All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com site has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Capital One Venture X Guide: Benefits and Review

Capital One Venture X Rewards Credit Card is a strong card for anyone who wants a flexible miles option and some high value perks. It’s fairly easy to make up the value of the $395 annual fee.

Updates November 2025:

New terms now state that if you earn a welcome offer on the Venture X card, you will not be eligible to earn a welcome offer on the Venture X or Venture or VentureOne card for 48 months. If you want to earn the offer on all three cards you’d need to start with the VentureOne and work up in annual fee.

I don’t think this is a huge deal though since there are so many other business card options for earning cash back or miles that can combine with Venture miles.

Updates coming February 1, 2026:

- No more guests at airport lounges (Priority Pass or Capital One lounges)

- Authorized users will no longer get lounge access automatically

- If you want authorized users to have lounge access, you’ll need to pay a $125 lounge fee

- See more details on these benefit changes below

Update March 1, 2025:

Plaza Premium lounges are no longer included with lounge access

Venture X Card Basics

Annual Fee – $395

The annual fee is $395 a year. If you've never had a card with a high annual fee, this may seem crazy! But thanks to just two of the annual benefits (the $300 travel credit and 10k anniversary miles), it is relatively easy for many people to get more than $395 value from this card.

You can also add 4 authorized users for free to share some of the benefits. NOTE: Starting February 1, 2026, you will still be able to add authorized users for free, but for them to get lounge access will require $125 per user.

Annual Travel Credit – $300

The $300 annual travel credit is per cardmember year. That means if you apply for the card in June 2025, you have through May 2026 to use the credit.

This credit is only for bookings made through Capital One Travel. You can book flights, hotels, car rentals, or activities.

Your credit will be offered to you to use during the booking process.

My Take: This is fairly easy to use, especially now that Capital One has added Activities to Capital One Travel. Essentially it works like a $300 coupon. You don't need to use it all at one time. The one disadvantage is that if you cancel a booking after your credit has expired, it will be lost.

Account Anniversary Bonus – 10,000 miles

Every year on your account anniversary, you will also receive 10,000 bonus miles.

My Take: At the minimum, you can redeem this for $100 in travel credit. That means this coupled with the $300 travel credit can make it easy to cover the value of the annual fee.

Earning rates

-

- 10x Venture miles on hotels and rental cars booked via Capital One Travel

-

- 5x Venture miles on flights and vacation rentals booked via Capital One Travel

-

- 2x Venture miles on all other purchases

Application Tips

Capital One can be finicky with approvals. There isn't a clear formula to follow to know you'll get an approval — in fact sometimes it seems like people with higher credit scores have a hard time getting approved.

One myth floating around is that you can only have 2 Capital One cards — fine print actually shows you could hold five.

Say You'll Carry a Balance

One question that you'll see on the application is different than other banks. It will ask you if you typically carry a balance on your credit card. This question is optional and non-binding.

It seems like (though we have only anecdotes) that if you check that you WILL carry a balance, you may be more likely to be approved.

Freeze Experian Credit Report

It seems like you'll have your best chance if you have relatively few new credit cards in the past 6 months. That's one reason we recommend in our Three Year Plan that a Venture X (or Venture) be one of the very first cards you get.

