All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from our partners. American Express is a Katiestraveltricks.com advertiser. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Guide to Chase Ultimate Rewards®

Chase Ultimate Rewards® are the points currencty that Chase uses for its own credit cards. These points have a variety of uses, depending on the card you have.

These are some of our favorite points because they are easy to earn and there are so many ways to use them. In fact, Season 1 of my podcast is dedicated to helping you become a master at using these points! Start listening here.

What are Ultimate Rewards worth?

The value you can get out of your Ultimate Rewards varies depending on the cards you have and how you use the points.

At a minimum, each point is worth 1 cent. That means at a minimum, if you have 10,000 points you can get $100 of value. If you choose to transfer your points to airline and hotel partners or book via Chase Travel℠, you can get even more value.

This guide goes into all the options for earning and redeeming points to help you find the strategy that works best for your travel plans.

Earning Ultimate Rewards Points

The easiest way to earn points quickly is to sign up for a new credit card offering a welcome bonus. Banks regularly offer bonuses as an incentive for signing up for their credit cards.

You can get both personal and business cards. There are a variety of cards that can earn Ultimate Rewards.

In my Three Year Plan, I walk you through a strategy on how to open multiple cards over the course of three years and earn these and other points.

Personal cards that can earn Ultimate Rewards Points

Chase Sapphire Preferred® Card

Business cards that earn Ultimate Rewards Points

Ink Business Preferred® Credit Card

Ink Business Unlimited® Credit Card

Ink Business Cash℠ Credit Card

Sapphire Reserve for Business℠

Note: Chase has another business card, the Ink Business Premier® Credit Card. This card only earns cash back. It does not earn Ultimate Rewards points. Any points earned on a Premier card cannot be combined with any of your other points. They can only be redeemed for cash back. Disclosure: The information related to Ink Business Premier® Credit Card was collected by Katie’s Travel Tricks and has not been reviewed or provided by the issuer of this product/card. Product details may vary. Please see the issuer website for current information. Katie’s Travel Tricks does not receive commission for this product.

Comparing personal cards that earn Ultimate Rewards

| Card Benefits | Freedom Flex | Freedom Unlimited | Sapphire Preferred® | Sapphire Reserve |

|---|---|---|---|---|

| Annual fee | $0 | $0 | $95 | $795 |

| Cash back value of 10k points | $100 | $100 | $100 | $100 |

| Earning bonuses | 5x on up to $1500 on quarterly bonus categories | 1.5x on all purchases | 5x on Chase Travel 3x dining, online grocery purchases, and select streaming services 2x all travel |

8x on Chase Travel 4x on direct flights and hotels 3x dining 1x all other purchases |

Comparing business cards that earn Ultimate Rewards

| Card Benefits | Ink Cash | Ink Unlimited | Ink Preferred | Ink Premier | Sapphire Reserve Business |

|---|---|---|---|---|---|

| Annual fee | $0 | $0 | $95 | $195 | $795 |

| Cash back value of 10k points | $100 | $100 | $100 | $100 | $100 |

| Earning bonuses | 5x on select business categories on the first $25,000 spent in combined purchases | 1.5x on all purchases | 3x on travel, shipping, internet, phone & advertising | 2x on all purchases 2.5x on purchases for $10,000+ | 8x on Chase Travel 4x on direct flights and hotels 3x on social media & search engine advertising 5x on Lyft (through September 2027) 1x all other purchases |

Card Application Tips

The 5/24 Rule

To get approved for a new credit card from Chase, you must have fewer than five new credit cards opened (from any issuer) in the past 24 months. This is known as the 5/24 rule.

Business cards typically don't count towards this total, but some do. We have a full article explaining all about the 5/24 Rule, including which cards count and how to figure out your total.

Holding Multiple Personal Cards

You are allowed to hold both Sapphire and Freedom cards at the same time.

Chase may allow you to hold both a Sapphire Preferred and a Sapphire Reserve.

However, if you currently hold a Sapphire Preferred card, you usually won't be approved for a Reserve card and vice versa.

