All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from our partners. American Express is a Katiestraveltricks.com advertiser. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Complete Guide to TSA PreCheck & Global Entry (and how to get them FREE!)

TSA PreCheck and Global Entry are two of the five Trusted Traveler Programs overseen by the Department of Homeland Security. What does that mean? You don’t wait in line as long and you don’t have to take off your shoes.

There are more than 35 credit cards that cover the cost of TSA PreCheck or Global Entry as a card benefit: keep reading to find out my favorites. Some even waive the annual fee the first year! (By the way: You don’t have to keep it beyond that year).

What Is TSA PreCheck?

TSA PreCheck is a program that allows travelers to expedite the security screening process at airports. First, you get to go through a special line. It also lets you go through security without having to remove shoes, belts, and jackets or take out liquids and electronics from carry-on bags.

Is TSA PreCheck Even Worth It?

Yes. At least, I think so. Having TSA PreCheck is one of my top recommendations for families wanting to cut down on stress at the airport.

Going through security may seem like a small part of your day, but it is hard to relax until you’ve gotten through and can go to your gate. And you get it for 5 years.

TSA PreCheck is great because:

- Lines are shorter

- People in the TSA PreCheck line move more quickly through the line because they know what they are doing

- You don’t have to take off your shoes

- You don’t have to remove liquids from your bag

- You don’t have to remove laptops or devices

- Any kids 12 and under can go through the TSA PreCheck with an adult who has it — so you only need to get it for the adults in your family.

- Kids 13-17 can usually access the TSA Precheck line if traveling with a parent that has TSA Precheck and they are on the same air reservation — it would print “TSA PRE” on their boarding pass if eligible.

How to get TSA PreCheck

- Apply Online – You will need to fill out an online application. At the end of your application form you will be able to schedule an in person appointment at an enrollment center.

- Enroll – At your appointment at the enrollment center, you will pay your $85 (if you have the right credit card, you will receive this back as a statement credit!), and you will have your fingerprints taken and a background check will be run. This appointment just takes a few minutes.

- If you are approved, you will receive an email with your Known Traveler Number.

- You will enter your Known Traveler Number in your airline accounts and/or when you are booking flights. Your boarding pass will indicate that you are TSA PreCheck. You can only use the TSA PreCheck lane if it is on your boarding pass! If you forget to add your Known Traveler Number and the airline does not have it on record, you will be turned away from the TSA PreCheck lane.

TSA Precheck Touchless ID

Touchless ID is a fairly new program that TSA has begun implementing at some airports. Dedicated TSA Precheck Touchless ID lanes at security allow you to pass through the TSA checkpoint without pulling out your ID or boarding pass.

Instead, a photo is taken as you approach the security checkpoint, and facial recognition is used to verify your identity.

The program is fairly new, and not all airports or airlines participate.

