All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from our partners. American Express is a Katiestraveltricks.com advertiser. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Citi ThankYou Points Guide

Citi ThankYou points are a valuable points currency with some unique sweet spots. As the only transfer partner for American Airlines, Citi is especially beneficial for anyone trying to earn American AAdvantage miles.

If you prefer using points for hotels, Citi offers some attractive options there as well, many with generous transfer ratios. For instance, you can transfer ThankYou points to Preferred Hotels at a 1:4 ratio. That means for every 1,000 ThankYou points you transfer, you get 4,000 Preferred Hotel points!

This article explains all the ins and outs of the Citi program to help you make the most of your ThankYou points.

Earning Citi ThankYou Points

The easiest way to earn a lot of ThankYou points quickly is to sign up for a new credit card offering a welcome bonus.

Cards that Earn Citi ThankYou Points

- Citi Strata Elite℠ Card

- Citi Strata Premier℠ Card

- Citi Strata℠ Card

- Citi Double Cash® Card

- Citi Custom Cash® Card

- AT&T Points Plus® Card from Citi

Citi cards that offer cash back (like Citi Double Cash®) earn the cash back in the form of Citi ThankYou points. You can redeem the points for cashback at a rate of one cent per point, or you can use them in other ways. More on that below.

Application Tips

How often to Apply

You can only be approved for a Citi card once every eight days, and no more than two cards in 65 days.

For most Citi cards, you’re only eligible to earn the bonus on a particular card once every 48 months.

There is no set limit to the number of cards you can have, but Citi will limit the total amount of credit it has extended to you. There isn’t a hard and fast rule on the amount; it can vary by person.

Hard Inquiries on Your Credit Report

Citi has a reputation for being inquiry sensitive. There are no set rules for this, but if you have a lot of recent inquiries on your credit report, it might be harder to get approved.

Anecdotal evidence suggests that it’s best to be under 6 hard inquiries in 6 months if you can, but some people report being approved for a card with more inquiries.

Other Ways to Earn Citi ThankYou Points

Everyday Spend

Even after you earn that initial welcome offer, you can keep earning points by putting everyday spend on your Citi credit cards. Each card has its own earning rates, with some generous multipliers in certain spending categories.

Here are some examples of point multipliers on some of the Citi cards:

- Citi Strata Elite℠ Card: 3x points at restaurants or 6x points during Citi Nights℠ (Friday and Saturday from 6:00 pm-6:00 am Eastern time)

- Citi Strata℠ Card: 3x points on supermarkets, select transit, gas stations, and EV charging.

- Citi DoubleCash® Card: 2x points on everything.

- Citi Custom Cash® Card: 5x points on your top eligible spending category each billing cycle

Having a couple of these cards in your wallet can help you earn a steady stream of points, even when you’re not working towards a welcome offer.

Refer a Friend

Citi doesn’t typically offer referral bonuses, unfortunately. They do occasionally offer targeted opportunities to earn referral points. These are not common, but they do provide a good way to earn additional points if you’re targeted.

Combining Points

If you hold multiple cards that earn Citi ThankYou points, all of those points will be held on the individual cards where you earned them. But they don’t have to stay there! If you want to pool your points together and use them for a single redemption, you can!

Citi allows you to combine your ThankYou points onto one card and use them from whichever account you choose. This is valuable because not all cards redeem points at the same rate.

You can combine your points onto whichever card offers the highest value and use them from there.

