All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from our partners. American Express is a Katiestraveltricks.com advertiser. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Booking Car Rentals with Points

Car rentals are one of those things that can be hard to use points and miles for. But it doesn’t have to be! There are several ways to use points to offset the expense of a rental car.

Even if you plan to pay with cash, you can make the most out of your car rental booking by earning extra points and booking with a card that offers extra protection. Many credit cards offer valuable insurance to ensure you’re protected if something happens to the car while renting.

Certain cards also give high-level status with rental car loyalty programs. That status gives you access to special deals and perks you wouldn’t have otherwise.

In this guide, I’ll go over all the ins and outs of booking rental cars with points, plus show you my exact strategy for getting the lowest prices!

Earning Points on Car Rentals

Put it Towards a Welcome Offer

If you’re working on a welcome offer for a new card, a rental car can help you meet that minimum spend—especially if it’s a larger expense.

Go through a Bank Travel Site

You can often earn more points by booking your car rental through a bank travel portal, like Capital One Travel or Chase Travel℠.

With the Capital One Venture X Rewards Credit Card, you earn 10 points per dollar spent on car rentals in Capital One Travel. That’s a good way to earn a lot of points on that expense!

Here are some other cards that offer elevated earnings on rental cars booked through their bank’s travel portal:

- Citi Strata Elite℠ card: 12x points on purchases in CitiTravel

- Citi Strata Premier® Card: 10x points on purchases in CitiTravel

- Citi Strata℠ Card: 5x points on purchases in CitiTravel

- Chase Sapphire Reserve®: 8x points on rental cars in Chase Travel℠

- Chase Sapphire Preferred® Card: 5x points on purchases in Chase Travel℠

Use a Shopping Portal

By booking your car rental through a shopping portal such as Rakuten or AAdvantage eShopping, you can earn extra points (or get some cashback). Just visit the shopping portal first, then click through their link to visit the merchant where you want to book the car.

Note: You can’t stack a shopping portal with a bank travel portal (it’s one or the other). But if you don’t have a card that offers elevated earnings in the bank travel portal, using a shopping portal is another way to earn extra points.

Redeeming Points for Car Rentals

Pay Yourself Back

The easiest way to use points to cover expenses for a car rental is to use pay yourself back, or redeem points for cash back in the amount of the purchase.

Many credit cards give you the option to redeem points for cashback. This is often at a rate of 1 cent per point. In this case, 10,000 points would cover a $100 car rental. Some options like Aeroplan Pay Yourself Back have a slightly higher redemption rate.

Use a Credit Card that offers Travel Credit

Some credit cards come with an annual travel credit that you can use for a variety of travel expenses, including rental cars.

