All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com site has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Chase Sapphire Reserve® Card Guide (and 2025 Changes)

Update January 25, 2026

Multiple sites are reporting Chase has announced new eligibility guidelines. You are now eligible to earn a welcome offer on each Sapphire product. That means if you currently hold a Chase Sapphire Preferred® Card, you are still eligible to open a Chase Sapphire Reserve® and receive a welcome offer. The reverse is also true — if you have previously earned a welcome offer on a Sapphire Reserve, you are still eligible for an offer on the Sapphire Preferred in the future. Official language on the landing pages has not updated but this was reported in the following sources: The Points Guy, Doctor of Credit, Upgraded Points, CNBC

The Chase Sapphire Reserve® card is the premium Chase Ultimate Rewards® earning card. It has a high annual fee but comes with a lot of perks and benefits that may make it worth the high fee for you.

Want to know if this card is worth it for you? Scroll to our benefits calculator at the bottom of the page to make your own valuation!

In June, 2025 Chase also introduced a new credit card: Chase Sapphire Reserve for Business. Read the full guide to the business version here.

Annual Fee:

Annual Fee

The annual fee for the Chase Sapphire Reserve® is $795 a year. This makes it one of the highest annual fees around (Except for ultra premium cards that are invite-only).

Authorized users cost $195 to add.

My Take: This is an incredibly hefty annual fee and that fee alone will mean a lot of people will pass up this card. It's not a beginner friendly card at this price point. But some people will see that astronomical fee and look at the annual credits and decide that surprisingly it makes sense for them. It all depends on how you already do your spending if this card provides true value to you.

Earning Rates

This is what you earn when you make purchases on the card:

| Purchase Type | Earning Rate |

|---|---|

| Flights, hotels, and car rentals booked through Chase Travel℠ | 8x |

| Hotels and flights booked directly with hotels and airlines | 4x |

| All other travel purchases | 1x |

| Lyft | 5x |

| Dining | 3x |

| All other purchases | 1x |

Points on travel are not earned until after the first $300 is spent annually on purchases in the travel category. The first $300 spent goes towards the $300 Annual Travel Credit.

Benefits

$300 Annual Travel Credit

Any purchase that you make that codes as a travel expense will automatically trigger the statement credit. This is true for larger purchases like hotel rooms or flights, but also works for parking, bus tickets, or even some campsites.

My Take: This $300 travel credit is the easiest travel credit to use of any premium card.

$120 Trusted Traveler Credit

You get a statement credit of up to $120 every four years for purchases made for Trusted Traveler programs like Global Entry, NEXUS, and TSA Precheck.

My Take: We love our Global Entry, but if you're in the points world long enough, these credits become less valuable because you might already have Global Entry. And now that kids get Global Entry for free if parents have it, most households need a max of 2 of these credits. It's still a nice credit.

Airport Lounge Access

The Chase Sapphire Reserve® provides access to 3 networks.

- Priority Pass lounges for the primary cardholder and two guests.

- Chase Sapphire Lounge® by The Club for the primary cardholder and two guests.

- 20+ select Air Canada Maple Leaf Lounges and Air Canada Cafés when traveling on a Star Alliance airline for the primary cardholder and one guest.

My take: This doesn't quite cut it for families of 4+ but is still more generous than the new Capital One Venture X Rewards Credit Card policies and Amex policies!

Bigger families would need to either pay $195 to add an authorized user to get more guest access (pricey) or have another person in the household get this card or another card. See more on lounge strategy here.

DoorDash Benefits

You get free DashPass through 12/31/27 or a minimum of 1 year. This depends on the activation date. If activated by 12/31/26, the expiration date will be 12/31/27. If DashPass is activated between 1/1/27 – 12/31/27, your expiration date will be one year from activation.

You get up to $10 off two orders per month on DoorDash non-restaurant orders. Discounts must be used for two separate orders.

Chase Sapphire Reserve® members enrolled in DashPass will receive $5 per month DoorDash credit. If the credit is not used within the calendar month, it will be carried over for a maximum of 2 months. Up to $15 in credit can be accrued before a $5 credit expires.

My Take: I like this benefit, but some people find it hard to use if they don't have a pickup location near them. I still wouldn't value it at $300/year like Chase claims. Personally, I place the value more around $100/year. But it can still be a great way to get road trip snacks or to get items delivered to your house for about the same price as going to the store. Here's how to activate this.

Lyft Credit $10/month

Chase Sapphire Reserve® members get $10 in monthly credit towards Lyft rides when they link their card to their Lyft account. This offer is good through September 2027.