How to Combine Citi ThankYou Points

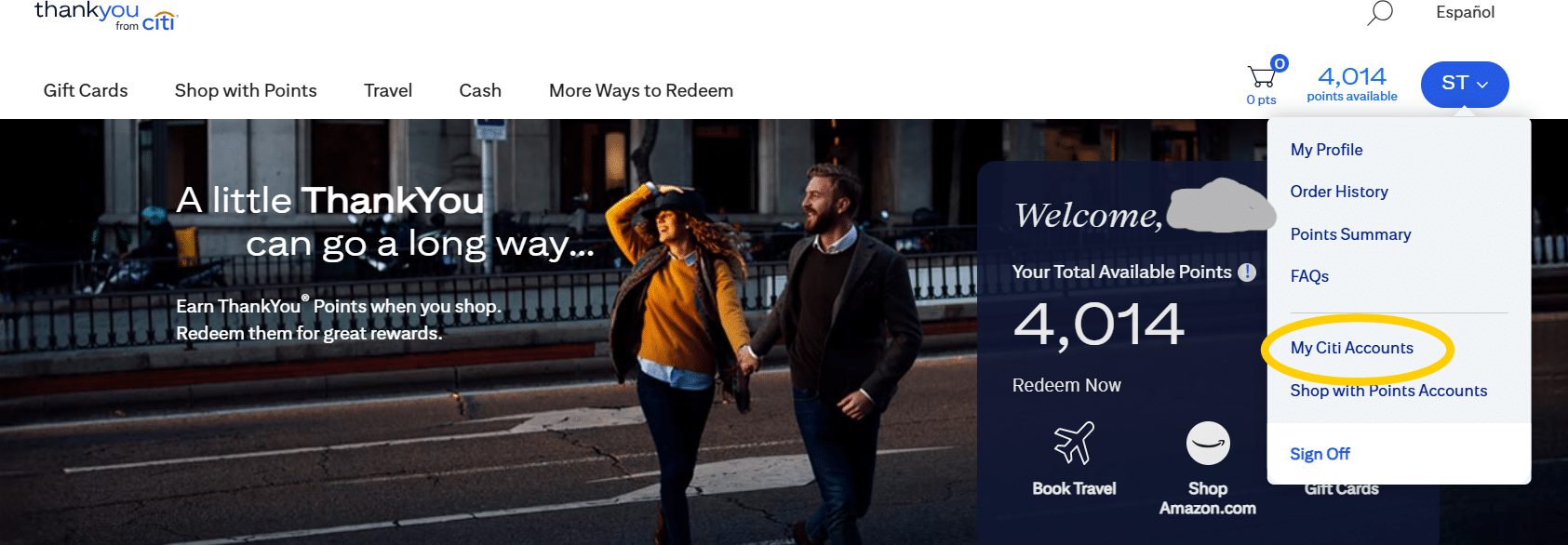

To combine points, head to the Citi ThankYou homepage at Thankyou.com/myCitiAccounts and log in. In the top right corner, click on your initials and then “My Citi Accounts”.

From there, you can see all of your accounts and combine points. You can also combine points over the phone by calling Citi ThankYou customer service.

Note: If you hold a cobranded card from Citi that does not earn ThankYou points, those points do not combine with your ThankYou points. For example, if you hold any of the AAdvantage credit cards issued by Citi, those earn AAdvantage miles and can only be used through the American Airlines AAdvantage program. Cards that earn ThankYou points are the ones you can combine!

Sharing Points with a Friend or Family Member

Citi allows you to share your ThankYou points with anyone, for free. You can send up to 100,000 and receive up to 100,000 ThankYou points per calendar year.

This makes it easy to team up with a partner to earn more points! You can pool your points together to reach your goal and book that trip sooner.

It’s important to know that points expire 90 days after being shared. You’ll definitely want to have a plan in place to use those points before initiating the transfer.

Points from the Citi Custom Cash® Card cannot be shared with a friend or family member.

Using Your Citi ThankYou Points: Transfer Points to Partners

Transferring points is one of the best ways to use your Citi ThankYou points because you can often get outsized value from your points.

The transfer ratio you get depends on which card(s) you hold. Cards with an annual fee offer a higher transfer ratio than cards with no annual fee.

Things to know about transferring points:

- Points must be transferred in increments of 1,000.

- A maximum of 500,000 points can be transferred at one time.

- Points can only be transferred to the loyalty account of the cardholder or authorized users on the card.

- Once points are transferred to a partner program, they cannot be transferred back to Citi.

Citi Transfer Partners and Transfer Ratios

The transfer ratio is based on the Citi card that you have. Cards with no annual fee transfer at a lower rate than those that carry an annual fee. For most transfer partners, the transfer ratio from the no annual fee cards is reduced by about 30%.

If you hold the Citi Strata Elite℠ Card or the Citi Strata Premier℠ Card, you can move points from your other cards over to one of those cards before transferring to get the best ratio.