Eligibility Rules:

The terms and conditions for Sapphire cards state "The new cardmember bonus may not be available to you if you currently have any other personal Sapphire cards open, previously held this card or received a new cardmember bonus for this card." Some people are calling this a "once per lifetime rule" but these terms are actually vague and don't state that. We have seen data points of people being approved for the same card again after a waiting period as short as 3 years. This waiting period may vary per person. This applies to the Chase Sapphire Preferred® Card and Chase Sapphire Reserve®.

Holding Multiple Business Cards

Chase doesn't have any hard and fast rules on this, but recent data points suggest that you are much more likely to be approved for a new business card if you hold no more than 2 business cards from Chase already.

If you hold 3 or more business cards, it's possible you could still be approved, but it's less likely.

Ways to Keep Earning Ultimate Rewards Points

In addition to welcome offers, there are many more ways to earn Ultimate Rewards Points.

Max out the Freedom Flex quarterly bonus

Every quarter, you earn 5 points per dollar on a certain category with a Freedom Flex card on up to $1,500. Maxing this out each quarter will give you 30,000 points per year.

Refer friends (or your spouse) to your favorite cards

You can earn points for referring someone to open a new card account. You can generate referral links here: https://www.chase.com/referafriend/catch-all.

Note: As of October 7, 2025, if you refer someone to an Ink business card, you will only earn referral points for NEW Chase business customers. That means if the person you're referring already holds a business card from Chase, you won't earn points for referring them.

Shop Through Chase

Chase has its own shopping portal where you can earn bonus points for shopping online. If you have any card that earns Ultimate Rewards points (Freedom, Ink, or Sapphire), you can use Shop Through Chase to earn extra points.

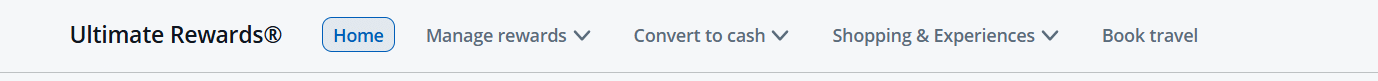

To access Shop Through Chase, log into your card account and select "Shopping and & Experiences" from the top menu. From there, select "Shop & earn bonus points".

Combining Ultimate Rewards Points from Different Cards

Any Ultimate Rewards points you earn are held on the card you earned them on. They don't have to stay there, though! You can combine any of your Ultimate Rewards points with points from any other card you hold that also earns Ultimate Rewards.

You can even combine points across business and personal accounts.

Note: Your business and personal Chase cards will not automatically appear on the same login. Follow these steps to connect them.

You can also combine points across your household. Chase allows you to combine points with one other member in your household. The first time you do this, you will need to call to get this option added to your account. After that, should be able to do it online.

Why Combine Points

You need a Chase Sapphire card or an Ink Preferred card to be able to transfer Ultimate Rewards points to travel partners like Hyatt, Southwest, or United.

If you get a no annual fee card like a Freedom card, Ink Cash, or Ink Unlimited, you still earn Ultimate Rewards points, but they can only be redeemed as cash back as long as they are held on that card.

BUT! If you have an Ultimate Rewards earning card with an annual fee, you can move your Freedom/Ink Cash/Ink Unlimited points over to your Sapphire/Ink Preferred and transfer to partners like Hyatt from there.

These are the cards that can transfer points to partners:

Chase Sapphire Preferred® Card

Chase Sapphire Reserve®

Chase Ink Preferred®

Chase Sapphire Reserve for Business℠

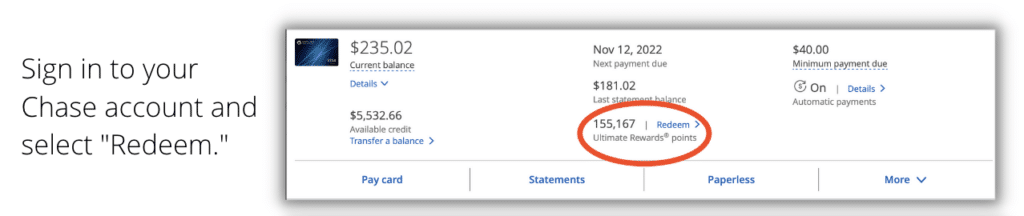

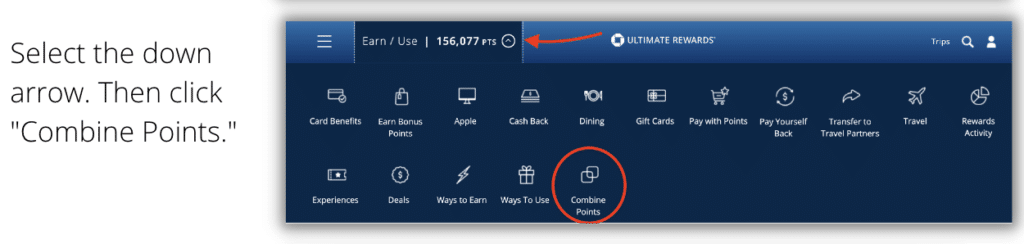

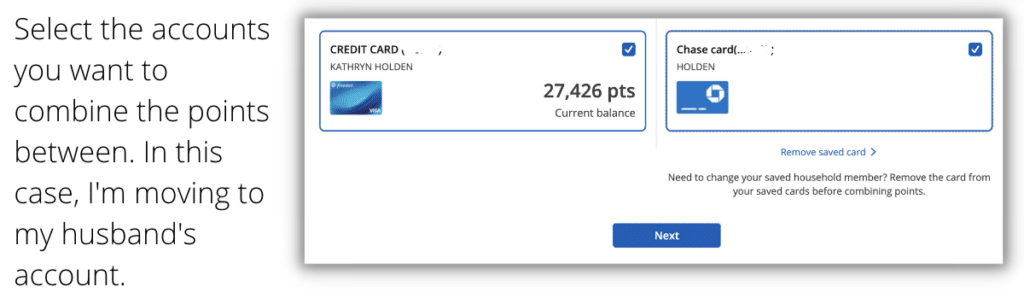

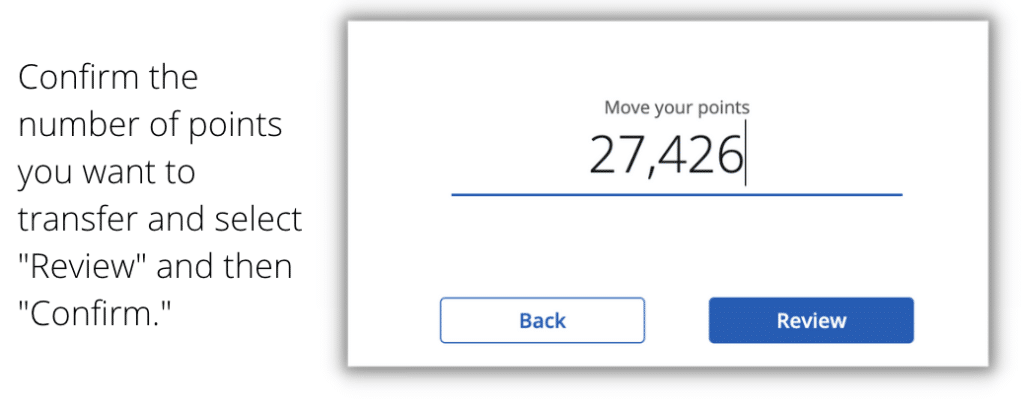

Step By Step: How to Combine Points Between Cards

This option should automatically show in your own account for all of your own cards.

Combining Across a Household: The first time you do this to combine points across your household, you will need to call to get this option added to your account. After that, should be able to do it online.

Combining Business + Personal: When you first open a business card, you will have to create a new business profile with Chase. From there, you'll be able to add your personal cards to your business profile so you can see all your cards in one place and transfer points between your accounts easily. Here's how to do this.

Once you've set up your account for household or business/personal access, you can proceed with the screenshots below.

