All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from our partners. American Express is a Katiestraveltricks.com advertiser. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Venture X Business Card Guide

The Capital One Venture X Business card was released in the fall of 2023 and is a great option for a business card with premium perks. This card is very similar to the Capital One Venture X Rewards Credit Card, which is a personal version of this card. There are a few differences and reasons why you’d pick one over the other.

Quick Hits

Key Differences to Venture X

- Authorized Users for Venture X Business do not receive lounge access benefits (after February 1, 2026, you can add lounge access for authorized users for a $125 annual fee.)

- Card account will not show on your credit report, therefore will not add to your 5/24 count

- This is a charge card, not a credit card — there is no official credit limit and you must pay in full each month

- Venture X Business has a much larger welcome bonus with big minimum spend requirements

Who This Card is Good For

- Business owners who have a large expected business expenses

- Anyone who wants the perks of a Venture X card but doesn’t want to give up a 5/24 slot

Who This Card Doesn’t Make Sense For

If you are a family of 4+ and want to get lounge access for your whole family, opening this card alone won’t get you lounge access. It might still make sense for you, but you’ll need to pair it with another card to get your whole family into lounges. Alone, it will get access for the primary cardholder and 2 guests. The other adult in your household might consider a Venture X Rewards Credit Card (especially if you live at an airport with a Capital One lounge like Denver, Dulles, or DFW) or The Ritz-Carlton™ Credit Card (especially if you live at an airport with a Chase Sapphire Lounge like LGA or JFK).

Card Overview

Affiliate link

Annual Fee:

This card is very similar to the consumer (personal) card that has an almost identical name — the Capital One Venture X Rewards Credit Card.

This Business version has an annual fee of $395.

Note that this is a “Pay in Full” card — you’ll need to pay it off in full each month. There is no preset spending limit but Capital One says “This card comes with no preset spend limit that adapts to your needs based on spending behavior, payment history and credit profile”

$300 Travel Credit

Every year you’ll get a $300 travel credit. This travel credit comes essentially in the form of a coupon that can only be used at Capital One Business Travel. If you book a rental car, hotel, or flight through Capital One Business Travel, this credit will come off your total. You don’t have to use all $300 at once.

10,000 Anniversary Miles

Every year on your account anniversary, you’ll receive 10,000 anniversary miles. At the very minimum, this is worth $100 if you redeem this for erasing travel purchases.

You can see that between these top two benefits alone, it’s easy to make up your entire annual fee!

Earning rates

- 10x Venture miles on hotels and rental cars booked via Capital One Business Travel

