All content was accurate at the time of publication. Check issuer’s site for most up to date information.

Katiestraveltricks.com has partnered with CardRatings for our coverage of credit card products. Katiestraveltricks.com and CardRatings may receive a commission from our partners. American Express is a Katiestraveltricks.com advertiser. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Bilt Rewards Explained (Earn Points Even Without the Credit Card)

Bilt is a program with a lot of value. You don’t have to have the Bilt credit card to benefit from the program either. Just by signing up and becoming a member, you can earn points for things like dining, prescriptions, Lyft rides, and more.

It’s especially valuable because Bilt has a lot of desirable transfer partners like Hyatt, Japan Airlines, and Atmos, which are hard to get points with otherwise.

On the first of each month, Bilt also has “Rent Day” where they offer deals like status matches and transfer bonuses that can be incredibly valuable. In this post, I’ll show you how you can benefit from the Bilt program, with or without the Bilt credit card!

Update November 2025:

You can now earn Bilt points by shopping through Rakuten! We’ve updated this article with all the details.

Set up to Earn Bilt Points

Anyone can sign up for Bilt Rewards and start earning points right away. Sign up online at Biltrewards.com or download the Bilt app and sign up there. It’s free to sign up, and no Bilt card is required.

It will try to encourage you to sign up for the credit card when you sign up for Bilt Rewards. Generally, we recommend just signing up for the program not the card.

Add a Card to Your Bilt Wallet

While you don’t need the Bilt Mastercard to start earning points, you will want to add a credit card (or a few) to your Bilt wallet. This can be any credit card. It doesn’t have to be the Bilt Mastercard.

