All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com site has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

The Complete Guide to the Chase Ritz Carlton® Card

The Chase Ritz Carlton® card flies under the radar of a lot of credit card enthusiasts because it is not open for new sign ups. But this card is still available as an upgrade option and is one of the best options for airport lounge access.

The Priority Pass lounge access it offers is unmatched by any other card — all card holders (even authorized users) get Priority Pass access. You get two Priority Pass guests for each cardholder. And it is free to add authorized users! If you frequent JFK, BOS, or LGA this card also gets you unlimited access to the new Chase Sapphire lounges. Unfortunately, as of July 1, 2024, this card will no longer provide access to Priority Pass Restaurants but will retain other Priority Pass experiences like Be Relax Spa.

Chase Ritz-Carlton® Card: Quick Hits

The information related to the Chase Ritz-Carlton® Card was collected by Katie’s Travel Tricks and has not been reviewed or provided by the issuer of this product/card. Product details may vary. Please see the issuer website for current information. Katie’s Travel Tricks does not receive commission for this product.

- Earning: 6x on Marriott, 3x on dining/car rentals/airfare, 2x on all other purchases.

- Welcome Offer: None. Available via upgrade only.

- Annual Fee: $450.

- Top Perks:

- Unlimited Priority Pass Select membership (including experiences, does not include restaurants after July 1, 2024).

- Global Entry/TSA Precheck credit ($120 every 4 years).

- Free authorized users who also get Priority Pass access.

- Annual Free Night Certificate (up to 85,000 points).

- Automatic Marriott Gold Status

- $300 Annual Travel Credit.

Good for: Frequent travelers who want airport lounge access, especially if you frequent an airport with a Priority Pass experience like Be Relax Spa, Gameway, or a Chase Sapphire Lounge. Can be especially valuable for families due to Priority Pass access for two guests and free authorized users who also get lounge access.

Drawbacks: No welcome bonus, requires existing Marriott card and $10,000 credit line for upgrade.

Overall: A hidden gem among travel cards with excellent benefits for its annual fee, especially for families.

How to Get the Chase Ritz-Carlton® Card

The Chase Ritz Carlton credit card is a bit more tricky to get into your wallet. You currently cannot apply outright for this card. So how exactly do you get this card?

You need to apply for a different Chase Marriott personal credit card like the Chase Marriott Boundless® first. After holding this card for one year, you’re eligible to upgrade to the Ritz Carlton card. Simply call the number on the back of your credit card or send a secure message to Chase and ask for an upgrade.

See the Chase Marriott cards here. Make sure you’re looking at the Chase cards and not American Express cards.

There are a few caveats to getting the Ritz Carlton card:

- To open a Chase Marriott card in the first place, you’ll be subject to Chase’s 5/24 rule. If you’re not sure what that is, you can read all about it here! Be aware that to apply (and receive) a welcome offer any Marriott card, you cannot have received the welcome offer on any Marriott card in the previous 24 months.

- When upgrading to the Ritz Carlton card you’ll be required to have at least a $10,000 credit line on the card. If your current Marriott card doesn’t have that high of a limit, you can always request to move some credit to that card from an existing personal card with Chase.

- Some people who are trying to upgrade directly from the Marriott Bonvoy Bold® Credit Card are told it isn’t possible. But when people upgrade from the Bold to the Boundless, wait 7 days, then ask to upgrade to the Ritz, it seems to work!

Earning Rates

- 6x points on Marriott purchases

- 3x points on dining, car rentals and airfare

- 2x on all other purchases worldwide

While this card doesn’t have the best earning rates on the market, it is on par with what you’d expect from other co branded Marriott credit cards. And let’s be honest, the star of this card is the benefits that come with it – not the earning rates.

Note that this card also comes with 0% Foreign Transaction Fees – making it a viable card to carry with you abroad.

Benefits of the Chase Ritz-Carlton® Card

Our favorite perk on this card is the lounge access — but the annual certificate, hotel status, and travel credits are valuable, too.

Lounge Access

This card has the best Priority Pass lounge access options out there! The Ritz Carlton card gives you access to unlimited Priority Pass lounges for you and up to two guests traveling with you. Authorized users are free to add and get their own lounge access with up to two guests each.

This doesn’t give access to Priority Pass restaurants, but does give access to Priority Pass Experiences, including Gameway, Be Relax Spas, and Minute Suites.

