All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from our partners. American Express is a Katiestraveltricks.com advertiser. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Chase Sapphire Reserve for Business: Guide

Update September 17, 2025:

Chase announced that starting January 1, 2026:

- The Edit Credit: They are updating the existing $500 annual credit for stays with The Edit. Beginning January 1, cardmembers can automatically receive up to $250 for each prepaid booking with The Edit, up to $500 annually (versus split between two 6-month time periods).

- $250 credit for select Chase Travel hotels: Cardmembers will get up to $250 in statement credits in 2026 on prepaid Chase Travel hotel bookings for IHG Hotels & Resorts, Montage Hotels & Resorts, Pendry Hotels & Resorts, Omni Hotels & Resorts, Virgin Hotels, Minor Hotels and Pan Pacific Hotels and Resorts. In addition to receiving the statement credit, these bookings are eligible to earn Ultimate Rewards points (for spend above the $250 credit amount) and corresponding hotel loyalty program points for the entirety of the purchase.

- Prepaid bookings with a two-night minimum are required to receive each statement credit.

On June 23, 2025 Chase released a new card: the Chase Sapphire Reserve for Business. In many ways this mirrors the new version of the Chase Sapphire Reserve® but it has some differences as well.

Annual Fee:

Annual Fee

The annual fee is $795 for the Sapphire Reserve for Business.

My Take: Like the personal version, this is an incredibly hefty annual fee. It's not a beginner friendly card at this price point. But some people will see that astronomical fee and look at the annual credits and decide that surprisingly it makes sense for them. It all depends on how you already do your spending if this card provides true value to you. Scroll down for our benefits calculator to help you decide!

Credits that Match The Personal Version

How does Chase justify the high annual fee? Well it is through a slew of credits that seem kind of like a coupon book. Here's what this card offers.

$300 Annual Travel Credit

Any purchase that you make that codes as as travel expense will automatically trigger the statement credit. This is true for larger purchases like hotel rooms or flights. But also works for parking, bus tickets, or even some campsites.

My Take: This $300 travel credit is the easiest travel credit to use of any premium card.

$120 Trusted Traveler Credit

You get a statement credit of up to $120 every four years for purchases made for Trusted Traveler programs like Global Entry, NEXUS, and TSA Precheck.

My Take: We love our Global Entry but if you're in the points world long enough, these credits become less valuable because you might already have Global Entry. And now that kids get Global Entry for free if parents have it, most households need a max of 2 of these credits. Still a nice credit.

Airport Lounge Access

This card provided access to Chase Sapphire Lounge® by The Club and Priority Pass lounges for the primary cardholder and two guests. There is no way to for authorized users to get lounge access.

The personal version also includes access to 20+ select Air Canada Maple Leaf Lounges and Air Canada Cafés when traveling on a Star Alliance airline for the primary cardholder and one guest.

My take: This doesn't cut it for families of 4+ with no option for additional guest access. But you could pair this with another card option for lounge access.

DoorDash Benefits

Identical to the personal version: you'll get free DashPass through 12/31/27 or a minimum of 1 year depending on the activation date. If activated by 12/31/26, the expiration date will be 12/31/27. If DashPass is activated between 1/1/27 – 12/31/27, your expiration date will be one year from activation.

You get up to $10 off two orders per month on DoorDash non-restaurant orders. Discounts must be used for two separate orders.

Chase Sapphire Reserve for Business members enrolled in DashPass will receive $5 per month DoorDash credit. If the credit is not used within the calendar month, it will be carried over for a maximum of 2 months. Up to $15 in credit can be accrued before a $5 credit expires.

My Take: I like this benefit but some people find it hard to use if they don't have a pickup location near them. I still wouldn't value it at $300/year like Chase claims. Personally I place the value more around $100/year. Here's how to activate this.

Lyft Credit $10/month

Again, a benefit that matches the personal version. Members get $10 in monthly credit towards Lyft rides when they link their card to their Lyft account. This offer is good through September 2027.

Credits do not roll over to the next month, and they cannot be used on Wait & Save rides or bike and scooter rentals.

My Take: Useful if you use Lyft, if not — this may not add value for you.

Just in 2026: $250 credit for select Chase Travel hotels

This benefit was announced in September 2025 and at this point is just for 2026. Cardmembers will get up to $250 in statement credits in 2026 on prepaid Chase Travel hotel bookings for IHG Hotels & Resorts, Montage Hotels & Resorts, Pendry Hotels & Resorts, Omni Hotels & Resorts, Virgin Hotels, Minor Hotels and Pan Pacific Hotels and Resorts. In addition to receiving the statement credit, these bookings are eligible to earn Ultimate Rewards points (for spend above the $250 credit amount) and corresponding hotel loyalty program points for the entirety of the purchase. A two night stay is required to receive the statement credit.

My Take: This is a really interesting credit to see added. The fact that IHG Hotels & Resorts are included means there are a huge number of hotels you could use this at. I believe (but cannot confirm yet) that this would also stack with the Edit Collection credit. So if you found an IHG property that was also on The Edit list, you'd get a total of $500 back for a 2 night stay. Because it's a one year credit only, I probably personally won't assign a value to it but I could definitely see us using it. One of our favorite Chicago hotels is the Intercontinental which has an amazing art deco pool and winter rates are often quite low, so this credit would almost cover 2 nights there.

