Know exactly which cards to open and when!

Your easy 3-year plan to earn

up to 1.3M travel points (or more!).

Ready to save thousands on travel with credit card points— but terrified of doing it wrong?

- What card should you open first?

- When should you open your next one… and your next one?

- How many cards is too many to have?

- Won’t all this tank your credit score?

I talk to people all the time who want to better use their travel points, but they’re too overwhelmed—or too nervous about hurting their credit score—to start. They tell me, “Katie, I just need someone to hold my hand and tell me exactly what to do and when to do it.”

That’s why I created this Three-Year Plan.

In it, you’ll see the exact card order and timing I would use if I were starting over today. Check off steps as you go, watch your points add up, and finish with up to 1.3 million points (or more!) to spend—on just about any kind of travel you can dream up.

We love throwing in tons of detail—for free.

Here’s how we can provide it at no cost to you.

Everything I share—on the site, the podcast, and social media—is completely free for you. I know that can make people wonder if there’s a hidden catch or some kind of sales push. Here’s how it actually works: when you use my links to apply for a credit card, I may earn a commission. But I only share offers I truly think are the best available, even if I don’t earn anything from them (how else could you trust me?). Over time, it all balances out. So as long as you keep using those links when it makes sense for you, I can keep creating reliable content you can trust!

This is really important!

Don’t start applying for cards just yet.

Step #1

Read Travel Points 101.

It only takes about 20 minutes to read—and it will save you from headaches like hurting your credit score, paying unnecessary fees, or getting that dreaded “Sorry, your application was denied” email.

Step #2

Now you can start applying!

Next, dive into the plan that makes the most sense for you—one-person if you’re earning points solo or two-person if you have a partner in your household who’s joining in.

Step #3

Get help anytime you need it.

As you start working through your plan, hop into our free Facebook group. You’ll be part of a community of people following the same steps—so you can ask questions, get advice, and share wins as you go.

At this point, I’m going to assume you

have completed Travel Points 101—congrats!

Now it’s time to pick your plan.

Six months after finding this, we have almost half a million Chase Ultimate Rewards and have booked our first hotel redemption in Hawaii.

Katie takes the time to thoroughly explain things for those who are entirely new to this hobby. I would highly recommend it to anyone interested in getting into points and miles – and I have!

-Podcast reviewer

One-person earners,

you’re in the right place!

One-Person Plan

I’m about to walk you through a lot of information—but don’t worry.

We’ll go step by step so you can check off each one without feeling overwhelmed.