Credits do not roll over to the next month, and they cannot be used on Wait & Save rides or bike and scooter rentals.

My Take: Useful if you use Lyft. If not — this may not add value for you.

Travel and purchase protections

The Chase Sapphire Reserve® offers some great protections to give you peace of mind when you're traveling and on those big purchases.

The Trip Delay Reimbursement is an upgrade to a similar benefit you receive on the Chase Sapphire Preferred® Card. On the Preferred card, this benefit kicks in after a delay of 12 hours. On the Reserve card, it kicks in after a delay of just six hours.

Other benefits include:

- Auto Rental Collision Damage Waiver

- Trip Cancellation/Trip Interruption Insurance

- Travel and Emergency Assistance Services

- Extended Warranty Protection

- Purchase Protection

Who gets travel insurance protections:

Trip delay/cancellation/interruption, baggage delay, and lost luggage insurance all apply to the card member and their immediate family.

The card member does not need to be traveling on the reservation for coverage to apply! The trip just needs to be booked using the card.

Free Subscription to Apple TV+ and Apple Music

This benefit is through June 22, 2027. To activate this benefit, you'll need to open your Chase Mobile® app and go to the Card Benefits section. Then you'll look for the Apple TV+ and Apple Music offers and follow the prompts to link your Apple ID. It will then let you activate your complimentary subscriptions. If you already have a subscription, it will be automatically suspended.

Normally Apple TV+ costs $9.99/month and Apple Music costs $10.99/month.

My Take: Useful if you already pay for these. Or if you're willing to switch from another music service (like Spotify) to save. Personally I value this at about $100/year. We have Apple TV+ most of the year but not all year. And we use YouTube Premium so the Apple Music isn't particularly useful to us.

Peloton: 10x Points + $10/month

10x points on eligible Peloton hardware and accessory purchases, up to 50,000 total points. Maximum of $10/month ($120 max annually) annual statement credits towards Peloton memberships, including All-Access Membership, App One, App+, Guide or Strength+.

My Take: If you already have a subscription, this is a true credit. If not, it might be a fun perk or might be worthless to you. The cheapest option is a subscription to the Strength+ App which costs $9.99/month. This credit should cover that in full. Note that you have to activate this benefit at onepeloton.com/digital/promotions/chase

StubHub Credits: $300 a year (in two $150 credits)

You get a $150 statement credit for purchases at StubHub or viagogo twice a year. One $150 will be good from January 1 to June 30 each year. Then between July 1 and December 31 you could get up to another $150 credit. This is through December 31, 2027.

A few notes:

- One-time activation required on chase.com or the Chase Mobile® app

- Events in the UK will not work

- Tread carefully with purchases made near the cutoff date, it's unclear if you make a purchase on June 30 but it posts on July 2 which credit it would use.

My Take: For us this is a great credit as we actually use StubHub regularly to buy tickets to sports events (Go Cubs!) and theater productions in Chicago. We particularly like using it for last minute tickets — like when we saw Hamilton for $50! But as with all the credits, you need to value it according to how you actually spend your money.

Restaurant Credits: $300 A Year (In Two $150 credits)

Here are the participating restaurants.

If you dine in at these restaurants, a statement credit will be automatically applied. You can get a maximum accumulation of $150 in statement credits from January 1 through June 30. Then it resets and you can get up to another $150 from July 1 through December 31, for a total maximum accumulation of $300 in statement credits each calendar year.

Notes:

- Delivery, takeout, merchandise, gift cards might not trigger the credit.

- If you pay with a digital wallet (like Apple Pay) it might not trigger the statement — you should pay with the physical card.

- Go to OpenTable.com/Sapphire-Reserve-Dining to see the list of restaurants. Some also hold additional tables for card members to reserve.

My Take: I think this is a fun new benefit if you live in one of the cities with restaurants, or you'll travel to them. Some of the restaurants are higher end and some have medium priced meals. So for us, this means we could probably get 3-4 dates a year using this benefit and that's fun! Or two fancy dates. But it's easy for us because we live in Chicago.

Sapphire Reserve Exclusive Tables

Participating Restaurants

Hotel credits with The Edit Collection

This is marketed as a $500 credit for stays with The Edit collection. Like the credits above, it comes in two credits, each for half the year making it less valuable than it appears. It is $250 for January to June and $250 for July to December. Maximum of $250 each half year.

Beginning January 1, cardmembers can automatically receive up to $250 for each prepaid booking with The Edit, up to $500 annually (versus split between two 6-month time periods).

Notes:

- Two-night minimum.

- Purchases that qualify will not earn points.