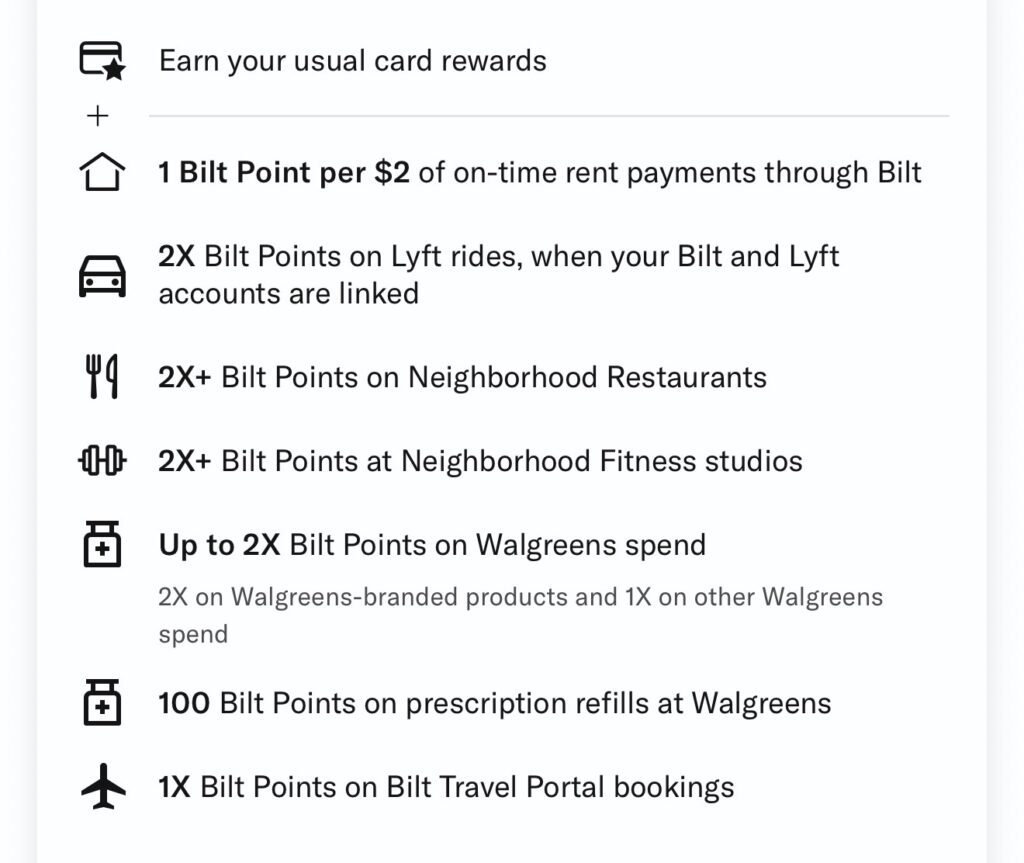

Using a card linked to your Bilt wallet allows you to earn points on some purchases automatically (even if you don’t have the Bilt credit card). You’ll earn points in all of these categories when you add a card to your Bilt wallet.

We recommend adding the credit cards that you use most often, especially those that you may intentionally use for higher earning rates on restaurant, pharmacy, and Lyft purchases.

For many people this includes:

- Chase Sapphire Reserve®

- Chase Sapphire Preferred® Card

- American Express® Gold Card

- Chase Freedom Unlimited®

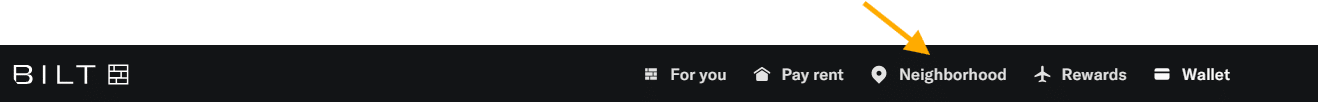

Neighborhood

Visit the “neighborhood” section on the website or app to see where you can start earning points.

Under neighborhood, you’ll see things like dining, fitness, pharmacy, and rideshare.

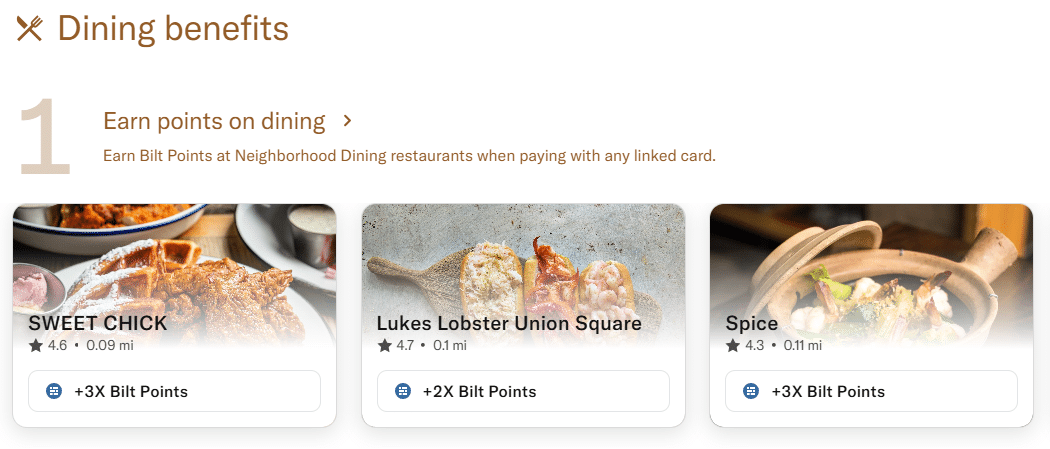

Dining

You’ll automatically earn Bilt points when you use a credit card in your Bilt wallet to pay at a participating restaurant. This is in addition to any points you earn by spending on your credit card.

For example, say you use a card like the Chase Sapphire Preferred® Card that earns 3x on dining. In that case, you’ll earn the 3x points in your Chase account for the dining purchase PLUS whatever points Bilt is offering for that particular restaurant (usually 2x or 3x points) in your Bilt account.

You can see the full list of participating restaurants on the Bilt website and app. The restaurants are limited, but hundreds are included, including some chain restaurants and many local spots, too.

As an added perk, Bilt members can get a complimentary item from the kitchen at certain restaurants.

Pharmacy

Earn Bilt rewards when you shop at Walgreens and use any card linked in your Bilt wallet to pay.