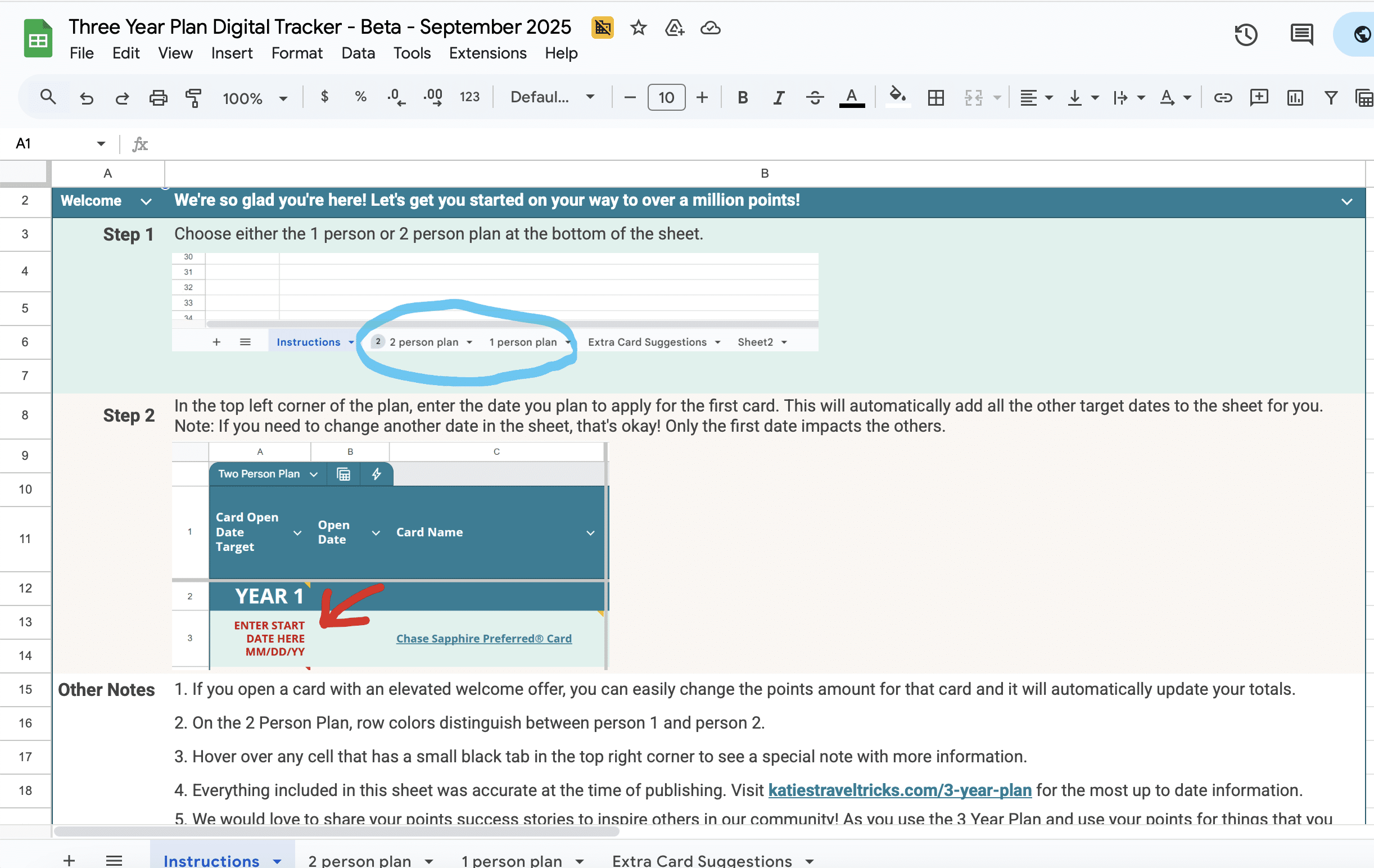

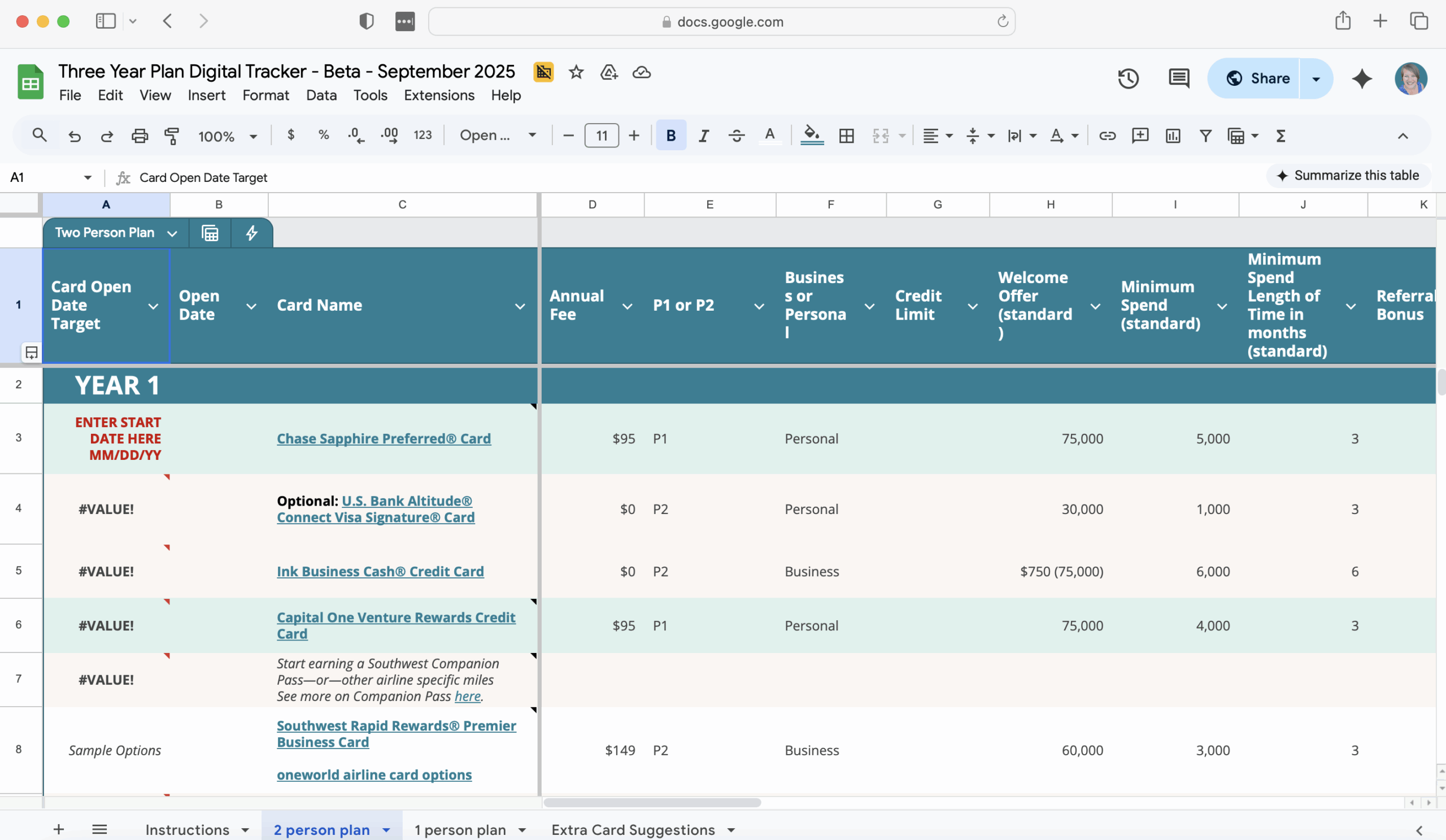

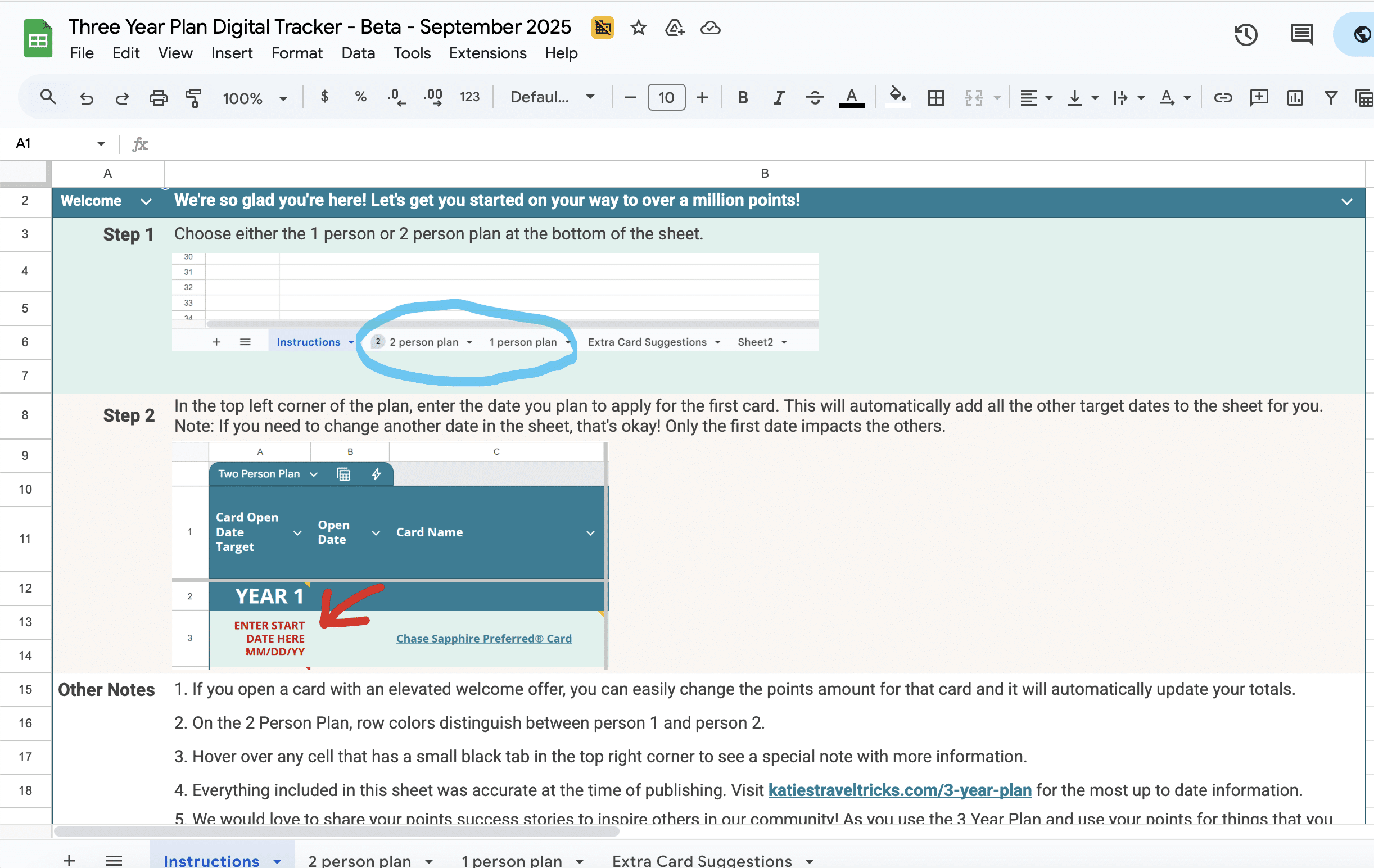

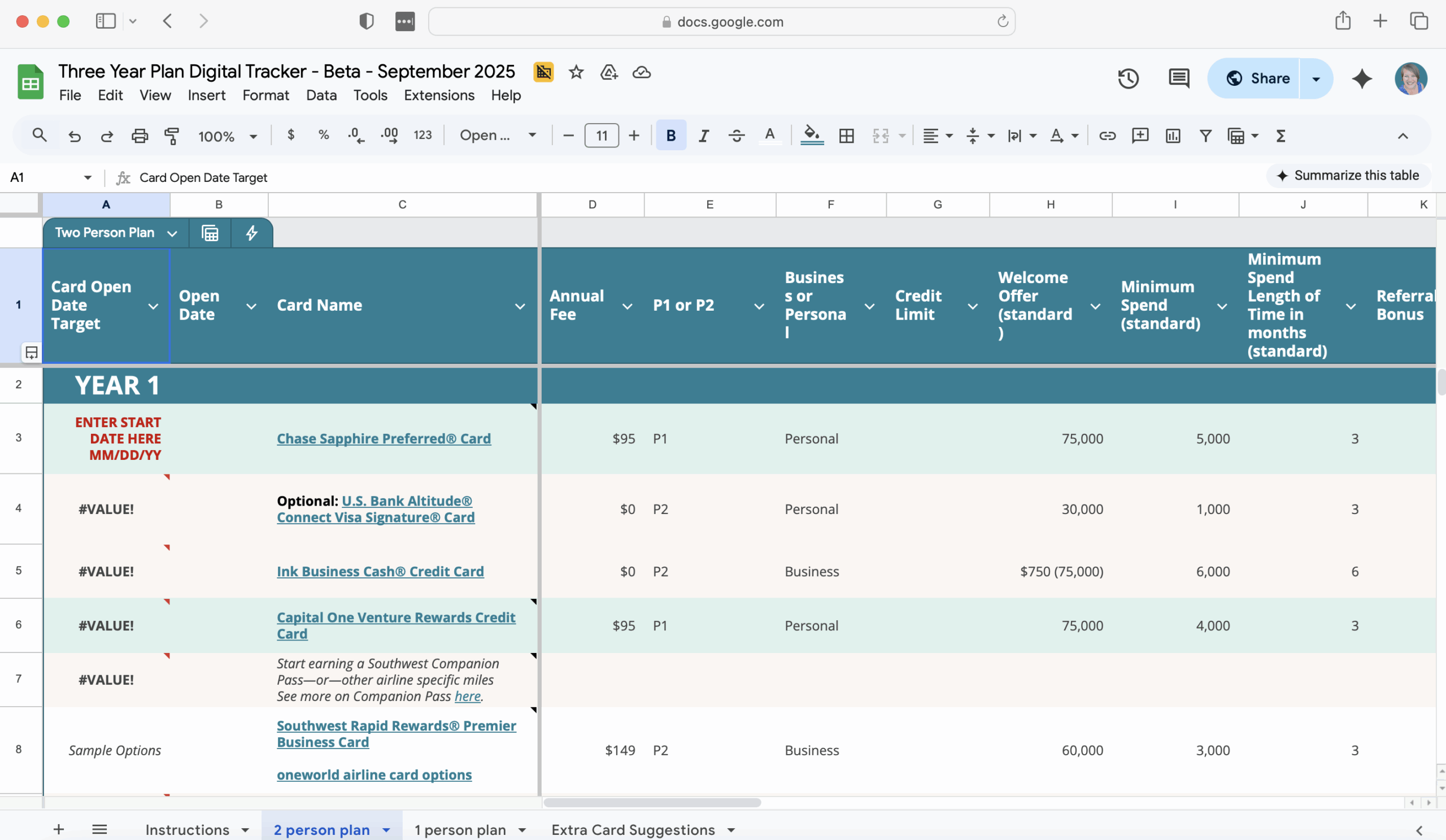

Drop your email below, and I’ll send you a digital tracker to chart your progress.

In three years, you’ll earn 1.1M+ points worth an estimated $16,000+ to use towards flights, hotels, and other travel perks.

Year One

313,000 points

Year Two

406,500 points

Year Three

407,000 points

These annual charts give you the mile-high overview.

We’ll dig into the details in the sections below—but anytime you’re ready, you can grab your free digital tracker to follow along.

Now, let’s fill in the what, the

why, and the how behind each step.

Year One

When you’re starting out, the hardest part is knowing where to begin. There are so many cards and rules, and it feels like if you pick the wrong one, you’ll mess everything up. That’s why Year 1 of this plan is all about keeping things simple, building confidence, and stacking a big pile of points right away.