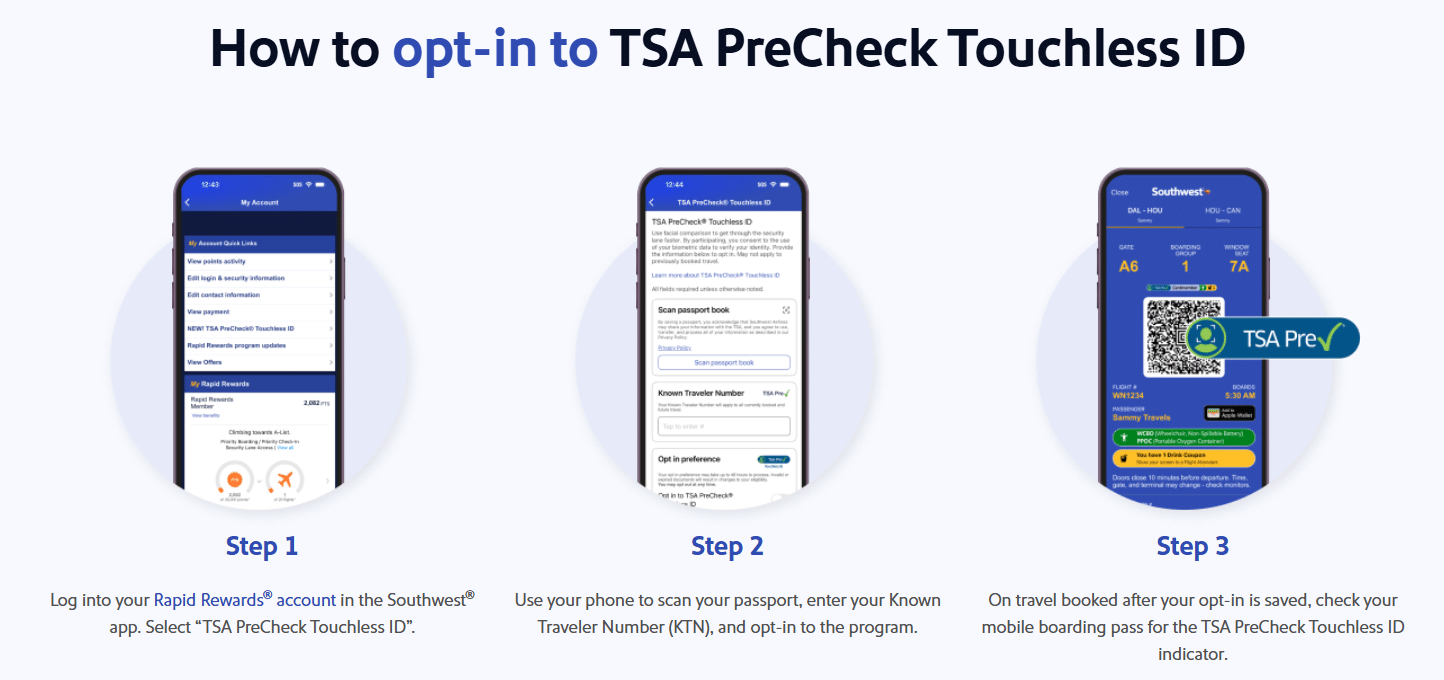

To use the Touchless ID program, you have to first opt in. You do that through the airline frequent flyer program that you’re planning to fly with. You have to opt in separately with each airline.

Currently, the airlines that participate are:

- Alaska Airlines

- American Airlines

- Delta

- Southwest Airlines

- United Airlines

You can see a full list of airports with Touchless ID lanes here.

Here’s what the process looks like when opting in to Touchless ID with Southwest:

Important things to know about Touchless ID

Participation varies by airport and airline. Some airlines have the program at some airports and not others. For example, you can use Touchless ID when flying United at Atlanta (ATL), but not Detroit (DTW). Even though DTW participates in Touchless ID, for some reason United it not a participating airline, so you can’t use it when flying United. Check this list for up-to-date info.

Not all airlines allow kids to register – but kids can still go in the Touchless ID line with you. For example, Southwest Airlines requires passengers to be 18+ in order to opt in to Touchless ID. But if you have a child who is 12 and under, they can always go through the TSA Precheck or Touchless ID lane with you as long as you have it. If your child is 13-17, they would need “TSA Pre” printed on their boarding pass to go through the Touchless ID line with you, just like the other TSA Precheck line.

It’s always a good idea to carry a physical copy of your ID with you, even when using Touchless ID lanes at security!

What Is Global Entry?

Global Entry gives you the benefits of TSA Precheck while also adding expedited entrance to the US when you’ve been abroad. You can use automated kiosks at select airports, bypassing the long customs and immigration lines.

Is Global Entry Worth It?

While TSA PreCheck helps you through the security line at U.S. airports, Global Entry helps you when you are entering the U.S. by air, land, or sea. As an added benefit, if you have Global Entry, you will also have access to the TSA PreCheck lines for yourself as well as kids under twelve.

If you travel outside the country regularly, Global Entry can save you a lot of time spent in the passport control line on your way into the U.S. You will be directed to a special Global Entry line and be received by a kiosk.

How to get Global Entry

- Apply Online – The application process for Global Entry is more extensive than for TSA PreCheck. You will pay your $120 application fee when you apply. With the right credit card, you will be able to receive a statement credit for your application fee. As of October 1, 2024, kids under 18 will be exempt from this fee if a parent already has Global Entry or is applying for Global Entry at the same time.

- Schedule an interview – In order to get approved for Global Entry, you will need to go to an in person interview. You may schedule your interview at an enrollment center or, in some cases, you may be able to complete this when you return to the U.S. at an Enrollment on Arrival location. Even kids need an interview.

Note that interviews can take months to schedule and U.S. Customs and Border Control sometimes recommends that people utilize Enrollment on Arrival or sign up for TSA PreCheck instead.