You get 2x points for Walgreens branded products and 1x points for all other purchases. Additionally, members can earn 100 Bilt points for each prescription filled at Walgreens. This is a great way to earn extra points on everyday purchases you have to make anyway.

Rideshare

When you link your Lyft account with Bilt, you can earn points for every ride you take.

Bilt x Rakuten

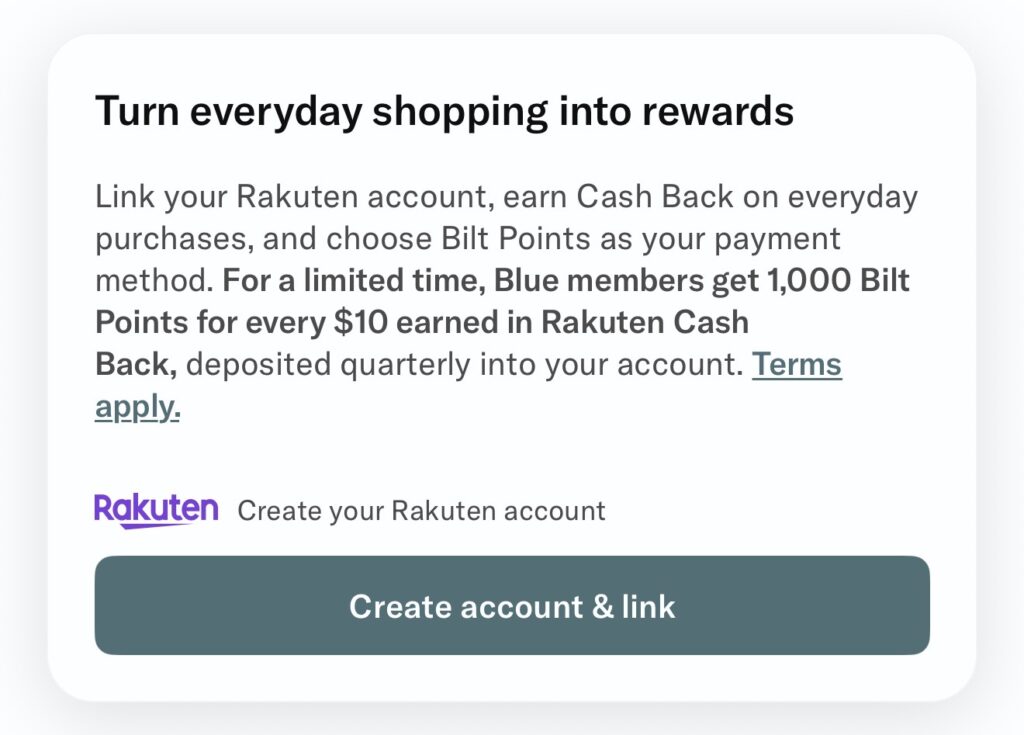

As of November 2025, Bilt is now partnering with Rakuten. This opens the door to so many earning opportunities.

Rakuten is a shopping portal where you can earn cashback on everyday purchases.

To earn points, you’ll sign up for an account, link it to your Bilt account, and then click through a Rakuten link (via their website, browser extension, or app) before making an eligible purchase at a participating retailer.

You don’t have to make the purchase on a specific card to get the points. You can use any form of payment that is accepted by the retailer, including other credit cards, debit cards, and gift cards.

This is a great way to earn more points on top of the points you already earn when paying with a credit card!

Step One: Open a Rakuten Account

New to Rakuten? Here is our referral link. You should open a Rakuten account first because the new member offer that Bilt is advertising is worse than our referral offer!

You’ll want the email you register with to match the email on your Bilt account.