By the end of Year 1, you’ll have about 313,000 points and miles spread across three programs:

- Chase Ultimate Rewards® (these are the most flexible and easiest to use)

- Capital One Venture miles (great for perks and easy redemptions)

- American Airlines miles (helpful for flights, often enough for a free round trip)

That’s enough to cover multiple plane tickets, hotel nights, or even an entire vacation for two. And you’ll do it without hurting your credit score or juggling more than you can handle. Use the expandable sections below to understand what to open and when, step by step.

Note: With little consequence, you can start this plan at any point in the year. To keep things simple, I’m assuming you’ll start January 1.

We begin with the Chase Sapphire Preferred®. This card is the best “starter” in the points world because it keeps everything in one easy-to-use program called Ultimate Rewards®. You’ll earn a big welcome bonus (worth at least $750, and usually much more when transferred to travel partners).

Why Chase first? Chase has some of the most valuable points, but they also have one of the strictest approval rules: if you’ve opened too many cards in the past two years, they won’t approve you. That’s why we grab this card early—before anything else gets in the way.

You’ll use this card for your everyday spending and start earning a flexible pile of Chase points. Later in the plan, we’ll add more Chase cards that can combine with these same points, making them even more powerful.

Learn How to Apply for Chase Sapphire Preferred® here (affiliate link)>>

Resources

- Article: Guide to Chase Sapphire Preferred

- Article: Why I recommend starting with this card

- Podcast: Season 1 (deep dive into this card—best to listen sequentially from Ep 1)

- Article: 20+ Ways to Use Ultimate Rewards

Application Notes

- Chase’s “5/24” rule applies—if you’ve opened five or more personal cards in the last 24 months, you won’t be approved. This is why it’s important to start here.

- As of June 23, 2025, Chase changed how points are valued through Chase Travel (usually worth less, sometimes more). Points are still easy to redeem and transfer to partners like Hyatt.

- Extra perk: through December 31, 2027, you’ll also get $10/month in DoorDash credits (non-restaurant purchases).

Alternate Card Option

- Chase Sapphire Reserve®: Includes more perks like airport lounge access. Most people will get some lounge access anyway with Card #2 (Venture X), but if your home airport has a Sapphire Lounge, this might be worth it. You can also start with Preferred and upgrade later.

Next, we’ll branch out a little and add the Capital One Venture X. Why now? Capital One can be picky about approvals if you’ve opened a lot of cards recently, so we want to lock this in early.

This card comes with premium travel perks that make your life easier right away:

- Global Entry or TSA PreCheck credit (skip the long lines at the airport)

- Airport lounge access (a comfortable spot to relax before your flight)

- Cell phone protection if you pay your bill with the card

It also earns flexible miles you can use toward almost any kind of travel. Think of it as a card that levels up your travel experience while adding a big chunk of miles to your balance.

Note: Starting in February 2026, the Venture X will no longer include complimentary guest access at its lounges. If you’re a solo traveler, this may not affect you–unless you usually travel with friends.

Learn How to Apply for Capital One Venture X here >>

Resources

-

- Article: Guide to Capital One Venture X Rewards Credit Card

- Podcast: Season 2 (full episode on Venture X benefits and redemptions)

Application Notes

- Capital One is finicky about approvals. Generally, the more recent accounts/inquiries you have, the harder it is to get approved.

- Some people report better approval odds by checking the box that says “I plan to carry a balance” (you should never actually carry a balance — it’s non-binding, but signals profitability to Capital One).

- Strong long-term value: $300 annual travel credit + 10,000 bonus miles each year on your anniversary.

Alternate Card Option

- Capital One Venture: Lower annual fee, still earns Venture miles. A good alternative if you already have lounge access through another card or don’t care about lounge access.

The Chase Ink Business Cash® is one of the easiest ways to boost your points total. Here’s why it’s special: business cards don’t show up on your personal credit report, so they don’t make it harder to get approved for other cards later. You get the points without “using up a spot” in your 5/24 count.

The welcome bonus often shows up as “$750 cash back,” but here’s the trick: when you pair this card with your Sapphire Preferred, those points turn into Chase Ultimate Rewards® you can transfer to airlines and hotels. That makes them far more valuable than just cash back.

Learn How to Apply for Chase Ink Business Cash® here (Affiliate link) >>

Resources

- Article: Guide to Ink Cash and Ink Unlimited (no annual fee cards!)

- Article: How (almost) anyone can open a business card

- Podcast: Keep earning Ultimate Rewards forever

- YouTube: Business Application Walk Through

Application Notes

- We have a full video walkthrough for first-time business card applicants.

- People in our Facebook group have reported approvals with side hustles as small as $50/year in sales.

- You need to be under 5/24 to get approved for this card.

Alternate Card Options

- Any of the Chase Ink cards could work.

- No annual fee: Ink Business Cash®, Ink Business Unlimited®

- With annual fee: Ink Business Preferred®

- Premium: Chase Sapphire Reserve® for Business

- Prioritize whichever one has the best elevated offer when you apply.

Finally, we’ll round out Year 1 by adding an airline-specific stash of miles. Katie recommends American Airlines here, using the CitiBusiness® / AAdvantage® Platinum Select® Mastercard®.

Airline miles are less flexible than Chase or Capital One points, but they can be incredibly valuable when you want to book flights directly. A single card bonus can often cover a full round-trip ticket. This step gives you options beyond Chase and Capital One, so you aren’t locked into just one way of booking.

By the end of the year, you’ll have three strong buckets of points to work with, giving you flexibility for flights, hotels, and upgrades.

Learn How to Apply for CitiBusiness® / AAdvantage® Platinum Select® here >>

Alternate Card Options

If you’re not focused on American Airlines, the main rule is: don’t spread yourself too thin. Pick one airline you’ll actually use and stick with it (start with a business version, then add a personal version later).

At the end of Year 1, you’ll be sitting on over 300,000 points and miles. That’s enough for:

- Multiple domestic round-trip flights

- Several free hotel nights (Chase → Hyatt is a favorite strategy)

- A premium travel experience with lounge access and TSA PreCheck/Global Entry already covered

Most importantly, you’ll have learned how to follow a clear plan without feeling overwhelmed. Every card has a reason, every step builds on the last, and you’ll end the year confident instead of confused.

Year Two

In Year 2 of the plan, you’ll double down on earning Chase Ultimate Rewards®. We love these points for their flexibility and strong value. We just can’t get enough of them! You’ll also add to your airline miles stash and branch out into hotel-specific points.

By the end of Year 2, you’ll earn about 406,000 points and miles spread across a few programs:

- Over 100,000 Chase Ultimate Rewards® you can transfer to Hyatt, book travel via Chase Travel(sm), or transfer to airline partners

- Airline miles from 1-2 airlines to pay for multiple round trip flights in economy

- Enough hotel points with another program for a few nights

As much as we love Ultimate Rewards, you still need to pace yourself. It’s important to establish a good relationship with banks and avoid opening too many cards too quickly. We recommend never opening more than 4 cards with Chase in any rolling 12 month period, ideally fewer than 4!

You opened a Chase Ink Business Cash® Credit Card in Year 1 and now it’s time for a Chase Ink Business Preferred® Credit Card.

Remember: business cards don’t show up on your personal credit report, so they don’t make it harder to get approved for other cards later. You get the points without “using up a spot” in your 5/24 count.

Learn How to Apply for Chase Ink Business Preferred® here (Non-Affiliate link) >>

Resources

- Article: Guide to Ink Preferred

- Article: How (almost) anyone can open a business card

- Podcast: Keep earning Ultimate Rewards forever

- YouTube: Business Application Walk Through

Application Notes

- Katie has a full video walkthrough for first-time business card applicants.

- People in Katie’s Facebook group have reported approvals with side hustles as small as $50/year in sales.

- You need to be under 5/24 to get approved for this card.

Alternate Card Options

- Any of the Chase Ink cards could work but new application terms (As of November 2025) mean that it’s harder to get approved for multiple no-annual fee Inks as a sole proprietor.

- If you have an LLC, you are more likely to be approved for another no-annual fee Ink like the Ink Unlimited.

- Premium option: Chase Sapphire Reserve® for Business

- Prioritize whichever one has the best elevated offer when you apply.

A years ago, you kicked off this plan by opening a Chase Sapphire Preferred® Card. It’s a key piece of the strategy because it lets you convert the cash back from no-annual fee Ink cards or Freedom cards into Ultimate Rewards® points, which can then be transferred to Hyatt and other partners.

Now it’s time to decide what to do with your Sapphire card.

Your options:

- Keep it if you regularly use the benefits and perks.

- Keep it if you haven’t opened a Chase Ink Business Preferred® card

- Downgrade it if you did open a Chase Ink Business Preferred® card and want to minimize annual fees.

Downgrade details:

You’ll be able to downgrade to a Freedom card. Our recommendation is to request the Visa Freedom with Chase Ultimate Rewards® (sometimes called “Classic Freedom”). Though discontinued, it mimics the Freedom Flex® with rotating 5x categories each quarter (up to $1,500 spend). If you can max out those categories, it’s an excellent way to keep earning points.

Resources

- Article: Keeping Your Credit Score High

- Article: Ultimate Guide to Closing a Card

- Article: Ultimate Rewards Guide (how to combine points)

Airline miles are less flexible than Chase or Capital One points, but they can be incredibly valuable when you want to book flights, and then you can save your flexible points for something else. A single card bonus can often cover multiple round-trip tickets.

