All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com site has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Points Transfer Guide {With Dynamic Charts}

This post is all about how to get more value from your credit card points by transferring to hotel and airline partners.

Many credit cards give you the option to transfer points to airlines and hotels. This can unlock better value and help you stretch your points for more travel.

Why Transfer Points

Here’s a great example of how transferring your points can provide a better value.

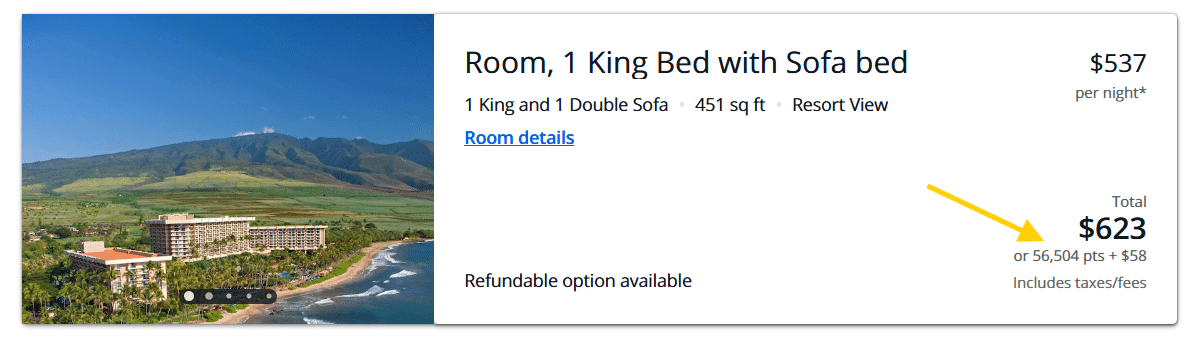

Let’s say you want to book a night at the Hyatt Regency in Maui. If you wanted to use your Chase Ultimate Rewards points and book using the Chase Travel℠ website, you can expect to pay over 50,000 points per night.

At this price point, you would need almost 400,000 points to book a 7-night stay, plus another $400+ for the fees.

Your points can stretch further if you transfer Ultimate Rewards points to Hyatt.

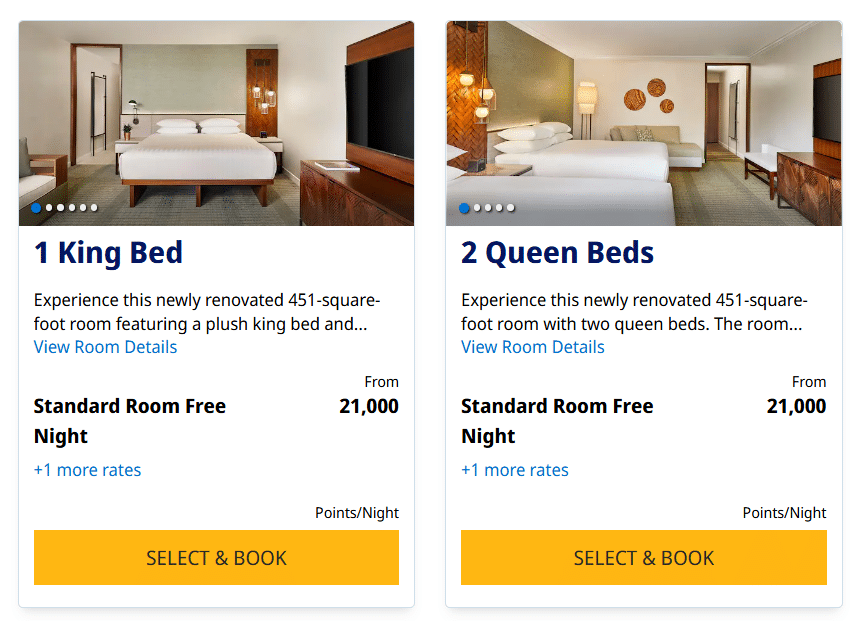

Rates at the Hyatt Regency Maui when booked through Hyatt range from 21,000-29,000 points per night–and that includes all taxes and fees! Plus, when you book an award stay with Hyatt, resort fees are also waived.

At this rate, you would only need 147,000 points to book a 7-night stay, and $0 in cash. Even if your dates are peak pricing of 29,000 points per night, a 7-night stay would only cost 203,000 points. That’s about half of what the same stay would cost if booked through Chase Travel℠.

Points Transfer Basics

This guide includes a chart that shows the transferable points “currencies” from the four most powerful programs: Chase Ultimate Rewards®, Citi ThankYou® Points, Capital One Venture® Miles, and American Express Membership Rewards®.

Before we get to the chart, here are some things to know about transferring points.