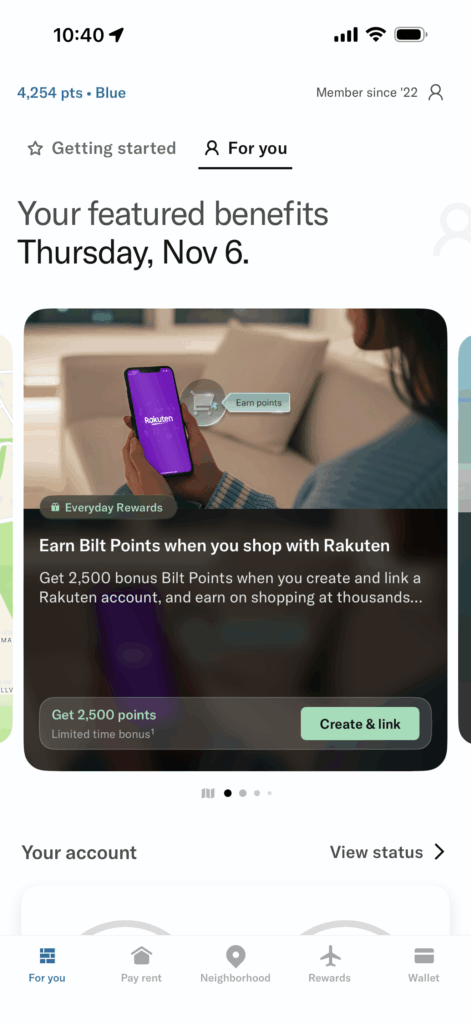

Step Two: Log Into Bilt to activate

When this was launched, an activation link appeared on the Bilt app “For You” page. If that doesn’t work for you, try this direct link – https://www.bilt.com/p/rakuten

Look for this on the Bilt “for you” page

If you already have a Rakuten account, it won’t create a new account, it will just link it to your existing account

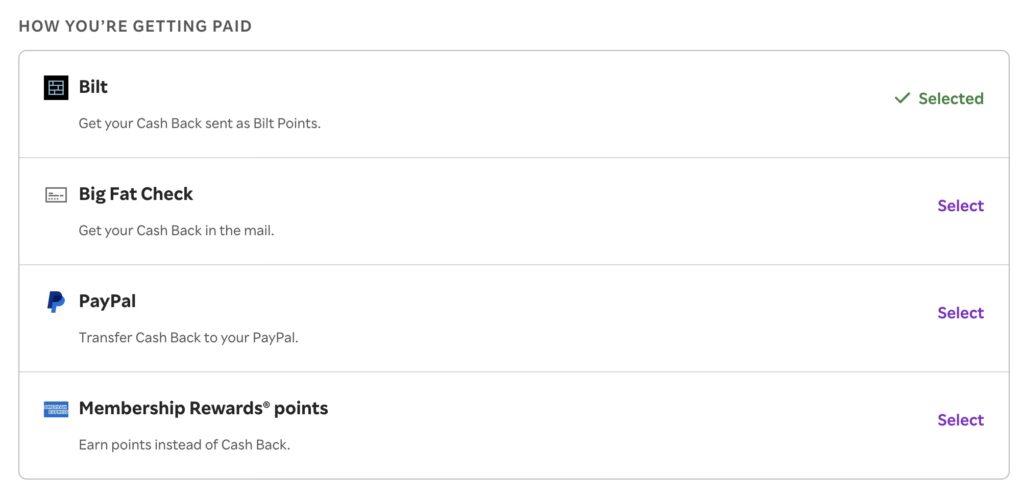

Step 3: Confirm it tracked in Rakuten

If you navigate to your Account in Rakuten and then to Account Settings, you can see how you are getting paid. You’ll want to be sure you see Bilt activated.

Step Four: Automate Rakuten Earnings

The easiest way to automate earnings with Rakuten is to download the browser extension to always be reminded when you can be earning! Find directions here.

If you have an iPhone, you should also download the browser extension for your phone. Otherwise, you can download the Rakuten app and shop from your mobile phone through there.

Rakuten also has a number of in-store deals. Like the Bilt Wallet, you’d need to add credit cards to your “Linked Credit Cards” in your Rakuten account to earn this way.

This includes all the same restaurants as Bilt but you can earn 5x instead of 3x! Bilt Dining and Rakuten Dining Rewards run on the same network, so you’ll have to pick one program. In the first 6 months you’re using Bilt x Rakuten, you’re better off linking your card that you use for restaurants to Rakuten to earn even more.

