All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from our partners. American Express is a Katiestraveltricks.com advertiser. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Pay Yourself Back for any travel expense with the Aeroplan® Card

For travelers who want an easy way to redeem points for travel expenses that are traditionally hard to cover with points — like Airbnbs, Disney tickets, rental cars and more — one of the very best options is one that flies under most people’s radar — the Aeroplan® Credit Card.

Even better: you can pair a Chase Sapphire Preferred® Card, Chase Sapphire Reserve®, or Ink Business Preferred® Credit Card with an Aeroplan® Credit Card to stretch your points further.

During some promotions, you can stack card benefits to use 50,000 Ultimate Rewards points to cover a travel expense of up to $812. Here are all the details.

Update January 2026

Pay Yourself Back for travel has been extended through December 31, 2026. There is a cap of 200,000 miles redeemed which could cover a maximum of $2,500 in travel.

What is Aeroplan?

Aeroplan is the loyalty program of Air Canada. You can use Aeroplan points to book flights with Air Canada or with any of their airline partners (subject to availability). It is a program that we have featured in many of our guides to booking flights to specific destinations. One of the perks of the program is the ability to add a stopover for 5,000 points.

While there are some intermediate to advanced ways to use Aeroplan points to get a lot of hypothetical value from your points, there are also ways to use Aeroplan points to cover any travel expense — if you have the right credit card. You must have the Aeroplan® Credit Card is issued by Chase to be able to use Aeroplan points this way.

Aeroplan Credit Card Overview

The Aeroplan® Credit Card is issued by Chase. It earns Aeroplan points and has some benefits specific to travel with Air Canada. This includes benefits like cardmembers and up to travel companions (up to eight) on the same reservation can all get one free checked bag (up to 50 lbs) on Air Canada flights. You can also get preferred pricing for flight award redemptions.

But even for someone that never intends to fly on Air Canada it can provide a lot of value!

One of those benefits is the statement credit of up to $120 (every 4 years) for Trusted Traveler programs including TSA Precheck, Global Entry, or NEXUS.

But the biggest benefit for the average traveler is this ability to use the points to pay yourself back for any travel expense.

Pay Yourself Back – through December 31, 2026

Points earned with an Aeroplan® Credit Card have a unique redemption option. This is currently available through December 31, 2025. But it’s worth noting that this benefit has previously been extended twice already.

You can use your points to “Pay Yourself Back” for any expenses you have put on your Aeroplan card that code as travel expenses.

Max Redemption: On January 1, 2025, this card added a restriction that you can redeem a maximum of 200,000 Aeroplan points this way per calendar year for travel expenses. The same cap has been added for 2026.

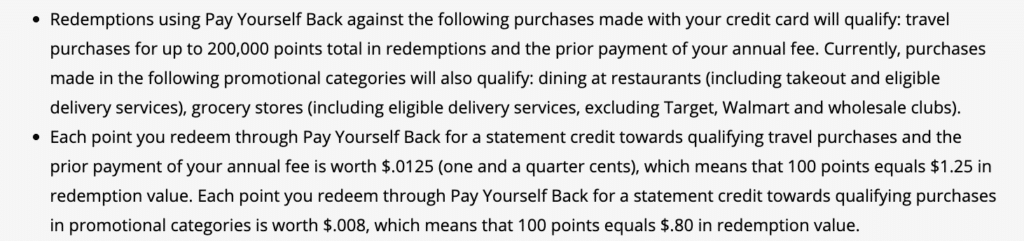

Note that other categories are available for Pay Yourself Back but at a lower rate.

Your points are worth 1.25 cents per point for travel expenses. So if you have 10,000 points, you can can offset $125 of travel.

This is a benefit I’d love to see on the Chase Sapphire Preferred! With a Sapphire Preferred you can only use your points for general travel expenses when booking through Chase Travel℠. But Chase Travel℠ is sometimes more expensive than booking a rental car, flight, or hotel directly. And doesn’t give you the option to book an Airbnb and cover it with points.

But if you make a travel purchase with your Aeroplan card, you can offset it with your points within 90 days of the purchase. You can offset a full purchase or just part of it. Here’s the fine print on the Pay Yourself Back options.