This card also offers the best access to the Chase Sapphire Lounges of any card. You are able to bring in two guests and have unlimited visits. See current locations here. Even better, some people find that by holding the Ritz card, you’ll actually skip the waitlist at the lounge.

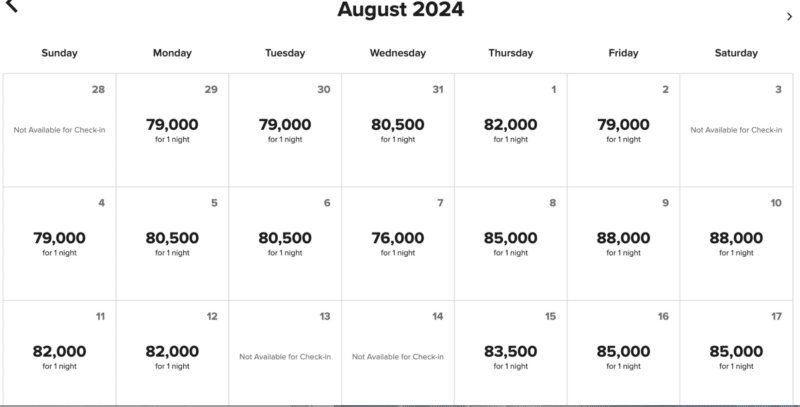

85,000 Annual Free Night Certificate

This certificate is redeemable at thousands of Marriott Properties. You can also top off your certificate with up to 15,000 additional points. This means you can book a hotel valued up to 100,000 points with this certificate.

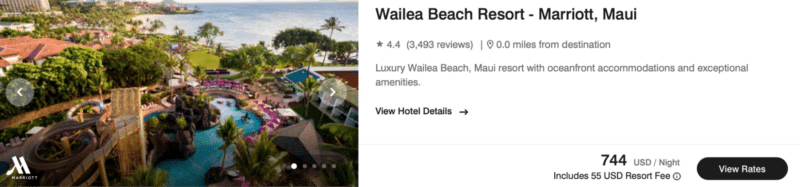

You can use your free night certificate at thousands of hotels across the globe including some aspirational family friendly properties such as Wailea Beach Resort.

If you’d like to stay closer to home, the popular-with-families JW Marriott Marco Island has many nights available during summer travel season.

$300 Annual Travel Credit

Officially, you can use this credit for travel incidentals like baggage fees, seat assignments, upgrades, lounge access and more.

This is a little more cumbersome than some travel credits — as you’ll need to make a charge and then contact Chase to ask the statement credit to be applied. You can ask by secure messaging Chase or calling 1-855-896-2222 after making your purchase.

Unofficially, there are a lot more charges that can be covered. You can find examples of what works here.

Free Authorized Users

There is no fee for adding authorized users to the Ritz Carlton card. And they enjoy the same level of lounge access to Priority Pass and Sapphire lounges. Your authorized users also get to bring in two guests each.

Other Travel Benefits

15 Elite Night Credits: Automatically earn 15 Elite Night Credits each calendar year that you hold the card. This could help you earn Marriott status faster.

Automatic Marriott Gold Status: Marriott Gold status isn’t extremely valuable but does get you late checkout at 2pm (subject to availability) and some complimentary room upgrades. This card does allow you to spend your way to Platinum with $75,000 spend on the card each calendar year — but that’s unlikely to be worth putting so much spend on this card just for that.

Global Entry/TSA Precheck/NEXUS Credit: A $120 credit is available every four years to use for yourself or anyone else!

Less Frequently Used Travel Benefits

$100 Property Credit at Participating Ritz Carlton Properties: When booking a minimum of a 2 night stay at a participating Ritz Carlton or St Regis hotel on a non-discounted, member rate, with your Ritz Carlton card, you are eligible to receive a $100 property credit during your stay. Credit may not be used on room rates or property goods/services operated by a third party. This credit seems unlikely to be of extreme value to most people. However, it’s worth taking note of if you happen to fulfill the requirements to use it. Call 1-800-542-8680 to book.

Three Ritz Carlton Club Level Certificates: These certificates are awarded each account anniversary and are available to be used on paid stays of up to seven nights maximum. They are subject to availability and are only available on non-discounted member rates. Much like the $100 property credit, the likelihood of most people using this perk is low. However if you find yourself fulfilling the requirements to use it, it is worth it to be aware of this benefit. Call 1-800-542-8680 to book and redeem your certificate.

Additional Benefits and Protection

Lost Luggage Reimbursement: Up to $3,000

Rental Car Coverage: Primary rental car coverage up to $75,000 when you charge the entire rental car to your Ritz Carlton card. Coverage includes theft and collision damage both domestically and abroad.