I’m recommending a business version of an airline card here to keep you under 5/24 longer.

American Airlines, Southwest, Atmos Rewards, United Airlines, Delta–all of these can be good options depending on where you live and plan to travel to.

Opening a Freedom card allows you to keep earning more Ultimate Rewards from Chase.

I recommend the Chase Freedom Flex℠.

All information about this card has been collected independently by Katie’s Travel Tricks. (AKA, this is not an affiliate link and Chase needs me to tell you so).

This is also a great way to keep earning Ultimate Rewards, especially if you’re in between new card offers. This card earns 5% back on rotating categories each quarter, on up to $1500 per quarter.

It also earns 3% back on dining and drugstores.

While this card is billed as earning cash back, it technically earns a limited type of Chase Ultimate Rewards®, just like the Ink cards. But you can combine these cash back points with your Sapphire card and then use them to transfer to hotel and airline partners.

Learn How to Apply for Chase Freedom Flex℠ >>

Alternate Card

If you’d rather have a card that earns a flat 1.5% cash back on everything — pick the Chase Freedom Unlimited® Card.

This time you could open a personal version of an airline card. I’d suggest buddying up with one of the business airline cards you have to consolidate points.

American Airlines, Southwest, Atmos Rewards, United Airlines, Delta–all of these can be good options depending on where you live and plan to travel to.

You’ll be canceling the Ink card you opened in Year 1 (July, or whenever you started).

Before you cancel:

- Transfer all your points to a Sapphire card.

- Make sure it’s been at least 12 months since you first opened the card.

Once those steps are done, you’re clear to call and cancel.

Why cancel? Two main reasons:

- In 2025, new data showed that it became harder to get approved for Chase business cards if you were already holding three or more.

- To avoid that roadblock, we keep the number of Chase business cards in your wallet as low as possible.

Resources

- Article: Ultimate Guide to Closing a Card

- Article: Ultimate Rewards Guide (how to combine points)

We’ll wrap up Year 2 by adding a hotel-specific stash of miles.

A few things to keep in mind:

- Since we want to keep you under 5/24, a business hotel card is usually the best option if you can get one.

- There’s no single “best” hotel program—it really depends on where you want to stay.

That said, we usually recommend starting with Hyatt as your main program. It’s easy to understand, consistently offers good value, and the credit card is a long-term keeper.

Even though the Hyatt personal card doesn’t usually have flashy welcome offers, we consider it a keeper. The annual fee is $95, but each year, you’ll earn a free night certificate (Category 1–4 hotel) on your anniversary. We often redeem that free night for a Chicago staycation worth $250–$300. In our minds, that’s a prepaid, discounted vacation.

Other hotel cards—especially when they’re offering an elevated bonus—can easily cover a 3–5 night stay.

Ultimately, choose a hotel program that works for you:

- Maybe there’s a specific destination or hotel you’ve been eyeing.

- Or maybe you want to jump on a strong welcome offer.

The good news? Most of our favorite hotel cards are “keepers,” thanks to the free hotel night you get every year on your cardmember anniversary.

Read our guides here.

- Marriott Cards (options with Chase and American Express)

- Hilton Cards (via American Express)

- Hyatt Cards (via Chase)

- IHG Cards (via Chase)

Application Notes

If you don’t already have lounge access through another card, you might want to consider getting on a pathway to the Chase Ritz Carlton® Card. You’ll need to open another card first, wait a year, and then upgrade to the Ritz card. A hassle? Yes, but this Ritz boasts the strongest lounge access of any card out there. Read more here.

Resources

Browse our maps for more inspiration!

At the end of Year 1, you opened an airline card. Now it’s time to decide whether it’s worth keeping.

A couple things to know:

- Even if you cancel the card, your airline miles are safe. You don’t need to keep the card open to keep your points alive.

- What you do need to check is whether the annual fee makes sense compared to the benefits you’re actually using.

Take a minute to weigh the cost against the perks. If the value balances out, keep it. If not, it’s safe to let it go.

Resources

Year 2 helps you diversify your points.

You’ll need to do a little research to choose airline and hotel cards that make sense for you. Just don’t get stuck in analysis paralysis—there are plenty of good options, and the most important step is just picking one. You can always add more later.

Since you’ve doubled down on Chase Ultimate Rewards® this year, you’ll also become more confident and skilled at using them.

Now, if you’re ready to start opening cards faster than this plan suggests, you can—just keep your 5/24 status in mind. In most cases, it’s best to add non-Chase cards at that point. This plan prioritizes Chase cards but intentionally leaves space for you to branch out with other banks.

Year Three

By Year 3, we hope you’re starting to feel comfortable with earning and redeeming points. Here’s the good news: you don’t really have to learn anything new this year. It’s more of the same good stuff!

In Year 3, you’ll earn about 407,000 points, including:

- More Chase Ultimate Rewards® (are you surprised?)

- A new flexible rewards currency

- More airline miles

- And a card of your choice!

The Three-Year Plan originally included another Chase Ink Card here. But as of November 2025, it looks like Chase has tightened some approvals for Ink cards, especially for sole proprietors. We’re still watching data points to see if we can find factors that increase odds of approval.

In the meantime, we’re adding a placeholder here for another business card.

The good news? There are a lot of options! Chase has business cards for IHG points, Hyatt points, United miles. (Affiliate links). If you have a large spend, look at Chase Sapphire Reserve® for Business.

You can also find a whole list of cards in the FAQs about non-Chase business cards we recommend.

Resources

- Article: Guide to Ink Preferred

- Article: How (almost) anyone can open a business card

- Podcast: Keep earning Ultimate Rewards forever

- YouTube: Business Application Walk Through

Application Notes

- Katie has a full video walkthrough for first-time business card applicants.

- You need to be under 5/24 to get approved for this card.

Two years ago, you kicked off this plan by opening a Chase Sapphire Preferred® Card. It’s a key piece of the strategy because it lets you convert the cash back from Ink cards into Ultimate Rewards® points, which can then be transferred to Hyatt and other partners.

Now it’s time to decide what to do with your Sapphire card.

Your options:

- Keep it if you regularly use the benefits and perks.

- Keep it if you haven’t opened a Chase Ink Business Preferred® card

- Downgrade it if you did open a Chase Ink Business Preferred® card and want to minimize annual fees.

Downgrade details:

You’ll be able to downgrade to a Freedom card. Our recommendation is to request the Visa Freedom with Chase Ultimate Rewards® (sometimes called “Classic Freedom”). Though discontinued, it mimics the Freedom Flex® with rotating 5x categories each quarter (up to $1,500 spend). If you can max out those categories, it’s an excellent way to keep earning points.

Next, it’s time to close your Chase Ink Unlimited® card from Year 2.

Before you cancel:

- Move all your points to a “keeper” card — either the Sapphire (if you kept it) or the Ink Preferred.

- Once the points are transferred, you’re safe to cancel.

Why cancel? In 2025, new data showed it was harder to get approved for Chase business cards if you already had three or more open. To keep approvals smooth, we recommend keeping the number of Chase business cards in your wallet as low as possible.

Resources

- Article: Keeping Your Credit Score High

- Article: Ultimate Guide to Closing a Card

- Article: Ultimate Rewards Guide (how to combine points)

This is a good time to start collecting another flexible points currency. This will give you additional flight and hotel options over just Chase and Capital One.

We suggest Citi Strata Premier® Card here because it has a few unique transfer partners. One is American Airlines. The other is the 1:2 transfer to Choice Hotels. Choice Hotels has a few good options in the US but also a lot of good value and even unique properties overseas.

You could also start diversifying into American Express Membership Rewards at this point, too.

Learn How to Apply for Citi Strata Premier® Card (non-affiliate) >>

Alternate Cards:

- Citi Strata Elite℠ Card (premium version)

- American Express® Green Card (start earning American Express Membership Rewards)

In April of last year, you opened an airline card. Now it’s time to decide whether it’s worth keeping beyond the first year.

Good news: Even if you cancel the card, your airline miles are safe. You don’t need to keep the card open to preserve your points.

What you do need to check is whether the annual fee is justified by the benefits you’re actually using. Take a moment to weigh the cost against the perks—if the value balances out, keep it. If not, it’s safe to close.

Resources

You’re almost done with the Three-Year Plan and hopefully by now you have a sense of what kind of points you want more of. This month you’ll choose a card that appeals to you.

Don’t get analysis paralysis! You could choose something that’s having a limited time offer or double down on some kind of points you have and know you like.

You don’t have to pick a personal card here – you could choose a business card instead to stay further under 5/24. But we wanted to give a space here for you to feel free to add a personal card either from Chase or another bank.

Not sure what to pick? Browse current best offers here and see what catches your eye.

In July of last year, you opened an airline card. Now it’s time to decide whether it’s worth keeping past the first year.

The good news: Even if you cancel the card, your airline miles are safe. You don’t need to keep the card open to preserve your points.

What you do need to check is whether the annual fee makes sense compared to the benefits you’re actually using. Take a minute to weigh the cost against the perks — if the value is there, keep it. If not, it’s fine to close.

Resources

It’s time to open another Ink Card!

Learn How to Apply for Chase Ink Business Cash® here (Affiliate link) >>

Note: As I’m writing this update to the plan in 2025, we’re not 100% sure what Ink approvals will hold in 2 years. We will update the plan as needed as we learn and know more.