- Must be a pre-paid stay

- Most of these hotels are priced higher via Chase Travel than booking direct

My Take: I don’t consider this a true savings for the average person but there is value potential here. I used this perk for the first time in August 2025 by using a combination of Points + Cash booking via Chase Travel. I left exactly $250 of cash and paid the rest with my points.

Edit Collection hotels are all part of Points Boost and you get a redemption rate of 2 cents per point while booking them. This opens the door to some options for independent hotels as well as chain hotels. At some chain hotels like Hyatt you’ll even still earn elite night credits. I also like how you can book into any room type but still use your points.

Just in 2026: $250 credit for select Chase Travel hotels (MAP)

This benefit was announced in September 2025 and at this point is just for 2026.

Cardmembers will get up to $250 in statement credits in 2026 on prepaid Chase Travel hotel bookings for IHG Hotels & Resorts, Montage Hotels & Resorts, Pendry Hotels & Resorts, Omni Hotels & Resorts, Virgin Hotels, Minor Hotels and Pan Pacific Hotels and Resorts. In addition to receiving the statement credit, these bookings are eligible to earn Ultimate Rewards points (for spend above the $250 credit amount) and corresponding hotel loyalty program points for the entirety of the purchase. A two night stay is required to receive the statement credit.

My Take: This is a really interesting credit to see added. The fact that IHG Hotels & Resorts are included means there are a huge number of hotels you could use this at. I believe (but cannot confirm yet) that this would also stack with the Edit Collection credit. So if you found an IHG property that was also on The Edit list, you’d get a total of $500 back for a 2 night stay.

Because it’s a one year credit only, I probably personally won’t assign a value to it but I could definitely see us using it. One of our favorite Chicago hotels is the Intercontinental which has an amazing art deco pool and winter rates are often quite low, so this credit would almost cover 2 nights there.

Hotel Map for Select Chase Travel Hotels $250 Credit

NOTE: IHG Hotels & Resorts and Minor Hotels are not listed on the map below due to the large number of options. Please see the individual sites to view the property locations.

Filter by Brand

Brands

2025 Changes:

Before June 23, 2025, the annual fee was $550 per year. Authorized users used to cost $75 to add.

Benefits Added

All of these benefits were added in 2025:

- Free Apple TV+ and Apple Music subscriptions

- $10 per month Peloton credit

- $300 per year Stubhub credits

- $300 per year restaurant credit

- $500 credits with The Edit collection

- $250 credit for select hotels in Chase Travel

Changes to Earning Points

| Purchase Type | Old Earning Rate (Reserve) | New Earning Rate (Reserve) |

| Flights purchased through Chase | 5x | 8x |

| Hotels and car rentals booked through Chase | 10x | 8x |

| All other travel purchases | 3x | 4x for hotels and flights 1x for all other |

| Lyft | 5x | 5x |

| Dining | 3x | 3x |

| All other purchases | 1x | 1x |

My Take: Losing 3x earning on all travel purchases will be a loss for a lot of people. This affects purchases like trains, car rentals, Airbnb, even tickets for amusement parks that are purchased from travel agents. I don't think the 4x on hotels and flights booked directly will make up for that loss for most people.

Loss of Standard 1.5x: Changes to Redeeming Points via Chase Travel℠

I have long touted the perk of redeeming Chase Ultimate Rewards® from a Sapphire Reserve through the travel portal at a rate of 1.5x. This has been the highest value you can get for your points booking through an online travel portal and one reason I encouraged a lot of people to consider the card.

But this benefit is being discontinued and the new base rate for redemptions via Chase Travel will now be 1 cent per point.

Now there is a new "perk" called Points Boost where cardmembers' points "could be worth up to 2x" on some hotels and some premium class flights.

Note that points earned prior to October 26, 2025 by Sapphire Reserve cardmembers who applied prior to June 23, 2025 can be redeemed at 1.5x on Chase Travel until October 26, 2027. Those grandfathered cardmembers will automatically receive the best offer available, whether it's Points Boost or 1.5x on Chase Travel, maximizing rewards value for two years.

My Take: This is a huge loss for what has been a great option for booking cheap flights and independent hotels with the great 1.5x rate. We'll have to wait and see how the Points Boosts play out. The top option may remain redeeming points via Aeroplan Pay Yourself Back.

Other Changes I think are irrelevant

Chase also added some "premium benefits" if you spend more than $75,000 a year on this card. Sure if you're spending that much on the card these might be nice? But not worth doing all that spending to get these.