Different Credit Cards Have Different Transfer Partners

Each bank has its own collection of hotel and airline programs you can transfer to. There is quite a bit of overlap between them, but some programs offer unique redemption options. For instance, Citi is the only bank that allows transfers to American Airlines.

Not all points can be transferred to other programs

While most major banks have their own kind of points currencies that can be transferred to a variety of hotel and airline programs, not all do.

Usually, if you have points or miles specific to an airline or hotel (like American Airlines, Hyatt hotels, etc), these cannot be transferred to another program.

You Can’t Reverse a Points Transfer

Once you transfer your points from a bank’s flexible points currency to an airline or hotel program, they are stuck in that program until you use them. You can’t reverse a transfer or transfer points back to the bank.

Because of this, it’s important to confirm availability before you transfer points.

Some transfers are instant, and some take a few days

Sometimes, if you have a new loyalty membership, it can take a few days for a points transfer to go through.

Don’t do a “test transfer” first of a smaller amount. This can trigger a fraud alert, which makes your second transfer take longer to go through.

Hotels Have Limited Numbers of Rooms Available to Book with Points

Hotels only release a certain number of rooms that are available to book with points. Sometimes, the standard room is the only one bookable with points. You may be able to pay more points to book a nicer room (like a suite).

The earlier you book, the more likely you are to find availability, especially in popular places like Hawaii.

Airlines May Have Limited Seats Available to Book with Points

Just because you see a flight doesn’t mean that you can book that flight with points. Some airlines only release a certain number of seats that are bookable with points. Once those are booked, you won’t see award space anymore.

Like with hotel redemptions, booking early is one of the best ways to find availability and good pricing.

This isn’t always the case, though; sometimes better pricing opens up later.

Transferring Points to a Partner Doesn’t Guarantee Better Value

It’s true that transferring points to partners can often give you better value, but that doesn’t mean transferring points is the best option every time.

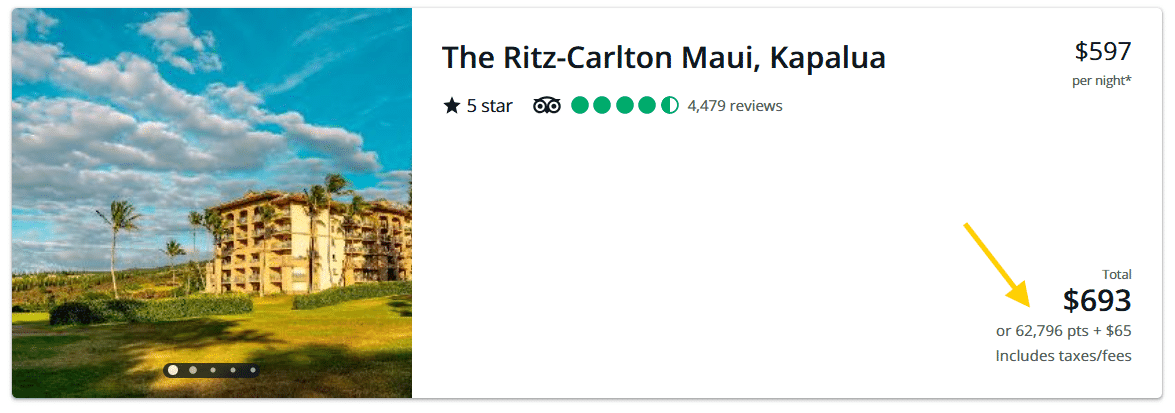

Here’s an example of when transferring points wouldn’t make sense.