Resources

- Article: Guide to Ink Cash and Ink Unlimited (no annual fee cards!)

- Article: How (almost) anyone can open a business card

- Podcast: Keep earning Ultimate Rewards forever

- YouTube: Business Application Walk Through

Application Notes

- We have a full video walkthrough for first-time business card applicants.

- People in her Facebook group have reported approvals with side hustles as small as $50/year in sales.

- You need to be under 5/24 to get approved for this card.

Alternate Card Options

- Any of the Chase Ink cards could work. You’ll be more likely to be approved for a card you previously held if you have an LLC.

- No annual fee: Ink Business Cash®, Ink Business Unlimited®

- With annual fee: Ink Business Preferred®

- Premium: Chase Sapphire Reserve® for Business

- Prioritize whichever one has the best elevated offer when you apply.

You’ve made it to the end of three years and earned over a million points! We hope you’ve taken some memorable trips and feel ready to create your own points strategy to take vacations every year.

As you continue on, we hope you find our in-depth resources helpful. Check out our Destinations Page for tips on hotels and detailed flight guides, too.

“But Katie, I have a question!”

Like I said, this can be a lot to take in, so I expect you’ll have questions! Here are the ones

we tend to answer a lot. If you have others, you can check the Facebook group or contact us here.

Yep, you sure can! There’s almost nothing in the plan that’s time-sensitive.

The only exception is if you choose to earn a Southwest Companion Pass. That process usually starts around mid October for the following year. It can also begin through mid-June. If you’ll find time to use the Companion Pass at least twice, it’s still worth going for.

I mean this sincerely, there is no best way.

The best way is any way that allows you to travel and be a part of an experience that you find valuable.

I’m not a strong proponent of standardized “cents per point” comparisons and calculations because I find they lead more to bragging rights and FOMO for others more than adding valuable memories to your life.

Now, getting off my soap box, I will point you towards all the resources on our site where you can find inspiration.

Start with our Destinations Page which is full of them!

If you want to move faster than my plan, you can! You’re just going to need to keep the following in mind.

Velocity With Chase

I don’t recommend you apply for more than 4 cards from Chase in any given 12 month period. Space out your cards and apply for cards from other banks, too.

Watch Your 5/24 Count

My plan keeps you under 5/24 at all times so that you always have the option to apply for Chase cards. I love the flexibility to do this when a great offer comes out — especially if it matches with some bigger spending I have coming up. You can add in personal cards to this plan, but just be mindful of how that will affect your 5/24 status.

Jump on Elevated Offers

Sometimes a great elevated offer comes around and you want to grab it! You can see all my current favorite offers here.

My Favorite: Apply for Business Cards from Other Banks

This is my personal favorite way to add more cards into my wallet (and more points into my loyalty accounts!)

Check the next FAQ for my list of recommended cards.

Opening non-Chase business cards is the perfect way to keep earning points or cash back but still be eligible for all the cards in this plan.

You could add any of these at any time to the plan:

American Express Cards

- The Blue Business® Plus Credit Card from American Express – Doesn’t have a high offer (Except occasional highly targeted offers) but does allow you to start earning Membership Rewards which then allows you to link Rakuten to Membership Rewards earning

- American Express® Business Gold Card

- The Business Platinum Card® from American Express

- Marriott Bonvoy Business® American Express® Card

- Hilton Honors Business Card

- Any Delta Business Card

Bank of America Cards

Capital One Cards

- Capital One Spark Cash Plus High spend required, can be combined with Venture miles

- Capital One Venture X Business

Citi Cards

US Bank Cards

- Variety of card options, see US Bank’s site here

- Business Altitude Connect Annual fee waived first year then $95; provides 4 Priority Pass lounge visits each year, including restaurants

Barclays

- JetBlue Business Card

- Hawaiian Business Card

- Wyndham Business Card

Yes, you can!

There’s a lot of flexibility to this plan.

It’s always fine to move cards around according to when you need the points or when an elevated offer pops up.

That being said–you need to watch your velocity with Chase and the spacing of your Ink cards especially if you move cards around.

Recent data points suggest you’re most likely to get approved if you hold fewer than 3 Chase business cards when you apply for another. The plan accounts for this in its timing. So if you move things around, you need to pay attention to your own stats.

I originally released a Three-Year Plan in March 2024. You can find an archived version here.

I released my first update to it in September 2025.

Most changes were made to the Two Person version–the One Person version was unchanged.

Here’s why:

Chase Ink card referral rules changed in October 2025. The new rules mean that if you hold a Chase Ink, someone can’t get referral points for referring you to another one. I spaced out Ink applications and the way they alternate to accommodate this change.

Capital One Venture X announced it was pulling all guest access for lounges. This change happens in February 2026. While overall the card still has value when you consider the $395 annual fee gives you a $300 travel credit and 10,000 points a year (among other benefits)–without the family friendly lounge policies, it no longer feels like a no-brainer card.

I added the U.S. Bank Altitude Connect early in the plan as a great no-annual fee option for getting limited lounge access.

I moved up the Southwest cards to fall of Year One–because I realized most people prefer to optimize the Companion Pass timeline. My original Three-Year Plan had Southwest cards in January of Year Two–which still works! But a lot of people were following my optimized timelines that start in mid to late Fall so I reworked the Three-Year Plan to match that.

Finally, I adjusted some of the card timings to fall when we occasionally see elevated offers. Overall, I believe it is more important to be consistently opening cards rather than waiting around for elevated offers. But we all love the thrill of getting an elevated offer, too. In Year Two and Year Three, I tried to align cards if I could with times we have seen elevated offers in the past. A past elevated offer is never a guarantee of a future one–but sometimes we do see patterns over time.

We’ve made it to the end of the one-person plan! Keep scrolling to check out the two-person plan.

Oh hey there,

two-person peeps!

Two-Person Plan

I’m about to walk you through a lot of information—but don’t worry.

We’ll go step by step so you can check off each one without feeling overwhelmed.

Drop your email below, and I’ll send you a digital tracker to chart your progress.

In three years, you’ll earn 1.3M+ points worth an estimated $18,000 to use towards flights, hotels, and other travel perks.

Year One

368,000 points

Year Two

467,000 points

Year Three

472,000 points

These annual charts give you the mile-high overview.

We’ll dig into the details in the sections below—but anytime you’re ready, you can grab your free digital tracker to follow along.

Now, let’s fill in the what, the

why, and the how behind each step.

Year One

When you’re starting out, the hardest part is knowing where to begin. There are so many cards and rules, and it feels like if you pick the wrong one, you’ll mess everything up. That’s why Year 1 of this plan is all about keeping things simple, building confidence, and stacking a big pile of points right away.

By the end of Year 1, you’ll have over 368,000 points and miles spread across three programs:

- Chase Ultimate Rewards® (these are the most flexible and easiest to use–also great for our favorite hotel redemptions via Hyatt)

- Capital One Venture miles (great for easy redemptions but flexible with other options, too)

- Either a Southwest Companion Pass – or – other airline miles that fit with your home airport and your goals (enough for at least 4 free round trips)

You’ll also have the option to open a no-annual fee card with some great perks, including 4 airport lounge visits per year and a credit for TSA PreCheck or Global Entry.

All in all, that’s enough to cover multiple plane tickets, hotel nights, or even an entire vacation for a family. And you’ll do it without hurting your credit score or juggling more than you can handle. Use the expandable sections below to understand what to open and when, step by step.

Throughout the plan, we’ll label you as Person 1 (P1) and your partner as Person 2 (P2).

Note: With little consequence, you can start this plan at any point in the year. To keep things simple, I’m assuming you’ll start January 1.

We begin with the Chase Sapphire Preferred® Card. This card is the best “starter” in the points world because it keeps everything in one easy-to-use program called Ultimate Rewards®. You’ll earn a big welcome bonus (worth at least $750, and usually much more when transferred to travel partners).

Why Chase first? Chase has some of the most valuable points, but they also have one of the strictest approval rules: if you’ve opened too many cards in the past two years, they won’t approve you. That’s why we grab this card early—before anything else gets in the way.

You’ll use this card for your everyday spending and start earning a flexible pile of Chase points. Later in the plan, we’ll add more Chase cards that can combine with these same points, making them even more powerful.

Learn How to Apply for Chase Sapphire Preferred® here (affiliate link) >>

Resources

- Article: Guide to Chase Sapphire Preferred

- Article: Why I recommend starting with this card

- Podcast: Season 1 (deep dive into this card—best to listen sequentially from Ep 1)

- Article: 20+ Ways to Use Ultimate Rewards

Application Notes

- Chase’s “5/24” rule applies — if you’ve opened five or more personal cards in the last 24 months, you won’t be approved. This is why it’s important to start here.

- As of June 23, 2025, Chase changed how points are valued through Chase Travel (usually worth less, sometimes more). Points are still easy to redeem and transfer to partners like Hyatt.

- Extra perk: through December 31, 2027, you’ll also get $10/month in DoorDash credits (non-restaurant purchases).

Alternate Card Option

- Chase Sapphire Reserve®: Includes more perks like airport lounge access. If your home airport has a lounge, this might be worth it. You can also start with Preferred and upgrade later. You can check out our benefits calculator to see if the annual fee is worth it for you.

This card flies under the radar of most travel bloggers but the perks are incredible for a no annual fee card.

