Link These Accounts to Earn Points on Autopilot

Take a few minutes to set up these links right now! While none of these offer a huge bonus or number of points, it’s easy to set these up so you can earn without a second though.

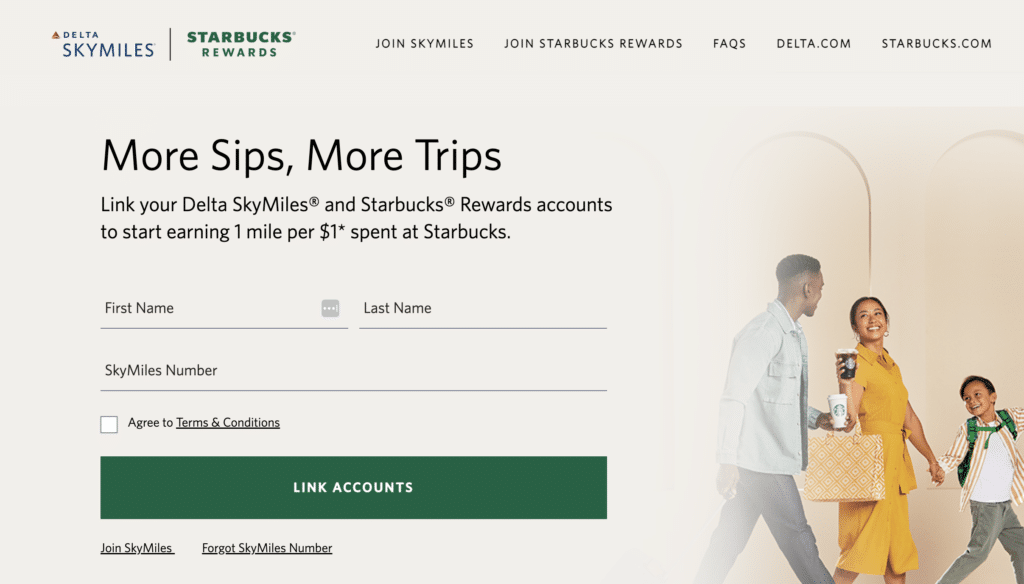

Delta and Starbucks

You can link your Delta SkyMiles and Starbucks accounts to earn 1 mile per $1 spent at Starbucks.

If you link your accounts before 3/31/2023, you’ll earn 200 Stars for new Starbucks Rewards Members (must make a qualifying purchase) and 500 miles for new SkyMiles Members.

Grabbing a coffee before your flight? On days that you are flying Delta, you will earn 2 stars per $1 spent on qualifying Starbucks purchases. If you are paying with a registered, preloaded Starbucks card, you’ll earn 4 stars per $1 spent.

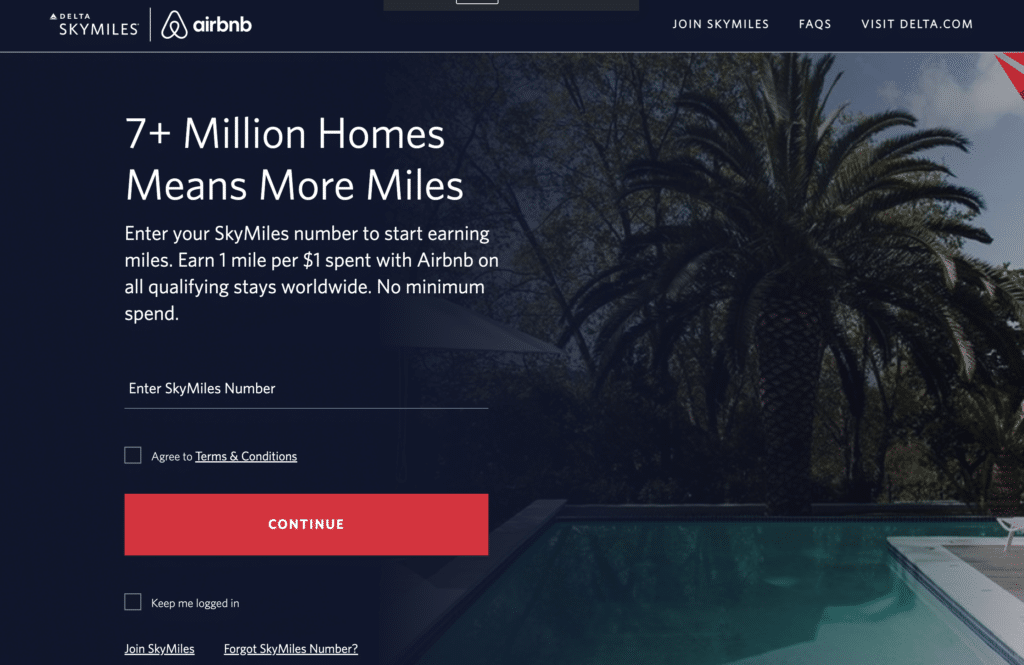

Delta and Airbnb

This one isn’t automatic but I wanted to include it because it is an easy way to earn a little extra on your Airbnb stays.

Link your Delta SkyMiles and Airbnb accounts to earn 1 SkyMile per $1 spent on Airbnb.

Earning SkyMiles with Airbnb bookings is NOT automatic. You will need to start each booking through Delta, and enter your Delta SkyMiles number, to earn SkyMiles.

