All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from our partners. American Express is a Katiestraveltricks.com advertiser. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Citi Strata Premier® Card vs Citi Strata Elite℠ Card: Comparison

The Citi Premier Card relaunched as the Citi Strata Premier on May 12, 2024. The card kept many of the same benefits as the previous version and added some new benefits as well.

On July 27, 2025, Citi launched a new premium card called the Citi Strata Elite℠ Card. This article walks you through the similarities and differences between the two cards.

Similarities Between the Cards

Extended Warranty Protection

Both cards offer excellent extended warranty protection.

The Extended Warranty is the best in the business and a reason to keep one of these cards (or another one from Citi) long term. You get a full 2 years of warranty on items that you purchase with the Citi Strata Premier.

With the Citi Strata Elite℠ Card, the length of the manufacturer’s warranty or store warranty is doubled, up to a period of 24 months.

We have used this benefit for anything from washing machines to clothes.

Travel Insurance

Both cards offer travel insurance as well. Here’s what you can expect:

- Trip Delay Protection

- Trip Cancellation & Interruption Protection (Common Carrier)

- Lost or Damaged Luggage

- Secondary Car Rental Coverage (the Elite provides primary coverage outside the cardholder’s primary country of residence)

No Foreign Transaction Fees

Both cards offer no foreign transaction fees.

Points Sharing

Citi allows you to transfer points to another Citi cardholder for free. This makes it easy to pool points with a friend or family member. You can send up to 100,000 points per year and receive up to 100,000 points per year.

Before you send points to a friend, make sure you have a plan to use those points! Any shared points expire 90 days after the transfer so you’ll want to use them pretty quickly.

Options for Redeeming Points

Both cards allow you to redeem your points in a variety of ways.

- Redeem for cash back at a rate of .75 cents per point (10,000 points = $75)

- Transfer to hotel and airline partners

- Book travel through CitiTravel.com

- Redeem for gift cards or shop with points (these options generally offer less value)

Access to The Reserve by Citi Travel

The Reserve is a collection of luxury hotels you can book through CitiTravel.com. When you make a reservation for one of these hotels in Citi Travel, you get extra perks like free breakfast, $100 experience credit, room upgrades, late checkout, and more. The exact benefits vary by location and are subject to availability.

You can book The Reserve collection in Citi Travel with either the Premier card or the Elite card to get these benefits.

Citi Strata Premier® Card Details

Annual Fee: $95

Authorized users are free.

Earning rates:

- 10 ThankYou points for each $1 spent on hotels, car rentals, and attractions booked through CitiTravel.com

- 3 ThankYou Points for each $1 spent at restaurants

- 3 ThankYou Points for each $1 spent at supermarkets

- 3 ThankYou Points for each $1 spent at gas stations and EV charging stations

- 3 ThankYou Points for each $1 spent on air travel and hotels

- 1 point for everything else

Citi Strata Premier® Card Perks

- Once per calendar year, get $100 off a single hotel stay of $500 or more, excluding taxes and fees, when booked through CitiTravel.com

I think the $100 hotel credit isn’t that useful to most people, but you may find a good option. Hotel rates at CitiTravel.com (where you have to book to get this benefit) can be inflated, so you may not actually save $100. But you never know, and it is worth checking if you are going to pay cash anyway.

non affiliate link

Current offer:

This is a non-affiliate link. To see a curated list of affiliate links for cards that can help you earn airline miles to fly on one world airlines, click here.

Annual Fee:

Citi Strata Elite℠ Card Details

Annual Fee: $595

It costs $75 per year for each authorized user.

Earning rates:

-

- 12 ThankYou points for each $1 spent on hotels, car rentals, and attractions booked through CitiTravel.com

- 6 ThankYou Points for each $1 spent on air travel through CitiTravel.com

- 6 ThankYou Points for each $1 spent at restaurants during “Citi Nights” (Fridays and Saturdays between 6 p.m. and 6 a.m. Eastern Time)

- 3 ThankYou Points for each $1 spent at restaurants during all other times

- 1.5 points for everything else

Citi Strata Elite℠ Card Perks

-

- Up to $300 annual hotel credit (valid on hotel stays of at least two nights booked through CitiTravel.com). This is a calendar year credit.