Full list of transfer partners and the transfer ratios offered:

Transfer Partners

Pro Tip: If you hold the Citi Strata Elite℠ Card or the Citi Strata Premier℠ Card, you can move points from your other cards over to one of those cards before transferring to get the best ratio.

| Partner Program | Premium Cards (Annual Fee) | Other Cards (No Annual Fee) |

|---|---|---|

| Air France-KLM Flying Blue | 1:1 | 1 : 0.7 |

| ALL Accor Live Limitless | 2:1 | 1 : 0.35 |

| American Airlines AAdvantage | 1:1 | 1 : 0.7 |

| Avianca LifeMiles | 1:1 | 1 : 0.7 |

| Cathay Pacific Asia Miles | 1:1 | 1 : 0.7 |

| Choice Privileges | 1:2 | 2 : 3 |

| Emirates Skywards | 5:4 | 1 : 0.56 |

| Etihad Guest | 1:1 | 1 : 0.7 |

| EVA Air Infinity MileageLands | 1:1 | 1 : 0.7 |

| JetBlue TrueBlue | 1:1 | 5 : 4 |

| Leading Hotels of the World | 5:1 | 1 : 0.14 |

| Preferred Hotels & Resorts | 1:4 | 1 : 2.8 |

| Qantas Frequent Flyer | 1:1 | 1 : 0.7 |

| Qatar Airways Privilege Club | 1:1 | 1 : 0.7 |

| Singapore Airlines KrisFlyer | 1:1 | 1 : 0.7 |

| Thai Royal Orchid Plus | 1:1 | 1 : 0.7 |

| Turkish Airlines Miles&Smiles | 1:1 | 1 : 0.7 |

| Virgin Atlantic Flying Club | 1:1 | 1 : 0.7 |

| Virgin Red | 1:1 | 1 : 0.7 |

| Wyndham Rewards | 1:1 | 5 : 4 |

Transfer bonuses

Citi occasionally offers promotions where you can get a bonus when you transfer to a specific program.

For example, you can transfer ThankYou points to Avianca LifeMiles any time at a 1:1 ratio. That means for every 1,000 ThankYou points you transfer, you’ll get 1,000 LifeMiles. But if there is a 20% transfer bonus offered to Avianca, you would get 1,200 LifeMiles for every 1,000 points transferred!

Transfer Partner Sweet Spots: Airlines

American Airlines

Citi is the only transfer partner for American Airlines. That makes Citi ThankYou points especially valuable if you’re working on earning American AAdvantage miles.

American offers competitive award pricing with some of the best rates out there to places like Japan and Hawaii.

Qantas

You can transfer points to Qantas to book flights to Australia and New Zealand. Qantas tends to have more award availability to/from New Zealand than other programs, which makes this a nice option.

To fly from the west coast to Auckland booked with Qantas costs about 86,000 miles and $220 in taxes and fees roundtrip. Qantas also offers a non-stop from JFK to Auckland, which is a nice option from the east coast.

Qatar Airways Privilege Club (and the Avios Ecosystem)

Qatar Airways Privileges Club uses the same points currency as Aer Lingus, British Airways, Iberia, and Finnair. You can transfer ThankYou points to Qatar and then instantly move those Avios to another Avios partner by linking your accounts.

This opens up a lot of options for booking with points, like using Finnair to book onto American or Alaska Airlines flights.

