Credit Cards with Calendar Year Credits

Credit cards with statement credits can have high annual fees but the credits can add a lot of value to the card and make it worth keeping!

Most issuers have moved towards awarding credits based on the card anniversary. This means that statement credits expire and reset based on when you opened the card. However, there are some cards that have statement credits that follow the calendar year. It’s important to pay attention to these so you get the max value of your cards!

American Express Statement Credits

While some American Express benefits are based on the calendar year and expire on December 31, there are also monthly and/or quarterly benefits that need to be used each month or every six months.

On the table below, benefits that are marked with an asterisk (*) are monthly benefits and benefits marked with a plus (+) are quarterly benefits. Be sure to take advantage of your monthly benefits each month.

Log into your American Express account for all the information on these credits and other benefits. And note that many of these credits require you to ENROLL with Amex before you are able to use the statement credit. You will need to navigate to the benefits page of your credit card, find the credit, and click “Enroll.”

| Card Name | Statement credits |

American Express® Green Card |

Annual Credits (Expire December 31, reset January 1)

|

American Express® Gold Card |

Monthly Credits

|

American Express® Business Gold Card |

Earn up to $20 in statement credits monthly after you use the Business Gold Card for eligible U.S. purchases at FedEx, Grubhub, and Office Supply Stores. This can be an annual savings of up to $240. Enrollment required. Get $12.95 back in statement credits each month when you pay for a monthly Walmart+ membership (subject to auto-renewal) with your Business Gold Card. $12.95 plus applicable taxes. |

The Platinum Card® from American Express |

Annual Credits (Expire December 31, reset January 1)

Semi-Annual Credit

Monthly Credits

|

The Business Platinum Card® from American Express |

Annual Credits (Expire December 31, reset January 1)

Enroll and get up to $120 in statement credits per year (up to $10 back per month) for wireless telephone service purchases made directly with a wireless provider in the U.S. on your Business Platinum Card.‡ |

Hilton Honors American Express Aspire Card |

Annual Credit

Semi Annual Credit

Quarterly Credit

|

Marriott Bonvoy Brilliant® American Express® Card |

Monthly Credit

|

If you have an American Express card not listed above, make sure to check your card benefits to ensure you’ve used any applicable statement credits.

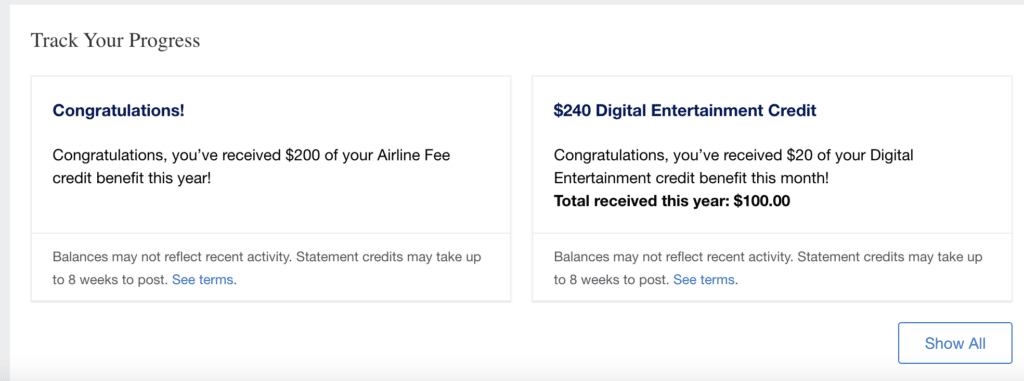

Track Your Statement Credits with Amex

If you aren’t sure whether you have fully used a credit, you can log into your American Express account, select the “Rewards and Benefits” section, and scroll down to “Track Your Progress” to see how much of your credits have been used.

Enroll in Amex Benefits

For some of these credits, it’s not enough to simply charge the spending to your American Express card. American Express requires that you Enroll to be eligible for many of these statement credits. Enrollment is simple, and only needs to be done once.

-

- Log into your American Express account

-

- Click on “Rewards and Benefits”

-

- Click on “Benefits”

-

- Scroll down and select “Enroll”

-

- Find the benefits you would like to enroll in and follow the prompts.

Chase Statement Credits

All Chase cards also come with a monthly GoPuff statement credit (ends 12/31/2023).

| Card Name | Statement credits |

Chase Freedom®, Chase Freedom Flex℠, Chase Freedom Unlimited®, Chase Freedom Rise℠ and Chase Freedom® Student Credit Card |

Quarterly Credits

|

Chase Sapphire Preferred® Card |

Quarterly Credits

|

Chase Sapphire Reserve® Card |

Monthly Credits

|

The Ritz-Carlton™ Credit Card |

Annual Credits (Expire December 31, reset January 1)

|

|

Semi Annual Credit

|

Table of Contents

Table of Contents

- American Express Statement Credits

- American Express® Green Card

- American Express® Gold Card

- American Express® Business Gold Card

- The Platinum Card® from American Express

- The Business Platinum Card® from American Express

- Hilton Honors American Express Aspire Card

- Marriott Bonvoy Brilliant® American Express® Card

- Track Your Statement Credits with Amex

- Enroll in Amex Benefits

- Chase Statement Credits

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Thank you so much for this article Katie! :) This is the perfect article for procrastinators like me HAHAHA

Cutting it close for 2023 credits LOL