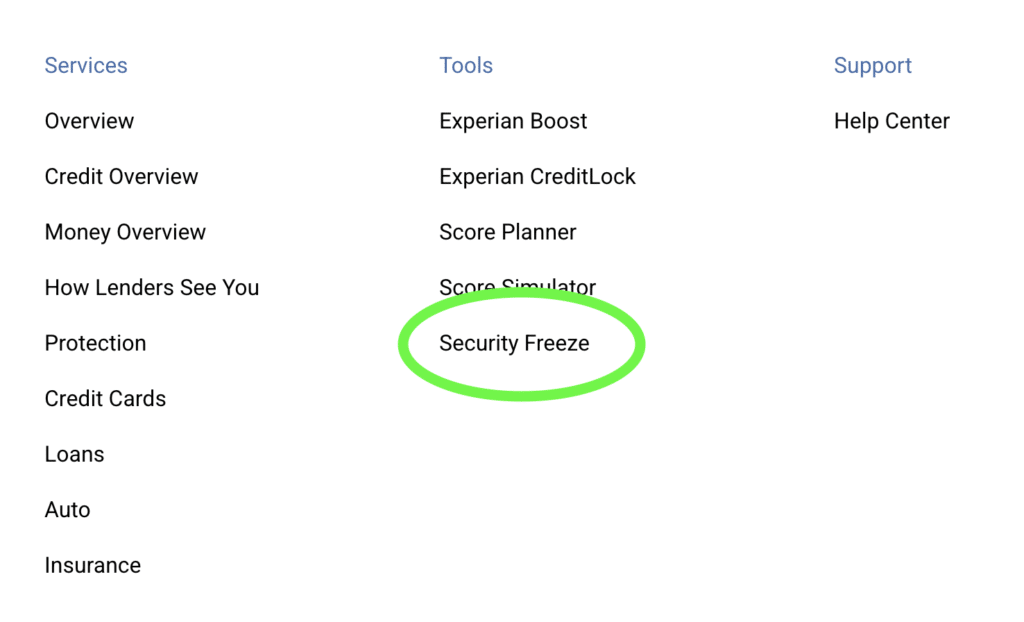

You can also help your chances by freezing one of your three credit reports. Capital One will always pull your credit from all three credit bureaus. They will still approve an application even if you have your Experian report frozen.

Data points seem to show that a lot of people get approved with the Experian report frozen. This doesn't seem to be true for having the TransUnion report frozen.

This is especially helpful if you have a number of inquires for business cards that ultimately didn't hit your credit report as new cards, just as inquiries.

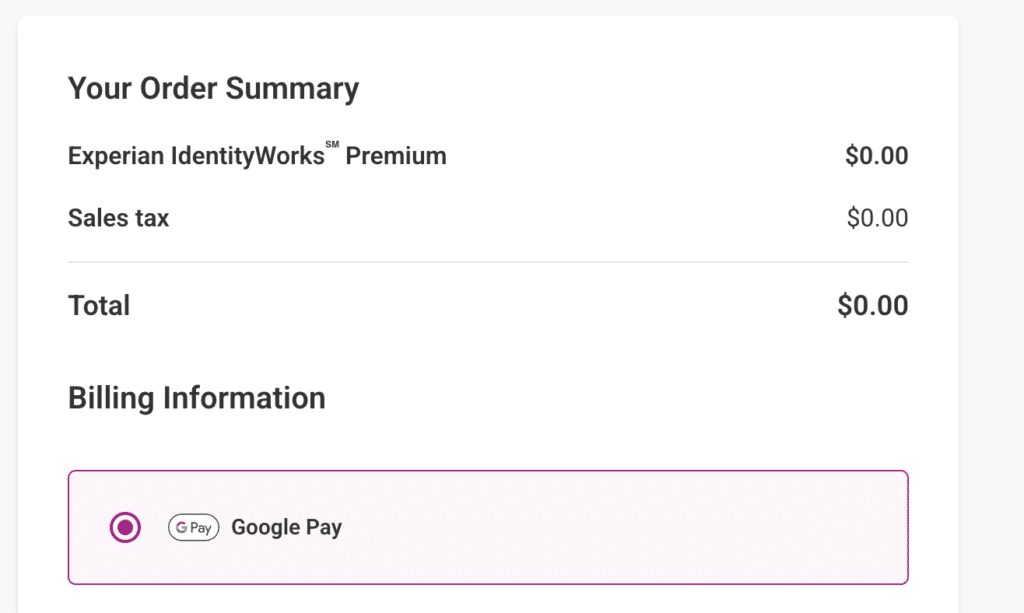

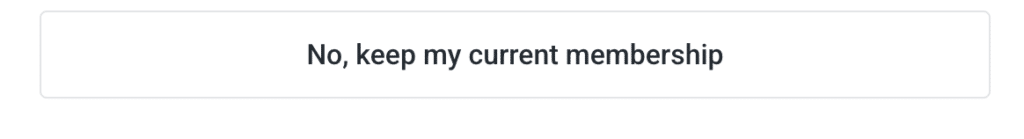

You can freeze your Experian report here. Just note that every time you log in, they will try to upsell you on a premium membership. Be sure to decline.