- IHG One Rewards Diamond Elite Status (you can get this just by holding an IHG Credit Card)

- Southwest Airlines® A-List Status (most benefits will probably be redundant if you have the higher annual fee Southwest cards)

- $500 Southwest Airlines credit when booked through Chase Travel (Generally you're better off transferring points to Southwest to book instead of booking via Chase Travel thanks to added flexibility but if you earn this credit, go ahead and book via Chase Travel to use it!)

- $250 credit to The Shops at Chase, a new online shopping experience designed exclusively for cardmembers allowing them to shop for brands including Dyson, Sony, Therabody, and Tumi, with rotating promotions, using their Ultimate Rewards points or their card to pay

Benefits Calculator

Chase Sapphire Reserve®: What's It Worth to You?

Enter your personal estimated annual value for each benefit to see a customized calculation of the card's worth.

Your Total Annual Value:

Annual Fee: $795

Your Net Value / Cost:

Benefits Checklist

Chase Sapphire Reserve® Card Benefit Checklist

A handy guide for Katie's Travel Tricks readers to maximize your card benefits.

Reminder: Automatically applied to your account for travel purchases.

Reminder: Fee credit for Global Entry or TSA PreCheck® application every 4 years.

Reminder: Access to Sapphire & Priority Pass lounges for you and 2 guests.

Reminder: DashPass membership ($120/yr) and $25/mo ($300/yr) in credits.

Reminder: $10 in credits applied to your account each month.

Reminder: With The Edit Collection ($250 twice per year).

Reminder: For IHG Hotels & Resorts, Montage Hotels & Resorts, Pendry Hotels & Resorts, Omni Hotels & Resorts, Virgin Hotels, Minor Hotels and Pan Pacific Hotels and Resorts.

Reminder: Via Sapphire Reserve Exclusive Tables ($150 biannually).

Reminder: Credit for Apple TV+ and Apple Music.

Reminder: $150 in credits delivered biannually.

Reminder: $10 in statement credits each month on eligible memberships.

Reminder: Car Rental CDW, baggage delay insurance, emergency evacuation and transportation, emergency medical and dental benefit, extended warranty, lost luggage reimbursement, purchase protection, return protection, roadside assistance, travel accident insurance, trip cancellation/interruption insurance, trip delay reimbursement.

Is it worth it?

What do you need to keep in mind if you're evaluating if this card makes sense for you?

If you look at these credits and they don't match the way you spend, ignore this card! It will take mental energy to ensure you're getting your money's worth — besides the fact you'll have to shell out $795 up front and then later try to make your money back on it!

You could also look instead to the new business version of this card. Read our full take on that card here. One advantage of the business version is that it does not add to your 5/24 count. The benefits are slightly different and may be better or worse for your spending habits. We have a calculator on that article to help you decide that, too! Keep in mind the business version does not have any option to pay for authorized users to have lounge access.

Approval Odds

Chase doesn't have specific approval guidelines listed on their website. This card used to have a 48 month family restriction on earning welcome offers, but this has been discontinued in favor of terms that are more vague.

We recommend you only apply for this card with a strong credit score.

Like all Chase cards, you'll almost always need to be under 5/24 to be approved. Read more about 5/24 here.

There are other terms listed on the website application:

"This credit card is unavailable to you if you currently have one open. The new cardmember bonus may not be available to you if you currently have any other personal Sapphire cards open, previously held this card or received a new cardmember bonus for this card. We may also consider the number of cards you have opened and closed, as well as other factors in determining your bonus eligibility."

Not available to current Sapphire Reserve Cardholders

This is very straightforward. If you currently hold a Sapphire Reserve, you can't apply for another one. If you have received a welcome offer on a Sapphire Reserve, you won't be eligible for another one.

Update January 25, 2026

Multiple sites are reporting Chase has announced new eligibility guidelines. You are now eligible to earn a welcome offer on each Sapphire product. That means if you currently hold a Chase Sapphire Preferred® Card, you are still eligible to open a Chase Sapphire Reserve® and receive a welcome offer. The reverse is also true — if you have previously earned a welcome offer on a Sapphire Reserve, you are still eligible for an offer on the Sapphire Preferred in the future. Official language on the landing pages has not updated but this was reported in the following sources: The Points Guy, Doctor of Credit, Upgraded Points, CNBC

Number of cards you have opened and closed

This part of the offer terms is vague and just gives Chase the chance to deny someone a card with a bonus, much like Amex does.