Hotel credits with The Edit Collection

This is billed as a $500 credit for stays with The Edit collection. It comes in two credits, each for half the year. It is $250 for January to June and $250 for July to December. Maximum of $250 each half year. Beginning January 1, cardmembers can automatically receive up to $250 for each prepaid booking with The Edit, up to $500 annually (versus split between two 6-month time periods).

Notes:

- Two-night minimum.

- Purchases that qualify will not earn points.

- Must be a pre-paid stay

- Most of these hotels are priced higher via Chase Travel than booking direct

My Take:I don't consider this a true savings for the average person but there is value potential here. I used this perk for the first time in August 2025 by using a combination of Points + Cash booking via Chase Travel. I left exactly $250 of cash and paid the rest with my points. Edit Collection hotels are all part of Points Boost and you get a redemption rate of 2 cents per point while booking them. This opens the door to some options for independent hotels as well as chain hotels. At some chain hotels like Hyatt you'll even still earn elite night credits. I also like how you can book into any room type but still use your points.

Other travel and purchase protections

These should generally match the personal version as this will be a Visa Infinite card. Note that sometimes Chase terms will state these are only valid if you're traveling for business.

Other benefits include:

- Auto Rental Collision Damage Waiver

- Trip Cancellation/Trip Interruption Insurance

- Trip Delay Reimbursement

- Travel and Emergency Assistance Services

- Extended Warranty Protection

- Purchase Protection

Credits Unique to the Business Version

$400 ZipRecruiter Credit

You get a $200 statement credit for purchases at ZipRecruiter twice a year. One $200 will be good from January 1 to June 30 each year. Then between July 1 and December 31 you could get up to another $200 credit.

My Take: Useful if you already pay for these. Highly depends on your business.

$200 Google Workspace Credit

Up to $200 per calendar year via statement credits for Google Workspace. Note that you can pre-pay this to make sure you use your full credit by December each year. This credit will reset in January.

First navigate to your Google Admin account and to Billing > Payment Accounts. You'll need to add your card as a payment method.

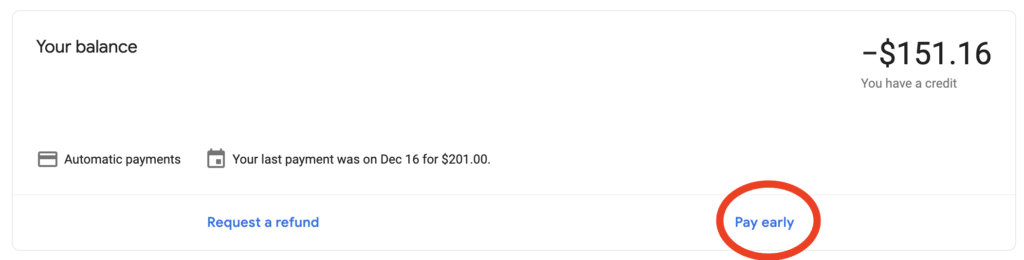

Then look for your balance and the text that says "Pay Early"