Don't get this!

Make sure to click this instead!

Then at the bottom of the page, you can find this link to Freeze your credit for free

I recommend you leave your reports frozen as the default anyway for better identity production.

Order to Apply

Starting in late 2025, Capital One changed the eligibility rules for the lower annual fee Venture and Venture One cards.

If you earn a welcome offer on a Venture X, you'll then be in-eligible to earn a welcome offer on a Venture or Venture One card for 48 months.

The terms don't stop you from earning a bonus on a higher annual fee card in the same card family. So if you already have a Venture or Venture One card, you'll still be eligible for a Venture X card with a welcome offer.

I don't think it's a huge deal to jump straight to a Venture X if you like the higher level of benefits.

That's because while you would be prevented from getting a Venture offer, you could still get all of the Spark Cash and Spark Miles cards. A lot of these business cards report to personal credit reports, so they do affect your 5/24 status but so does the Venture card. You could also earn cash back on the Savor cards and move those to combine with Venture miles.

Lounge Access

Note: Lounge access benefits are changing on February 1, 2026. See more about these changes below.

Which lounges can I go into?

You get access to Capital One Lounges and Priority Pass lounges. The best way to see which lounges you can access is on Capital One's Partner Lounge website. Scroll down to find the search bar.

Authorized User Access to Lounges

Through February 1, 2026 you can add 4 authorized users for free and they all get their own lounge access for themselves. After February 1, 2026, you need to pay $125 for an authorized user to have unlimited complimentary lounge access for themselves.

Capital One Lounges

Capital One lounges are some of the nicest lounges in the US! Only a few airports have them but if you're lucky enough to pass through one of these, you'll love it.

Sometimes these lounges have a waitlist.

WATCH: Here's how to get on the lounge waitlist before you arrive

Through February 1, each cardmember can bring two guests with them into these Capital One lounges. After February 1, 2026 there are no complimentary guests unless you spend $75,000 a year on your card.

To access the lounge, just show your Venture X card.

Priority Pass Lounges

Priority Pass is the largest lounge network this card provides access to. Each cardmember is able to enroll in a Priority Pass membership. Enter in your home airport or airports you are traveling to on the Priority Pass website to browse some options.

When you receive your physical card, you can use the number to sign up here for Priority Pass Membership : https://prioritypass.com/capitalone

A few weeks after you sign up, you will receive your Priority Pass card in the mail. I recommend you download the app and use the digital membership card instead!

When you enter a Priority Pass location, you'll typically need to show your membership card and your boarding pass for the day. They will process your card and add any guests you have with you. Be sure to check open and close times as well as guest policies for individual lounges.

Note: When the Venture X was first released, the Priority Pass membership was included access to non-lounge Priority Pass experiences, including select airport restaurants and spas. As of January 1, 2023, Priority Pass membership through the Venture X will exclude these non-lounge experiences. You will only be able to access places that are actual lounges.

The New Reality: What Changes on February 1, 2026

Get ready for some significant shifts in how the Venture X lounge benefits work, especially for families and authorized users.

Authorized Users Will Have a Fee (for Lounge Access):

- Starting February 1, 2026, authorized users will no longer automatically receive complimentary lounge access.

- To give an authorized user lounge access (to Capital One Lounges, Capital One Landings, and Priority Pass lounges), you'll need to pay an annual lounge access fee of $125 per authorized user.

- Important New Detail: Any authorized user you want to add for lounge access must be 18 or older. You can still add authorized users for free, but they won't have lounge access unless you pay that $125 fee.