Transfer Partner Sweet Spots: Hotels

Preferred Hotels & Resorts

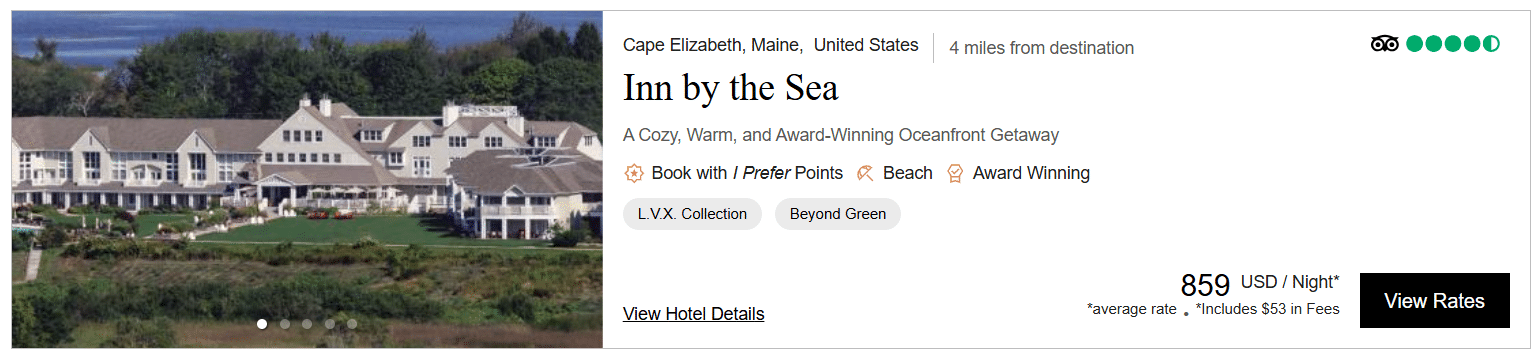

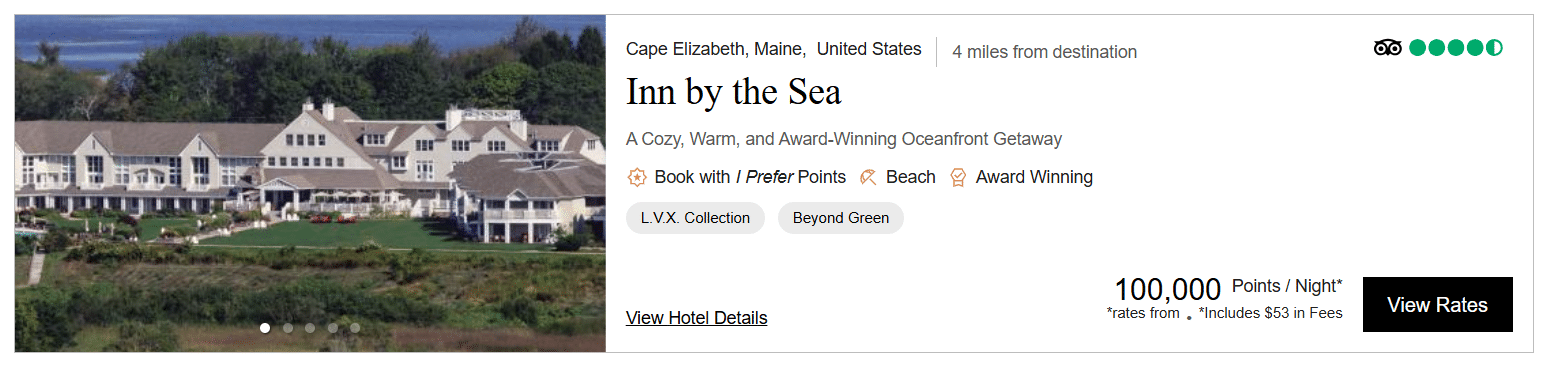

The I Prefer program with Preferred Hotels includes a lot of unique and independent boutique hotels.

This oceanfront hotel in Cape Elizabeth Maine is available to book for $859 or 100,000 points per night. With the 1:4 transfer ratio, you would only need to transfer 25,000 ThankYou points per night to cover this stay.