The card? The U.S. Bank Altitude® Connect Visa Signature® Card. Yes, that’s a mouthful!

Despite having a $0 annual fee, this card includes:

- 4 visits per year to Priority Pass lounges–including restaurants which most cards don’t include. You can even share these with family members traveling with you.

- $100 (every 4 years) to cover TSA PreCheck or Global Entry. If you’re a parent, don’t forget that kids under 18 can get Global Entry for free with your application.

This card has a modest welcome offer and relatively low spend–usually around $1000. But this card isn’t on the list for the points really, it’s locking in those perks long term.

Now if you don’t care about lounge access at the airport or already have TSA Precheck, it very well may make sense for you to skip this card.

If you earn a 30,000 point bonus, that will work out to about $300 towards travel or if you have a US Bank checking account, you can deposit it straight as cash back. Still pretty good return for spending just $1,000.

Learn How to Apply for U.S. Bank Altitude® Connect Visa Signature® Card here (non-affiliate link) >>

Resources

- Article: Guide to Airport Lounges

- Article: TSA Precheck vs. Global Entry

Application Notes

- You can move this card around to whenever you could meet the spend. I put it early in the year because P2 doesn’t have many personal cards in Year 1.

- If you decided to get a Sapphire Reserve or already have lounge access, you may choose to skip this card, and that’s fine! This is still unique in that it provides access to Priority Pass restaurants, which is rare. But that may not matter to you.

Don’t get scared by the word “business.” Almost everyone qualifies for a business card in the bank’s eyes. Selling items online, freelancing, tutoring, babysitting, dog walking—any side income counts.

The Chase Ink Business Cash® Credit Card is one of the easiest ways to boost your points total. Here’s why it’s special: business cards don’t show up on your personal credit report, so they don’t make it harder to get approved for other cards later. You get the points without “using up a spot” in your 5/24 count.

The welcome bonus often shows up as “$750 cash back,” but here’s the trick: when you pair this card with your Sapphire Preferred, those points turn into Ultimate Rewards® you can transfer to airlines and hotels. That makes them far more valuable than just cash back.

Learn How to Apply for Chase Ink Business Cash® here (affiliate link)>>

Resources

- Article: Guide to Ink Cash and Ink Unlimited (no annual fee cards!)

- Article: How (almost) anyone can open a business card

- Podcast: Keep earning Ultimate Rewards forever

- YouTube: Business Application Walk Through

Application Notes

- We have a full video walkthrough for first-time business card applicants.

- People in her Facebook group have reported approvals with side hustles as small as $50/year in sales.

- You need to be under 5/24 to get approved for this card.

Alternate Card Options

- Any of the Chase Ink cards could work.

- No annual fee: Ink Business Cash®, Ink Business Unlimited®

- With annual fee: Ink Business Preferred®

- Premium Card with more perks: Chase Sapphire Reserve® For Business

- Prioritize whichever one has the best elevated offer when you apply, or the one where you can meet the spend requirements.

Next, we’ll branch out a little and add the Capital One Venture Rewards Credit Card. Why now? Capital One can be picky about approvals if you’ve opened a lot of cards recently, so we want to lock this in early.

This card comes with one travel perk that will make your life easier right away: Global Entry or TSA PreCheck credit (skip the long lines at the airport).

It also earns flexible miles you can use toward almost any kind of travel.

Learn How to Apply for Capital One Venture Rewards Credit Card here (affiliate link) >>

Resources

- Article: Guide to Capital One Venture Rewards Credit Card

- Podcast: Season 2 (full episode on Venture redemptions)

- Article: Guide to Venture miles

Application Notes

- Capital One is finicky about approvals. Generally, the more recent accounts/inquiries you have, the harder it is to get approved.

- Some people report better approval odds by checking the box that says “I plan to carry a balance” (you should never actually carry a balance — it’s non-binding, but signals profitability to Capital One).

- Another thing that can help is keeping your Experian credit report frozen when you apply.

Alternate Card Option

- Capital One Venture X Rewards Credit Card: This card used to be the standard recommendation for the Three-Year Plan but with guest access changing for airport access in Feb 2026, we moved it down to an alternate option. It still has strong potential value: $300 annual travel credit + 10,000 bonus miles each year on your anniversary.

- Not interested in Venture miles? You could start earning another kind of flexible rewards. In that case, I’d suggest a Citi Strata Premier® or American Express Green Card.

Finally, we’ll round out Year 1 by adding an airline-specific stash of miles.

Our top recommendation is the Southwest Companion Pass. Why? Because you don’t just earn a big pile of points—you also unlock the Companion Pass, one of the most valuable travel perks out there.

Here’s why the timing matters:

- The Companion Pass is valid for the year you earn it, plus the entire following year.

- By starting the process in the fall, you can open your cards and get approved—but wait to hit the minimum spend until after January 1.

- That way, all your points post in the new year, giving you almost two full years of Companion Pass benefits.

Quick version of how to earn it:

- Open one Southwest business card and one Southwest personal card.

- Combined, you’ll earn over 135,000 Rapid Rewards points, which qualifies you for the Companion Pass.

Since most people live near a Southwest airport, this strategy is often the simplest—and most rewarding—choice.

Learn More About Southwest Companion Pass

- Article: Tricks to Earning a Southwest Companion Pass

- Podcast Episode: How to earn a Companion Pass

- Free Course: (see last module)

- YouTube: Earn 2 Companion Pass with 3 cards

Application Notes

- If you’re applying in late fall, timing is really important to pay attention to with the Southwest cards. Be sure you understand the overall Companion Pass strategy. That will help you confidently know when you can plug this into your strategy.

- You need to be under 5/24 to qualify for these cards.

Alternate Options

If you’re not focused on Southwest, the main rule is: don’t spread yourself too thin. Pick one airline you’ll actually use and stick with it (start with a business version, then add a personal version later).

American Airlines, Atmos Rewards, United Airlines, Delta–all of these can be good options depending on where you live and plan to travel to. Generally speaking, I’d advise starting with American or Atmos (Alaska/Hawaiian first). Search for airline cards here.

At the end of Year 1, you’ll be sitting on over 300,000 points and miles. That’s enough for:

- Multiple domestic round-trip flights

- Several free hotel nights (Chase → Hyatt is a favorite strategy)

- Global Entry already covered for one adult + all kids under 18 (or two adults if you opened the optional Altitude Connect)

Most importantly, you’ll have learned how to follow a clear plan without feeling overwhelmed. Every card has a reason, every step builds on the last, and you’ll end the year confident instead of confused.

Year Two

In Year 2 of the plan, you’ll double down on earning Chase Ultimate Rewards®. We love these points for their flexibility and strong value. We just can’t get enough of them! You will start leveraging referral bonuses in your household, too. You’ll also branch out into hotel-specific points.

By the end of Year 2, you’ll earn about 467,000 points and miles spread across two programs:

- Over 300,000 Chase Ultimate Rewards® (you can transfer them to Hyatt, book via Chase Travel(sm), or transfer to airline partners)

- Enough hotel points with another program for a few nights!

As much as we love Ultimate Rewards, you still need to pace yourself. It’s important to establish a good relationship with banks and avoid opening too many cards too quickly. We recommend never opening more than four cards with Chase in any rolling 12-month period, ideally fewer than four!

We’ll start off Year 2 by adding an hotel-specific stash of miles. There isn’t one best hotel program for this.

That said, we usually recommend starting with Hyatt as your main program. It’s easy to understand, consistently offers good value, and the credit card is a long-term keeper.

Even though the Hyatt personal card doesn’t usually have flashy welcome offers, we consider it a keeper. The annual fee is $95, but each year, you’ll earn a free night certificate (Category 1–4 hotel) on your anniversary. We often redeem that free night for a Chicago staycation worth $250–$300. In our minds, that’s a prepaid, discounted vacation.

Other hotel cards—especially when they’re offering an elevated bonus—can easily cover a 3–5 night stay.

Ultimately, choose a hotel program that works for you:

- Maybe there’s a specific destination or hotel you’ve been eyeing.

- Or maybe you want to jump on a strong welcome offer.

The good news? Most of our favorite hotel cards are “keepers,” thanks to the free hotel night you get every year on your cardmember anniversary.

Read our guides here.

- Marriott Cards (options with Chase and American Express)

- Hilton Cards (via American Express)

- Hyatt Cards (via Chase)

- IHG Cards (via Chase)

Application Notes

If you don’t already have lounge access through another card, you might want to consider getting on a pathway to the Chase Ritz Carlton® Card. You’ll need to open another card first, wait a year, and then upgrade to the Ritz card. A hassle? Yes, but this Ritz boasts the strongest lounge access of any card out there. Read more here.

Resources

Browse our maps for more inspiration!

Ink cards currently offer a 20,000 point referral bonus. Ink cards also offer “family” referrals which means if you hold ANY Ink card, you can refer a friend to ANY Ink card. This family also includes the Sapphire Reserve® for Business.

So when P2 refers P1 to an Ink Business Cash® Credit Card or Ink Business Unlimited® Credit Card, you’re earning a 20,000 point referral bonus on top of the welcome offer.

Note: After October 7, 2025 – Chase terms state that Ink referrals will only be awarded to “new Chase Business card customers only. Referrals of individuals with existing Chase business card accounts will no longer qualify for the referral bonus.” I think it might be possible to get a referral again later if you close any existing Ink cards and the plan assumes this in the timing of the Ink cards.