And since the Aeroplan Credit Card has robust travel protections including trip delay, trip cancellation, baggage delay, and more — you can feel confident booking trips with it.

Aeroplan Pay Yourself Back Example

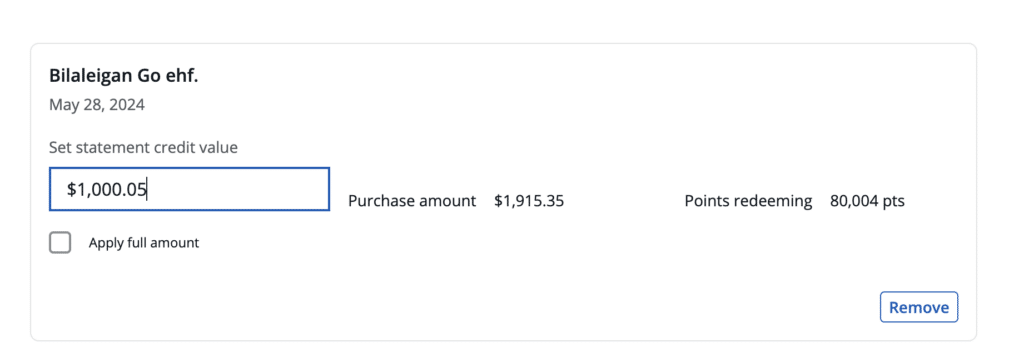

I decided to use my Aeroplan points to pay myself back for part of our campervan rental in Iceland. Here’s how the process works.

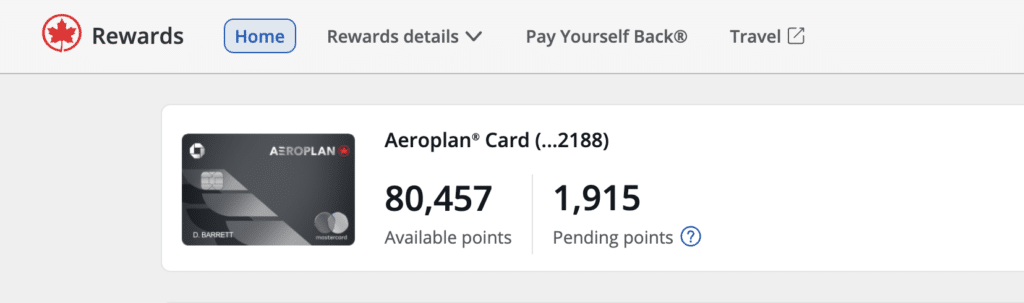

I logged into Chase.com and navigated to the rewards details on my Aeroplan Credit Card.

I had 80,457 points available to use.

After selecting “Pay Yourself Back” at the top menu, I could see the travel purchases I had made. I entered that I wanted to receive $1000.05 in statement credit value and used 80,004 to do so.

I got a confirmation screen that confirmed that my points had been deducted and I would see a statement credit in the next few days.

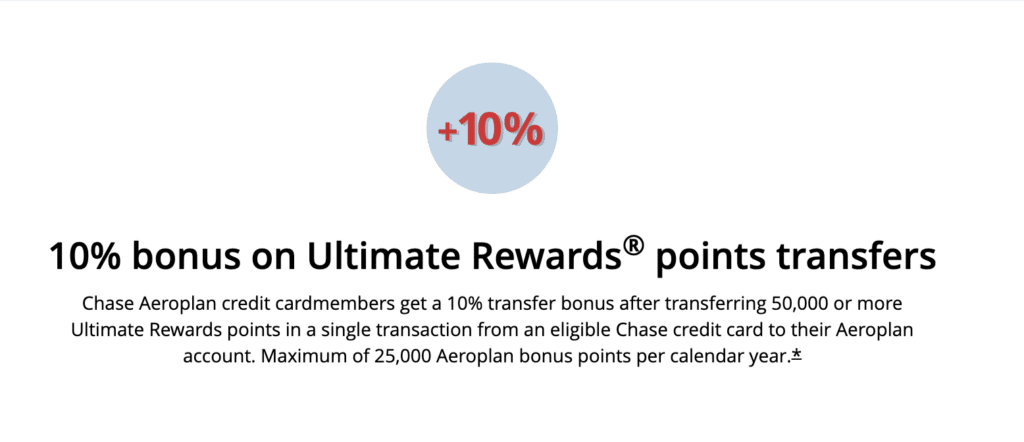

10% Bonus for Transferring Ultimate Rewards to Aeroplan

Using Pay Yourself Back with points you earned directly on an Aeroplan card is fairly straightforward — but with a few steps you can actually use Ultimate Rewards points in the same way.