- 5x Venture miles on flights booked via Capital One Business Travel

- 2x Venture miles on all other purchases

Favorite Venture X Benefit: Lounge Access

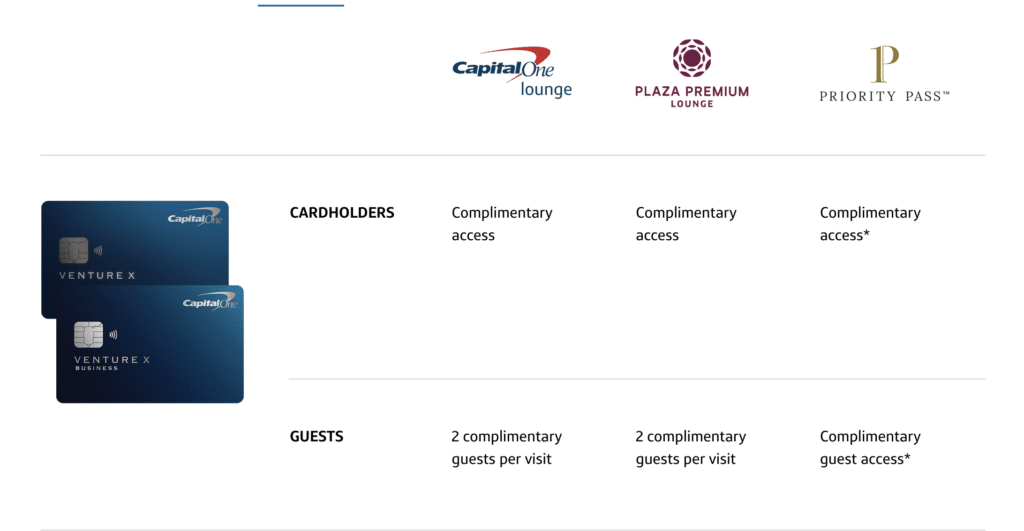

This is hands down my favorite perk of the card. You get access to lounges with 3 different lounge networks: Capital One Lounges, Priority Pass, and Plaza Premium.

Which lounges can I go into?

You get access to Capital One Lounges, Plaza Premium Lounges, and Priority Pass lounges. Guest policy differs depending on the network. Check Capital One’s website for an up to date list on included lounges.

Note: Plaza Premium Lounges were removed in March 2025.

More Capital One Venture X Benefits

- Global Entry or TSA PreCheck statement credit for up to $120 (valid once every 4 years). You can use this benefit for yourself or use it to pay for another friend or family member.

- No foreign transaction fees (See rates and fees)

- Cell Phone Protection through Mastercard World Elite benefits (up to $600)

Using Capital One Miles

You can use Capital One miles either to cover travel purchases you’ve made with your Venture X business card — or they can be transferred to certain airline and hotel partners.

If you cover purchases, you’ll get a flat redemption rate. 10,000 miles will let you cover a $100 purchase.

If you choose to transfer to airlines or hotels, your redemption rates will vary.

Capital One Transfer Partners

Though Capital One doesn’t have any US based airlines as transfer partners, there are still plenty of ways to use these miles for both US domestic flights as well as international flights.

You can transfer your Capital One miles to all of the following airlines and hotels:

1:2 transfer ratio

(1,000 Venture Miles = 2,000 points)

- Preferred Hotels & Resorts (I Prefer)

1:1 transfer ratio

(1,000 Venture Miles = 1,000 miles/points)

- Aeromexico Club Premier

- Air Canada – Aeroplan®

- Avianca LifeMiles

- British Airways Executive Club

- Cathay Pacific – Asia Miles

- Choice Privileges®

- Emirates Skywards

- Etihad Guest

- Finnair Plus

- Flying Blue

- Qantas Frequent Flyer

- Qatar (Privilege Club)

- Singapore Airlines KrisFlyer

- TAP Miles&Go

- Turkish Airlines Miles&Smiles

- Virgin Red

- Wyndham Rewards

2:1.5 transfer ratio

(1,000 Venture Miles = 750 miles/points)

- EVA Air – Infinity MileageLands

- JAL (JAL Mileage Bank)

2:1 transfer ratio

(1,000 Venture Miles = 500 points)

- ALL – Accor Live Limitless

5:3 transfer ratio

(1,000 Venture Miles = 600 miles)

- JetBlue TrueBlue

Some Sweet Spots for Capital One Transfer Partners

Transfer to Avianca to book onto Star Alliance carriers including United. This is what our family did to fly to Japan.

Transfer to Virgin Red to book cruises or Sky Team Flights, including Delta. Virgin has some sweet cruise deals that pop up with points. Note that they are adults only. You can also use Virgin miles to book Delta flights.

Transfer to FlyingBlue to book great deals on round trip flights to Europe or Tahiti on Air France and KLM.

Transfer to Choice Hotels for great stays in Europe. This isn’t as good as the Citi Premier® Card, which transfers at 1:2 — so if you like this option, I’d recommend you look at the Citi Premier card instead. But Choice has some fabulous hotels in Europe — like this one in Venice which is as low as 16,000 points per night. It also has some great family options in the US with 1 bedroom suites or bigger.

Table of Contents

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.