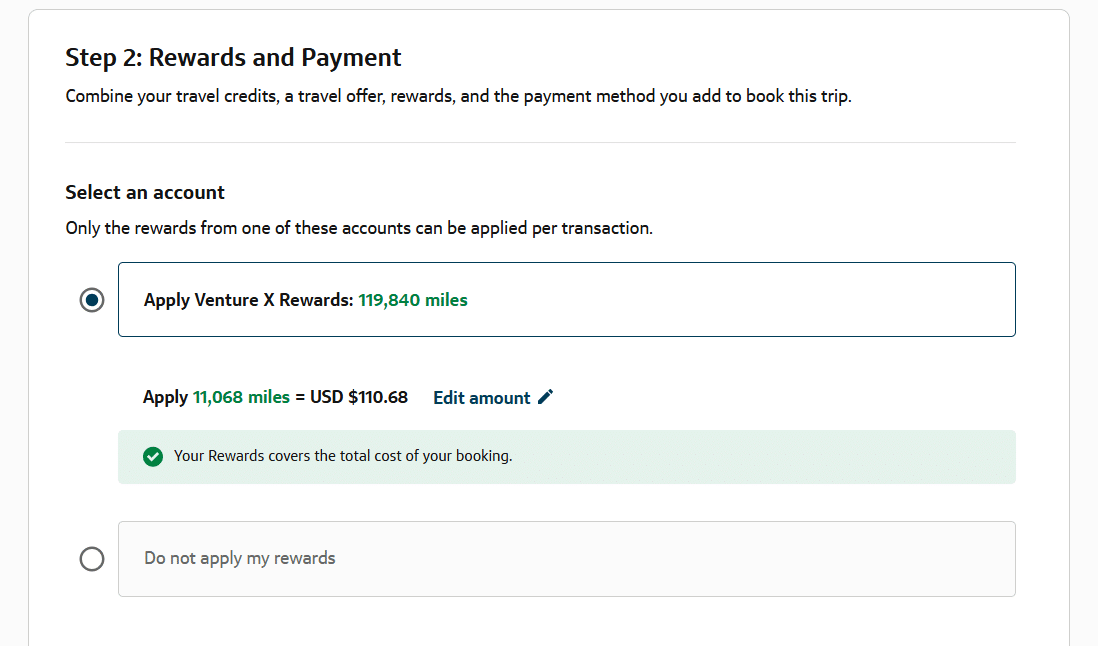

For example, the Capital One Venture X comes with a $300 annual travel credit. To use the credit, travel reservations must be made through Capital One Travel, the booking portal for Capital One.

When you go to checkout, you’ll be able to select your travel credit as the payment method. In the case of Capital One, the credit comes off like a coupon.

The Chase Sapphire Reserve® card is another card that gives an annual $300 travel credit. With this card, purchases that code as travel (like rental cars) are automatically credited back to your account, up to the $300 annual credit amount.

Use a Bank Travel Site

You can pay with points when booking a rental car in a bank travel portal like Chase Travel℠ or Capital One Travel.

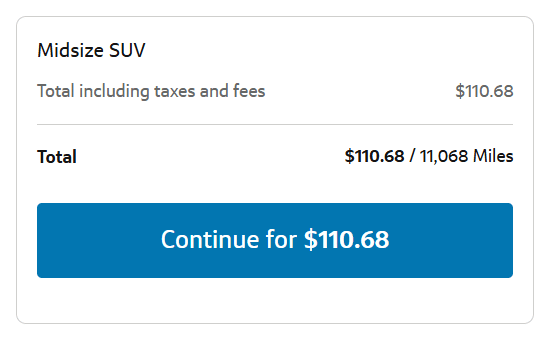

Select your car as usual, then on the checkout screen, select points as the payment method. You may have the option to pay the full purchase with points, or just a portion.

You’ll still need a card on file to make the booking.

Maximize Your Points By Doing Both

It’s possible to both earn and redeem points on the same purchase when booking a car rental.

Instead of using points to book the car rental directly, charge the expense to your card first. That way, you’ll earn points on the purchase. Then you can still redeem points to cover that purchase.

Here’s an example of how it works with Capital One. Say you book a $100 car rental through Capital One Travel. You could book it directly with points, using 10,000 points to cover the purchase.

OR you could book the same $100 rental through Capital One Travel and charge the expense to your Venture X card. You would earn 1,000 points for the booking, since car rentals booked through Capital One Travel earn 10x points with this card. Then you could redeem 10,000 points using the “cover travel purchases” feature that Capital One offers.

In the end, it’s like getting a 10% discount on the points needed to pay for the booking.

Note that when you redeem the travel credit, you don’t earn points on any portion that is covered by the travel credit.

Using AutoSlash to Get the Best Price

This is the exact process I use to get the best prices on rental cars! Autoslash makes it easy to keep track of prices so you can rebook if the price goes down.

Step One: Compare Prices

Start your search on AutoSlash to compare prices from multiple companies quickly. The website won’t show you the prices; you have to give them your contact information, and then they email you.

Another powerful aggregator we recommend is Discover Cars. Unlike AutoSlash, it shows you rates directly on the site, which makes for a fast comparison. We’ve found it to have especially competitive pricing for European rentals, so it’s a must-check if you’re traveling abroad.

Once you have quotes from those aggregators, I’d also recommend cross-checking a few other key places if they apply to you:

Costco Travel: If you’re a Costco member, it’s always worth a look. Theoretically, AutoSlash checks Costco prices, but we find it’s more reliable to check manually.