Trip Cancellation/Interruption Insurance: Reimbursement up to $10,000 per person and $20,000 per trip for nonrefundable, prepaid expenses.

Trip Delay Reimbursement: A common carrier delay of more than 6 hours OR an overnight stay results in reimbursement for non-covered expenses. This includes lodging and meals for each ticket that is paid for using the Ritz Carlton card.

Extended Warranty Protection: A one year extended warranty of the original manufacturer’s warranty of three years or less.

Return Protection: Reimbursement available for items purchased within 90 days that are not eligible for return with the merchant. There is a $500 maximum per claim, up to $1,000 per year.

Purchase Protection: Items less than 120 days old that were purchased using the Ritz Carlton card are covered up to $10,000 and $50,000 per year.

Roadside Assistance: Towing, jumpstart, locksmith, gas delivery are a few of the covered incidents up to 4 times per year with a $50 service fee.

JP Morgan Concierge: Similar to the Amex Platinum concierge, the JP Morgan concierge can book travel, dining and event reservations for you, along with shopping needs.

Note that some of the above mentioned benefits are not unique to just the Ritz Carlton card. However, the array of benefits included on the Ritz Carlton card make it a heavy hitter in the frequent traveler’s wallet.

Card Benefit Calculator

The Ritz-Carlton™ Card: What's It Worth to You?

Enter your personal estimated annual value for each benefit to see a customized calculation of the card's worth.

Your Total Annual Value:

Annual Fee: $450

Your Net Value / Cost:

Card Benefit Checklist

The Ritz-Carlton™ Card Benefit Checklist

A handy guide for Katie's Travel Tricks readers to maximize your card benefits.

Reminder: For airline incidentals such as baggage fees, seat upgrades, and lounge passes.

Reminder: Redeemable for a stay up to 85,000 points after your card anniversary.

Reminder: Enjoy access to over 1,300 airport lounges worldwide for you and 2 guests.

Reminder: Up to $120 statement credit every 4 years for application fees.

Reminder: Valid on paid stays of two nights or longer at The Ritz-Carlton® or St. Regis® hotels.

Reminder: Automatic Gold Elite status, offering late checkout, enhanced points earning, and room upgrades when available.

Reminder: Valid on paid stays of up to 7 nights at The Ritz-Carlton®.

Reminder: Primary Rental Car Coverage, Trip Cancellation/Interruption Insurance, Lost Luggage Reimbursement, Return Protection, and more.

The Final Verdict

Within the Marriott card family, the closest contender to the Ritz Carlton card is the American Express Bonvoy Brilliant card with an annual fee of a whopping $650.

If you’d like to learn more about the Ritz Carlton card, you can do so directly on their website, here.

This card is a hidden gem among the ultra premium cards. If you can make use of the annual free night certificate, travel credit and lounge access, this card can be a great addition to your wallet. For family travel specifically, this might be one of the best luxury card options on the market.

Table of Contents

- Chase Ritz-Carlton® Card: Quick Hits

- How to Get the Chase Ritz-Carlton® Card

- Earning Rates

- Benefits of the Chase Ritz-Carlton® Card

- Lounge Access

- 85,000 Annual Free Night Certificate

- $300 Annual Travel Credit

- Free Authorized Users

- Other Travel Benefits

- Additional Benefits and Protection

- Card Benefit Calculator

- Card Benefit Checklist

- The Final Verdict

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

If I upgrade to this card, in the future can I get a Marriott Bonvoy card again as well? I haven’t been able to find any articles which state you can hold both cards? thanks

Yes, if it has been 24 months since you earned a welcome offer on the Boundless card, you could apply again. Or you’d also be eligible for the welcome offer on the Bonvoy Business card. You’d want to double check and read the offer terms before applying.

I am in the first year of holding the Chase Marriott Bonvoy card. Do I have to wait for the full year to pass before applying for the Ritz Carlton card (which means I will have to pay the year 2 annual fee on the Bonvoy card and then also pay the Ritz Carlton card fee)? It seems like a double dip on the part of Chase.

If you upgrade after a full year, they typically will refund the first fee and then charge you the new fee for the new card. Or pro-rate it.

if you do a product change to the Ritz card, let’s say, 2 months before your Chase Marriott anniversary/annual fee, and pay the $450 fee, will you receive the 85k certificate in the first year?

or do you have to pay the $450 fee twice and wait a year after product change to receive the 85k certificate?

thanks!