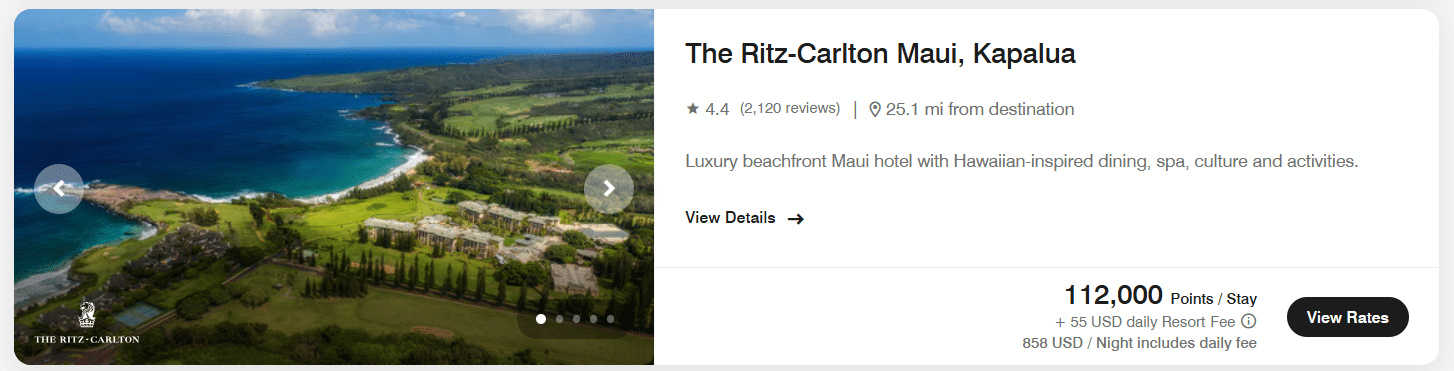

Say you want to splurge on a night at the Ritz-Carlton in Maui. You could book through Chase Travel℠ for about 63,000 points and $65 in fees per night.

If you transfer points to Marriott, the same room on the same night costs 112,000 points per night plus $55 in fees. In this case, you would be better off using your points to book through Chase Travel℠ than transferring to Marriott.

For some hotel partners (like Marriott), the points prices are often considerably higher when booking direct than they would be booking through a travel portal like Chase Travel℠.

With Hyatt, you will almost always get better value by transferring points to Hyatt to book, but that isn’t the case for all hotel programs.

It’s worth comparing prices before booking to see which one makes the most sense for you.

How to Transfer Miles and Points

If you don’t already have a loyalty account with the hotel or airline, you will need to set that up first. The name on your credit card must match the name on your loyalty account.

Capital One®

- Sign in to your account and select "View Rewards".

- Scroll part way down and click "Convert Rewards".

- Scroll to the partner you want and click "Transfer Miles".

- Enter your member number and confirm the transfer.

.

.

Chase®

- Sign in to your account and select "Redeem".

- Click the down arrow, then "Transfer to Travel Partners".

- Scroll to the partner you want and click "Transfer Points".

- Enter your member number and confirm the transfer.

.

.

Citi®

- Sign in, select "Rewards & Offers" then "ThankYou Rewards".

- Select "Travel" and then click "Points Transfer".

- Scroll down to the partner you want and click "Continue".

- Enter your member number and confirm the transfer.

.

.

Amex®

- Sign in to your account and select "Rewards & Benefits".

- Select "Earn and Redeem" and then "Transfer Points".

- Scroll down to the partner you want and click to expand.

- Enter your member number and confirm the transfer.

.

Transferring Points to Hotel Partners

Hotel transfers are some of the easiest points redemptions. They have fewer steps and can provide amazing value. That’s one great reason to start with hotel transfers!

In our household, we transfer most of our Chase Ultimate Rewards to Hyatt and Citi Thank You points to Choice Hotels.

How to Use This Chart:

The ratios shown are credit card points to transfer partners. Most banks transfer to most hotels at a 1:1 ratio, meaning if you transfer 1,000 bank points, you will get 1,000 points in the hotel program.

Some banks offer a different ratio to certain hotels, such as Citi Thank You points to Choice Privileges at a 1:2 ratio. This means transferring 1,000 Citi Points will give you 2,000 Choice Points.

Dynamic Hotel Transfer Partner Chart

|

Hotels ↕

|

Amex Rewards ↕

|

Capital One Miles ↕

|

Chase Ultimate Rewards ↕

|

Citi ThankYou Points ↕

|

|---|

Transferring Points to Airline Partners

Transferring to airline partners is more complicated than transferring to hotels. That’s because airlines have different partners and more flight variables. The good news is, you don’t have to learn every program to get a good value for your points.

Here are a few key things to understand before using the chart:

Ratios Shown are Credit Card Points to Airline Miles

Most banks transfer to most airlines at a 1:1 ratio, meaning if you transfer 1,000 bank points, you will get 1,000 points in the airline program.

For example, if you transfer 1,000 Amex Membership Rewards® to ANA Mileage Club, you will get 1,000 ANA Mileage Club points. The chart shows 1:1 for this transfer.

Airline Alliances are Key

There are three major airline alliances: Star Alliance, oneworld, and SkyTeam. These alliance partnerships allow you to book awards not only on the airline you transfer miles to, but also on their alliance partners as well.

This means you can use United miles to book a flight on Asiana since they are both in the Star Alliance. Keep in mind: airlines don’t release all their seats to their partners to be bookable with points. Generally, the earlier you book, the more options you’ll have.

Some Airlines Have No Credit Card Transfer Partners

For example, Alaska Airlines isn’t listed on the transfer partner chart. This is because you can’t transfer points to Alaska from Amex®, Citi®, Chase®, or Capital One®.

To earn Alaska Airlines Atmos Rewards points, your best option is to open an Atmos Rewards branded credit card with a good welcome offer. You can transfer points from Bilt Rewards to Alaska, but it’s hard to earn a lot of points that way.