Guest Access Gets Pricier (Capital One Lounges & Landings):

- The primary cardholder will no longer automatically get complimentary guest access.

- Guests 18 and older will be charged $45 per visit ($35 for Priority Pass lounges).

- Kids aged 2-17 will cost $25 per visit ($35 for Priority Pass lounges). Children under two are still free.

- The High-Roller Exception: If you spend $75,000 or more on your Venture X card per calendar year, you'll regain the ability to bring up to two complimentary guests to Capital One Lounges and one complimentary guest to Capital One Landings. (This spending threshold started in 2025, and if you hit it, your complimentary guest access is good for that year and the next.)

Chart Comparison of Lounge Changes

| Benefit | Current Status (Until Jan 31, 2026) | New Status (Effective Feb 1, 2026) |

|---|---|---|

| Primary Cardholder Lounge Access | Complimentary access to Capital One Lounges, Capital One Landings, and Priority Pass. | Continues to receive complimentary access to Capital One Lounges, Capital One Landings, and Priority Pass. |

| Authorized User Lounge Access | Complimentary access to Capital One Lounges, Capital One Landings, and Priority Pass. No fee to add AU. | NO longer automatic. Annual fee of $125 per authorized user for lounge access. Authorized user *must be 18 or older* to gain lounge access with this fee. |

| Guest Access (Capital One Lounges) | Primary cardholder can bring two complimentary guests. | NO longer automatic.

|

| Guest Access (Capital One Landings) | Primary cardholder can bring one complimentary guest. | NO longer automatic.

|

| Guest Access (Priority Pass Lounges) | Primary cardholder can bring two complimentary guests. | NO longer complimentary. Guests will cost $35 per visit. ($75,000 spending threshold *does NOT apply* for Priority Pass guest access.) |

More Capital One Venture X Benefits

Because the Venture X is a Visa Infinite card, you also get access to Visa Infinite perks.

Cell Phone Protection

If you pay your cell phone bill with the Venture X card, you will receive complimentary cell phone protection. It applies to all lines on the bill.

You get $800 of coverage (up to the value of your phone) if your cell phone is stolen or damaged. There is a $50 deductible per claim and you can use the benefit twice per 12 month period.

This includes accidental damage.

My Take: Unfortunately this is harder and harder to actually use. T-mobile will take away your auto-pay discount if you pay with a credit card. Verizon has a workaround to pay with a credit card but requires you to use an in-person kiosk every month. If your cell provider lets you pay with a credit card, it's a great benefit, though.

TSA Precheck / Global Entry Credit

If you pay for your TSA Precheck or Global Entry membership with the Venture X, you will get a statement credit for up to $120 (valid once every 4 years). You can use this benefit for yourself or use it to pay for another friend or family member.

My Take: We love this benefit! Read about these programs here.

Hertz President's Circle status

The primary card member and authorized users can sign up for this status. Perks include being able to skip the counter, guaranteed upgrades, and adding your spouse/partner as an additional driver for free.

Read more about how to use this benefit in my complete guide.

To access this offer, eligible cardholders must enroll via the Capital One website or mobile app. Once enrolled, your status level will remain active for the duration of the promotional period. Please be aware that signing up directly through the standard Hertz Gold Plus Rewards process (such as on Hertz.com) will not automatically recognize your eligibility, and you will not receive an automatic status upgrade. Additional terms and conditions apply.

My Take: We have been able to get free upgrades to SUVs or Teslas every time we have used this in the US. Outside of the US, I strongly advise against using Hertz as we've only had bad experiences overseas and they won't recognize this status anyway. Some people have more mixed experiences with Hertz in the US recognizing this status.

Extended Warranty Protection

You can receive an additional year of warranty protection at no charge on eligible items that are purchased with your Venture X card.

My Take: This matches the benefit on most credit cards.

Free Shipt Membership for 3 Years (Discontinued)

With your Venture X card, you are also entitled to a Free Shipt Membership for 3 years! This gives you free delivery on orders over $35.