Should I get TSA PreCheck or Global Entry?

Enrolling in TSA PreCheck or Global Entry will give you access to the TSA PreCheck lines at the airport. So which one should you sign up for?

Cost

At $120, Global Entry costs slightly more than TSA PreCheck ($85), but most cards that offer this benefit will allow you to use it for either program.

Years valid

Both programs are valid for 5 years. You may renew your TSA PreCheck membership up to six months before the expiration date. You may renew your Global Entry membership one year prior to expiration. (Credit cards typically allow this benefit to be used once every four years.)

What’s included

TSA PreCheck will get you AND any kids 12 and under into the TSA PreCheck lane at the airport. These are dedicated security lanes that allow you to keep your shoes on and leave your liquids and laptops in your bags.

Global Entry will get you and any kids 12 and under into the TSA PreCheck lane. You (and only you) will also have expedited reentry into the U.S. through automatic kiosks at dozens of U.S. airports, as well as some international airports. The full list of participating airports is available through Customs and Border Protection. As of October 1, 2024 kids under 18 can get Global Entry for free if a parent already has Global Entry or is applying for Global Entry at the same time — but they do need to apply for Global Entry to access the benefits.

Eligibility

Both programs are open to applicants that are U.S. citizens and U.S. lawful permanent residents. Global Entry is also available to citizens of more than a dozen other countries.

Passport requirements

A passport is not required for TSA PreCheck. A passport is required for Global Entry.

Application process

The application process for Global Entry is a lot more involved and can take several months to complete. Most Global Entry applications must be completed at an enrollment center.

However, Global Entry does have an Enrollment on Arrival option that allows conditionally approved applicants to complete their interviews upon arrival into the U.S. You can read more about Enrollment on Arrival here.

| TSA PreCheck | Global Entry | |

| Cost | $85 | $120 – Kids are free if a parent has Global Entry or is applying for it at the same time. |

| Years Valid | 5 | 5 |

| Includes | Access to TSA PreCheck lane at the airport for you and all kids 12 and under. Kids 13-17 traveling on the same reservation as a parent with TSA Precheck should also have access to the TSA Precheck lane. | Access to TSA PreCheck lane at the airport for you and all kids 12 and under, expedited reentry into US after an international trip only for named individual (kids must have their own Global Entry) |

| Eligibility | U.S. citizens and lawful permanent residents | U.S. citizens, lawful permanent residents, and citizens of certain other countries |

| Passport Required | No | Yes, or lawful permanent resident card |

| Application Process | Application process: 5 minute application online. 10 minute appointment to get fingerprinted and get a background check | Online application. Once conditionally approved, you will need to make an appointment at an enrollment center for finger printing and an interview. You can also complete the interview when returning to the US at a number of airports. |

| Website | More info here | More info here |

Important to note: There are fewer enrollment centers for Global Entry interviews so make sure there is one near you if you choose to apply for that program. Interviews are often scheduled farther out, even months in the future.

After approval, then what?

You will be issued a Known Traveler Number (KTN). Just having this number will not automatically get you access to the TSA Precheck line at the airport.

First, you will need to be flying on an airline that participates in the program. There are some international airlines who do not participate even though they depart from US airports. Check the list here.

If you are flying on an eligible airline:

- Add your Known Traveler Number to your flight reservation

- Make sure “TSA PRE” printed on your boarding pass

- Enjoy the shorter lines!

You must link your KTN to your flight reservation. You can add it to your frequent flier account, add it when you are making a reservation, or add it after you have made your reservation. If your TSA PreCheck status does not make it onto your boarding pass, you will NOT be able to use the TSA PreCheck lane.

Getting Global Entry For Kids

Applying for Global Entry for kids is almost the exact same process as applying for an adult. The only difference is, kids must have parent or guardian permission to apply so you’ll need to enter parent/guardian info on the application.

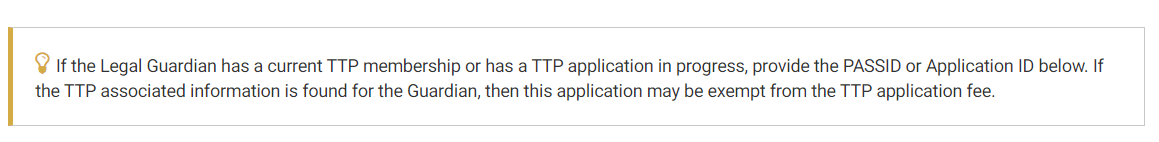

If parents and kids are applying for global entry at the same time, fill out the parent’s application first. Once your application is submitted, you’ll get an application ID #. As the parent or guardian, you’ll need that number when you apply for your kids to get their application fee waived.