You’ll need an Aeroplan Credit Card as well as one of the Chase cards that has the ability to transfer points to airline partners: Chase Sapphire Preferred® Card, Chase Sapphire Reserve®, or Ink Business Preferred® Credit Card. If you’re following my Three Year Plan, you should have at least one of these.

The value actually increases when you transfer Ultimate Rewards points over!

If you hold an Aeroplan Credit Card, you’ll get a 10% bonus on Ultimate Rewards points transfers to Air Canada Aeroplan when you transfer 50,000 points or more in a single transaction. This is one of the listed card benefits. There is a maximum of 25,000 Aeroplan bonus points in a calendar year.

You’ll need to be transferring from a card in your name — so I would need to transfer from my Sapphire card to my Aeroplan account and also be the one holding the Aeroplan card. Make sure you take this into account. If you only have one Sapphire account in your household, the same person would need to be the one with the Aeroplan card.

This means if I transfer 50,000 Ultimate Rewards, I will actually end up with 55,000 Aeroplan points. You don’t need to transfer in increments of 50,000 points to get the 10% bonus. Any number over 50,000 points will give you a 10% bonus (up to 25,000 bonus per year).

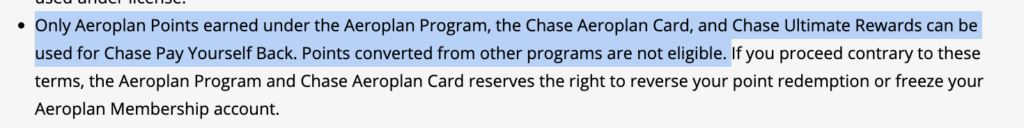

Restriction: Only points transferred from Ultimate Rewards to Pay Yourself Back

Once you have your Ultimate Rewards transferred over to Aeroplan, you can use these to Pay Yourself Back for any travel expenses that you’ve paid in the past 90 days with your Aeroplan Card.

In fact, the terms on the Aeroplan Pay Yourself Back page specify that this option is available for points transferred in from Ultimate Rewards.

If I had transferred 50,000 Ultimate Rewards, they would now be 55,000 Aeroplan points. I could use them to pay myself back for $687 of travel.

Even though other points currencies transfer to Aeroplan like American Express Membership Rewards, Capital One Miles, and Bilt Rewards — you cannot use points transferred from these programs to Pay Yourself Back.

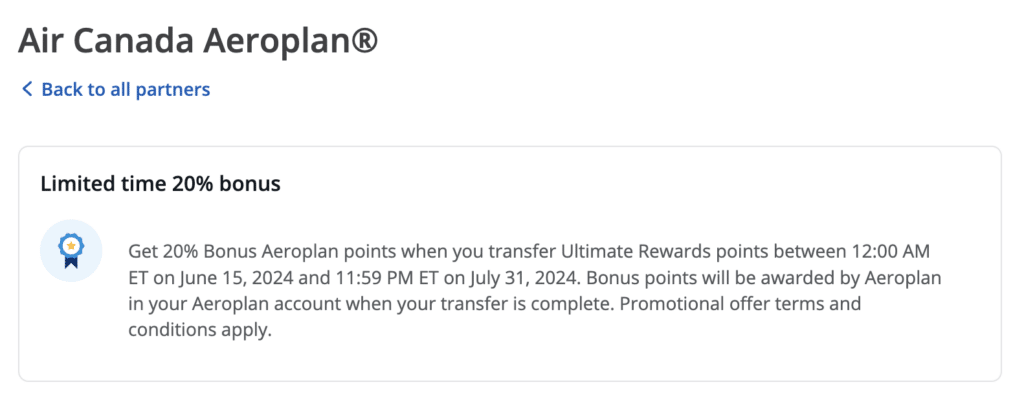

20% More: Stack with Transfer Bonuses

Occasionally, Chase also runs transfer bonuses that would give you even more points. We saw these pop up three times in 2024. Each gave a 20% bonus when you transferred Ultimate Rewards points to Aeroplan. Here’s an example of how it looks when you’re looking at your Ultimate Rewards points.