Several Airlines Share a Points Currency Called Avios

British Airways, Aer Lingus, Finnair, Iberia, and Qatar Airlines all use a shared points currency called Avios.

Once you have Avios with any of these airlines, you can transfer your Avios to another one of them for no fee. Since these airlines have different redemption deals, this provides even more booking options.

You Can Book One Way or Round Trip Flights

When booking with points, you can choose to book one way awards separately or book a round trip ticket.

With most airline programs, there is no difference in price whether you book two one way flights (one way to your destination and a separate one way back) or one round trip. This allows you to be more flexible and opens up your options.

Sometimes we will book one way tickets with one airline and book the return tickets with a different airline if the flight times or value are better.

Some Airlines Allow Open Jaws or Stopovers

An open jaw is when you fly into one city and leave out of a different city. For example, we are going to Europe and flying from Chicago to London but our return tickets are from Zurich to Chicago.

We like to use open jaws to book the longer flights and then pay for shorter inter-continent travel using cheaper budget airlines in the middle of the trip.

Some Award Flights are More Difficult to Book Than Others

Booking an award flight on United or Southwest is very easy. Their websites are easy to navigate and you can see pricing for a whole month at a time to compare options.

If you want to use your Turkish miles to book an award flight, it is going to take more time. The website is slow and doesn’t show available options. If you call in, wait times are long, and some agents aren’t familiar with ticketing awards. This requires more patience.

Taxes and Fees on Award Flights

Every airline ticket you book with points will also require a payment of taxes and fees. This varies based on destination and airline.

Taxes and Fees on Domestic Flights Within the US

Any award flight fully within the United States should have a $5.60 fee each way. This should be the same no matter what airline you are booking with.

Government Taxes and Fees

When you travel between countries, you will also be charged additional fees. These are determined by local governments.

When you book a cash ticket, these fees have been included in your ticket price. But with award tickets, you will pay these fees separately.

For example, a round trip flight from the US to Jamaica will incur about $150 of fees. A round trip flight to Mexico will cost about $90 in fees. Departing from London to the US will incur a large $100+ additional “UK Passenger Duty” fee.

Airline Surcharges

Some airlines also add airline-specific surcharges when booking award flights.

For instance, British Airways adds high fuel surcharges on transatlantic flights, which can be as high as $640 on an economy flight!

Dynamic Airline Transfer Partner Chart

|

Airlines ↕

|

Amex Rewards ↕

|

Capital One Miles ↕

|

Chase Ultimate Rewards ↕

|

Citi ThankYou Points ↕

|

|---|

Common Mistakes to Avoid

Not transferring points because it seems too complicated.

Transferring points before confirming availability.

If you transfer points to a hotel or airline, you can’t reverse it! Make sure you have confirmed that the flights or nights are available to book with points before you transfer.

Assuming transfers are always the best option.

Don’t forget to compare cash options or other ways to redeem points. If flights are low in price, it might be better to pay cash or use your points in a bank’s portal like Chase Travel℠.

Easy Redemptions With Transfers

Stay at an All Inclusive Resort:

Transfer Chase Ultimate Rewards to Hyatt to book a stay at one of Hyatt’s all-inclusive properties. Rates range from 12,000-58,000 points per night for two people.

Fly to Europe on Air France or KLM:

Air France and KLM have monthly promotions where you can fly to Europe for as low as 37,500 points round trip in economy or 90,000 points round trip in business class.

Enjoy a Boutique Hotel:

Citi ThankYou points transfer to Choice hotels at a 1:2 ratio. This unlocks some great hotel options in Europe and the US through their partnership with the Ascend Hotel collection.

Book Domestic flights with JetBlue or Southwest

It’s easy to transfer points to either JetBlue or Southwest and book a domestic flight. Both of these airlines frequently offer sales, making the points needed to book even lower!

Book Family Hotels in Hawaii:

There are several great hotels in Hawaii that you can book with points. You can go with the Hyatt Place Waikiki for 15,000 points per night. Or splurge on a luxury stay at Hyatt Regency Maui starting at just 21,000 points per night.

Table of Contents

- Why Transfer Points

- Points Transfer Basics

- Different Credit Cards Have Different Transfer Partners

- Not all points can be transferred to other programs

- You Can’t Reverse a Points Transfer

- Some transfers are instant, and some take a few days

- Hotels Have Limited Numbers of Rooms Available to Book with Points

- Airlines May Have Limited Seats Available to Book with Points

- Transferring Points to a Partner Doesn’t Guarantee Better Value

- How to Transfer Miles and Points

- Transferring Points to Hotel Partners

- Transferring Points to Airline Partners

- Common Mistakes to Avoid

- Easy Redemptions With Transfers

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.