Free Museum Membership (Discontinued)

This partnership with Cultivist is now discontinued

Venture X Travel Protection

Overall, if you have a Chase Sapphire Preferred® Card or Chase Sapphire Reserve® you're better off putting travel purchases on those cards for the travel protection benefits. They offer more comprehensive coverage.

Trip Cancellation and Interruption Coverage

If you paid for a ticket with your Venture X, you can receive up to $2,000 per eligible person for the nonrefundable common carrier ticket.

"Eligible persons" include you (the cardholder), your spouse or domestic partner and your dependent children if you charged the entire cost of the trip to your card or redeemed your miles earned from the card.

The trip cancellation and interruption insurance on the Venture X will only cover you and your immediate family members in one of the following scenarios, but there are some excluded situations.

-

- Death, accidental bodily injury, disease or physical illness.

-

-

- Default of the common carrier resulting from financial insolvency.

Trip Delay Reimbursement

If you experience a flight delay of at least six hours or requiring an overnight stay, you can receive up to $500 per eligible person for reasonable expenses incurred such as hotel rooms, meals and more. Your period of travel also must not exceed more than 365 days.

Auto Rental Collision Damage Waiver

Rent an eligible vehicle with your card and you could be covered for damage due to collision or theft. Learn more about rental car insurance.

My Take

I like that it is easy to make up your $395 annual fee. The $300 annual travel credit is fairly easy to use. The 10,000 bonus miles are posted automatically on your anniversary year.

Capital One also has some unique transfer partners (like JAL which is great for trips to Japan).

But in 2026, this is going from one of the best options for family lounge access to one of the worst. It's still a great option for solo travelers. For couples it could also be a good option. Either both of you could hold your own card (if you find the $300 travel credit easy to use) or you could pay $125 for the 2nd person to have their own lounge access.

That change means it's no longer a slam dunk card, even if it still offers good value overall.

Venture X Value Calculator

Capital One Venture X®: What's It Worth to You?

Enter your personal estimated annual value for each benefit to see a customized calculation of the card's worth.

Your Total Annual Value:

Annual Fee: $395

Your Net Value / Cost:

Unique Uses of Venture X Miles

Here are some of my favorite family friendly uses for Venture X miles. Read our full guide here.

Transfer to JAL to book flights to Japan

Capital One added Japan Airlines as a transfer partner in 2025. This is a pretty unique option and great for anyone planning a trip to Japan as JAL has increased availability of awards when using their own miles. Read more here.

Use your miles to Cover any travel purchase — even Disney!

While this is not the way to get the max value from your miles — it is a very easy redemption option that still provides value! If you have 75,000 miles, you can use it to cover $750 of travel purchases.

This works for any expense that codes as a travel expense. You can cover Airbnbs, hotels, or cheap flights. This is also the easiest way to pay for Disney Vacations using miles.

You can even plan to use your miles this way before you have them.

Transfer to British Airways for cheap flights to Dublin

This booking might seem more advanced if you're new to miles and points, but I promise you can do it!

British Airways has different partner airlines and those are the ones you'd want to use miles to book on. British Airways charges very high taxes and surcharges on its own flights, so we avoid them.

The sweet spot here is direct flights. British Airways uses a distance-based calculation for award flights. It also charges per flight segment. This means it makes flights with connection very expensive.

One of the best deals is:

-

- Fly on AerLingus for 26,000 miles round trip on direct flights from Chicago and farther east (if you fly off-peak). You will pay taxes and fees of $200ish per person.

Buy baseball tickets to a MLB game

Capital One has some exclusive tickets at baseball games — and sometimes you can get great seats for as little as 5,000 miles each. See Thrifty Traveler's write up for all the details.

Transfer to Virgin Red for a luxury adults cruise — or for flights on Delta airlines!

Virgin Red has some sweet cruise deals that pop up with miles. Note that they are adults only.