By adding a second of these cards to your household, you’ll double the number of Priority Pass visits you get for the year.

That’s because despite having a $0 annual fee, this card includes:

- 4 visits per year to Priority Pass lounges–including restaurants which most cards don’t include. You can even share these with family members traveling with you.

- $100 (every 4 years) to cover TSA Precheck or Global Entry. If you’re a parent, don’t forget that kids under 18 can get Global Entry for free with your application.

You may not need any more Global Entry credits if your family is already covered but you could offer to pay for it for an extended family member.

Just like in the Year One explanation–if you don’t care about lounge access at the airport go ahead and skip this card.

Learn How to Apply for U.S. Bank Altitude® Connect Visa Signature® Card here (non-affiliate link) >>

Resources

- Article: Guide to Airport Lounges

- Article: TSA Precheck vs. Global Entry

Application Notes

- You can move this card around to whenever you could meet the spend. I put it mid-year because P1 doesn’t have many personal cards in Year 2.

- If you decided to get a Sapphire Reserve or already have lounge access, you may choose to skip this card, and that’s fine! This is still unique in that it provides access to Priority Pass restaurants, which is rare. But that may not matter to you.

You’re going to be evaluating the Ink card you opened Year 1 in April (or whenever you opened it). It’s a good practice to do this with any card every year.

But before you consider closing a card, it’s essential that you:

- Waited for any referral bonus to post

- Make sure you’ve transferred all your points to a Sapphire card

- Make sure it’s been 12 months since you first opened the card

Once those things are done, you can choose to go ahead and call to cancel.

But why cancel? Two reasons you might consider this.

In 2025, we saw new data points indicating that it was harder to get approved for Chase business cards if at the time of application you held 3 or more. So we try to keep the Chase business cards in your wallet to a minimum.

We also saw a new referral rule come into place. After October 7, 2025 – Chase terms state that Ink referrals will only be awarded to “new Chase Business card customers only. Referrals of individuals with existing Chase business card accounts will no longer qualify for the referral bonus.”

At this point, the terms are vague enough that it seems like if you cancel all your Inks that someone might be able to refer you in the future–and that’s what this plan assumes. So it aims to keep you eligible for more referrals in the future.

Resources

- Article: Ultimate Guide to Closing a Card

- Article: Ultimate Rewards Guide (how to combine points)

The “two person” plan includes a lot of referrals back and forth and here’s the next one!

With the Chase Sapphire Preferred, the referral bonus is currently 15,000 Ultimate Rewards points.

You’ll refer your P2 to this card so they can earn a bonus – and then the P1 will also get a referral bonus.

You’ll be able to combine your points across your household as well.

Application Tips

Generally, I think it’s better to apply regularly for cards than sit around waiting for a limited time offer to pop up.

That being said, for the past few years, we’ve seen an elevated offer for the Sapphire Preferred in late spring–sometime between mid April and mid June. You might want to watch for it and see if it fits with your timing!

Ink referrals are a powerful part of this strategy! Here’s why:

- Family referrals: If you hold any Chase Ink card, you can refer someone to any other Ink card. This “family” even includes the Sapphire Reserve® for Business.

- Step 1: P1 should refer P2 to an Ink card that P2 didn’t open last year.

- Step 2: P2 earns the new card’s welcome bonus.

- Step 3: P1 earns a 20,000-point referral bonus on top.

That’s why we love referrals—you’re stacking points on both sides at once.

Remember: After October 7, 2025 – Chase terms state that Ink referrals will only be awarded to “new Chase Business card customers only. Referrals of individuals with existing Chase business card accounts will no longer qualify for the referral bonus.” P1 won’t earn a referral bonus if P2 already has an Ink card open.

Update November 2025: Chase has tightened eligibility for Ink approvals. If you already got a no-annual fee Ink, you are more likely to be approved for either the Ink Preferred or Sapphire Reserve for Business. One notable exception is if you have an LLC, LLCs seem to be approved more readily for additional no-annual fee Inks.

At the end of Year 1, you opened one or two airline cards. Now it’s time to decide whether they are worth keeping past that first year.

With airline miles–even if you cancel a card, your miles are safe. You don’t need to keep these cards open to keep your points alive.

You do need to take a minute and look at the annual fee and look at the benefits you’re getting and see if it balances out for you.

Resources

Year 2 is fairly simple.

It starts off requiring you to do some research and pick a hotel card. Don’t let analysis paralysis stop you from picking one. There are a lot of good hotel cards out there and you have to start with one of them. You can add more later!

Since you’ve doubled down on Ultimate Rewards this year, you can really become an expert in using them.

If you’re ready to start opening cards more quickly than this plan allows, you can. Keep your 5/24 scores in mind. Generally, it’s best if you open additional non-Chase cards. This plan optimizes for Chase cards but leaves room for you to add cards from other banks.

Year Three

By Year 3, we hope you’re starting to feel comfortable with earning and redeeming points. Here’s the good news: you don’t really have to learn anything new this year. It’s more of the same good stuff!

In Year 3, you’ll earn about 472,000 points, including:

- More hotel-specific points–you could double down on what you earned last year or pick a new program

- More Ultimate Rewards (are you surprised?)

- More Venture miles

- More airline miles–either another Southwest Companion Pass or miles with another airline of your choice

Two years ago, P1 started this plan by opening a Chase Sapphire Preferred® Card. It’s the key to making a lot of the rest of the plan work. It allows you to convert the cash back from Ink cards to Ultimate Rewards that can then be transferred to Hyatt and other partners.

But technically you only need one Sapphire card per family. That’s because you can combine points across your household into one Sapphire account and transfer out from there.

Some households choose to minimize their annual fees as much as possible and if that’s you–you can go ahead and downgrade your Sapphire card now.

If you find the $95 annual fee to be well worth the value you’re getting from other benefits, you can also choose to both keep your Sapphire cards.

Downgrade Options

You’ll be able to downgrade to Freedom cards.

Our general recommendation is to ask for the “Visa Freedom with Ultimate Rewards” or “Classic Freedom.” This is a now discontinued card that has rotating categories that earn 5x every quarter on a maximum of $1500. It can be a great way to keep earning points if you can max out those categories.

This is a good time for P2 to get their own Venture card (with the P1 referral). This would enable P1 (the original owner of the Venture) to downgrade the Venture to a no annual fee version or cancel it so you aren’t paying that annual fee twice.

Don’t cancel P1’s Venture card unless P1 has first moved their Venture miles over to P2’s new Venture. Capital One makes that easy because they allow you to move Venture miles to anyone.

Capital One sometimes won’t let you downgrade if you don’t call right before the date your annual fee is due, so watch this part of the timeline closely. P2 will want to apply at least a few weeks before the date that P1 will be charged the Venture annual fee.

Resources

- Article: Guide to Capital One Venture Rewards Credit Card

- Podcast: Season 2 (full episode on Venture redemptions)

- Article: Guide to Venture miles

Application Notes

- Capital One is finicky about approvals. Generally, the more recent accounts/inquiries you have, the harder it is to get approved.

- Some people report better approval odds by checking the box that says “I plan to carry a balance” (you should never actually carry a balance — it’s non-binding, but signals profitability to Capital One).

- Another thing that can help is keeping your Experian credit report frozen when you apply.

Alternate Card Option

- Capital One Venture X Rewards Credit Card: This card used to be the standard recommendation for the Three-Year Plan but with guest access changing for airport access in Feb 2026, we moved it down to an alternate option. It still has strong potential value: $300 annual travel credit + 10,000 bonus miles each year on your anniversary.

- Not interested in Venture miles? You could even start earning another kind of flexible rewards. In that case, I’d suggest a Citi Strata Premier® or American Express Green Card.

If you were happy with whatever P1 picked in Year 2, they can probably refer P2 to the same card! Or if you have a specific travel plan in mind, pick another hotel card.

Ultimately, choose a hotel program that works for you:

- Maybe there’s a specific destination or hotel you’ve been eyeing.

- Or maybe you want to jump on a strong welcome offer.

You could prioritize business cards to stay under 5/24 or prioritize opening a hotel card from a bank that isn’t Chase at first so you’re diversifying the banks you’re getting cards from.

The good news? Most of our favorite hotel cards are “keepers,” thanks to the free hotel night you get every year on your cardmember anniversary.

Read our guides here.

- Marriott Cards (options with Chase and American Express)

- Hilton Cards (via American Express)

- Hyatt Cards (via Chase)

- IHG Cards (via Chase)

Application Notes

If you don’t already have lounge access through another card, you might want to consider getting on a pathway to the Chase Ritz Carlton® Card. You’ll need to open another card first, wait a year, and then upgrade to the Ritz card. A hassle? Yes, but this Ritz boasts the strongest lounge access of any card out there. Read more here.

Resources

Browse our maps for more inspiration!

You’ll be evaluating the Ink card you opened in Year 2 (April, or whenever you started).

Before you ever consider canceling:

- Wait for your referral bonus to post.

- Transfer all your points to a Sapphire card.

- Make sure it’s been at least 12 months since you first opened the card.

Once those steps are done, you’re clear to consider a cancellation.

But why might you? Two reasons.

In 2025, we saw new data points indicating that it was harder to get approved for Chase business cards if at the time of application you held 3 or more. So we try to keep the Chase business cards in your wallet to a minimum.