If the parent already has Global Entry when you go to apply for your kids, you’ll enter your PASS ID on the application under parent info.

Applying for Global Entry for Minors

Each individual must have their own account to apply for Global Entry so you’ll need to create a separate account for each child with a unique e-mail address. You can’t apply for multiple children on one application, they each need their own.

Bonus Tip: Gmail has a trick where you can create multiple email addresses under one account. By adding a + followed by additional characters or numbers, you can create unique email addresses that all go to the same inbox. For example, if your email is parentname@gmail.com, you could do parentname+kid1@gmail.com and those emails will go to the same inbox. You can do this for multiple children and they’ll all go to the same inbox. Just add something after the + to help you know which child the email account is for.

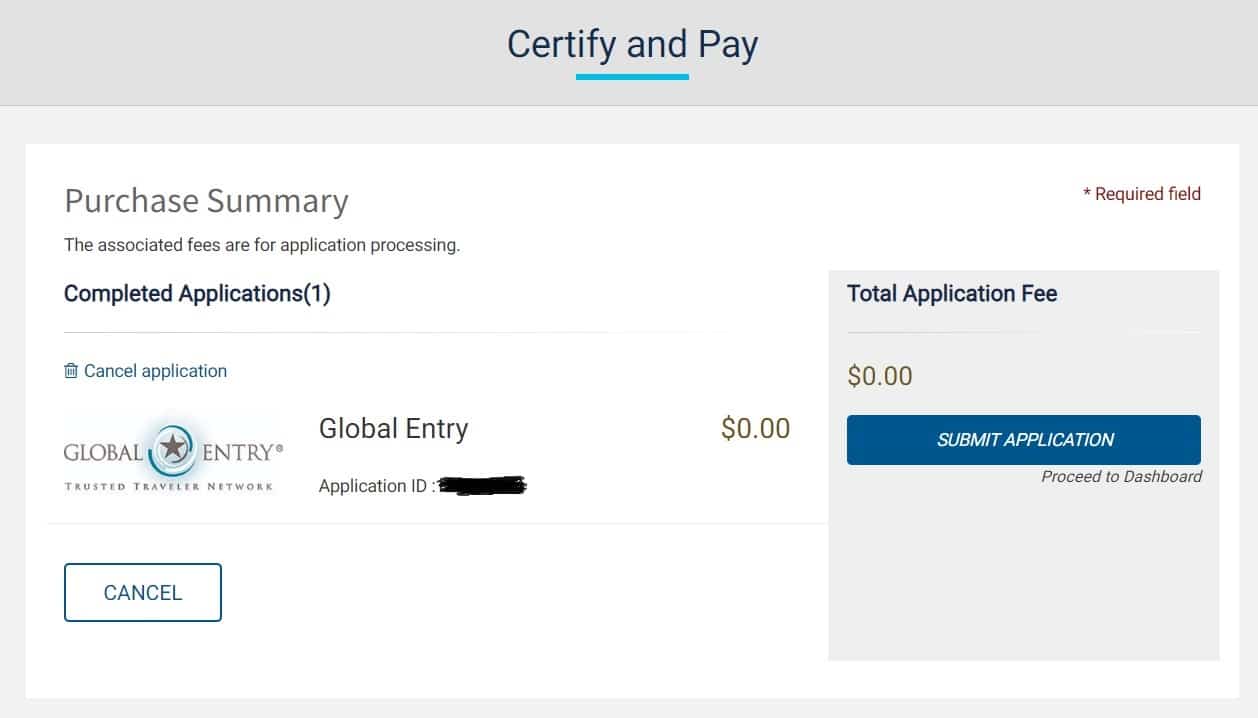

Global Entry Fee for Minors

As of October 1, 2024, Global Entry is free for minors if a parent already has Global Entry or is applying for Global Entry at the same time.

When you first create an account for your minor children, you’ll see the fees listed, but those will be removed during the application process. If a parent already has Global Entry or has an application in process, you’ll need to include that parent’s information on the application. Then the fee will change to $0.

Once you submit the application, you’ll wait for conditional approval, just like when applying for an adult. When the application is conditionally approved, you’ll be ready to schedule an interview. Everyone must go through the interview process, even babies!