Bank Travel Portals: If you have a credit card that offers extra earnings in a travel portal (like the Capital One Venture X or the Chase Sapphire Reserve®), check there as well. Capital One Travel, in particular, can have some surprisingly great pricing.

Note: Prices for rental cars fluctuate all the time. No one website consistently offers the best price, which is why we recommend comparing prices across AutoSlash, Discover Cars, and these other sources!

Step Two: Make a Booking

You can book whatever is cheapest, but make sure you feel good about the company you select. Some of the bargain car rental companies have very poor reviews (especially at certain airports). It could be worth paying a little bit more for a well-known company with a good reputation.

Important: Make sure whatever you book offers free cancellation. Car rental prices are really volatile. With most rentals, there’s a good chance the price could go down. If you have free cancellation, you can easily rebook to get a better price if and when the price goes down.

Add Your Loyalty Number

When you make the booking, be sure to add your loyalty number for that car rental company. If you aren’t a member, join before you book! Not only can you get extra perks, but being a member also makes it a lot easier to pick up your car and get going faster.

Step Three: Track Prices

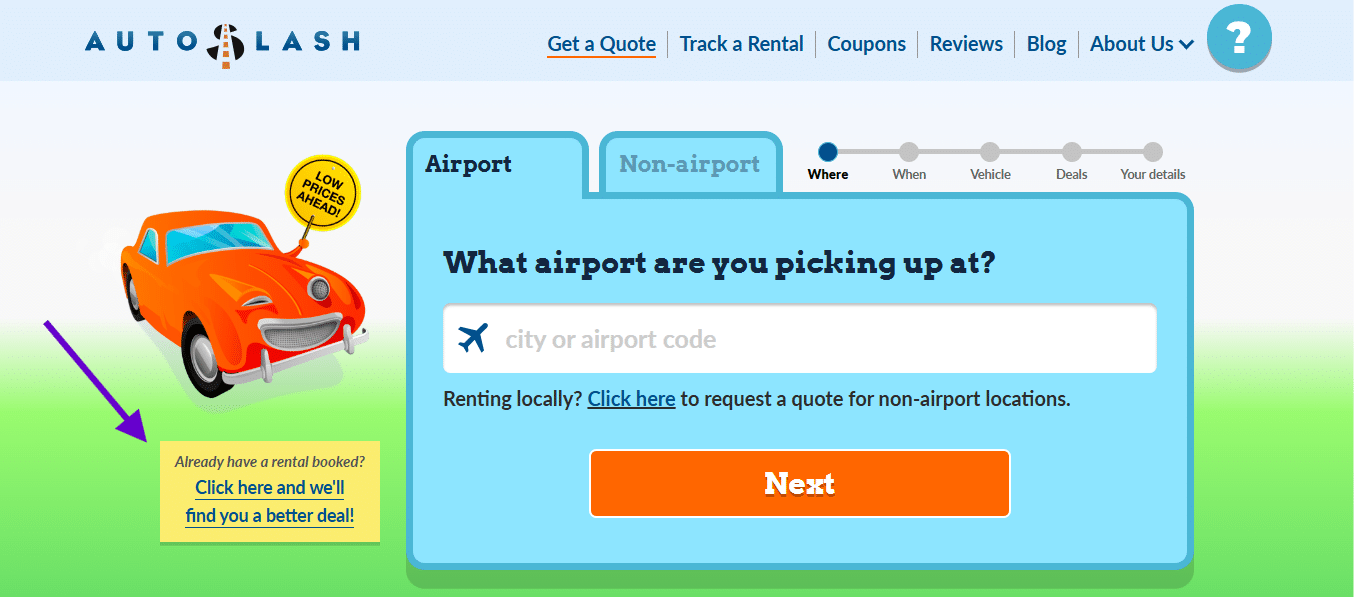

After you’ve made the booking, go back to AutoSlash and set up an alert for your dates and location. Find the box where it says “Click here and we’ll find you a better deal!” That’s where you can set up a price alert.

Once the alert is set up, you’ll get an email every time the price goes down.