- Up to $200 annual Splurge credit (on your choice of up to two brands, including American Airlines, Best Buy, Live Nation, 1st Dibs, and Future Personal Training). This is a calendar year credit.

- Up to $200 annual Black Lane credit

- Priority Pass Select Membership

- 4 American Airlines Admirals Club Passes per calendar year

- Up to $120 credit for Global Entry or TSA Pre Check

Like with other premium cards, the Citi Strata Elite comes with a lot of perks and credits to help offset the annual fee. If you’re able to make use of these credits, the card can be a good value. When deciding if a credit card is a good fit, it’s important to look at the credits and determine which ones are actually useful for your family.

Calendar Year Credits (and Double or Triple Dip)

Most of the credits on this card follow a calendar year which means they reset every year on January 1st. That opens up some opportunities for double or triple dipping credits, even when paying just one annual fee.

If you apply for the card in December, you’ll get the credits right away! Then they’ll reset on January 1st and you can use them again. Even when your 2nd annual fee posts, you still have 30 days from that point to make a decision on if you will be keeping the card or not. You may even be able to use those credits the following January.

$300 Hotel Credit

This credit is for up to $300 but does require a 2 night stay and requires you to book through Citi Travel. It works like a coupon — it will come off at the time of booking.

This is a calendar year credit which means it resets every year on January 1.

My Take: Citi Travel is powered by Booking.com which means prices are good and selection is plentiful. If you book a cheaper hotel, it should be easy to take advantage of thsi!