Which cards offer this benefit for free?

For a complete list, see the TSA website’s list here.

Some of our favorite cards are on this list – including the Chase Sapphire® Reserve, Capital One Venture Rewards Credit Card and Venture X Rewards Credit Card, and Southwest® Rapid Rewards® Performance Business Credit Card – and provide a statement credit for the cost of Global Entry or TSA PreCheck once every four years.

Note that this statement credit can be used for anybody – it does not have to be used for the primary cardholder. So if you have multiple cards with this benefit, you can get Global Entry for yourself on one card and for someone else with your other card(s).

Best Overall Cards With TSA Precheck

The Capital One Venture X Rewards Credit Card and Capital One Venture Rewards Credit Card are both in our Top 5 Credit Cards. These are solid cards that offer great benefits and sign up bonuses. Both of these also offer a statement credit for TSA Precheck or Global Entry!

Note: On October 1, 2024 the cost for Global Entry increased to $120. Capital One, Chase, Citi, Barclay’s, and American Express all increased the reimbursement on their cards that offfer this benefit to cover the full $120.

Annual Fee:

Cards with annual fee waived the first year

ELEVATED OFFER!

Non-affiliate offer:

up to 85,000 Bonus Points

Requires a flight attendant code + adding an authorized user to earn the full bonus. Email nicole@katiestraveltricks.com for a flight attendant code!

All information about this card has been collected independently by Katie’s Travel Tricks.

Annual Fee:

non affiliate link

Annual Fee:

$95

(waived the first year)

Cards with a $99 annual fee or less

Annual Fee:

Annual Fee:

Annual Fee:

$49

Cards with an annual fee from $199-$250

Annual Fee:

Terms apply to American Express benefits and offers. Enrollment is required for select benefits. Visit americanexpress.com

Premium Cards (annual fees $450+)

Annual Fee:

affiliate link

Annual Fee:

Terms apply to American Express benefits and offers. Enrollment is required for select benefits. Visit americanexpress.com

affiliate link

Annual Fee:

Terms apply to American Express benefits and offers. Enrollment is required for select benefits. Visit americanexpress.com

affiliate link

Annual Fee:

Terms apply to American Express benefits and offers. Enrollment is required for select benefits. Visit americanexpress.com

affiliate link

Annual Fee:

Terms apply to American Express benefits and offers. Enrollment is required for select benefits. Visit americanexpress.com

Alternatives to Global Entry and TSA PreCheck

If you don’t have Global Entry or TSA PreCheck, there are several other options that can help make your travel a bit smoother.

NEXUS and Sentri are two additional Trusted Traveler Programs that your credit card may cover. These programs are primarily for those who are looking for expedited crossing between the U.S. and Canada (NEXUS) or expedited entrance into the U.S. from Canada and Mexico (Sentri). While these programs have their own benefits, enrollment centers are limited and only located near the Canadian and Mexican borders.

CLEAR

CLEAR is a private company that offers an expedited airport security experience through the use of biometric information (iris scan) to verify your identity.

CLEAR lines at major airports are often empty. CLEAR is more expensive ($199) than both Global Entry and TSA PreCheck, and is only valid for one year. American Express Platinum card offers a $209 Clear+ credit and the American Express Green card offer a $199 CLEAR credit. Children go through Clear free, and you can add additional adults to your membership for $60 per person.

If you are interested in trying Clear you can sign up for a CLEAR trial for you and your family here.

Mobile Passport Control App

If you are looking for expedited reentry into the U.S. without Global Entry, be sure to download the Mobile Passport Control app on your phone before your flight.

This free app allows eligible travelers to submit passport and customs declaration information to Customs and Border Protection electronically, after arrival at one of the 38 participating locations. You will then have access to an expedited passport control line. You can read all about Mobile Passport Control here.

Table of Contents

- What Is TSA PreCheck?

- What Is Global Entry?

- Should I get TSA PreCheck or Global Entry?

- After approval, then what?

- Getting Global Entry For Kids

- Which cards offer this benefit for free?

- ELEVATED OFFER!

- ELEVATED OFFER!

- ELEVATED OFFER!

- ELEVATED OFFER!

- LIMITED TIME OFFER

- ELEVATED OFFER!

- LIMITED TIME OFFER

- Alternatives to Global Entry and TSA PreCheck

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.