While this was a limited time offer, we do see these promotional transfer bonuses regularly from Chase points to Aeroplan. In 2024, we saw it come up three times.

Don’t want to miss a transfer bonus? Sign up here for alerts.

This means that if you transferred 50,000 Ultimate Rewards points to Aeroplan, you’ll actually end up with 60,000 Aeroplan points.

Max Value: Adding it all together to stretch your points

If you’re able to use both the Aeroplan card bonus (of 10% if you transfer 50,000 points) and a limited time transfer bonus (of 20%), you’ll actually be able to get 1.65 cents per point.

What I love about this option is that it gives you total freedom in using your points for travel expenses — and at a higher rate than anywhere I’ve seen.

If you transfer 50,000 Ultimate Rewards points to Aeroplan during a transfer bonus (while you hold an Aeroplan Card), you’ll have a total of 65,000 points. You got 5,000 bonus points (10% for your benefit on the Aeroplan card) and 10,000 bonus points (20%) for the limited time transfer bonus.

Then Pay Yourself Back gives you 1.25 cents per point — so you’ll get to redeem that 65,000 for $812.

Keep in mind you have to put $812 of expenses that code as travel onto your Aeroplan Card. And you have 90 days from purchase to later Pay Yourself Back.

Best ways to use Pay Yourself Back

Since you can use Pay Yourself Back on the Aeroplan card for any travel expense, the options are unlimited. But here are a few use cases that I think are especially worthwhile.

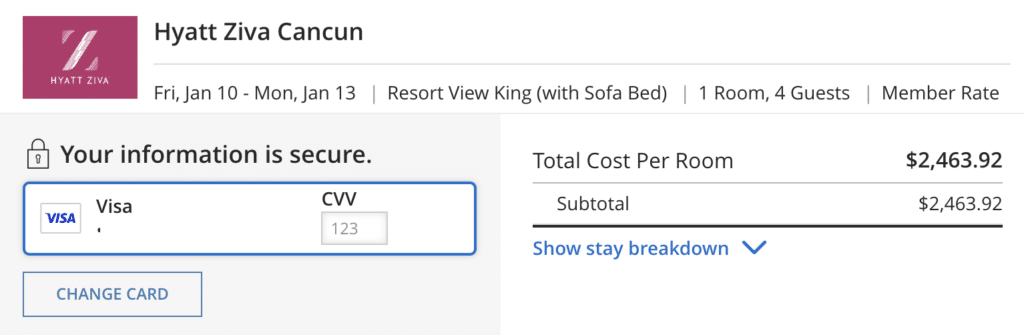

Book Hyatt all-inclusive hotels (or any hotel)

Our family is a big fan of the Hyatt Ziva Cancun. We’ve been 5 times. But it has gotten increasingly harder to book with points. We like to go in January and current rates would cost 58,000 points per night for 2 adults and then we’d have to pay an additional $250 per night to add our kids to our room. That’s 174,000 points + $750 for a 3 night vacation and admittedly out of what we’re willing to pay.

But if I booked a room for 2 adults and 2 kids on the Hyatt website directly, I could pay with my Aeroplan card. A three night stay in January costs $2463 for 2 adults and 2 kids.

I earn 2463 Aeroplan points on this purchase (1 point per dollar).

I’d also earn 12,315 Hyatt points — because when you pay for a Hyatt reservation with cash, you earn 5 points per dollar.

I’d also earn 3 elite night credits with Hyatt (if you’re tracking to earn status). When you book through Chase Travel℠ you don’t earn elite night credits or Hyatt points.