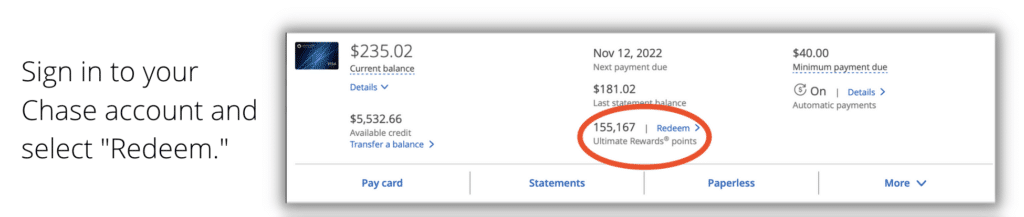

Transferring Points to Partners

Chase Ultimate Rewards can be transferred to 11 airline and 4 hotel partners at a 1:1 ratio. That means if you transfer 1,000 Ultimate Rewards, you can get 1,000 points at their partners.

Here are some examples of deals you can get when you transfer your points:

- Book round trip flights to Hawaii for 20,000-30,000 points

- Stay at Hyatt hotels for as low as 3,500 points per night

- Fly to London on Virgin Atlantic from 12,000 points round trip

For inspiration and more on sweet spots, check out this post.

More to know about transfers:

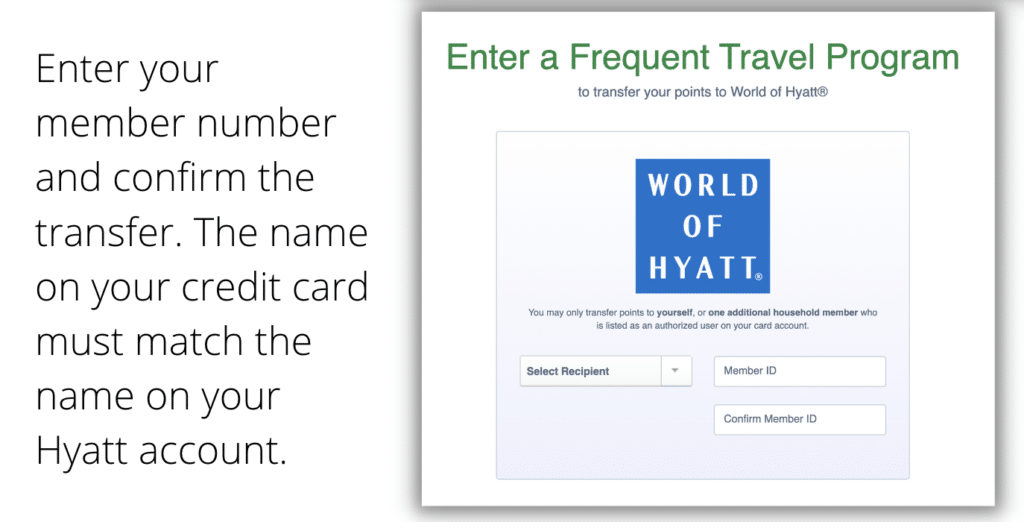

Authorized User Transfers: You can transfer points to the account owner's loyalty program as well as "to participating partner program accounts belonging to one additional household member who is listed as an authorized user on your Chase credit card account."

We generally don't recommend adding your partner as an authorized user in the first 24 months of having a card due to how it can affect your 5/24 status — but sometimes you may have specific reasons you want to transfer points to a partner's loyalty account rather than your own and this makes it possible.

You can't reverse a points transfer. Once you transfer your Chase points to an airline or hotel, you can't return them back to Chase. That's why it is important to confirm availability before you transfer them.

Some transfers are instant, and some take a few days. Transfers are usually instant, but not always. Try to avoid making a test transfer of a smaller amount, followed by a larger transfer. Sometimes this can trigger fraud alerts.

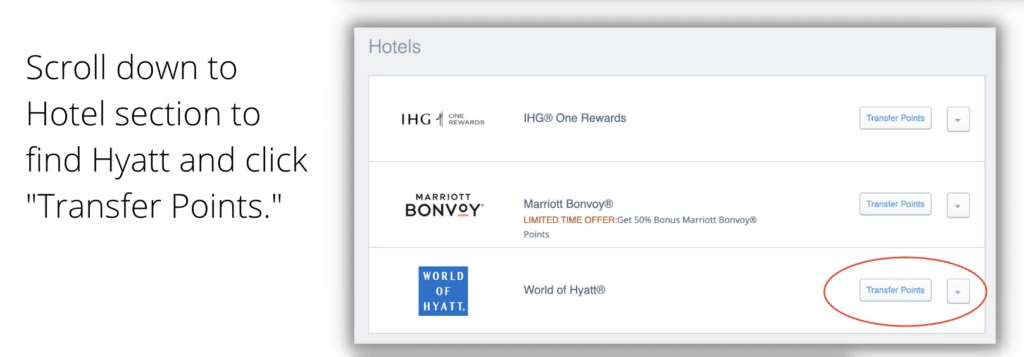

Generally, you'll get better value from transferring to airline and hotel partners. But not all airline and hotel partners are created equal! For hotels, for instance, we generally only recommend transferring to Hyatt.