When you get an alert that the price has gone down, cross-check the pricing found on AutoSlash with Costco and your preferred bank portal (like Capital One Travel or Chase Travel℠).

Step Four: Cancel and Rebook

When you’ve found a lower price, cancel your previous reservation and rebook whatever is the new cheapest option. You can do this several times!

Other Ways to Get a Discount on Car Rentals

Use a Corporate Code

If your company has a relationship with a particular car rental company, you may have a corporate discount code available to you. You can often use the code for personal reservations in addition to business trips.

Join the Loyalty Program

When you join the rental car company’s loyalty program, you get access to discounts and coupons that aren’t offered to the general public. Plus, you can earn points for every rental that can be redeemed for future rentals.

There may also be perks you’ll want to take advantage of, like making it easier to pick up your car! You can often skip the line and head straight to the lot. Programs vary, but many offer benefits like complimentary upgrades, bonus points earning, free additional drivers, and guaranteed availability.

Book Early

Booking early can help you get a better price. This isn’t always the case, though- sometimes rates go down! That’s why you want to keep tracking it and book a rate you can cancel.

Upgrade Your Status with a Credit Card

Many credit cards offer high-level status with different car rental programs as a benefit of the card. Here are some examples of the status you can get with several popular credit cards:

Capital One Venture X – Hertz President Circle

Chase Sapphire Reserve® – National Emerald Club Executive

United Club Card – Avis President’s Club

American Express Business Platinum gives you status with Hertz, Avis, and National.

Upgrade Your Status with a Status Match

Many car rental (and airline) programs will give you a higher level of status if you show them proof of your status with a competing program. This is known as a status match.

Here’s how it works. Say you have President’s Circle status with Hertz, but you want to book a car rental through Enterprise. You can go to the Enterprise status match page and fill out the form. Upload proof of your status with Hertz, and Enterprise will review the information. If you qualify, they’ll match your status with Hertz to the equivalent level of status that Enterprise offers. In this case, it would be Platinum.

Usually, a screenshot showing your name and level of status with the other company is sufficient proof of status.

Match from an Airline or Hotel

Even if you don’t have status with a competing car rental company, you may be able to match status from a hotel or airline program.

Different programs have different rules of when and how they’ll match status, so check with your preferred program for the details.

How to Find Status Match Information

To check if your preferred company offers a status match, just do a web search with the company name + status match.

For example, search “Enterprise status match” and you’ll be able to find information on how the Enterprise status match program works.

Use a Credit Card that Offers Rental Car Coverage

Many credit cards offer some level of rental car coverage. This can save you a lot of money in the case of an accident!

Primary rental car coverage kicks in before your auto insurance does. In many cases, this means you won’t have to file a claim with your personal auto insurance company at all.

Secondary rental car coverage works a little bit differently. Your personal auto insurance will apply first, and the secondary rental car coverage covers expenses that your auto insurance doesn’t cover. This type of coverage can often be used towards your deductible.

Note: Be sure to read the terms and conditions for what is and isn’t covered. Liability insurance typically isn’t included, and not all rental car types or countries are included.

Credit Cards that Offer Rental Car Coverage

Here are some popular credit cards that offer primary or secondary rental car coverage.

Primary coverage

- Chase Sapphire Preferred® Card

- Chase Sapphire Reserve®

- Capital One Venture X Rewards Credit Card

Secondary coverage

- American Express Platinum Card®

- American Express® Gold Card

- Capital One Venture Rewards Credit Card

- Aeroplan® Credit Card

- Southwest Credit Cards

For the American Express Platinum Card® and American Express Business Platinum Card:

Car Rental Loss and Damage Insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply. Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company. Inc..

For the American Express® Gold Card:

Car Rental Loss and Damage Insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply. Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

This isn’t an exhaustive list. Many credit cards offer this benefit! If your card isn’t listed here, you can check the terms and conditions of your card to see if rental car coverage is included.

Table of Contents

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Hi Katie. Thanks so much for all your tips! I have the Chase Sapphire Reserve and if I book the car through the Chase Travel portal using points to pay for the car, would I be covered under the Chase rental car protection?

yes you will!