If I then transfer 174,000 Ultimate Rewards to Aeroplan, I’d end up with 191,400 Aeroplan points (with the 10% bonus).

This will be worth $2392 with Pay Yourself Back.

I would use the same points but didn’t have to pay $750 out of pocket for the kids and I would earn over 12,000 Hyatt points.

This same idea can work for other Hyatt hotels, or any hotels! If I’m transferring points during a 20% transfer bonus, I’d have to transfer even fewer points.

Cover Disney tickets (or Disney resorts)

I get so many questions from families trying to cut down on Disney expenses. We used the Aeroplan Pay Yourself Back feature to cover our Disneyland tickets in 2025.

Important! When you book Disney tickets, they won’t code as travel unless you buy them through a travel agent like Undercover Tourist.

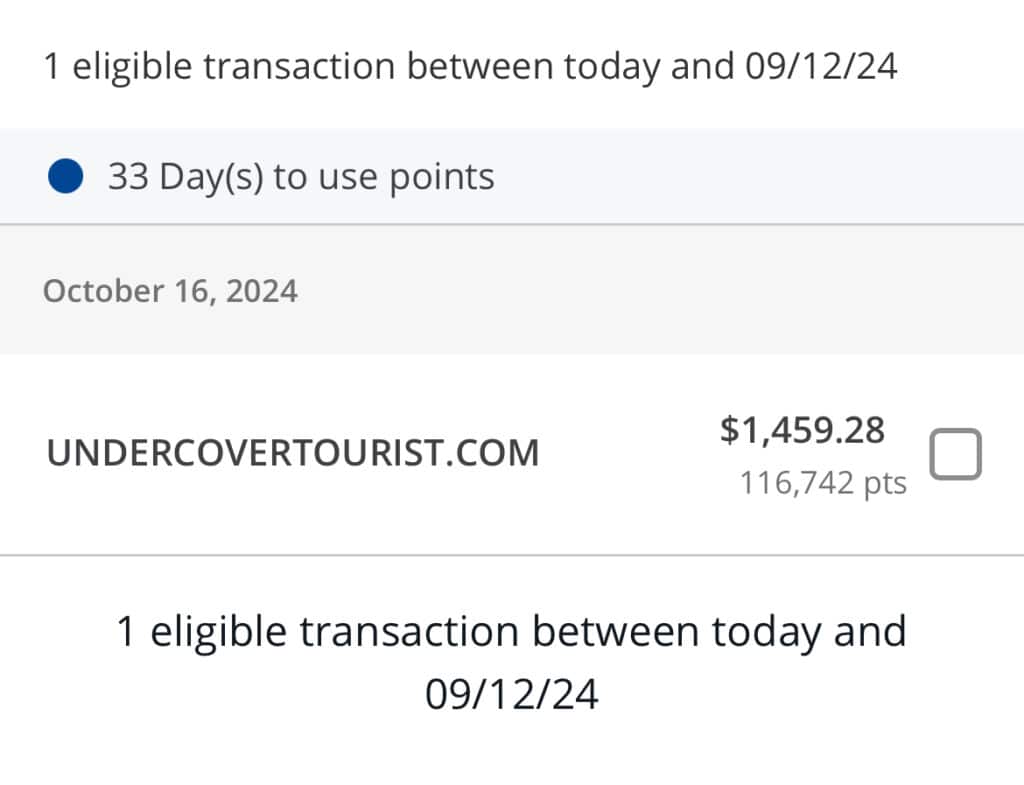

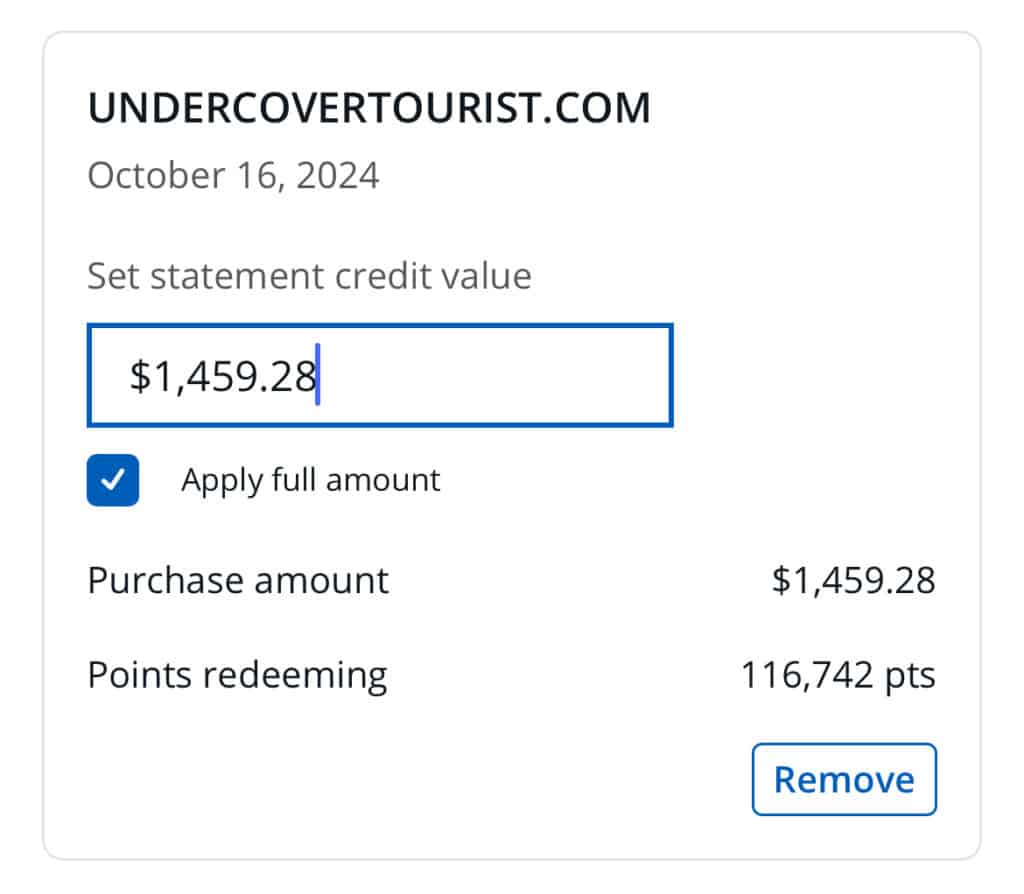

When I logged into my Aeroplan Credit Card account on December 11, 2024, I could see that I had 33 more days to use points to pay myself back for the Disney tickets.

I used 116,742 points to fully cover the $1459 expense. I had transferred these points from Ultimate Rewards so really I only had to transfer 90,000 points to cover this expense since I transferred during a bonus. My 90,000 points earned a 10% relationship bonus plus a 20% transfer bonus!