Look for bonuses. Chase regularly offers transfer bonuses where you can get even more points when you transfer to certain partners.

Airline Partners

-

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- British Airways Executive Club

- Emirates Skywards

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

Hotel Partners

-

- IHG One Rewards

- Marriott Bonvoy

- World of Hyatt

- Wyndham Rewards

Step By Step: How to transfer points to partners

Using Points in Chase Travel℠

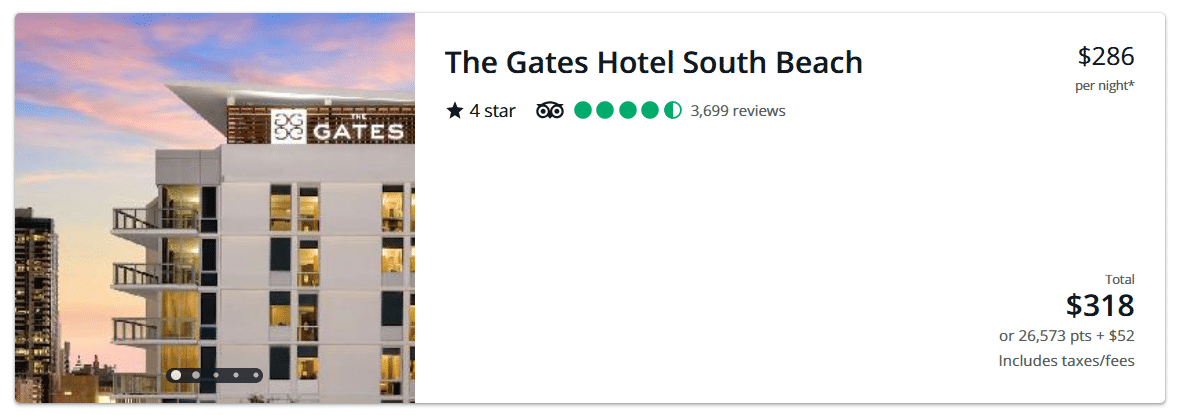

Chase Travel℠ is an online booking platform provided by Chase. You can book hotels, flights, rental cars, and more. You can pay with cash or use your points to book. Points are worth between 1 and 2 cents per point, depending on which card you have and what you book.

To access Chase Travel℠, log in to your account and choose "book travel" from the top menu.

If you're in a business account, select "benefits and travel"

You can also find this travel button on the right side of the page.

