All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from our partners. American Express is a Katiestraveltricks.com advertiser. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Guide to Capital One Venture Miles

Capital One Venture miles have some unique redemption options for a wide range of travel expenses and even select non-travel purchases like event tickets.

The Venture Miles Ecosystem

You can earn Venture miles directly with certain credit cards or by moving cash back from other Capital One cards.

Personal Cards that Earn Venture Miles

- Capital One Venture X Rewards Credit Card

- Capital One Venture Rewards Credit Card

- Capital One VentureOne Rewards Credit Card

- Capital One VentureOne Rewards for Good Credit

Business Cards that Earn Venture Miles

- Capital One Venture X Business card

- Capital One Spark Miles for Business

Note: Spark Miles cards do report to personal credit bureaus and impact 5/24 status

If you hold a Capital One card that earns cash back and one that earns Venture miles, you can convert cash back earned into Venture miles. If you convert $100 cash back, it will become 10,000 Venture miles.

Full list of cashback cards that can be converted to Venture Miles

Personal cards:

- Capital One Quicksilver Cash Rewards Credit Card

- Capital One Quicksilver Cash Rewards for Good Credit

- Capital One Quicksilver Secured Cash Rewards Credit Card

- Capital One QuicksilverOne Cash Rewards Credit Card

- Capital One Savor Cash Rewards Credit Card

- Capital One Savor Cash Rewards for Good Credit

- Capital One Savor Student Cash Rewards Credit Card

Business cards:

- Capital One Spark Cash

- Capital One Spark Cash Plus

- Capital One Spark Cash Select

- Capital One Spark Classic for Business

Note: Spark Cash cards do report to personal credit bureaus and impact 5/24 status– except for the Capital One Spark Cash Plus.

Sharing Miles

Venture miles can be transferred to any individual, meaning that you can pool miles for group travel with family or friends at any time for free. This policy is far more generous than many competitors.

Earning Venture Miles

Earning on Everyday Spending

Venture cards offer a straightforward earning structure. The Venture X and Venture cards consistently earn 2x miles on nearly all purchases.

Capital One Travel

Elevated earning rates are available when booking travel through Capital One Travel or the Capital One Business Travel for business cards. Earning rates vary per card. Venture X cardholders booking hotels and rental cars through this portal can earn 10x miles per dollar.

Flights booked through Capital One Travel earn 5x miles.

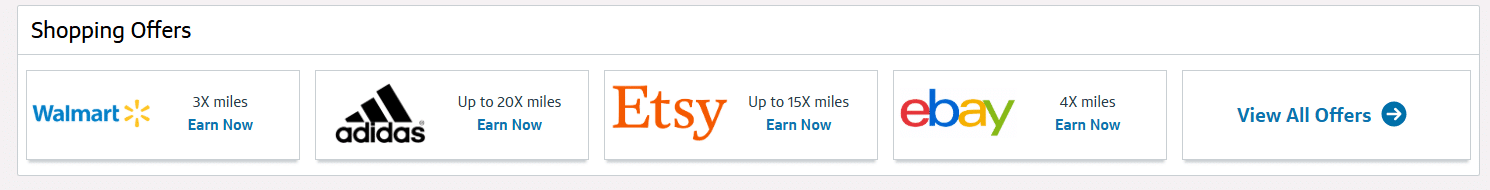

Capital One Offers

In your Capital One credit card account, you’ll find a section called “shopping offers”. Capital One used to offer cash back for their offers, but now most of them earn miles. And some offers earn a lot of miles!

Offers are targeted and change regularly.

The shopping offers work like a shopping portal. When you click through an offer, you’ll be taken to the merchant. You earn bonus miles when you make an eligible purchase through that shopping link.

You don’t have to pay with a Venture card, but you do have to click through the shopping offer link before making the purchase in order to get the bonus miles.

Be sure to look at the terms and conditions for specific details and exclusions as these can change depending on the merchant.

Convert Cashback to Venture Miles

If you have a Capital One card that earns cashback and a card that earns Venture Miles, you can convert the cashback from your cashback card to Venture Miles.

The cashback cards that qualify for this are the Quicksilver, Savor, and Spark Cash cards (see above for a full list).

You’ll also need a miles earning card such as the Venture, VentureOne, Venture X, Venture X Business, and/or Spark Miles for Business.

To convert your miles, go to your card account and select “view rewards”. From there, select “combine rewards” and choose the account you want to move the cashback to.

You can also combine Venture Miles with a friend or family member using the same process for free!

Note: It’s worth noting that you can convert cashback into miles, but you can not convert miles into cashback with this process. However, if you want to redeem your miles for cashback, there are some ways to do that!

Easiest Way to Redeem Venture Miles

Initially, Venture miles were primarily designed for offsetting travel purchases.

When an expense is coded as travel by the merchant, you can use Venture miles to offset the charge. Eligible travel purchases are categorized by merchant coding and include things like airlines, hotels, car rentals, public transportation, etc.