Without using this Pay Yourself Back trick, to cover Disney tickets, you could only cash out your Ultimate Rewards at 1 cent per point. So 50,000 points would get you $500 cash back.

With this trick, those 50,000 points are worth over $678! Or — if you transfer during a bonus period, $812!

Pay for an Airbnb

You can book an Airbnb and pay for it with your Aeroplan card — and then use points to offset the costs.

Rental cars and Campervans

Finding the best price on rental cars can often meaning booking on CostcoTravel or other websites.

When we rented a campervan in Iceland, we had to book directly through the company.

Both are times when you could book with an Aeroplan card and later Pay Yourself Back.

Cruises

Cruises are notoriously hard to cover with points! This is one of the best options out there and gives you the flexibility to book the cheapest rate you can find for that cruise. Even a Disney cruise!

Important Tips

If you want to utilize this redemption option keep in mind these logistical tips.

1) If you already have a Sapphire Preferred card, you’ll need an Aeroplan card to get this Pay Yourself Back option. The Aeroplan card will add to your 5/24 status.

2) Promotional transfer bonuses are limited time offers but we seem to see them at least once a year. In 2024, we saw them three times.

3) You have 90 days from the time you make your travel purchase to use the Pay Yourself Back feature.

Table of Contents

- What is Aeroplan?