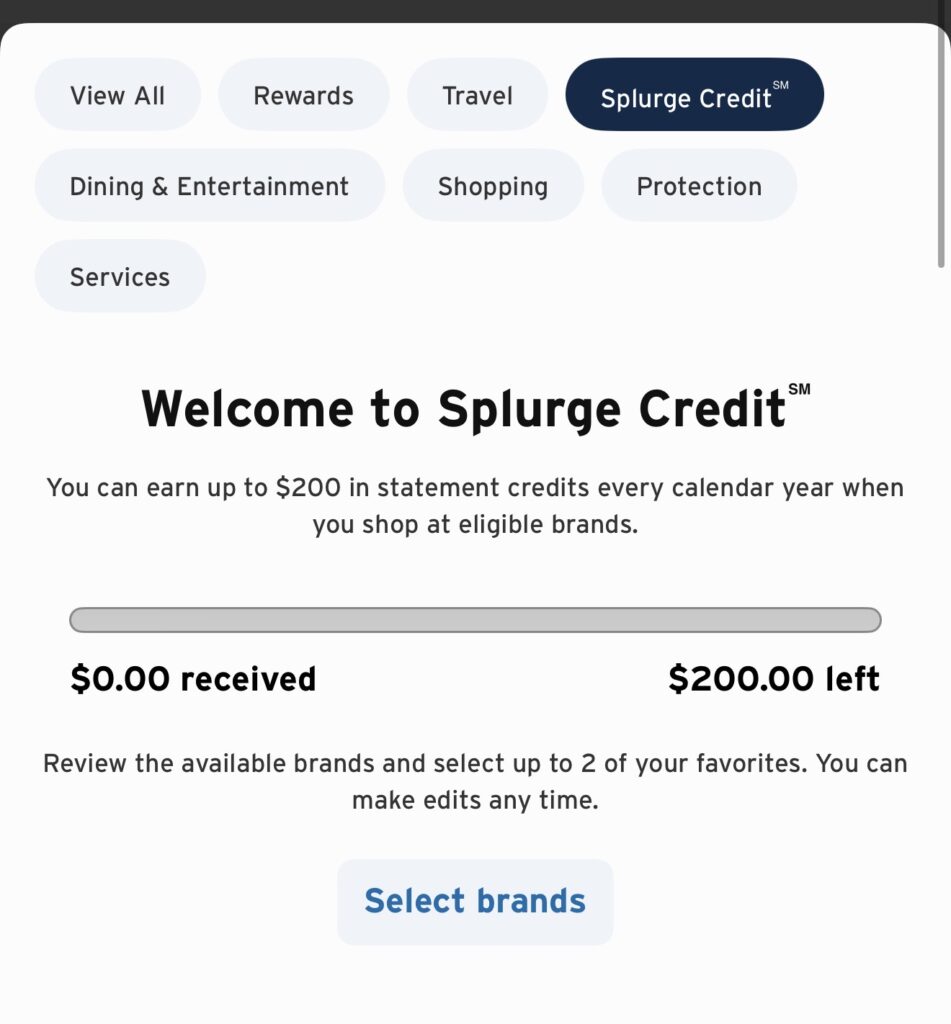

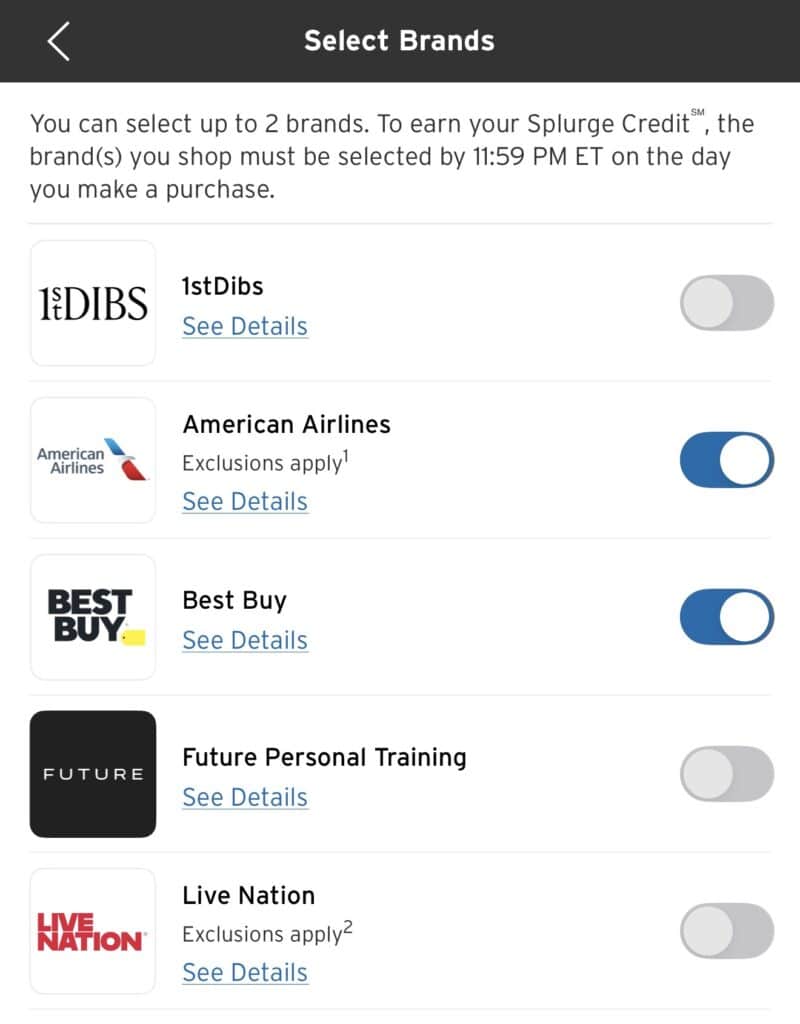

$200 Splurge Credit

To use this credit, you must select 1-2 brands from the list (American Airlines, Best Buy, Live Nation, 1st Dibs, and Future Personal Training) and enroll before making a purchase. You can find this under benefits in the app or website.

The tracker will show how much you have used.

Then you can select up to 2 brands.

Screenshot

Once you’re enrolled, you can change your preferred brands at any time.

It’s easy to get the full value from this credit. If you fly on American Airlines, the credit can be used for flights, baggage fees, and in-flight purchases.

If you select Best Buy, you can even buy gift cards at Best Buy for places you shop at anyway like Amazon, Airbnb, etc and use them to do your regular spending. Data points have been showing that even if you buy gift cards online it will work. Don’t buy Best Buy gift cards online as these are processed by another website and WILL NOT trigger the credit. Instead look for 3rd party gift cards like Amazon.