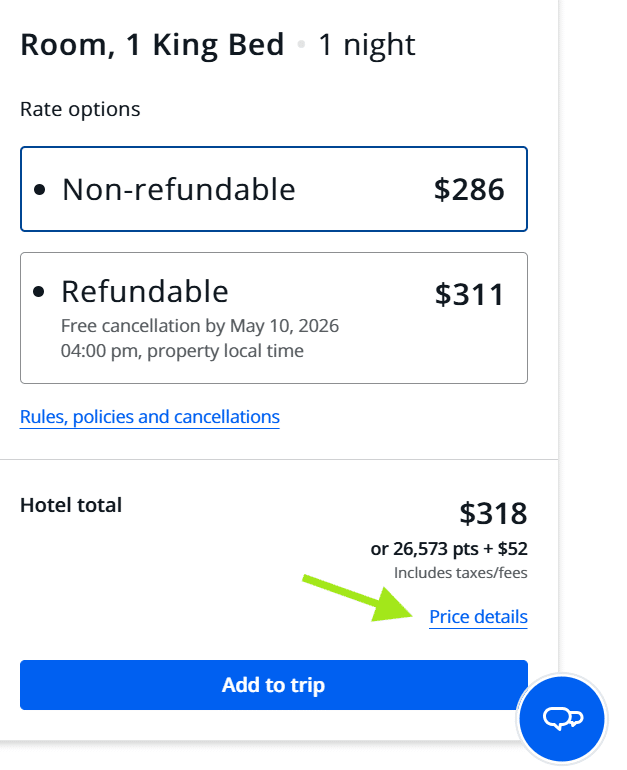

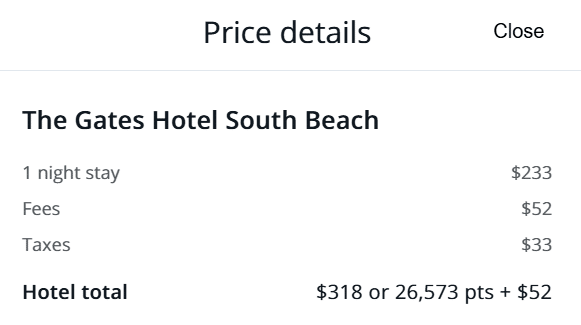

In Chase Travel℠, your points can be redeemed directly towards travel purchases. The standard rate is 1 cent per point. If you book a $200 hotel room, you could use 20,000 points to cover that purchase. If you don't have enough points to cover the purchase, you can use a combination of cash and points.

Note: Some hotels have fees that cannot be covered with points. You can check the pricing details to see the breakdown of all the charges.

Points Boost

Sapphire Preferred, Ink Preferred, and Sapphire Reserve cardholders have access to a special feature in Chase Travel℠ called Points Boost. With Points Boost, you can book certain hotels and flights for fewer points. This makes your points stretch further.

With a Sapphire Reserve card, your points can be redeemed for up to 2 cents per point for select flights and hotels when booking with Points Boost.

For Sapphire Preferred and Ink Preferred cardholders, you can get up to 1.5 cents per point for select hotels and up to 1.75 cents per point for select flights when booking with Points Boost.

If any are available, Points Boost options show up at the top of the search results. You can use the side arrows to scroll through the options.

You can also filter the results to show Points Boost only.

Note: If you hold a Sapphire Preferred or Sapphire Reserve that was opened before June 23, 2025, you can redeem any points earned prior to October 26, 2025 at an elevated value (1.25 cents per point for Preferred, 1.5 cents per point for Reserve) until October 26, 2027.

Tip: When using Chase Travel℠, Make Sure You're Booking with the Right Account

At the top right corner of the Chase Travel℠ homepage, you can select which card you want to use.

Different cards have different benefits (like Points Boost), and you'll only see those benefits if you're looking at Chase Travel with the correct card account.

For example, if you're using a Freedom card to look at Chase Travel℠, you won't see Points Boost at all, because that is a benefit only offered on the Ink Preferred, Sapphire Preferred, and Sapphire Reserve cards.

Remember, you can combine any of your Ultimate Rewards points onto any of your Ultimate Rewards earning cards.

So if you find a Points Boost property you want to book in Chase Travel℠, but you don't have enough points on your Sapphire card, you can move the needed points over from your other Ultimate Rewards earning cards and then book.

What's the best way to use my points?

This really depends on your travel style!

Using your points for cash back gives you straightforward value — if that's what you'd prefer, that's fine! Getting cash back is a good way to cover expenses like Disney tickets or cruises that are otherwise hard to cover with points.

For hotel partners, transferring to Hyatt generally gives the best value.

Each airline has opportunities for good values, depending on your home airport and where you want to go.

You can also use your points right in Chase Travel℠ to book cars, hotels, flights, cruises, and more.

Check out some sweet spots here.

Table of Contents

- What are Ultimate Rewards worth?

- Earning Ultimate Rewards Points

- Comparing personal cards that earn Ultimate Rewards

- Comparing business cards that earn Ultimate Rewards

- Card Application Tips

- Ways to Keep Earning Ultimate Rewards Points

- Combining Ultimate Rewards Points from Different Cards

- Step By Step: How to Combine Points Between Cards

- Transferring Points to Partners

- Step By Step: How to transfer points to partners

- Using Points in Chase Travel℠

- Points Boost

- What's the best way to use my points?

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.