- Aeroplan Credit Card Overview

- Pay Yourself Back – through December 31, 2026

- Aeroplan Pay Yourself Back Example

- 10% Bonus for Transferring Ultimate Rewards to Aeroplan

- 20% More: Stack with Transfer Bonuses

- Max Value: Adding it all together to stretch your points

- Best ways to use Pay Yourself Back

- Important Tips

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Katie, can you transfer Amex Membership Rewards to your Aeroplan account, and with your Chase Aeroplan card do the same Pay Yourself Back?

You can’t, that’s considered outside the terms and conditions and could be flagged/lead to a shutdown

Hi Katie! I opened the Aeroplan card (with your link- thank you!!) and am planning to move points from my current Sapphire Preferred to take advantage of the transfer bonus- but can I use those points to erase travel purchases I make that are also part of my spend towards the sign up bonus? Or will using points to pay myself back offset the spending and not count towards my minimum spend requirement?

It shouldn’t offset the minimum spend! They should be calculated differently. So you can make your travel purchase knowing that you’ll be able to pay yourself back AND earn a welcome bonus!

I was going to ask that same thing! Also, do you know if campground rentals would fall into travel expenses? Is there a list somewhere of purchases eligible for the travel expense category?

Typically campground HAS counted as travel for us in the past. Some data points here: https://www.reddit.com/r/CreditCards/comments/tzcz93/cash_back_at_campsites/

i can’t seem to figure out if the pay yourself back feature is expiring after dec 31. do you know if chase is adding any limits to the feature?

I have asked and they aren’t giving any info. It says in my login that it is extended through Dec 31, 2025 but the fine print indicates they are leaving a space for them to cap the redemptions this way.

They added a 200k cap

i can’t seem to figure out if the pay yourself back feature is changing in January. do you know if chase is adding any limits to the feature?

I have asked and they aren’t giving any info. It says in my login that it is extended through Dec 31, 2025 but the fine print indicates they are leaving a space for them to cap the redemptions this way.

They have capped it at 200k per year

Hi Katie! I am about to apply for this card to use the pay-yourself-back feature, but is this a good transfer rate for chase points? In other words, should I reserve the points to use for a better payoff? Thanks!

For covering any general travel expense, this is a higher rate for chase points than any other option! It’s definitely worth it if it matches up with how you want to use your points.

Hi Katie,

Thank you for sharing all your wonderful tips! I just started following you on Instagram because a good friend shared your Aeroplan story with me. Does the 25K transfer bonus point cap include the bonus points earned via the occasional limited time elevated 20% transfer bonuses too? For example, transferring 95K UR during these periods could earn you an extra 25K Aeroplan transfer bonus points. Would you then be ineligible to earn more transfer bonus points for the rest of the calendar year? Thank you!

Elevated transfer bonuses are separate! It’s just the “relationship” bonus that has a cap. The 10% one. And then there is the cap on using 200k per year for Pay Yourself Back.

Hello! I love all the info here. I recently earned the bonus with this card using your link and booked an airbnb. I erased the purchase with the points but now we gotta cancel that airbnb rental to get something else. Do you know what happens once airbnb reimburses the money? Will Aeroplane take back that action or will nothing happen? and of they do will I loose the points I had already used? I appreciate all your help

I’m pretty sure what will happen is that you just essentially cashed out your points. So Airbnb will just give you a refund and you already erased the cost.

Thank you! That’s really helpful!

Hello. I’ve recently acquired the Aeroplan card and have made a travel purchase 30 days ago that I would like to use the Pay Back feature. My question is if I pay my monthly balance, which includes the travel

purchase, can I still use the Pay Back feature since it’s still within the 90 days of purchase? And if so, do I just get credited the money back on my Aeroplan card?

Yes, you will see it as a statement credit even if you dip into negatives on your account statement.

Hi Katie,

I love the information that you’ve provided on this card. I’m 3/24 and really on the fence. Would love to use the pay yourself back, but with our 2025 travel already booked, we wouldn’t use it until 2026. Do you know when they announced the information that extended this benefit to 12/25? Wondering when we can expect to know if the benefit will be extended in 2026.

Wondering the same thing! Really wanting to use the pay yourself back on a European Airbnb next summer!