This is a calendar year credit which means it resets every year on January 1.

Black Lane

The Black Lane credit is good for $100 off, twice a year. This is a premium chauffeur service. The rides are so expensive, you’ll often end up spending more money than you save. Even after the credit, Black Lane usually costs considerably more than a rideshare or regular taxi.

Lounge Access

The Priority Pass membership allows the cardholder and two guests to enter the lounge for free. Authorized users get their own Priority Pass and can also bring two guests into the lounge. This is for lounges only (does not include Priority Pass restaurants or experiences)

Remember it costs $75 per year to add an authorized user to this card.

You actually don’t need to register for Priority Pass or have a physical Priority Pass card to access lounges; you can just present your Citi Strata Elite card at a Priority Pass lounge and gain access for the cardholder plus up to two complimentary guests. You can choose to request a digital Priority Pass account here.

Citi doesn’t have its own lounge network like Chase or American Express but this card does have a unique perk which is 4 Admirals Club passes per year.

Using the Admirals Club Passes

- You receive 4 per year.

- Each pass is good for 24 hours once it is activated and can be used multiple times in that 24 hour period. They can even be used on arrival.

- Each adult needs their own pass, and the primary cardholder must be present to use any passes.

- Authorized users don’t get their own passes.

- Up to 3 kids under 18 can enter for free using an adult’s pass! That means a family of 8 could get into an Admirals Club with just two passes (as long as your kids are under 18).

non affiliate link

Current offer:

This is a non-affiliate link. To see a curated list of affiliate links for cards that can help you earn airline miles to fly on one world airlines, click here.

Annual Fee:

Citi Strata Elite℠ Card: What's It Worth to You?

Enter your personal estimated annual value for each benefit to see a customized calculation of the card's worth.

Your Total Annual Value:

Annual Fee: $595

Your Net Value / Cost:

How to Use Citi ThankYou Points

Transfer to American Airlines at 1:1

Citi is currently the only transfer partner for American Airlines (this is new since summer 2025, previously there were none). Using American miles is one of the cheapest ways to get to Japan and Hawaii.

Transfer to Qantas at 1:1

You can use Qantas points to book flights to Australia and New Zealand. Qantas tends to have more award availability to/from New Zealand than other programs, which makes this a nice option.

To fly from the West Coast to Auckland booked with Qantas costs about 86,000 miles and $220 in taxes and fees roundtrip. Qantas also offers a non-stop from JFK to Auckland, which is a nice option from the East Coast.

Transfer to Choice Hotels at 1:2

With a transfer rate of 1:2, this option can provide some phenomenal value. That means if you transfer 50,000 Thank You points, you will have 100,000 Choice points.

Choice Hotels is often overlooked as a points program because it has a lot of lower-end properties in the US. But it actually has a number of great properties in Europe. Most hotels in the Preferred Hotel Collection are bookable with Choice points as well.

Also – Choice has a number of Ascend Collection hotels which are often independent, historic, or boutique hotels that partner with Choice Hotels. This collection includes a lot of unique options from 4-bedroom cabins in Big Bear, CA to B&B properties in Florida and historic hotels in the Northeast.

Most hotel chains only allow you to book a standard hotel room with points. Some offer the option to use more points to upgrade to a suite. With Choice, though, the number of points charged is the same no matter the room type. So if a property has larger suites or even 2-4 bedroom villas available, they cost the same as a 1 room hotel room! This makes these properties great options for families.

Choice also has a partnership with Bluegreen Vacations, which has timeshare properties that usually include a full kitchen and separate living room, these are included in the Ascend Collection.

Transfer to Preferred Hotels at 1:4

I Prefer is the loyalty program for Preferred Hotels & Resorts. The program features many unique and independent boutique hotels all over the world. With the 1:4 transfer ratio, you could transfer 25,000 ThankYou points and get 100,000 I Prefer Points!

Table of Contents

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Strata Premier warranty is +2 years on basically everything.

Strata elite is “up to 2 years” but just doubles your extended warranty, so you usually only get +1 year.

Thank you, we will update our article to be more specific.

Is American Airlines a transfer partner for BOTH Citi Elite and Premier?

yes!