I don’t know and exactly maybe someone else will eventually chime in. For us, our annual fee posting got reset to a whole new date and we didn’t get the 85k certificate right away when it posted. Our annual fee for the Boundless had posted on 9/4/24 and then I upgraded to the Ritz card in October. We got charged the $450 annual fee in March and then our 85k certificate posted on 9/4/25

The 85k certificate is on the anniversary of the ritz card so not upon the product change but a year later. And the annual fee will be refunded within three months of product change and then the 450 fee will be charged for the ritz card. I was told this today when I switched from the Bonvoy boundless card to the ritz.

How do you get the Priority Pass for the AUs? I applied for one AU about a month ago but no news on Priority Pass. Thank you!

You have to actually call and activate the Priority Pass for the Authorized users! Then it will come in the mail.

Do the AU’s get the Ritz card, too? Or just the Priority Pass?

They would have their own Ritz card which gives them access to the Sapphire lounges — then they can also activate a Priority Pass account

When using a WN credit, I always pay for the taxes ($5.60) with my Ritz card for protections, as suggested. I have CP, so for international flights, which taxes are a lot more than $5.60, does the whole tax amount need to be paid with the credit card or can I use a travel credit for some of it?TIA!

As long as even a little is paid, it should activate the insurance!

I’m assuming the earning rates are for Marriott points, not Chase Ultimate Rewards that can be transferred to other travel partners. Can you please confirm?

Correct, this card earns Marriott points. There are some transfer partners with Marriott but generally poor transfer rates.

Can you upgrade from a no fee card like Marriott Bold card to Ritz.

Yes you can! Any of the Chase Marriott cards can upgrade to it.

For the club level certificates, you say the likelihood of most people using this perk is low. Why is the likelihood of using considered to be low? This seems like it would be easy to use?

Thank you

For someone who is a Ritz loyalist, it is probably easier to use. But it requires a paid stay of 7 nights or more at a Ritz property. Generally, most people reading my blog are using points to book hotel stays so that commentary was targeted to my average reader!

I use the certificates, and Ritz has never required a 7 night stay. You can upgrade to Club Level for UP TO 7 nights; a 7 night stay is not required.

I believe that’s what our post states but maybe I’m missing a typo, thanks for the correction!

If you upgrade to this card and add an authorized user, will it could on either of your 5/24 scores?

Also if I’m an authorized user on my husbands current Marriott card would I be able to get the ritz card or does he have to be the one?

Upgrades don’t add an extra count to your 5/24. If you wait until the card is 24 months old, it won’t add anything to any authorized user’s 5/24 either. If your husband has the Marriott, he’d have to upgrade to Ritz and then could add you.

Do authorized users of this card also get a Digital Priority Pass that says “Sapphire Lounge” like the primary card member? Do they need to bring the physical Ritz Carlon credit card to enter Sapphire Lounges?

I personally could not figure out how to get a Digital Priority Pass for my authorized user card. So I just keep my Ritz card with me for Sapphire lounges. Plus the Ritz card itself helps you skip the line over Sapphire Reserve (At least in PHX when I was there)

Just found your site Katie, thanks for all of this intel! I am going to dump the Sapphire Reserve as the point reduction and then the emphasis on food perks doesn’t work so well for me. I am now having a frenzy booking with my 1.5 points. I just used your site to get the Bonvoy Boundless to then move up the the Ritz card–although Priority Pass lounges are a bit anticlimactic here in Boston, they seem to take great delight in telling you they are full and you cannot come in, on more than one occasion. There isn’t one in Portland, Oregon, Iceland and the one in Dublin, Ireland is just okay. Sometimes I just pay to go into the Aer Lingus Lounge. I got rid of my JetBlue, my Delta AmEx and might now get the Sapphire Preferred to round things out, I have the Aer Lingus by Chase. Seems the credit card companies are catering more and more to the elite clientele with higher spending amounts for bonuses etc not to mention the fees going up by 50%. I a, glad I found your site, will be keeping a close watch on your update, thank you again for your solid advice, Tricia

thanks for your note, sounds like you have a solid strategy!!

Where/how does getting the Ritz card fit if one is following your 3 year plan?

In Year 2, the first card is a hotel-specific card — so you could get the Marriott Boundless card then and then upgrade after a year. OR – the three year plan also includes wiggle room for adding in additional cards so you could add this in during the 1st year for P1! If you need specific advice, just email us, too!