You can also use SaveWise to activate all Bilt In-store offers at once. I like SaveWise because it shows you historical cash back offers from Rakuten and allows you to set alerts for when offers reach a certain threshold.

Rakuten Cash Back to Bilt Conversion

Once you link your accounts, you may also see this pop up on the Rakuten site.

For the first six months, you’ll earn 1:1 rates. That means 1 cent earned in cash back = 1 point. Or for every $100 cash back you earn, you’ll get 10,000 Bilt points deposited in your Bilt account.

After the initial six months, it looks like Blue Bilt Members (with no status) will only receive half of that. For every $100 cash back they earn, they will get 5,000 Bilt points.

BILT + Rakuten Checklist

Maximize Bilt & Rakuten

Follow these steps to earn points on autopilot—no new credit card required!

More Ways to Earn Points With Bilt

Pay Rent (even without the Bilt credit card)

You can earn points on rent payments through the Bilt app or website, even without using the Bilt credit card. Bilt does charge a 3% fee if you use a different card, so keep that in mind. It could make sense to pay the fee to help you meet a minimum spend or earn extra points for a particular redemption.

For rent payments made with the Atmos™ Rewards Ascent Visa Signature® credit card or the Atmos™ Rewards Summit Visa Infinite® Credit Card, you earn 3x points for every $1 spent through Bilt.

For rent payments made with a United MileagePlus Chase card, you earn 2 points for every $1 spent through Bilt.

For rent payments made with Visa, Mastercard, or Discover cards, you earn 1 point for every $1 spent through Bilt.

For rent payments made with American Express, you earn 1 point for every $2 spent through Bilt.

Bilt Rent Day

You can also earn bonus points on “Rent Day.”

“Rent Day” happens on the first of every month and includes special deals and promotions that are typically valid for one day only. Rent Day is for all Bilt Rewards members, whether you hold one of their credit cards or not.

Earn More Points

For Bilt cardholders, earning rates are doubled on rent day (except for rent and tax payments which always earn 1x points).

On the first of every month, you earn 6x points on dining (instead of the usual 3x) and 4x points on travel (instead of 2x) with the Bilt Mastercard. You can earn up to 1,000 bonus points per month.

Status Matches

Rent Day promotions vary from month to month, but occasionally they will offer free status matches that can be very valuable.

There have been status matches for both hotel and airline programs including Hyatt, Accor, Delta, and others.

It can be hard to earn high-level status with a hotel or airline program, even with brands you use regularly, so these status matches can really come in handy!

Often the status will be free for a set period. This could be a short time, such as 3-4 months, or it could be for a whole year. There is often a path to extend the status by meeting certain benchmarks, such as staying a minimum number of nights with a hotel program, or by earning a certain amount of points with an airline.

Once you have the status, you’ll be able to take full advantage of all the perks that status offers like early or late checkout, free upgrades, free seat selection and carry-on baggage, higher earning rates, etc.

We’ve been able to use Bilt status matches in the past to get free Economy Plus seats on United or free breakfast at Tabacon Resort in Costa Rica (with Hilton Gold status).

Transfer Bonuses

Sometimes for Rent Day, Bilt offers transfer bonuses. The amount of extra points you get usually depends on what level of status you have with Bilt. The higher the status, the better the transfer bonus.

But even members with the lowest status level (Blue) that you get just by signing up for Bilt Rewards, can participate in the transfer bonus.

Here’s an example of a previous Rent Day offer for points transferred to Air Canada Aeroplan.

- Blue status – 75% bonus (transfer 1,000 points, get 1,750 points)

- Silver status – 100% bonus (transfer 1,000 points, get 1,750 points)

- Gold status – 125% bonus (transfer 1,000 points, get 2,250 points)

- Platinum status – 150% bonus (transfer 1,000 points, get 2,500 points)

Taking advantage of transfer bonuses like this one is a great way to stretch your points further. Even if you’re just signing up for Bilt and have the lowest status level, a 75% transfer bonus is still a really great deal.

