The Reconsideration Call

What to Do When Your Credit Card Application is Denied

If you’ve been opening cards for points long enough, getting a credit card application denied is inevitable. Even with a stellar credit history, a high income, and a credit score of 800+, that doesn’t guarantee you’ll automatically be approved every time you apply.

So why do credit card applications get denied for people with excellent credit, and what are your options when your credit card application is denied?

Why do banks deny credit card applications?

You probably know that people with a low credit score, high debt, and/or a poor payment history have a harder time being approved for travel cards. If you fit into one of these categories, then you need take a look work on establishing good credit and paying your bills on time and in full before you start opening cards for travel points.

However, banks use complicated algorithms for automatic credit card approvals. That’s why even people with perfect credit histories and stellar credit scores get denied. If this is the case, there are several reasons why a bank may deny your credit card application.

Common reasons for a denial

Some common reasons you may have your credit card application denied include:

Application errors: If you mistype information on your credit card application or fill in the wrong details, this could lead to a denial. To avoid this, make sure to double check your application before submitting it.

Frozen credit report: Most of the time, credit card companies will access your credit report to determine whether to approve an application. If your credit report is frozen they will not be able to access it and your application will be automatically denied.

Insufficient income: Credit card companies need to make sure that applicants have enough income to pay off their credit card debt.

Too many opened accounts in a recent period: Having too many recently opened credit accounts can make lenders hesitant to lend to you. Notably, if you are applying for a Chase card, you will be denied if you have opened 5 or more personal cards in the past 24 months (known as the 5/24 rule).

Too many recent inquiries: Having too many inquiries on your credit report can be a sign of financial distress and can lead to lenders denying your application.

Not having a long enough credit history: Credit card companies may be hesitant to approve applicants who don’t have a long enough credit history.

When your credit card application is denied, the bank is required to inform you of the reason(s) why your application was denied. They will issue this in writing and mail it to you. If you already have a relationship with the bank, you may also be able to access the letter in your online account before you receive it in the mail.

What can you do when your application is denied?

Do nothing

The majority of people who get a credit card application denied stop at that. Maybe they don’t realize they can get their application reconsidered, they assume they will be rejected again, or they just don’t want to pick up the phone and call.

This should not be your response to a denied application! You’ve already had your credit pulled and you want the card bonus, so take a deep breath and pick up the phone to make a reconsideration call. Remember that the worst that can happen is they say no again.

Call the reconsideration line

If you receive a message that your application is “pending” or “under review” after submitting your credit card application, don’t worry. This is especially common with business applications and does not mean that your application will be denied. Depending on the bank and the reasons for the review, it may take a few hours to a couple weeks for the bank to notify you of their decision.

In order to inquire about an application under review or to try to get a denial overturned, you’ll need to pick up the phone and call the reconsideration department. Since a credit card application is usually valid for 30 days after you submit it, call sooner rather than later.

To find the best number to call, start by googling “[bank name] [personal/business] reconsideration line.”

If you’re trying to get a denial overturned, you may want to wait until you have your denial letter. That way you can be prepared to address the reasons for your denial on your reconsideration call.

If you call the reconsideration line and are denied again, you can HUCA (hang up, call again). There is a chance that another representative will approve you.

Apply again later

If you still can’t get approved and you still want the card, you may need to wait a few weeks or months and reapply. This should give you time to resolve any issues that factored into your denial.

Depending on the reason for your application denial, you may need to wait for cards to fall off your credit report, allow more time between inquiries, or move your spending around to make the bank happy.

What to say on the reconsideration call

A lot of people do not like making phone calls. I’m one of them. It helps to take a few minutes before you call to think about what you’re going to say to the credit analyst. Be prepared to:

- Address the reason(s) for the denial,

- Tell them why you want the card (without mentioning the card bonus),

Reconsideration tips by card issuer

Each card issuer has their own approval process. Some issuers are flexible with reconsiderations, while others are stringent and won’t overturn a denial, even for an application error.

American Express

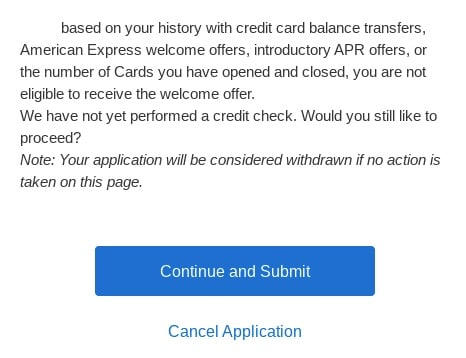

If you aren’t eligible for an American Express sign up bonus, you’ll get a pop-up notification that states you are not eligible for the welcome offer. While this may be because you’ve already had the card, other times it’s because you’ve made them mad. When you get this pop-up for your Amex applications, it’s commonly referred to as being in “pop-up jail.”

If you have closed an Amex card before the one-year mark or you aren’t spending on your Amex cards – among other reasons – you may receive this pop-up. Some people say the best way to get out (and be eligible for Amex bonuses again) is to be spending on the Amex cards you have.

Barclays

Although my husband and I were both approved for Barclays business cards after receiving an under review message (my husband waited almost 2 weeks for his approval, while I called early on and received approval after answering a few questions), its pretty common to get denied for Barclays business cards. However, the Barclays reconsideration process can be brutal! If you get an auto-denial, be prepared to submit a mound of paperwork to prove your identity. It’s a hassle, but it’s worth it for the free travel.

Capital One

Capital One rarely (if ever) reconsiders a denial. They also are known for denying people with good credit, even in the 800s. It can still be worth calling though, since they may overturn the denial for something like an application error or frozen credit.

Citibank

Citi has become particularly stringent with the Citi Premier card approvals and does not often reconsider a denial.

There are many reports of people being denied the Citi Premier card because they have too many recent inquiries and/or low credit utilization. While low utilization is a good thing, Citi takes it to mean you won’t be putting a lot of spend on the card.

If you really want a Citi Premier card, and you have a low (single digit) credit utilization, you may want to take steps to increase your utilization. This may mean increasing spending on personal cards and/or decreasing your personal credit card limits before applying. However, always make sure to keep your utilization under 30% so that your credit score is not negatively impacted.

Citi is more likely to reconsider a denial on co-branded American Airlines cards.

Table of Contents

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.