By using Venture Miles to retroactively “erase” these travel expenses from your statement, you effectively redeem miles for cash back against travel.

A practical example is utilizing Venture miles for Disney tickets. Tickets acquired directly from Disney World may code as “entertainment,” but purchases through online travel agents like Undercover Tourist typically code as “travel,” which enables point redemption. As an added benefit, Undercover Tourist often offers Disney tickets at rates below those available directly, helping you save even more.

This direct redemption method provides a consistent value of one cent per mile. If you have 75,000 Venture miles, it equates to $750 in travel credit.

This can also be a great use of miles if you want to offset a cheap cash ticket. Flights to Europe, for instance, are often in the $400s and you can often use fewer miles by offsetting them this way versus transferring to a partner.

Intermediate to Advanced Strategies for Venture Mile Redemptions

Erasing travel purchases can be a great way to stretch your travel budget, but it’s not the only way to use Venture Miles! Let’s look at some ways to supercharge your miles.

Pre-Earn Redemption

Capital One’s system allows you to actually use points before you even earn them.

Practical Scenario: A Venture X cardholder with a $4,000 spending requirement for a 75,000-mile bonus could book a $4,000 cruise on the new card. Upon statement closure, the 75,000-mile bonus, plus 8,000 miles from the purchase, would be awarded. Those 83,000 miles (equaling $830) could then be applied as a statement credit against the cruise purchase.

This works because any travel purchases within the previous 90 days are eligible for redemption.

Optimizing Capital One Travel Bookings

You can use your Venture Miles to pay for travel travel directly in the Capital One Travel portal, but don’t do that! An even better approach is to book hotels and rental cars via the portal and check out with your Venture X card. That way, you make the most of the 10x mile earning rate.

Then, you can still redeem miles against the travel charge on your statement. You’ll use the same amount of miles either way, but by putting the charge on your card first, you also earn miles from the purchase.

Practical Scenario: A Venture X cardholder books a car rental using the Capital One Travel portal. The total cash cost is $300. They could use 30,000 miles to pay for that purchase when they make the booking. OR they could charge that $300 to their Ventur X card and earn 3,000 miles (10x miles). Then, they could still erase that travel charge with 30,000 miles.

This maximizes miles earnings while still allowing you to redeem miles to cover the travel expense.

- Consideration: Booking hotels through Capital One Travel may keep you from earning hotel loyalty points or utilizing elite status benefits. This strategy is most effective for independent hotels or non-loyalty-affiliated stays.

- Price Assurance: Capital One Travel provides a price match guarantee. If you find a lower publicly available rate within 24 hours of booking, Capital One will provide a credit for the difference.

Major League Baseball Ticket Redemptions: One really unique redemption option is using your Venture miles for Major League Baseball tickets. Priced at 5,000 miles per ticket, this can offer compelling value for premium game experiences. Availability is typically released in blocks, so you’ll want to check regularly for the best ticket opportunities.

Transfer Partner Sweet Spots: Airlines

Beyond direct redemptions to cover travel expenses, Venture Miles can be transferred to a network of airline and hotel partners. This often unlocks increased value for certain sweet spots.

If you’re new to transferring miles, I highly recommend you check out our guide to transferring points. This walks through the basics of transferring points and also includes a handy chart to show you which bank points transfer to which airline and hotel programs.

Here are some key airline transfer partners and their specific strengths:

Air Canada Aeroplan (Also a Chase Ultimate Rewards partner)

Aeroplan, a Star Alliance member, is noteworthy for not imposing fuel surcharges on award tickets and for its stopover policy. For just 5,000 miles, you can incorporate a stopover into your itinerary, effectively visiting multiple destinations within a single award ticket. Note: There can be steep fees (often $150 per ticket) to cancel award tickets.

Avios (Brisith Airway, Qatar, and the Avios Ecosystem) (Also a Chase Ultimate Rewards partner)

Transferring to British Airways Avios grants access to a broader ecosystem of Avios-based programs, including Aer Lingus, Iberia, and Finnair. While Avios programs can offer excellent award pricing, fuel surcharges are typically applied. That means taxes and fees are often high. If you want to learn more about Avios sweet spots, check out my podcast episode here about ways to use Chase Ultimate Rewards. More details are covered for domestic flight sweet spots here.

Flying Blue (Air France/KLM) (Also a Chase Ultimate Rewards partner)

Flying Blue, the loyalty program for Air France and KLM, has relatively low cost awards to Europe. Promotional award rates can be as low as 15,000 miles each way, although taxes and fees can be significant, upwards of $200 roundtrip per person. Flying Blue also allows for complimentary stopovers in Amsterdam or Paris.

Japan Airlines

The transfer ratio is 2:1.5 so it’s not quite 1:1. Even so, Japan Airlines (JAL) is a really great transfer option for flights to Japan. This is one of the nicest airlines to fly to Japan and JAL has more award availability when you use their own miles. Full guide here.