I think they made the announcement really late last year if I can remember. But as long as you book something before Dec 31 2025 you can still use Pay Yourself Back to cover it — even if the travel would take place in summer 2026 or beyond.

I think I remember it was very late that they made the announcement. One option would be if you can book some 2026 travel in late November 2025 — you’d still have time to use Pay Yourself Back.

Hi Katie,

still a newbie……so in your camper van example, I assume you originally used the Aeroplan credit card to pay for the van rental, right ?

Then afterwards used your accumulated points to “pay yourself back”. so in essence you made points on the purchase which you then used to pay for the camper van?

Yes exactly!

Hi Katie! Great article! I love how well you explained it. I have the CSP and my husband has CSR, we are currently living overseas for a few years, is the Aeroplan card something that we should still get even tho air Canada isn’t an option for us to use right now? We are in the Middle East and Japan is next so I’m not sure if their alliances are an option for us either but I haven’t looked into it.

There would be Star Alliance options for you but also it’s a great option (I think) for Pay Yourself Back for any travel. So I think it could give you added flexibility for either flights or Pay yourself back options!

Thanks so much for all of this info! It’s so helpful.

Question- I just got the card and was excited to take advantage of the current 20% transfer bonus from Chase (plus the standard 10% bonus for transferring should equal 30%). I transferred 90k from my CSP and now have 108k- so only a 20% bonus instead of 30%. Is this an error? Or is the other 10% possibly not immediate? Am I misunderstanding something.?Appreciate any help!

If I remember correctly, sometimes the 10% bonus takes a few days to post. Hopefully you will see it soon!

Hi Katie, is my math correct? I applied for the Aeroplan last year after you posted an elevated offer link and I don’t want to keep it for a second year so I want to use up all my points via PYB before then.

I have 81,700 points from SUB and card spend. 200,000 max PYB – 81,700 current = 118,300 needed.

There’s a 20% transfer bonus and I’ll transfer 50k+ to get the additional 10% bonus. 118,300 / 1.3 = 91,000 UR to transfer.

I have $3,300 of travel in this last statement so with 200k PYB, I only need to pay off $800 from my checking account.

Thanks! Love all your content and miss your podcasts!

looks right to me!! way to leverage all of it!!

Just stumbled across this article! It’s an answer to a travel puzzle I’m trying to g sole IM SO GRATEFUL FOR THE INFO!

One question: is there a way to check what qualifies as ‘eligible travel’? We are booking a legitimate licensed rental, outside of Airbnb/vrbo platforms. And we are close to 5/24 so don’t want to do this if it won’t work for this specific purpose for our travel goals.

Is there a way to check prior to going this route?

You could try using this tool to see if you can find the specific merchant. Otherwise, the only way to know with absolute certainty would be to test a smaller charge amount but that might be hard in this case.

https://awardwallet.com/merchants

Is the pay yourself back feature good for 2026?

still is not showing any information for beyond December 2025

Thanks for the info – you’re always teaching me something new in this points & miles game! The Hyatt Ziva trick is brilliant! I’d all but written HZ off because it was getting too expensive. I’ve had the Aeroplan card for over a year now and was wondering if it was worth keeping it another year… this might be why it is for us! Thanks Katie!

Hope you find a time to go! We love that hotel so much!

Katie, thank you! I’ve been binging your podcast and this is just the card I need! I’m not a newbie, and we have been opening cards for a few years, but this one was NOT on my radar. We haven’t been able to be approved for a C1 card, worried I’m in too deep now lol and this will be so handy for us! We’ve amassed a lot of UR, but love booking airbnbs. I’m so glad you covered this!

yay, so glad it helped!

I used the Pay Yourself Back feature for a flight that was eventually canceled and refunded after the card had been paid off, so I now have a negative balance on my card. I don’t see info about this in the card terms. If I ask for a check for the balance on the card, will this be seen as violating the terms? Or should I spend on the card up to the amount I received back as a refund?

I think after a certain number of days they will send you a check but you can also request one. If you were doing this a lot, I can see them looking into it but for a one time thing that wasn’t even in your control, should not be an issue.