We also saw a new referral rule come into place. After October 7, 2025 – Chase terms state that Ink referrals will only be awarded to “new Chase Business card customers only. Referrals of individuals with existing Chase business card accounts will no longer qualify for the referral bonus.”

At this point, the terms are vague enough that it seems like if you cancel all your Inks that someone might be able to refer you in the future–and that’s what this plan assumes. So it aims to keep you eligible for more referrals in the future.

Resources

- Article: Ultimate Guide to Closing a Card

- Article: Ultimate Rewards Guide (how to combine points)

You don’t need to keep 2 Venture cards in your household–Capital One makes it really easy to combine your points.

But it’s still better to downgrade rather than cancel the card altogether. This helps keep your credit report strong and maintain a better relationship with the bank.

Double check that you got your referral bonus back in January before you do!

You could also choose to move your points to your partner’s Venture card before downgrading.

Once those things are done, you can go ahead and call to downgrade.

Capital One doesn’t always give everyone the same downgrade options. If you have the option for VentureOne, that’s what I’d recommend. Otherwise you can pick from the options they give you.

Resources

- Article: Ultimate Guide to Closing a Card

Remember that Ink cards offer “family” referrals which means if you hold ANY Ink card, you can refer a friend to ANY Ink card. This family also includes the Sapphire Reserve® for Business.

P2 should refer P1 to an Ink card they didn’t open last year.

And then P2 is earning another 20,000 point referral bonus on top of the welcome offer.

Remember: After October 7, 2025 – Chase terms state that Ink referrals will only be awarded to “new Chase Business card customers only. Referrals of individuals with existing Chase business card accounts will no longer qualify for the referral bonus.” That’s why P2 cancelled that Ink card back in May.

Update November 2025: Chase has tightened eligibility for Ink approvals. If you already got a no-annual fee Ink, you are more likely to be approved for either the Ink Preferred or Sapphire Reserve for Business. One notable exception is if you have an LLC, LLCs seem to be approved more readily for additional no-annual fee Inks.

By Year 3, it’s time for P1 to go after an airline bonus. Our favorite option is once again the Southwest Companion Pass—because it’s not just a stash of points, it’s two years of buy-one-get-one flights.

Here’s the strategy in a nutshell:

- Open one Southwest business card and one Southwest personal card.

- The bonuses combine to over 135,000 Rapid Rewards points, which qualifies you for the Companion Pass.

The key is timing. You’ll open the cards now, in the fall, but wait to finish the spending until after January 1. That way, your points post in the new calendar year—giving you the Companion Pass for the rest of that year plus the entire following year.

Since Southwest serves most major airports, this move usually makes the most sense. If it doesn’t fit your travel plans, you can always swap in another airline’s miles instead.

Learn More About Southwest Companion Pass

- Article: Tricks to Earning a Southwest Companion Pass

- Podcast Episode: How to earn a Companion Pass

- Free Course: (see last module)

- YouTube: Earn 2 Companion Pass with 3 cards

Application Notes

- If you’re applying in late fall, timing is really important to pay attention to with the Southwest cards. Be sure you understand the overall Companion Pass strategy. That will help you confidently know when you can plug this into your strategy.

- You need to be under 5/24 to qualify for these cards.

Alternate Options

If you really don’t like Southwest, you can pursue other airline cards. But don’t go all over the place! Focus on ONE airline. Just like with Southwest cards, you open a business card for that airline and then a personal card.

You’ll be evaluating the Ink card you opened in Year 2 (October, or whenever you started).

Before you even consider canceling:

- Wait for your referral bonus to post.

- Transfer all your points to a Sapphire card.

- Make sure it’s been at least 12 months since you first opened the card.

Once those steps are done, you’re clear to consider a cancellation.

But why cancel? Two reasons.

In 2025, we saw new data points indicating that it was harder to get approved for Chase business cards if at the time of application you held 3 or more. So we try to keep the Chase business cards in your wallet to a minimum.

We also saw a new referral rule come into place. After October 7, 2025 – Chase terms state that Ink referrals will only be awarded to “new Chase Business card customers only. Referrals of individuals with existing Chase business card accounts will no longer qualify for the referral bonus.”

At this point, the terms are vague enough that it seems like if you cancel all your Inks that someone might be able to refer you in the future–and that’s what this plan assumes. So it aims to keep you eligible for more referrals in the future.

Resources

- Article: Ultimate Guide to Closing a Card

- Article: Ultimate Rewards Guide (how to combine points)

You’ve made it to the end of three years and earned over a million points! We hope you’ve taken some memorable trips and feel ready to creating your own points strategy to take vacations every year.

As you continue on, we hope you find our in-depth resources helpful. Check out our Destinations Page for tips on hotels and detailed flight guides, too.

We’ve also set you up to be able to open yet another Ink card in January of Year 4–if you choose.

“But Katie, I have a question!”

Like I said, this can be a lot to take in, so I expect you’ll have questions! Here are the ones

we tend to answer a lot. If you have others, you can check the Facebook group or contact us here.

Yep, you sure can! There’s almost nothing in the plan that’s time-sensitive.

The only exception is if you choose to earn a Southwest Companion Pass. That process usually starts around mid October for the following year. It can also begin through mid-June. If you’ll find time to use the Companion Pass at least twice, it’s still worth going for.

I mean this sincerely, there is no best way.

The best way is any way that allows you to travel and be a part of an experience that you find valuable.

I’m not a strong proponent of standardized “cents per point” comparisons and calculations because I find they lead more to bragging rights and FOMO for others more than adding valuable memories to your life.

Now, getting off my soap box, I will point you towards all the resources on our site where you can find inspiration.

Start with our Destinations Page which is full of them!

If you want to move faster than my plan, you can! You’re just going to need to keep the following in mind.

Velocity With Chase

I don’t recommend you apply for more than 4 cards from Chase in any given 12 month period. Space out your cards and apply for cards from other banks, too.

Watch Your 5/24 Count

My plan keeps you under 5/24 at all times so that you always have the option to apply for Chase cards. I love the flexibility to do this when a great offer comes out—especially if it matches with some bigger spending I have coming up. You can add in personal cards to this plan, but just be mindful of how that will affect your 5/24 status.

Jump on Elevated Offers

Sometimes a great elevated offer comes around and you want to grab it! You can see all my current favorite offers here.

My Favorite: Apply for Business Cards from Other Banks

This is my personal favorite way to add more cards into my wallet (and more points into my loyalty accounts)!

Check the next FAQ for my list of recommended cards.

Opening non-Chase business cards is the perfect way to keep earning points or cash back but still be eligible for all the cards in this plan.

You could add any of these at any time to the plan:

American Express Cards

- The Blue Business® Plus Credit Card from American Express – Doesn’t have a high offer (Except occasional highly targeted offers) but does allow you to start earning Membership Rewards which then allows you to link Rakuten to Membership Rewards earning

- American Express® Business Gold Card

- The Business Platinum Card® from American Express

- Marriott Bonvoy Business® American Express® Card

- Hilton Honors Business Card

- Any Delta Business Card

Bank of America Cards

Capital One Cards

- Capital One Spark Cash Plus High spend required, can be combined with Venture miles

- Capital One Venture X Business

Citi Cards

US Bank Cards

- Variety of card options, see US Bank’s site here

- Business Altitude Connect Annual fee waived first year then $95; provides 4 Priority Pass lounge visits each year, including restaurants

Barclays

- JetBlue Business Card

- Hawaiian Business Card

- Wyndham Business Card

Yes, you can!

There’s a lot of flexibility to this plan.

It’s always fine to move cards around according to when you need the points or when an elevated offer pops up.

That being said–you need to watch your velocity with Chase and the spacing of your Ink cards especially if you move cards around.

Recent data points suggest you’re most likely to get approved if you hold fewer than three Chase business cards when you apply for another. The plan accounts for this in its timing. So if you move things around, you need to pay attention to your own stats.

I originally released a Three-Year Plan in March 2024. You can find an archived version here.

I released my first update to it in September 2025.

Most changes were made to the Two Person version–the One Person version was unchanged.

Here’s why:

Chase Ink card referral rules changed in October 2025. The new rules mean that if you hold a Chase Ink, someone can’t get referral points for referring you to another one. I spaced out Ink applications and the way they alternate to accommodate this change.

Capital One Venture X announced it was pulling all guest access for lounges. This change happens in February 2026. While overall the card still has value when you consider the $395 annual fee gives you a $300 travel credit and 10,000 points a year (among other benefits)–without the family friendly lounge policies, it no longer feels like a no-brainer card.

I added the U.S. Bank Altitude Connect early in the plan as a great no-annual fee option for getting limited lounge access.

I moved up the Southwest cards to fall of Year One–because I realized most people prefer to optimize the Companion Pass timeline. My original Three-Year Plan had Southwest cards in January of Year Two–which still works! But a lot of people were following my optimized timelines that start in mid to late Fall so I reworked the Three-Year Plan to match that.

Finally, I adjusted some of the card timings to fall when we occasionally see elevated offers. Overall, I believe it is more important to be consistently opening cards rather than waiting around for elevated offers. But we all love the thrill of getting an elevated offer, too. In Year Two and Year Three, I tried to align cards if I could with times we have seen elevated offers in the past. A past elevated offer is never a guarantee of a future one–but sometimes we do see patterns over time.