Qantas

Particularly relevant for travel to Australia and New Zealand. Qantas offers a non-stop route from New York to Auckland with relatively reasonable economy award pricing. We found routes for around 75,000 points + $150 in taxes. While Qantas is often part of broader routing options in our destination guides, fuel surcharges can be elevated on other routes.

Singapore Airlines (Also a Chase Ultimate Rewards partner)

Great for flying on Singapore Airlines, particularly for routes to Southeast Asia.

Virgin Red

While not solely an airline program, Virgin Red integrates with Virgin Atlantic and unlocks cruise redemptions. Virgin Atlantic has recently adopted dynamic award pricing, which has (in some cases) yielded really low award fares. Particularly in economy class on US-London routes (as low as 6,000 miles + $80 in taxes). This could be strategically combined with other return travel methods from Europe.

Transfer Partner Sweet Spots: Hotels

Venture miles extend to hotel transfer partners as well. Some of the most notable are Choice Privileges and Wyndham Rewards.

Choice Privileges

Often undervalued, Choice Privileges, which includes brands like Comfort Inn and Quality Suites, offers good value, particularly in Europe. European Choice properties tend to offer enhanced quality and family-friendly accommodations.

Choice Sweet Spots:

-

- European Accommodations that Sleep a Family of Four: Choice’s European portfolio often includes hotels with larger rooms suitable for families. And here’s a map to help you find those family-sized hotel rooms in Europe.

- US Suites: Select US properties, especially within the Ascend Collection, offer suite redemptions with your points. Check out this Choice Privileges map that we made to help you find these properties!

- Preferred Hotels: Access to higher-end independent hotels within the Preferred Hotels & Resorts network at competitive rates. We have a map for Preferred Hotels with Choice Points, too!

Earning Optimization for Choice Points:

While Venture miles transfer at a 1:1 ratio to Choice, Citi ThankYou Points and Wells Fargo Rewards points offer a better 1:2 transfer ratio. This makes programs like Citi Strata Premier or Wells Fargo Autograph Journey more efficient for accumulating Choice points.

Wyndham Rewards

Wyndham’s portfolio spans a range of hotel and resort properties, primarily in the US, with award nights starting at 7,500 points, but more commonly priced between 15,000 to 30,000 points per night.

One of the things I like about Wyndham is the ability to book larger rooms, including multiple bedrooms. Additionally, if you’re looking for all-inclusive options, they have some available.

- Wyndham Card Benefit: Wyndham credit card holders receive a 10% discount on award bookings, reducing your point costs even more.

Capital One Referral Program Note

You can earn miles when you refer someone and they open up a new Capital One Credit Card.

Capital One’s referral program has a specific condition: referral bonuses are only awarded if the referred individual is a new Capital One credit card customer.

Order to Open Cards

When opening Capital One credit cards, it’s good to be strategic about the order in which you open them. This is because Capital One terms state that if you have earned a welcome offer on a card, you won’t be eligible to earn the welcome offer on the same card or another card in the same family with a lower annual fee for 48 months.

The Venture One, Veture, and Venture X cards are all in the same family. This rule means that if you open a Venture X card first, you won’t be able to earn a bonus on another Venture X, the Venture, or Venture One Card for 48 months. The rule doesn’t apply when you are getting a card with a higher annual fee. So if you start with Venture One, you’re still eligible to get the welcome offer on a Venture or Venture X without waiting the 48 months.

To be eligible to earn a bonus on all of the cards in less time, start with the Venture One, then the Venture, and get the Venture X last.

Regardless of this rule, I still think it is ok to start with the Venture X first, even though it means giving up the welcome offer on the Venture and Venture One cards! That’s because there are a lot of business cards with Capital One that still offer opportunities to earn more Venture miles — including all the Spark Cash and Spark miles cards.

Stay Up to Date

To stay informed about the latest travel rewards opportunities and updates, consider subscribing to our newsletter, delivered every Saturday morning.

Table of Contents

- The Venture Miles Ecosystem

- Earning Venture Miles

- Convert Cashback to Venture Miles

- Easiest Way to Redeem Venture Miles

- Intermediate to Advanced Strategies for Venture Mile Redemptions

- Transfer Partner Sweet Spots: Airlines

- Air Canada Aeroplan (Also a Chase Ultimate Rewards partner)

- Avios (Brisith Airway, Qatar, and the Avios Ecosystem) (Also a Chase Ultimate Rewards partner)

- Flying Blue (Air France/KLM) (Also a Chase Ultimate Rewards partner)

- Japan Airlines

- Qantas

- Singapore Airlines (Also a Chase Ultimate Rewards partner)

- Virgin Red

- Transfer Partner Sweet Spots: Hotels

- Capital One Referral Program Note

- Order to Open Cards

- Stay Up to Date

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.