Capital One Transfer Partners

Looking for an option I didn't list above? You can transfer your Capital One miles to all of the following airlines and hotels:

1:2 transfer ratio

(1,000 Venture Miles = 2,000 points)

-

Preferred Hotels & Resorts (I Prefer)

1:1 transfer ratio

(1,000 Venture Miles = 1,000 miles/points)

-

Aeromexico Club Premier

-

Air Canada – Aeroplan®

-

Avianca LifeMiles

-

British Airways Executive Club

-

Cathay Pacific – Asia Miles

-

Choice Privileges®

-

Emirates Skywards

-

Etihad Guest

-

Finnair Plus

-

Flying Blue

-

Qantas Frequent Flyer

-

Qatar (Privilege Club)

-

Singapore Airlines KrisFlyer

-

TAP Miles&Go

-

Turkish Airlines Miles&Smiles

-

Virgin Red

-

Wyndham Rewards

2:1.5 transfer ratio

(1,000 Venture Miles = 750 miles/points)

-

EVA Air – Infinity MileageLands

-

JAL (JAL Mileage Bank)

2:1 transfer ratio

(1,000 Venture Miles = 500 points)

-

ALL – Accor Live Limitless

5:3 transfer ratio

(1,000 Venture Miles = 600 miles)

-

JetBlue TrueBlue

Table of Contents

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

[…] Extra Magic Hours where you can enter the park an hour early. The best way to do this is with a Capital One Venture X. You will earn 10x miles (essentially like a 10% discount) on your hotel booking and then you can […]

[…] My two favorite cards for using this method would be the Capital One Venture and Venture X. You can read my full post on the Venture X and see the other benefits I love on this card. […]

Hi Katie!

I was traveling with my 3 kids and have 2 Priority Memberships (I used your ‘single parent’ tip to get a second card). When we went into the lounge, they would not allow me to use my second membership since both memberships were under my name, so I had to pay for my third child to come in with us. This was one of the primary reasons I chose the Venture X card over the others. Did the rules change or am I not doing something correctly to take advantage of the second membership? Thank you!

A few questions. First, did you end up getting actually charged for the 3rd guest? As far as I have read in the terms it just says “guests” with no number. I haven’t gotten to test this out though and other bloggers have all been saying 2 guests. But I am not sure anyone has actually tested it and terms don’t have a number attached.

And then it is possible that this is just a rule enforced at that particular lounge. We’ve used two separate cards under the same name to sign in multiple times and never had an issue.

I have a few other ideas for workarounds, but first check to see if you were actually charged at all when they rung you up for 3 guests.

Hi Katie – Thanks for your reply.

This just happened over the weekend so I’m not sure if I’m going to be charged but I’m not seeing anything as pending so far. Perhaps you’re right that I won’t be charged but we were definitely limited to 2 guests. I’ll keep you posted about the charges.

However, I am optimistic that you’ve had success with two cards under the same name. This makes me feel alot better for choosing the Venture X card. Thanks again!

Hi Katie,

Looks like you were right. It’s been over a week and I’m not seeing the charges on my credit card.

Not sure why the front desk person had an issue with my second membership. It caused a bit of confusion at the time but seemed to have worked out. Next step is to use up the $300 travel credit and will try your suggestion, if needed. Thanks again!

Good to know! This fits with the terms that I can read which indicated it is actually unlimited guests at Priority Pass lounges. If you were to visit a Capital One lounge, you would just show the authorized user Venture X card for your child and that should be fine there. The other option is that Capital One has announced that you can use your Venture X instead of a Priority Pass card to enter a lounge. So you could try using the one Priority Pass card and the Venture X card that is in your child’s name. Unfortunately we don’t have any air travel at Priority Pass lounges where I can test all this until November!

Hi Katie – thanks for everything! You have great content and I am referring you to everyone I know! Just an FYI as I noticed a typo about the Cultivist program it is actually $440 not $40 per year as I saw when I clicked in the link.

looking at the museums lists for Cultivist it’s weird that a good amount of them listed are already free.