Lyft and Delta, Hilton, Alaska, or Bilt (pick one)

Turn your Lyft rides into miles or points! Lyft has partnered with Delta, Hilton, Alaska, and Bilt so that you can earn miles or points for each dollar spent on Lyft rides.

Choose to link your Lyft account with one of these loyalty program. Each loyalty program has a different earning structure.

Note that you do not have to have a credit card with any of these to earn the points, just a free loyalty account.

Pay for your Lyft ride with your eligible Chase card to earn more Chase Ultimate Rewards®, through March 2025. Chase Sapphire Reserve® cardholders earn 10x Chase Ultimate Rewards® on Lyft rides. Chase Sapphire Preferred® Card holders earn 5x Chase Ultimate Rewards® on Lyft.

Additionally, you can get two years of Lyft Pink free with your Chase Sapphire Reserve® card.

credit card

Current Bonus:

60,000 points

Earn 60,000 Ultimate Rewards® points after you spend $4,000 on purchases in the first 3 months from account opening.

Annual Fee:

$550

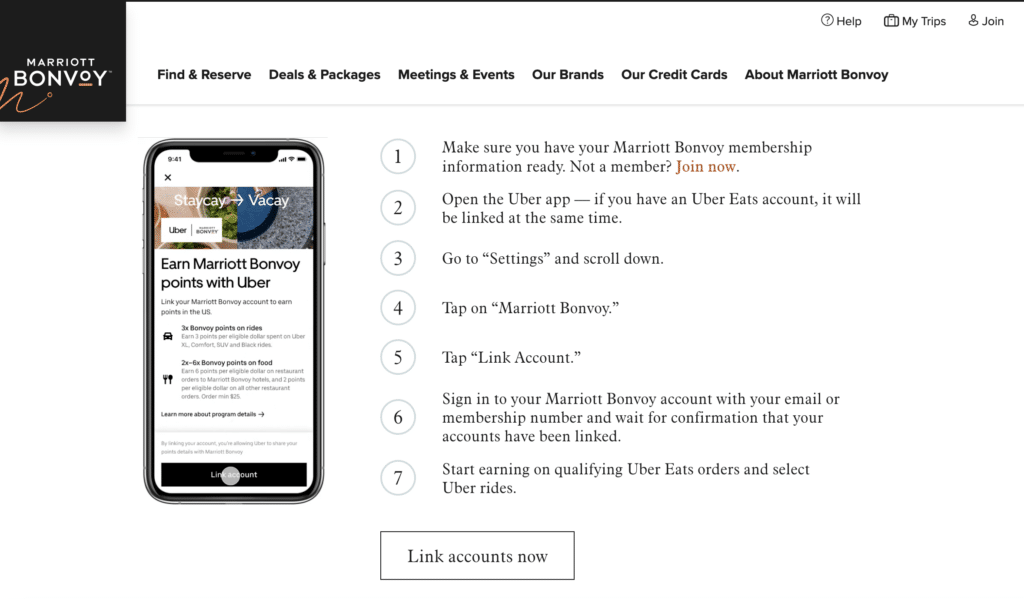

Uber and Marriott

Link your Marriott and Uber accounts to earn Marriott Bonvoy points on Uber Premium rides or Uber Eats.

In order to link your accounts, go to Settings in the Uber app, click on Marriott Bonvoy, click on “Link account,” and sign in to your Marriott account.

You’ll earn 3 points per $1 on Uber Premium rides (includes Uber XL, Uber Black, Uber SUV and Uber Comfort), 6 points per $1 when you order more than $25 from Uber Eats while you’re staying at a Marriott property, and 2 points per $1 on all other Uber Eats orders over $25.

Don’t have an Uber account yet? Download Uber or Uber Eats, set up an account, and link it to your Marriott Bonvoy account by June 30, 2023 to earn 1,000 bonus Marriott points.

Don’t forget, if have an American Express Platinum card, you get $200 in Uber Cash each year.

charge card

welcome offer:

Offers vary depending on the link you use to apply. Check CardMatch to see if you are matched with the new 150k offer on The Platinum Card® from American Express that is exclusive to CardMatch.

Alternate offer: Some people are finding up to 175,000 point offers at this link when they open in incognito.

All information about The Business Platinum Card® has been collected independently by Katie’s Travel Tricks. The Business Platinum Card® is no longer available through Katie’s Travel Tricks.

American Airlines and Hyatt

If you are an elite World of Hyatt member, you can link your Hyatt and AAdvantage accounts to earn one Hyatt bonus point per dollar spend on qualifying American Airlines flights.

If you are an elite member of World of Hyatt and AAdvantage, you can also earn one AAdvantage mile for every dollar spent on qualifying Hyatt stay.

credit card

welcome offer:

60,000 points

Go> Earn 60,000 Ultimate Rewards® points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

Annual Fee:

$95

credit card

Welcome Offer

Earn an additional 1.5% cash back

Earn 1.5% cash back on all spendings. Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back!

>Alternate offer : Earn $200 after you spend $500

Annual Fee:

$0

credit card

welcome offer:

$200 Bonus Cash Back

Learn How to Apply – Earn $200 bonus cash back after you spend $500 on purchases in your first 3 months from account opening.

Annual Fee:

$0

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Thanks for the info!