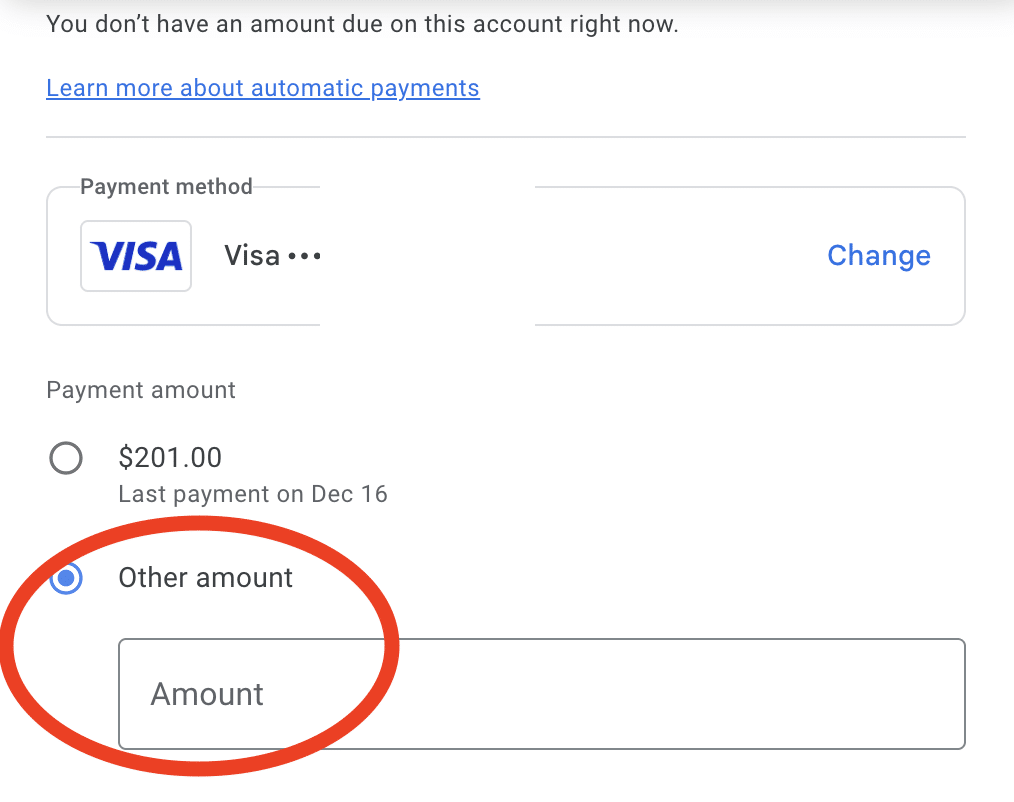

Then select to pay "Other amount" and enter in $200 (or however much of the credit you have remaining). Be sure to change payment method to your Sapphire Reserve for Business.

My Take: If you already use Google Workspace (Like I do), this is a true credit! If not, it might be worthless to you.

$100 Giftcards.com

You get a $50 statement credit for purchases at from this selection at Giftcards.com twice a year. One $50 will be good from January 1 to June 30 each year. Then between July 1 and December 31 you could get up to another $50 credit.

My Take: The selection is somewhat limited but I think many people can find one of the stores or restaurants on there that they frequent.

Earning and redeeming Points

The ways to earn and redeem points largely mirror the new personal version. Points on travel are not earned until after the first $300 is spent annually on purchases in the travel category. The first $300 spent goes towards the $300 Annual Travel Credit.

Earning compared to Personal Version

| Purchase Type | Business Reserve | Personal Reserve |

| Flights purchased through Chase | 8x | 8x |

| Hotels and car rentals booked through Chase | 8x | 8x |

| All other travel purchases |

4x for hotels and flights |

4x for hotels and flights 1x for all other |

| Lyft | 5x | 5x |

| Dining | 1x | 3x |

| Online Advertising | 3x | 1x |

My Take: Most purchases will earn 1x — but if you spend a lot with online advertising or flights and hotels booked directly for business travel, this could be a good earning card.

Redeeming Points via Chase Travel℠

The base rate for redemptions via Chase Travel are 1 cent per point.

With Points Boost, cardmembers' points "could be worth up to 2x" on some hotels and some premium class flights.

My Take: We'll have to wait and see how the Points Boosts play out but at the least it means you will need to take a minute to compare if booking via Chase Travel makes sense versus booking directly and cashing out points for a statement credit. Another options would be via Aeroplan Pay Yourself Back.

Other Perks I think are irrelevant

Chase is also adding some "premium benefits" if you spend more than $120,000 a year on this card. Sure if you're spending that much on the card these might be nice? But not worth doing all that spending to get these.

- IHG One Rewards Diamond Elite Status (you can also get this just by holding an IHG Credit Card)

- Southwest Airlines® A-List Status (most benefits will probably be redundant if you have the higher annual fee Southwest cards)

- $500 Southwest Airlines credit when booked through Chase Travel (Don't book Southwest flights via Chase Travel if you can help it, with the way the new credits work)

- $500 credit to The Shops at Chase, a new online shopping experience designed exclusively for cardmembers allowing them to shop for brands including Dyson, Sony, Therabody, and Tumi, with rotating promotions, using their Ultimate Rewards points or their card to pay

Benefits Calculator

Chase Sapphire Reserve for Business: What's It Worth to You?

Enter your personal estimated annual value for each benefit to see a customized calculation of the card's worth.

Your Total Annual Value:

Annual Fee: $795

Your Net Value / Cost:

Strategy Tips: Ignore, Get the Personal Version, or Apply?

Now that we have an overview of the card, let's talk about strategy. What do you need to keep in mind if you're evaluating if this card makes sense for you?

Strategy 1: Ignore the hype

This is a perfectly acceptable strategy. Though I assume if you made it this far in the article you're not completely ignoring the hype. If you look at these credits and they don't match the way you spend, ignore this card! It will take mental energy to ensure you're getting your money's worth — besides the fact you'll have to shell out $795 up front and then later try to make your money back on it!

Strategy 2: Get the Personal Version Instead

The personal version offers different credits than this one. And it really comes down to your personal spending habits as to which one is easier for you to find value in.

Read my full analysis here of the personal version.

Strategy 3: Apply

Pros:

- Will not add to your 5/24 count since it is a business card.

- New card product means everyone should be eligible — this is especially good if you've already opened all the Inks!

Cons:

- You have to keep track of all these credits to make sure you're getting the full value of the $795 annual fee

- Big spend to earn the welcome offer

How To Apply

Interested in applying? Please use my affiliate link. It helps support my site and doesn't cost you anything!

Table of Contents

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

I understand that this is a business card, but does this card count toward 5/24?

It should not as it should not report to credit reports.

Do you know if this Chase Sapphire Reserve Business offers the $150 biannual Chase Sapphire Exclusive Tables credit?

It does not, just the credits listed in this article