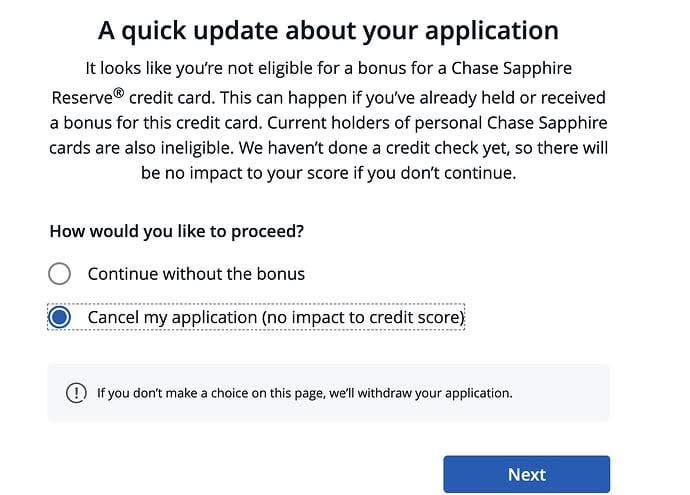

Pop Up Before Submitting

With the new vague terms, Chase has also added a step where if it finds you aren't eligible (due to their criteria), you will see a pop-up before fully submitting your application.

This at least gives you a chance to cancel the application with no impact to your credit score. Note that some people are still denied for this card, even if they don't receive the pop-up.

How To Apply

Interested in applying? Please use my affiliate link! It helps support my site and doesn't cost you anything!

Table of Contents

- ELEVATED OFFER!

- Earning Rates

- Benefits

- $300 Annual Travel Credit

- $120 Trusted Traveler Credit

- Airport Lounge Access

- DoorDash Benefits

- Lyft Credit $10/month

- Travel and purchase protections

- Free Subscription to Apple TV+ and Apple Music

- Peloton: 10x Points + $10/month

- StubHub Credits: $300 a year (in two $150 credits)

- Restaurant Credits: $300 A Year (In Two $150 credits)

- Sapphire Reserve Exclusive Tables

- 2025 Changes:

- Benefits Calculator

- Benefits Checklist

- Is it worth it?

- Approval Odds

- How To Apply

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

I currently have a CSR because my home airport has a Sapphire Lounge. In reading through the new details closely I wanted to pass along to anyone whose card anniversary falls after October and is thinking of utilizing the new benefits then downgrading or cancelling…

I didn’t read about the other programs but specifically for the $300 dining credit ($150/$150) and the Edit hotel stays ($250/$250) T&C’s state it takes 6-8 weeks to post the credit to your account. If you plan to cancel/downgrade, it has to be more than 90 days after those credits have posted or they will reverse the credits and you’ll be left with outstanding charges. For me, I will be deciding what to do (keep/downgrade) a year from now. So in order to use the January-June hotel or dining credit, I would need to utilize those in January or very early February, let the credits post 6-8 weeks later, then make sure I have at least 90 days before downgrading if I decide to do that. Which will make utilizing benefits tricky for some people, depending on their anniversary date.

On a positive note, I spent time checking out the dining options near me. While there are some high-end restaurants included, like you noted some of them are pretty reasonable. Making that $150 credit each 6 months more valuable to me in covering multiple date nights.

This is a great point — they are definitely trying to make it as hard as they can for “maximizers” who want to use the maximum number of benefits and then cancel.

My CSP is new (2 months old) so I can’t upgrade, but I have a Freedom Unlimited (for years and I never use it). I cancelled my CSR Jan 2025 (didn’t know I could downgrade). Could I still call to upgrade my Freedom and have both CSP and CSR at the same time?

Yes you can! That’s what I did.

My card renews on September 5. Would I still be charged the old annual fee then and also be able to get the new benefits on October 23?

Yep!

Thanks for the helpful analysis! Just to clarify, when you product changed your Freedom, that also changed the card year anniversary of when you would be charged another annual fee so that you would be able to get a full year of benefits at the old annual fee?

To be honest, I don’t know when my cardmember year starts/stops for that card. It might not be a full 12 months.

I have a Sapphire Reserve currently as well as a Freedom Unlimited. Do you think I would be able to downgrade to a Freedom Flex and then upgrade back to the Sapphire reserve for the sign up bonus offer? I think the benefits make sense for me to have the card.

It’s a little unclear now with the eligibility rules if they will necessarily approve you. If you don’t get approved you could then upgrade your Freedom again to a CSR but you would lose the grandfathered benefits.

I have CSP, if I downgrade, can I apply for CSR and get the bonus?

According to the new guidelines, yes in theory. But there are no guarantees you will get approved. You should get a pop up that tells you if you’re eligible before the application goes through.