Hi Katie, I’m brand new to this and am so glad I found your site!! So helpful! We have had the CSP for a few years now and never redeemed any of the points and are sitting on a couple hundred thousand right now. I recently had my husband refer me to that card and have satisfied the minimum required spending for the welcome offer. That being said, my husband just got the Venture X and we’ll easily get that welcome offer on the next statement close with our regular household monthly spend. I guess my question is – how do you rack up a meaningful amount of points beyond the initial 75,000 welcome bonus? I’m loosely following your three year plan and while the benefits of the Venture X seem great, I don’t really understand how I’ll get enough of them to really utilize them. The Chase Ultimate Rewards seem a lot easier to rack up….

Yes, Venture miles are much harder to rack up. I honestly don’t focus much on them for that reason. I DO think the card is well worth having and keeping for benefits but I don’t spend a lot of time or mental energy on redeeming my Venture miles because I know I will never have as many. There are some places you can move Venture miles that would match up with Ultimate Rewards and there are some specific redemptions I mention in this article but you’re right — most people won’t earn too many of them especially since they are very finnicky with approvals!

Hello! You recommend using the Lounge Buddy App, but I get an error message that app isn’t available in my country or region. I live in Maryland.

Unfortunately Amex bought out Lounge Buddy and discontinued it. You can bookmark this site instead! https://capitalonetravel.com/lounges/partner-lounge-network

Hi, Katie!

Thank you for sharing all this amazing information with us! I followed your tips and had my husband apply for the Venture X card and I’m so bummed because he was denied. The reason for his denial was: “number of bank trade cards opened in the last 24 months”.

Do you have any insight on this denial? He’s only opened 3 cards total in the last 24 months, one of them was the Venture card but it was not recent. Are there waiting period rules to when you can open a Venture X if you have a Venture card? Or rules to how many Capt. One cards you can hold at one time? (We have excellent credit)

We did use your reconsideration script (thanks!) but got the same answer.

Capital One is unfortunately very hard to predict when they will approve someone. It seems like the best chance is often not having any new inquiries in the past 6 months and only 1 new account in the past 12. Another thing that sometimes helps (maybe?) is checking the box that you “will” carry a balance on the card. If he really wants this he could upgrade his Venture. Otherwise, waiting 3-6 months and trying again is another option!

I am thinking of getting this venture X card first before the chase sapphire. Is there any down side to that? We are traveling in 2 months and would like the lounge perks

That’s fine! The exact order isn’t important especially if you could use lounge benefits soon.

Capital One’s ability to transfer to partners has been broken for over a month. Pretty discouraged about this.

Did you have any luck yet? Looks like some people are having luck with escalating the issue with IT. https://www.reddit.com/r/CreditCards/comments/1jx9syb/capital_one_transfer_partnerssystem_down/

Thanks for all of this helpful information! One quick question—do you have to book your flight on this card to get access to the lounges? I’m asking because my company books the flights, but I book the hotels.

Nope! You just show the card or lounge membership at the lounge!

Hi Katie! Love your site. I have listened to 4 other podcasts and was really having trouble understanding this until I found your site. Now I’m understanding. I am planning a trip that won’t leave until mid-February. That means I am going to miss out on the lounge benefits for my companion. Is there a different card you would recommend to newbies, 0/24, that includes lounge access for a guest?

It can depend on the home airport! This post would walk you through https://katiestraveltricks.com/best-credit-card-for-lounge-access-by-airport/

Rented a car last week @ MCO via Hertz thru Cap One Travel w Venture X partly because of free additional driver (29 yr old daughter was going to do half of the driving).

When we got to Orlando, Hertz would only add a spouse for free (daughter would be $15/day).

I ended up doing all the driving, which was a pain.

Ah that’s frustrating. I just updated my guide to include the specification that it must be a spouse or partner. Thanks for letting me know.

Do you think you’ll change your 3 year plan recommendation from the X to the regular Venture due to the changes in lounge etc?? Has your opinion of it as a keeper changed?

I had already changed my recommendation for the Two-person plan to the Venture instead of the Venture X. In one-person mode, I think it can still make sense to get Venture X right away for the lounge benefits if someone is a solo traveler.