To give you a point of comparison, banks regularly offer transfer bonuses, but for airline programs like Flying Blue and Aeroplan, these are often in the 15-20% range. Transfer bonuses to British Airways and Virgin Atlantic have been as high as 30-40%. For hotel programs like Hilton, Marriott, and IHG, we occasionally see bonuses in the 75%-100% range.

To see a transfer bonus to an airline above 50% is an incredible deal!

Other Rent Day Perks

- Enter the “Rent Free” contest to have your rent paid by Bilt for one month.

- Bilt Rewards members can get a free ride at SoulCycle every Rent Day. Bikes are limited and these often sell out early.

- Other Rent Day promotions have included things like free Lyft credits, two-for-one Virgin cruises, and more.

What to Do with Bilt Points

Like with other credit card programs, there are several ways to use your Bilt points.

Transfer Partners

Transferring points to travel partners is often a good way to get outsized value from your points. Especially if you can take advantage of a transfer bonus!

Here is a list of all of the Bilt transfer partners available and the normal ratio for transferring points. With Bilt, you must transfer a minimum of 2,000 points at any given time. If the program has a 1:1 ratio, that means for every 1,000 points you transfer, you’ll get 1,000 points in the program you’re transferring to.

Some of the most notable transfer partners are Hyatt and Southwest, because the only other way to transfer to them is via Chase Ultimate Rewards®, Atmos Rewards (the joint loyalty program for Alaska Airlines and Hawaiian Airlines), because no other programs transfer to Atmos, and Japan Airlines, because Capital One is the only other transfer partner.

The other transfer partners have more overlap with credit card programs, but a lot of potential value.

Airlines:

- Atmos Rewards – 1:1

- Avianca Lifemiles – 1:1

- United MileagePlus® – 1:1

- Air France/KLM Flying Blue® – 1:1

- Virgin Red® – 1:1

- Emirates Skywards® – 1:1

- British Airways Executive Club – 1:1

- Cathay Pacific – 1:1

- Turkish Airlines Miles&Smiles – 1:1

- Aer Lingus AerClub – 1:1

- Iberia Plus – 1:1

- Air Canada Aeroplan® – 1:1

- TAP Miles&Go – 1:1

- Southwest Airlines – 1:1

- Japan Airlines -1:1

- Qatar Airways Privilege Club Avios -1:1

Hotels:

- Hilton Honors – 1:1

- Marriott Bonvoy™ – 1:1

- World of Hyatt® – 1:1

- IHG® One Rewards – 1:1

- Accor Live Limitless – 3:2

Book in the Bilt Travel Portal

You can use the Bilt Travel Portal to book hotels, airfare, and other travel expenses with your points. Even if you don’t have very many Bilt points, you can use the points + cash feature to book with the points you do have.

Points are worth 1.25 cents per point this way. So if you have 10,000 points, you can book $125 of travel. Their travel portal is powered by Expedia so prices should be competitive.

Get a Discount on Rent

You can apply your Bilt points towards your rent payments under the “Rent” tab of the Bilt app or website. The rate for this seems to be about .55 cents per point. That means if you have 10,000 points, you’d get $55 towards rent.

Pay Student Loans

If you have a student loan serviced by Aidvantage, Mohela, Navient, or Sallie Mae, you can use points to help pay off the loan.

Student loan payments can be made directly in the Bilt app or on the website. Every 1,000 points redeemed for student loan payments takes $10 off your student loan balance.

More Ways to Redeem Points

Additionally, you can redeem points for gift cards, book fitness classes, and shop with points for merchandise on the Bilt site or app.

Is the Bilt Credit Card Worth It?

The answer is going to be different for each person. We have a full post talking about the new Bilt 2.0 system to help you decide for yourself. In the post, we go over the details of the three new Bilt credit cards, how to use the cards to earn points on rent and mortgage payments, and the costs involved.

There are certainly pros and cons to the new Bilt system. The rollout has been bumpy to say the least, and things are changing all the time! As more changes come, we’ll be sure to keep you updated. Subscribing to our weekly newsletter is one of the best ways to make sure you don’t miss any updates!

Table of Contents

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.