

- Family Groceries: Weekly trips to the grocery store, stocking up on household essentials at Costco or Sam’s Club, and even online grocery orders all count towards the minimum spend. With a family, these expenses add up quickly!

- Gas for the Family Car(s): Filling up the tank is a regular expense, and using the new card at the pump is an easy way to contribute to the spending goal.

- Family Meals Out (and Coffee Runs!): Whether it’s a quick breakfast on the go, a casual family dinner, or the occasional coffee run, these everyday dining expenses can help you reach your target.

- Kids’ Activities and Extracurriculars: From sports fees and music lessons to dance classes and school supplies, these expenses can be significant, especially with multiple children. Putting them on a new card can be a smart way to maximize those points.

- Household Bills (Utilities, Internet, Phone): Many utility companies, internet providers, and phone companies accept credit card payments. Just be sure to check if there are any processing fees, as sometimes the fees outweigh the reward.

- Online Shopping (for Everything!): From clothes and shoes for the family to household items and gifts, online shopping is a major part of our spending. Putting these purchases on the new card helps us reach the minimum spend quickly.

By focusing our everyday spending on a new card until we hit the minimum spend, we’re essentially getting a huge bonus on purchases we were already going to make. This is the most efficient way we’ve found to accumulate points without changing our spending habits. And we don’t get bogged down in complicated bonus category tracking.

It’s all about working smarter, not harder, to make those travel dreams a reality!

Big Expected Expenses

Beyond everyday spending, another smart strategy is to anticipate larger, upcoming expenses. These bigger purchases can be a goldmine for meeting minimum spend requirements and earning those valuable welcome bonuses. Think about things like:

- Charitable Giving: If you typically make charitable donations at certain times of the year, consider opening a new card a month or two beforehand. This way, your donation directly contributes to your minimum spend.

- Taxes (Property, Income, etc.): While there’s often a small fee for paying taxes with a credit card, the points earned from a large welcome bonus can often far outweigh the cost. This can be especially beneficial for self-employed individuals or those with significant tax liabilities.

- Home Renovations or Repairs: Whether it’s a kitchen remodel, a new roof, or even just replacing appliances, home improvement projects can be expensive. Opening a new card before starting the project can help you easily meet a higher minimum spend.

- Large Purchases (Furniture, Appliances, Electronics): If you’re planning to buy new furniture, appliances, or electronics, time it with a new card opening to maximize your points earning.

The key here is planning. By anticipating these larger expenses and strategically timing your card applications, you can turn necessary spending into amazing travel or cash back opportunities. You choose! It’s about what you value!

How to Get Started Earning More Points

The key takeaway is this: opening new credit cards with valuable welcome offers is the fastest way to accumulate travel points.

Here are your action steps:

- Calculate your typical monthly credit card expenses: This will help you understand what minimum spends you can realistically meet without overspending. Include any expenses you may currently be paying with a check or cash that you could start putting on a credit card.

- Jot down any larger expected expenses for the year and when they’re due: Plan to open a new card about a month before these expenses occur.

- Grab my brand new Free Beginners Guide {download}: https://katiestraveltricks.com/travel-points-101-quick-start-guide

- Check out my easy 3-Year plan for points: https://katiestraveltricks.com/easy-three-year-plan-for-points/

By making this simple mindset shift and planning strategically, you can dramatically increase your travel points and unlock incredible travel opportunities!

Table of Contents

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

I want to make an unsolicited endorsement of Katie’s advice. My wife and I have followed her suggestions for many years and, as a result have been able to basically fly free (still have to pay taxes of around $100) all over the world – many in business and even first class. It’s unfortunate that more people don’t understand or fear this simple process!

Thank you so much for your support, Robert!