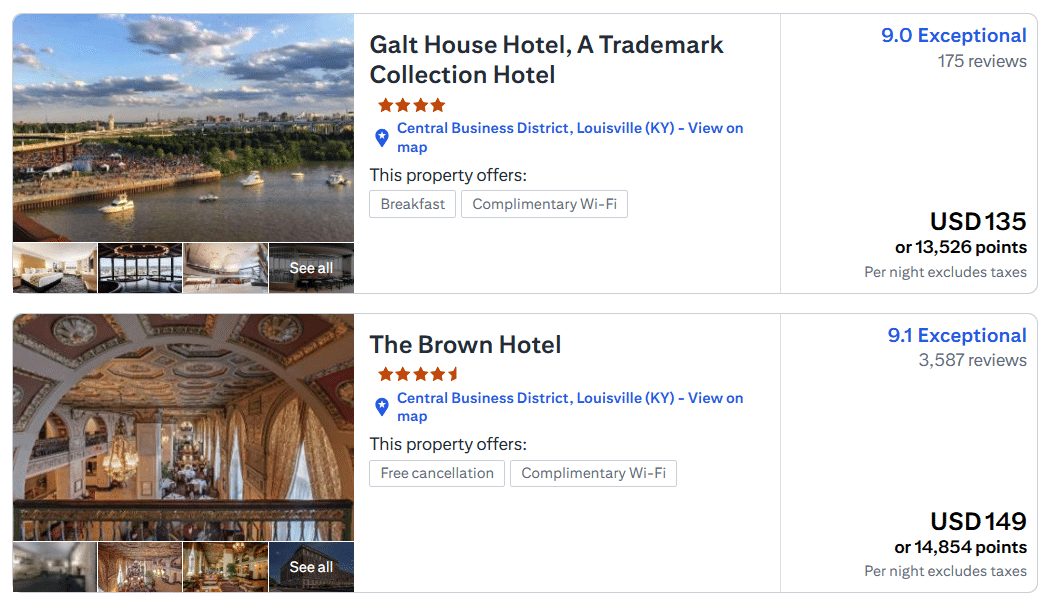

Choice Privileges

Choice Hotels is often overlooked as a points program because it has a lot of lower-end properties in the US. But it actually has a number of great properties in Europe.

Also – Choice has a number of Ascend Collection hotels, which are often independent, historic, or boutique hotels that partner with Choice Hotels. This collection includes a lot of unique options from 4-bedroom cabins in Big Bear, CA to B&B properties in Florida and historic hotels in the Northeast.

Most hotel chains only allow you to book a standard hotel room with points. Some offer the option to use more points to upgrade to a suite. With Choice, though, the number of points charged is the same no matter the room type. So if a property has larger suites or even 2-4 bedroom villas available, they cost the same as a 1 room hotel room! This makes these properties great options for families.

Choice also has a partnership with Bluegreen Vacations, which has timeshare properties that usually include a full kitchen and separate living room. These are included in the Ascend Collection.

Other Ways to Use Citi ThankYou Points

Redeem for Cashback

Citi ThankYou points can be redeemed for cashback to cover any expense you like. Depending on which card you have, you can apply the points as a statement credit or deposit the points as cash into a bank account.

The redemption rate depends on which card you have. In this case, having a cash back card offers the best value.

Cash back redemption rates

- Citi Strata Elite℠ Card: .75 cents per point

- Citi Strata Premier℠ Card: .75 cents per point

- Citi Strata℠ Card: .5 cents per point

- Citi Double Cash® Card: 1 cent per point

- Citi Custom Cash® Card: 1 cent per point

Citi Travel

You can redeem points directly towards travel like airfare, hotels, and experiences through Citi Travel. This is a simple and straightforward way to use your points to cover travel expenses. Points are worth 1 cent per point when redeemed this way. A $150 hotel reservation would take 15,000 points.

There are some pros and cons to booking this way. If you book through a travel portal like Citi Travel, you typically don’t earn hotel loyalty points or get any status benefits with the hotel chain.

We have an article all about the Pros and Cons of Booking through a Bank Travel Portal.

Shop with Points

The shop with points page allows you to redeem your points directly with retailers such as Amazon and Walmart.

This is generally a poor value for your points. If you want to use your points to pay for a purchase, you will usually get a better value by making the purchase directly, then redeeming points for cash back to cover the cost.

Redeem for Gift cards

You can exchange your points for gift cards as well. The standard rate is 1 cent per point. Citi occasionally offers sales where gift cards are slightly discounted.

Other Things to Know about Citi ThankYou Points

Closing an Account

If you close an account with Citi, any points earned on that card expire 60 days after the closure. Even if you move those points to another one of your cards that is still open and in good standing.

If you’ve combined points across cards, it may be impossible to tell which points were earned on which card. In this case, it would be better to downgrade to a no annual fee card rather than canceling, so you don’t risk losing any points.

Table of Contents

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.